Missouri Accredited Investor Status Certificate Letter-Individual

Description

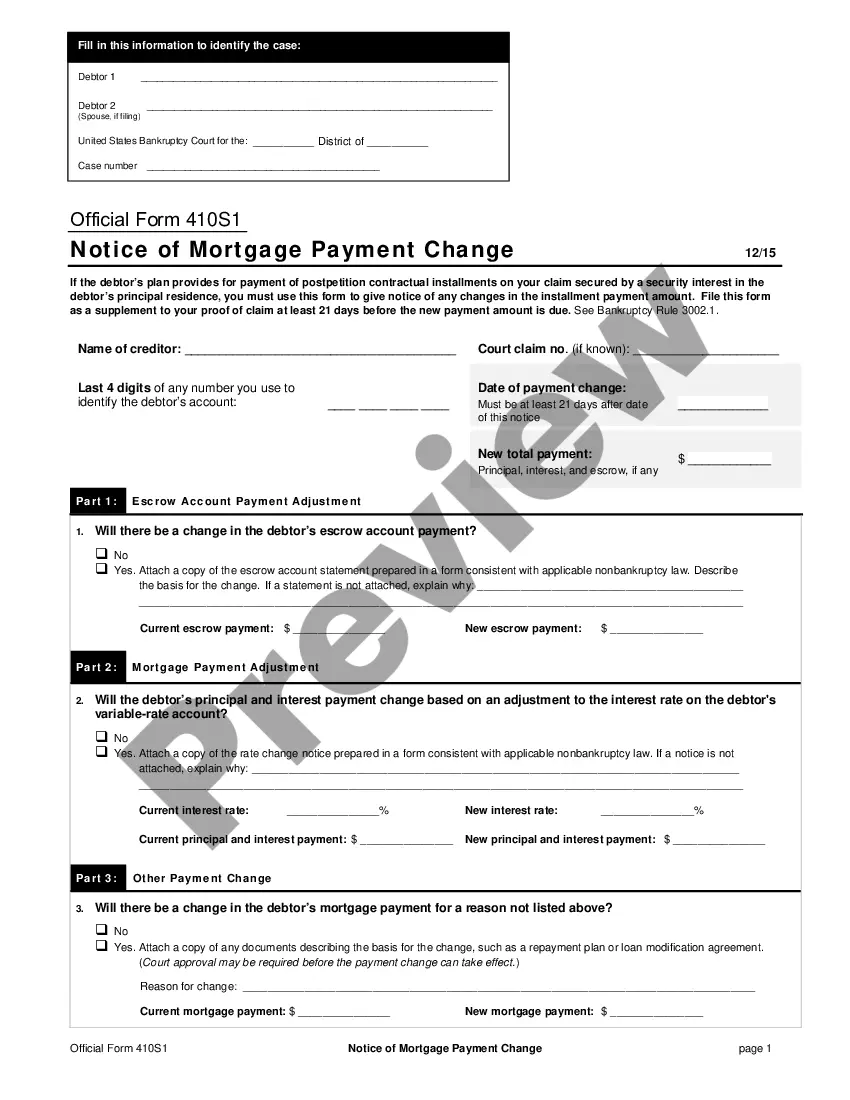

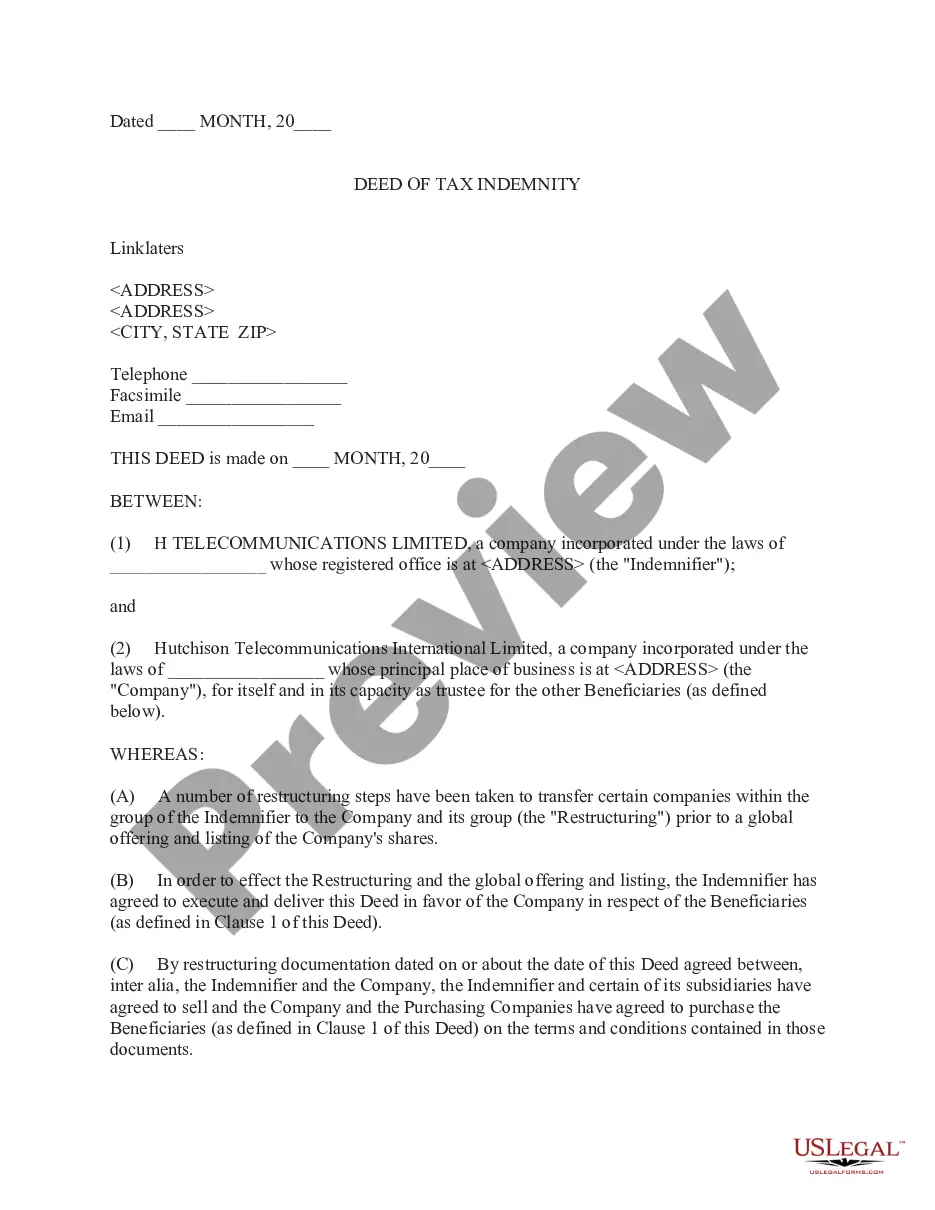

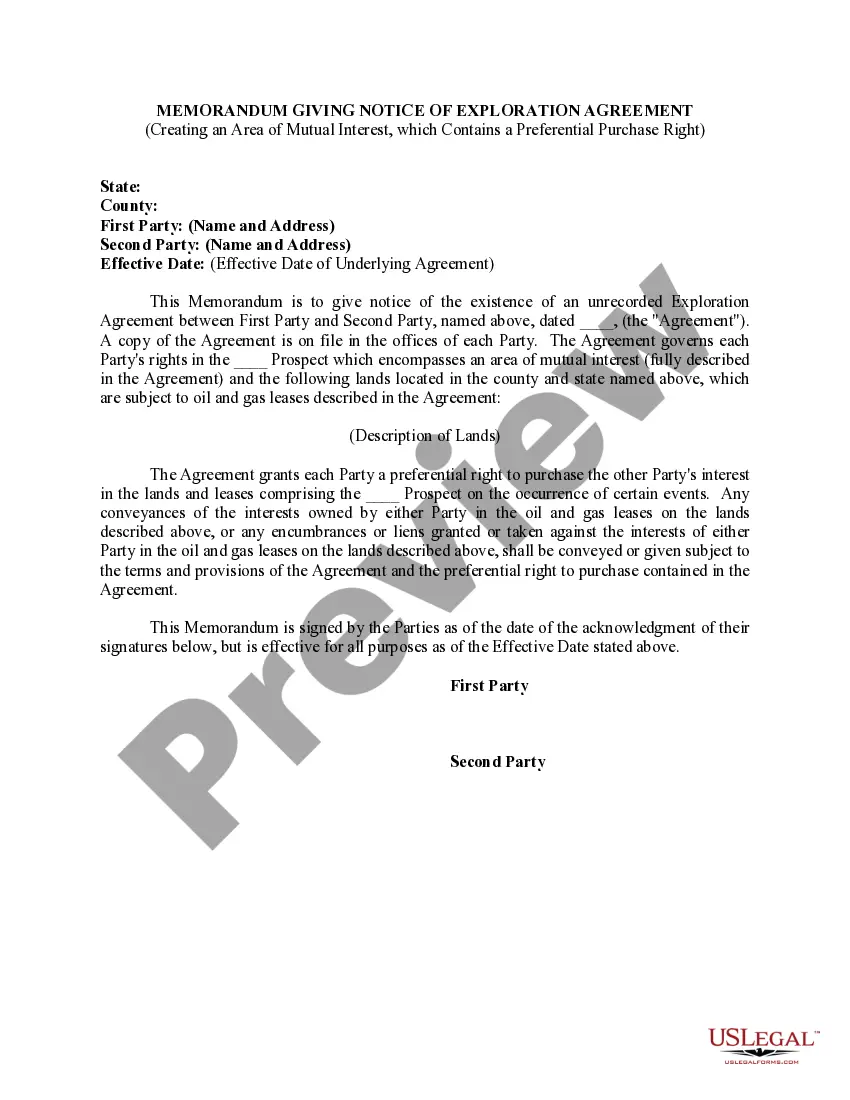

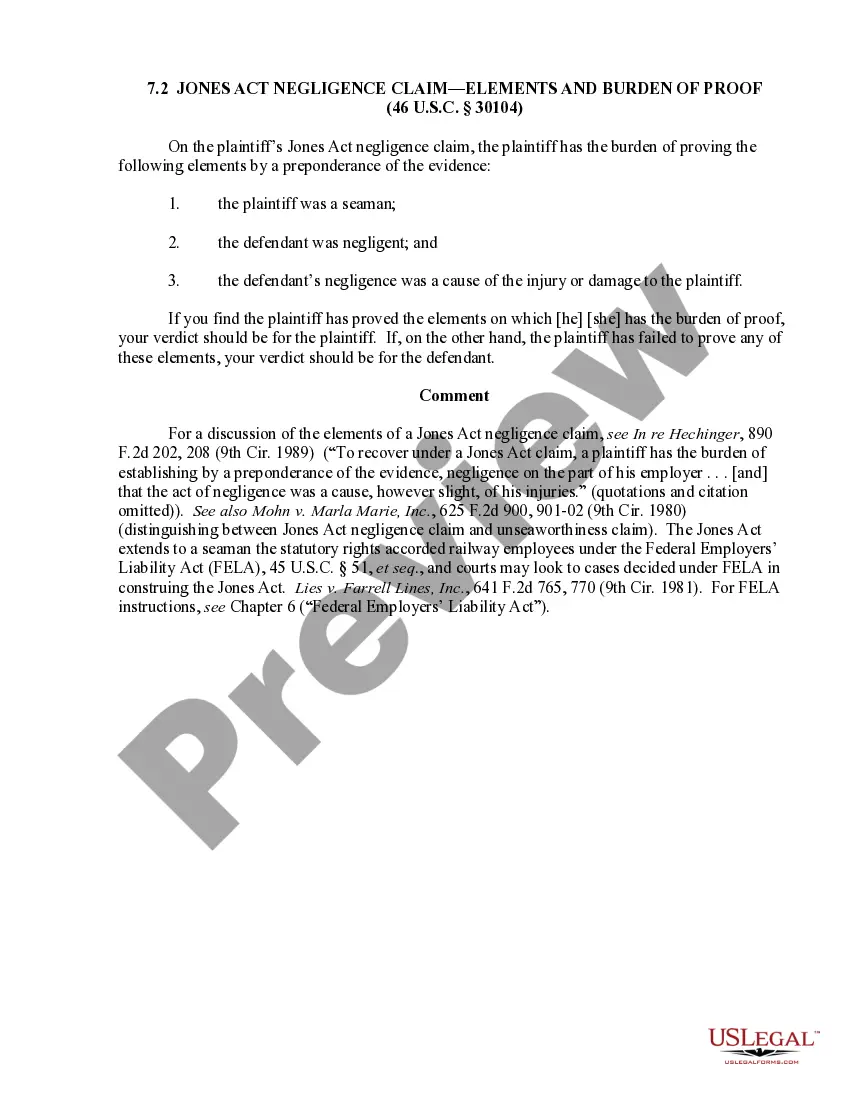

To become an accredited investor the (SEC) requires certain wealth, income or knowledge requirements. The investor must fall into one of three categories. Firms selling unregistered securities must put investors through their own screening process to determine if investors can be considered an accredited investor.

The Verifying Individual or Entity should take reasonable steps to verify and determined that an Investor is an "accredited investor" as such term is defined in Rule 501 of the Securities Act, and hereby provides written confirmation. This letter serves to help the Entity determine status.

How to fill out Accredited Investor Status Certificate Letter-Individual?

Are you in the position the place you will need documents for either business or person purposes virtually every working day? There are a lot of legitimate papers layouts available online, but getting ones you can rely is not straightforward. US Legal Forms offers a huge number of form layouts, just like the Missouri Accredited Investor Status Certificate Letter-Individual, which are published in order to meet federal and state requirements.

