Missouri Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company

Description

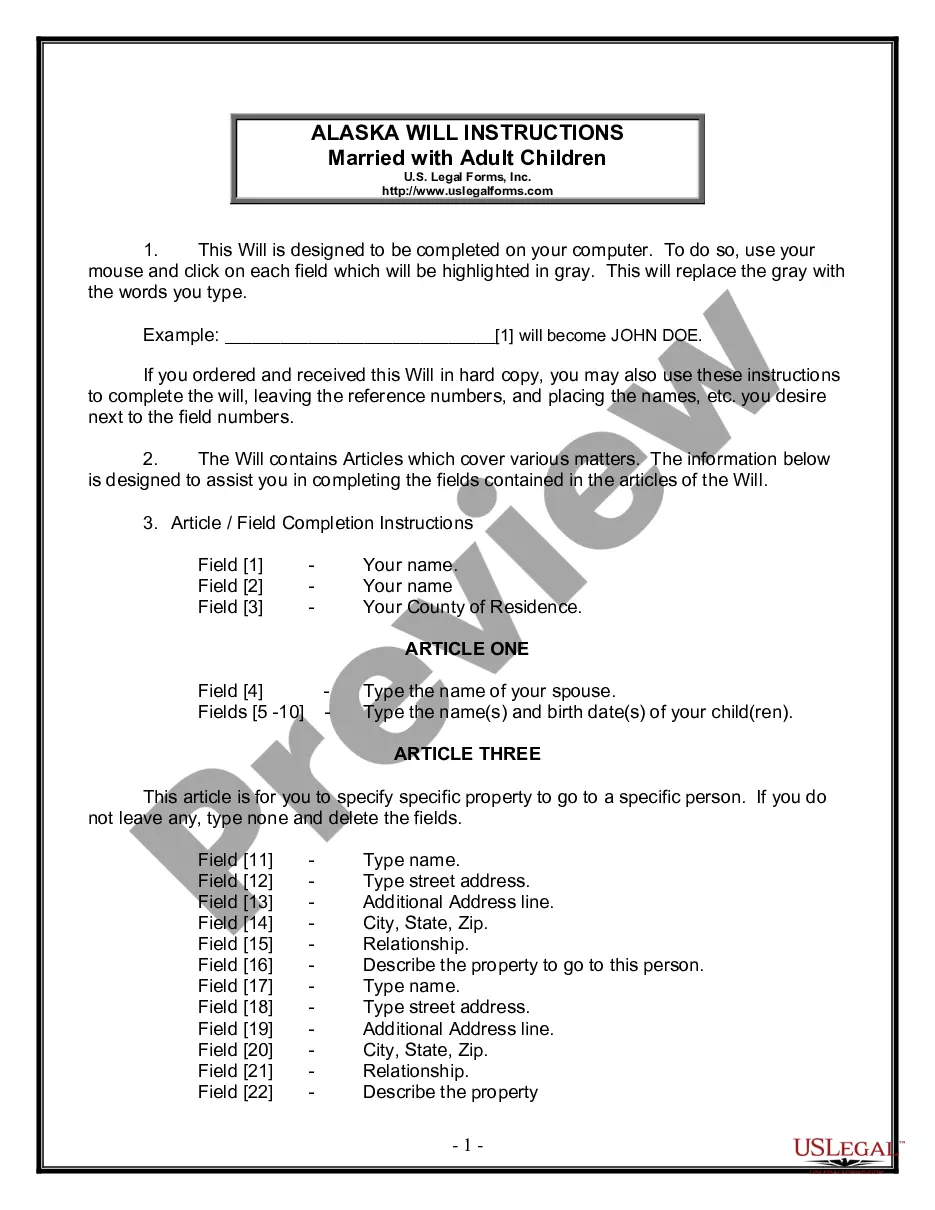

How to fill out Resolution Of Meeting Of LLC Members To Specify Amount Of Annual Disbursements To Members Of The Company?

If you're looking to gather, secure, or create authentic document templates, utilize US Legal Forms, the leading source of official forms available online.

Take advantage of the site's user-friendly and convenient search feature to find the documents you need.

A range of templates for business and personal purposes are categorized by types and titles, or keywords.

Step 4. Once you have identified the form you need, select the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

Step 5. Complete the payment. You can utilize your credit card or PayPal account to finalize the transaction.

- Use US Legal Forms to acquire the Missouri Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company with just a few clicks.

- If you're already a US Legal Forms member, Log In to your account and click the Obtain button to access the Missouri Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company.

- You can also view forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps outlined below.

- Step 1. Ensure you have chosen the form for your relevant city/state.

- Step 2. Utilize the Preview option to review the details of the form. Remember to read the description.

- Step 3. If you are dissatisfied with the form, use the Search field at the top of the page to locate other formats within the legal form design.

Form popularity

FAQ

Yes, Missouri requires LLCs to file an annual report. This report is crucial for maintaining your company's good standing with the state. When preparing your annual report, consider including a Missouri Resolution of Meeting of LLC Members to Specify Amount of Annual Disbursements to Members of the Company. This practice ensures that important financial decisions are documented, promoting transparency and accountability.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.

A resolution is a formal way in which a company can note decisions that are made at a meeting of company members.

Creating an LLC Corporate ResolutionOnce committed to writing, all managing members or the chairperson of the board should sign the resolutions. In a corporate structure, the board's secretary typically prepares the resolution based on the minutes from the meeting in which the resolution was voted upon and passed.

Any LLC member can propose a resolution, but all members must vote on it. Typically a majority of the members is needed to pass the resolution, but each LLC may have different voting rights. Some LLCs give a different value to each member's vote based on their percentage of interest in the company.

An LLC resolution is a written record of important decisions made by members that describes an action taken by the company and confirms that members were informed about it and agreed to it.

How To Write a Corporate Resolution Step by StepStep 1: Write the Company's Name.Step 2: Include Further Legal Identification.Step 3: Include Location, Date and Time.Step 4: List the Board Resolutions.Step 5: Sign and Date the Document.

An LLC resolution is a document describing an action taken by the managers or owners of a company, with a statement regarding the issue that needs to be voted on. This does not need to be a complicated document, and need only include necessary information.

An LLC member resolution is the written record of a member vote authorizing a specific business action. Formal resolutions aren't necessary for small, everyday decisions. However, they're useful for granting authority to members to transact significant business actions, such as taking out a loan on behalf of the LLC.