This form is a due diligence checklist that outlines information pertinent to non-employee directors in a business transaction.

Missouri Nonemployee Director Checklist

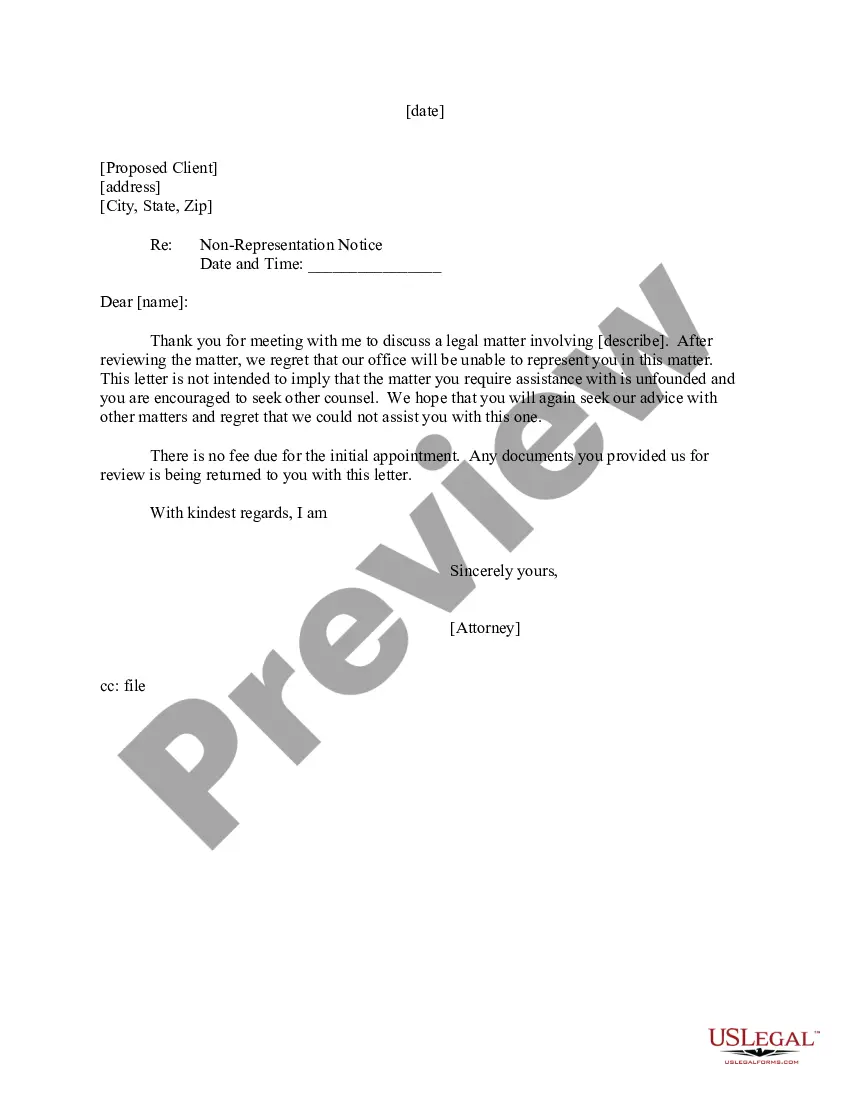

Description

How to fill out Nonemployee Director Checklist?

Selecting the appropriate legal document template can be challenging. Certainly, there are numerous templates found online, but how do you obtain the legal form you require.

Utilize the US Legal Forms website. The service offers a vast array of templates, such as the Missouri Nonemployee Director Checklist, which you can utilize for both professional and personal purposes. Each form is reviewed by specialists and meets state and federal requirements.

If you are already registered, Log In to your account and then click the Acquire button to obtain the Missouri Nonemployee Director Checklist. Use your account to search through the legal forms you have purchased previously. Go to the My documents tab of your account to get another copy of the document you need.

Choose the file format and download the legal document template to your device. Complete, edit, print, and sign the acquired Missouri Nonemployee Director Checklist. US Legal Forms is the largest collection of legal documents where you can find a variety of document templates. Take advantage of the service to download professionally created papers that comply with state requirements.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your city/county. You can browse the form using the Review button and read the form description to make sure it is the right fit for you.

- If the form does not meet your needs, use the Search field to find the appropriate form.

- When you are confident that the form is suitable, click the Acquire now button to obtain the form.

- Select the pricing plan you desire and enter the required information.

- Create your account and pay for the transaction using your PayPal account or credit card.

Form popularity

FAQ

Beginning with the 2020 tax year, the IRS will require business taxpayers to report nonemployee compensation on the new Form 1099-NEC instead of on Form 1099-MISC. Businesses will need to use this form if they made payments totaling $600 or more to a nonemployee, such as an independent contractor.

You'll use the amount in Box 1 on your Form(s) 1099-NEC to report your self-employment income. Instead of putting this information directly on Form 1040, you'll report it on Schedule C.

There are two methods to enter the Non-employee compensation and have it flow to the 1040, Line 21:Code the 1099-MISC with the Non-employee Compensation as Non-SE income. Or,Move the income from the 1099-MISC, Line 7 - Nonemployee compensation to 1099-MISC, Line 3 - Other income.

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

There is a new Form 1099-NEC, Nonemployee Compensation for business taxpayers who pay or receive nonemployee compensation. Starting in tax year 2020, payers must complete this form to report any payment of $600 or more to a payee. Generally, payers must file Form 1099-NEC by January 31.

Form 1099-MISC is used to report miscellaneous income. Before 2020, the 1099-MISC box 7 was used to report non-employee compensation. The forms 1099-MISC was provided instead of a Form W-2 to independent contractors who provided services but were not considered employees of the payer.

Nonemployee compensation (also known as self-employment income) is the income you receive from a payer who classifies you as an independent contractor rather than as an employee. This type of income is reported on Form 1099-MISC, and you're required to pay self-employment taxes on it.

Form 1099-NEC. Use Form 1099-NEC solely to report nonemployee compensation payments of $600 or more you make in the course of your business to individuals who aren't employees.Form 1099-MISC.Payer's name, address, and phone number.Payer's TIN.Recipient's TIN.Recipient's name.Street address.City, state, and ZIP.More items...?

Starting in tax year 2020, nonemployee compensation may be reported to your client on Form 1099-NEC. In previous years, this type of income was typically reported on Form 1099-MISC, box 7.