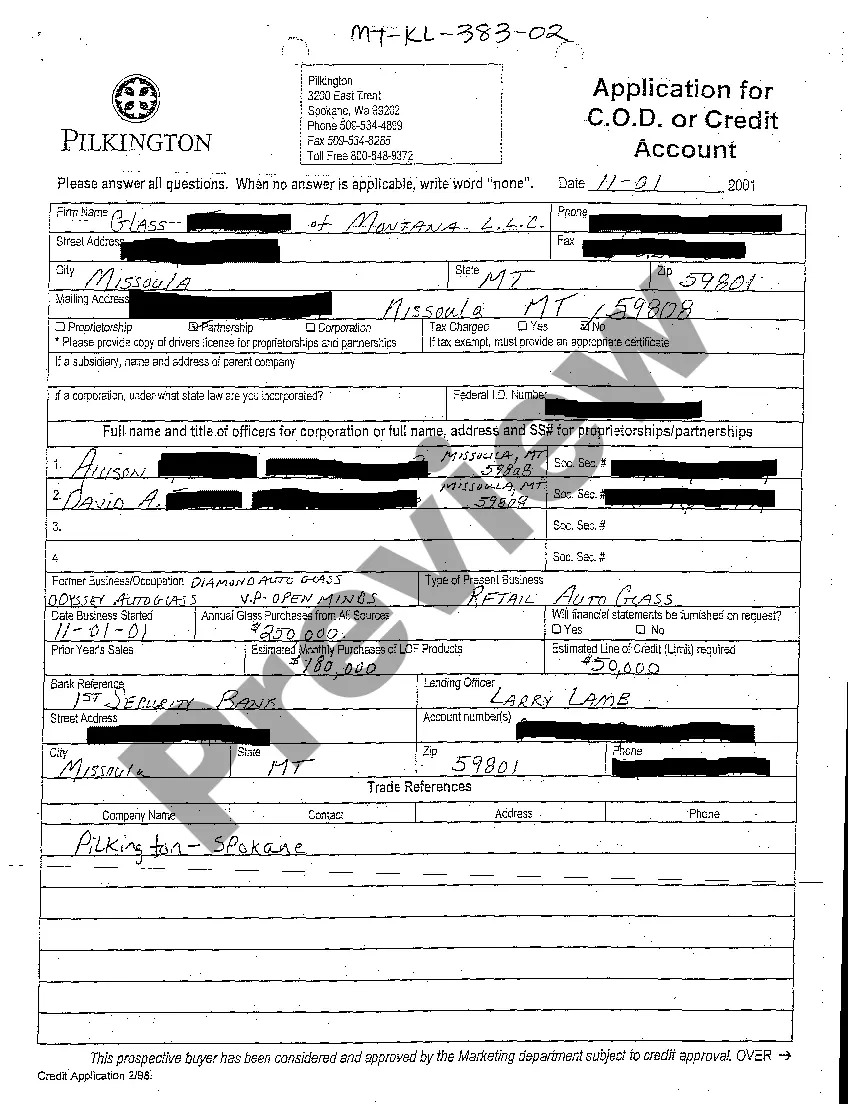

Missouri Credit Inquiry

Description

How to fill out Credit Inquiry?

Are you presently in a location where you require documents for both business or personal purposes on a daily basis.

There are many legitimate document templates available online, but finding ones you can trust isn’t straightforward.

US Legal Forms offers thousands of document templates, such as the Missouri Credit Inquiry, that are designed to comply with federal and state regulations.

Once you locate the appropriate document, click Get now.

Select the pricing plan you desire, provide the necessary information to create your account, and proceed to purchase an order using your PayPal or Visa or Mastercard.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Once logged in, you can download the Missouri Credit Inquiry template.

- If you don't have an account and wish to start using US Legal Forms, follow these instructions.

- Find the document you need and ensure it corresponds to the correct city/area.

- Use the Review button to check the document.

- Examine the description to confirm that you have selected the correct document.

- If the document isn’t what you're looking for, utilize the Lookup field to find the template that meets your needs.

Form popularity

FAQ

Yes, you can file your Missouri Property Tax Credit (PTC) online through the Missouri Department of Revenue’s website. This option simplifies the application process, making it quicker and more efficient. Ensure you gather all required documentation before starting your online application. Resources like US Legal Forms can provide additional support and clarity during this process.

Age 65 and Over Tax Exemptions for Missouri (AGEXMMO29A647NCEN) FRED St.

Under Missouri Law, the following property may be exempt: 1) Property owned by the State or other political subdivision such as city, county, public water district, etc. 2) Agricultural and Horticultural societies and non-profit cemeteries. 3) Property used exclusively for religious worship.

Missouri allows for a property tax credit for certain senior citizens and 100% disabled individuals for a portion of what was paid in real estate taxes or rent that was paid throughout the tax year. The maximum amount of the credit for renters is $750 and $1,100 for home owners that pay real estate taxes.

Adjusted Gross Income is simply your total gross income minus specific deductions. Additionally, your Adjusted Gross Income is the starting point for calculating your taxes and determining your eligibility for certain tax credits and deductions that you can use to help you lower your overall tax bill.

Your PIN is a 4 digit number located on the cover of your voucher booklet or return. If you have entered an invalid Missouri Tax Identification Number, you will receive the following message: The Missouri Tax Identification Number you entered is an invalid number.

InstructionsFill out appropriate tax exempt documents below: Tax Exempt Application signed and notarized.Sign and notarize all the correct forms.Mail or Bring the form and all above documentation to:You may also email the signed Application for Exemption Form and above documentation to: Zasr@stlouis-mo.gov.

year resident may elect to use this form to determine his or her tax as if he or she were a resident for the entire taxable year. If you pay tax to more than one state, you must complete a separate Form MOCR for each state.

Request a Retail Sales Tax License reprint You can email us at businesstaxregister@dor.mo.gov or call 573-751-5860. Please be sure to verify your correct mailing address and the correct address for the Retail Sales Tax License.

A MITS/MO ID number is assigned to all corporations registered with the Missouri Department of Revenue. This number is used to locate financial information associated with the corporation. This includes original returns, estimated tax payments, Form MO-7004 payments, etc.