If you are already informed about US Legal Forms website and have a free account, simply log in. Next, you are able to down load the Missouri Accredited Investor Status Certificate Letter-Individual design.

Should you not provide an account and would like to begin using US Legal Forms, abide by these steps:

- Obtain the form you will need and ensure it is for the right area/area.

- Use the Preview option to check the shape.

- See the description to actually have selected the right form.

- If the form is not what you`re searching for, make use of the Lookup industry to find the form that suits you and requirements.

- If you discover the right form, click on Get now.

- Opt for the costs plan you need, fill in the desired information and facts to generate your bank account, and buy the transaction utilizing your PayPal or charge card.

- Decide on a hassle-free data file format and down load your backup.

Get every one of the papers layouts you possess purchased in the My Forms menus. You can get a further backup of Missouri Accredited Investor Status Certificate Letter-Individual at any time, if needed. Just go through the needed form to down load or printing the papers design.

Use US Legal Forms, the most substantial assortment of legitimate types, in order to save time and stay away from errors. The service offers professionally manufactured legitimate papers layouts which you can use for a selection of purposes. Generate a free account on US Legal Forms and initiate creating your life easier.

Form popularity

FAQ

To confirm their status as an accredited investor, an investor can submit official documents for net worth and income verification, including: Tax returns. Pay stubs. Financial statements. IRS forms. Credit report. Brokerage statements. Tax assessments.

In the case of a successful verification, you'll get an attorney's letter certifying that you have been verified as an accredited investor pursuant to standards required by federal laws.

The simplest way to attain ?accredited investor? status is to ask for a 3rd party verification letter from a registered broker dealer, an attorney or a certified public accountant. Other paths require cumbersome documentation that can deter would-be investors from profitable investments, such as InvestinKona.com.

If you are accredited based on income, you will need to provide documentation in the form of tax returns, W-2s, or other official documents that show you meet the required income threshold for the prior two years.

Accredited Investor Definition The SEC defines an accredited investor as someone who meets one of following three requirements: Income. Has an annual income of at least $200,000, or $300,000 if combined with a spouse's income. This level of income should be sustained from year to year.

How can individuals qualify as accredited? Individuals (i.e., natural persons) may qualify as accredited investors based on wealth and income thresholds, as well as other measures of financial sophistication.

Individuals who want to become accredited investors must fall into one of three categories: have a net worth exceeding $1 million on your own or with a spouse or its equivalent; have earned an income surpassing $200,000 ($300,000 if combined with a spouse or its equivalent) during the last two years and prove an ...

VerifyInvestor.com is the leading resource for verification of accredited investors as required by federal laws.