Missouri Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split

Description

How to fill out Proposal To Amend Certificate Of Incorporation To Effectuate A One For Ten Reverse Stock Split?

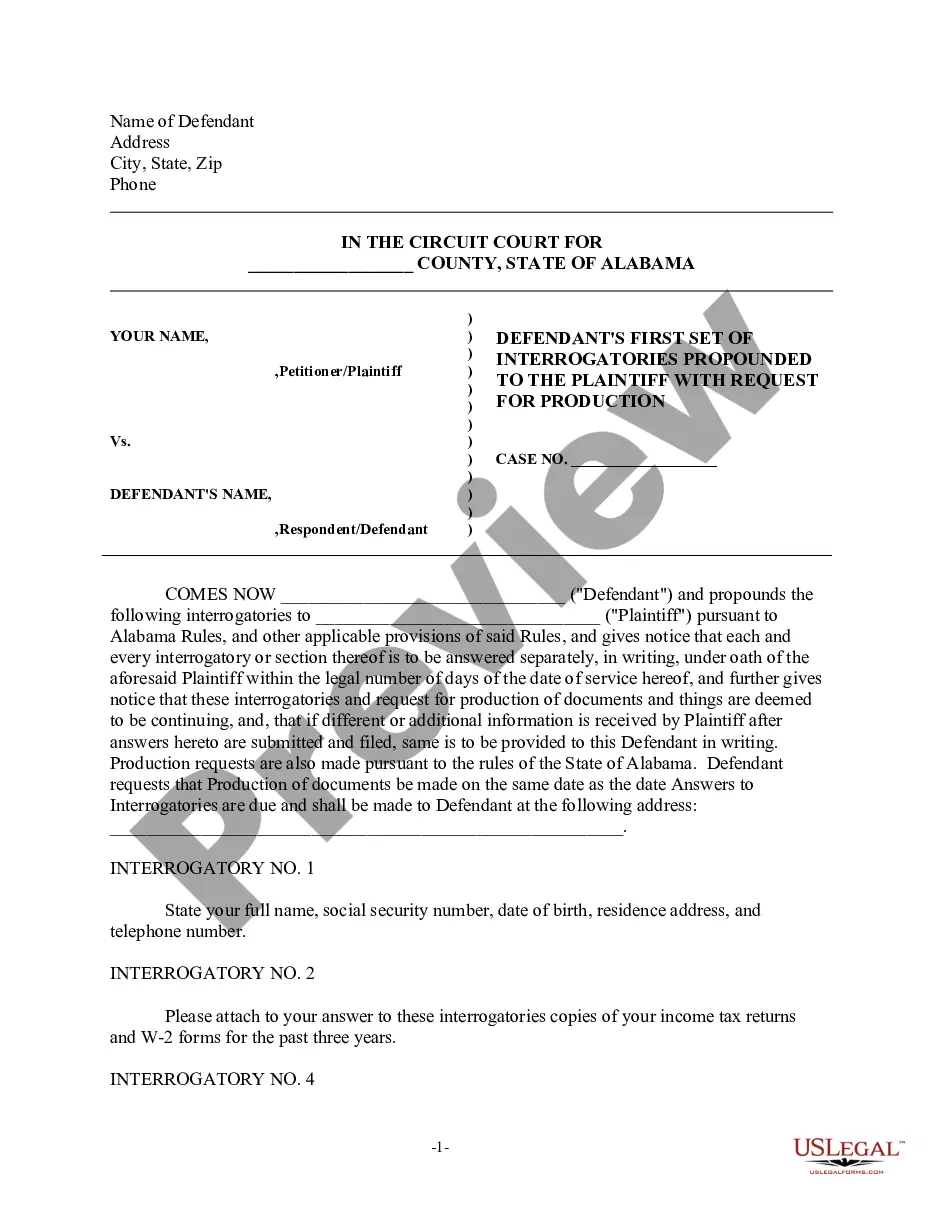

You are able to commit several hours on the Internet trying to find the lawful record template that suits the state and federal requirements you will need. US Legal Forms provides thousands of lawful kinds which are examined by pros. It is simple to download or print out the Missouri Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split from your assistance.

If you currently have a US Legal Forms bank account, it is possible to log in and then click the Down load option. After that, it is possible to total, revise, print out, or indicator the Missouri Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split. Every single lawful record template you acquire is your own property for a long time. To acquire yet another backup associated with a purchased form, check out the My Forms tab and then click the related option.

If you are using the US Legal Forms site initially, follow the basic recommendations below:

- Very first, make certain you have chosen the right record template to the region/metropolis that you pick. Browse the form outline to make sure you have picked the correct form. If readily available, utilize the Review option to look from the record template also.

- If you wish to get yet another edition in the form, utilize the Research field to obtain the template that suits you and requirements.

- Upon having identified the template you desire, click Get now to proceed.

- Choose the prices program you desire, type your accreditations, and sign up for your account on US Legal Forms.

- Complete the transaction. You should use your Visa or Mastercard or PayPal bank account to cover the lawful form.

- Choose the file format in the record and download it to your system.

- Make alterations to your record if needed. You are able to total, revise and indicator and print out Missouri Proposal to amend certificate of incorporation to effectuate a one for ten reverse stock split.

Down load and print out thousands of record templates while using US Legal Forms site, that offers the biggest collection of lawful kinds. Use skilled and condition-certain templates to tackle your business or person requires.

Form popularity

FAQ

NOTE: A new CUSIP number is required for a reverse stock split prior to the Marketplace Effective Date. This information can be provided by selecting the box for section 2 above. Is there a cash out associated with this reverse stock split?

Reverse stock splits are proposed by company management and are subject to consent from the shareholders through their voting rights.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

The only journal entry required for a reverse stock split is a memorandum entry to indicate that the numbers of shares outstanding have decreased. A journal entry with debits and credits are not needed since the line items on shareholders equity do not change in a reverse stock split.

Reverse stock splits work the same way as regular stock splits but in reverse. A reverse split takes multiple shares from investors and replaces them with fewer shares. The new share price is proportionally higher, leaving the total market value of the company unchanged.

The number of outstanding shares of Common Stock will be decreased as a result of a Reverse Stock Split, but the number of authorized shares of Common Stock will not be so decreased.

When a company completes a reverse stock split, each outstanding share of the company is converted into a fraction of a share. For example, if a company declares a one for ten reverse stock split, every ten shares that you own will be converted into a single share.