Missouri Re-Hire Employee Information Form

Description

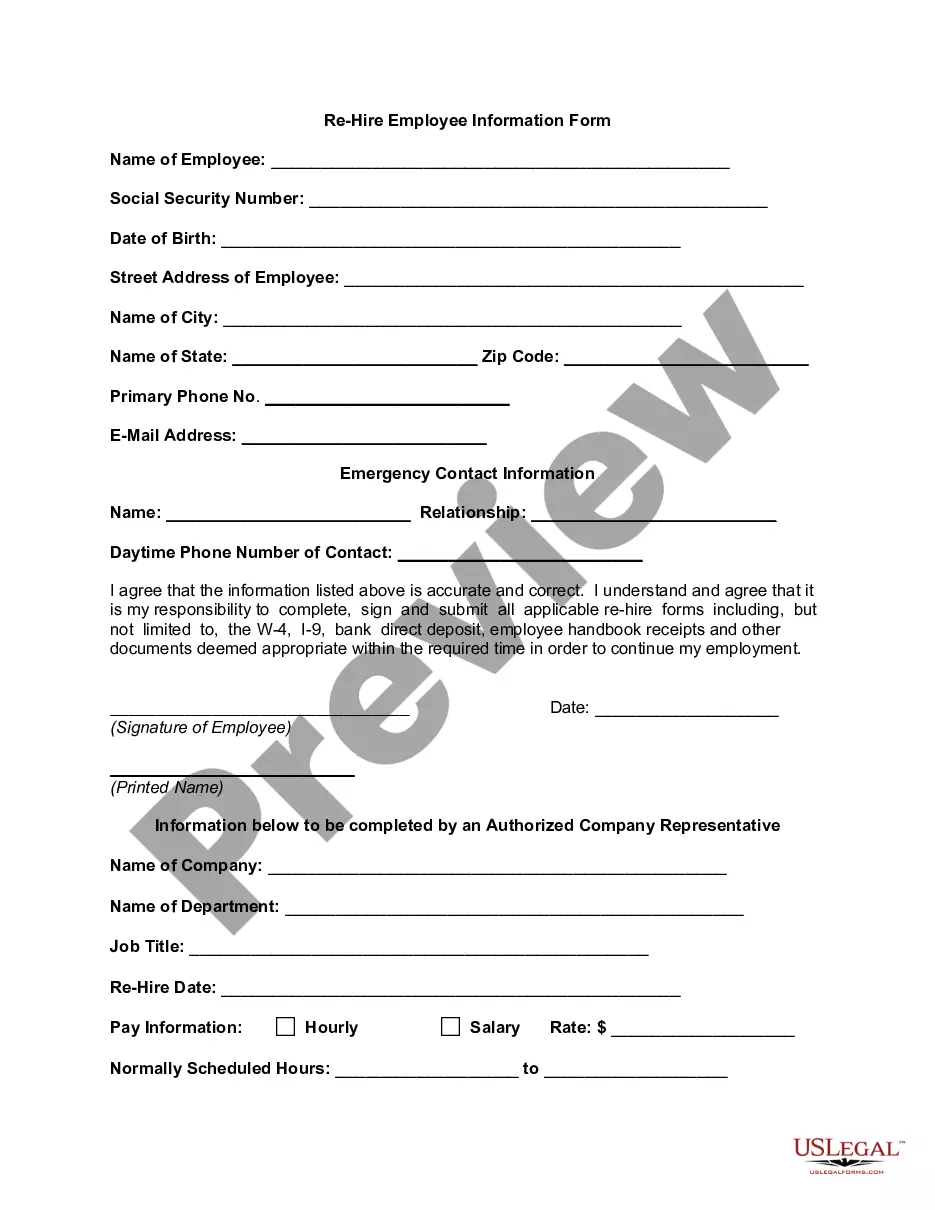

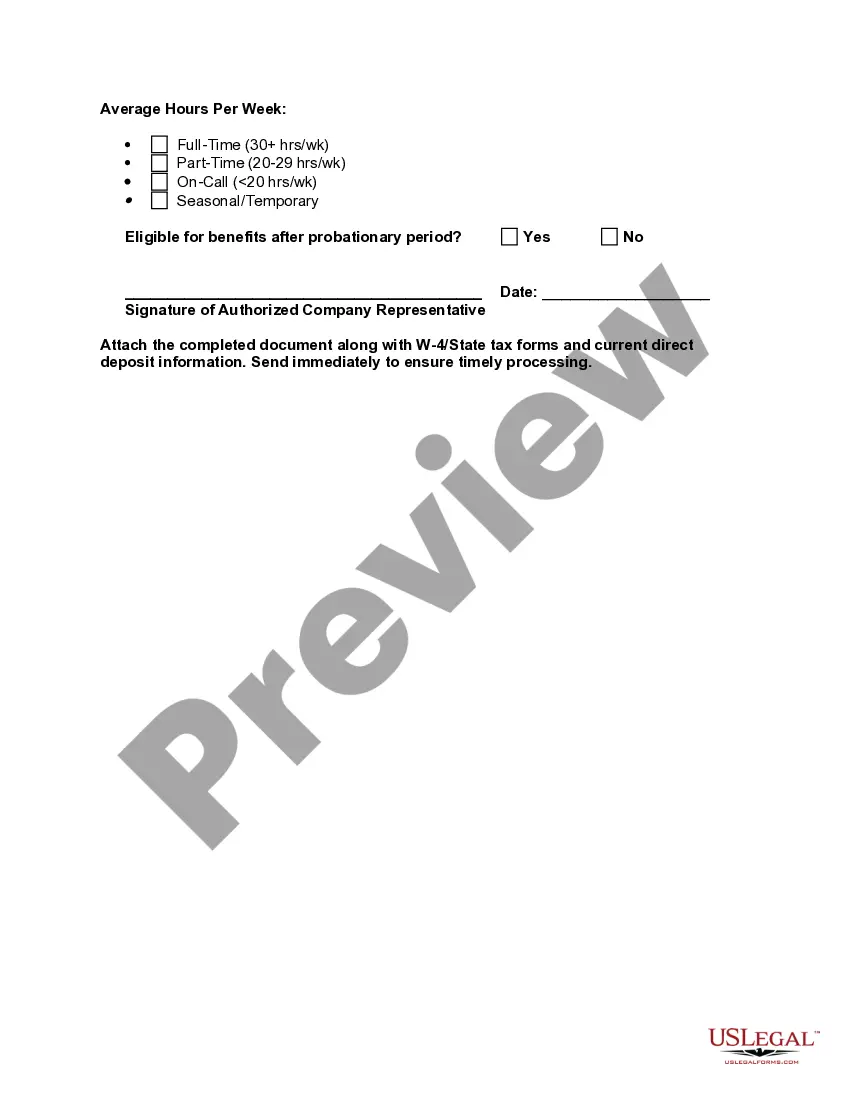

How to fill out Re-Hire Employee Information Form?

Finding the correct official document template can be challenging. Surely, there are numerous templates accessible online, but how do you obtain the official version you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Missouri Re-Hire Employee Information Form, that you can utilize for business and personal needs. All documents are reviewed by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to obtain the Missouri Re-Hire Employee Information Form. Use your account to search for the official documents you may have previously purchased. Navigate to the My documents section of your account and retrieve another copy of the document you need.

US Legal Forms is the largest repository of official forms where you can find a wide array of document templates. Take advantage of the service to download professionally crafted documents that adhere to state regulations.

- First, make sure you have selected the correct form for your city/region. You can examine the form using the Review button and review the form overview to ensure this is indeed the right fit for you.

- If the form doesn't fulfill your requirements, use the Search feature to find the suitable form.

- Once you are confident that the form is correct, click the Get now button to acquire the form.

- Choose the payment plan you prefer and enter the required information. Create your account and complete the transaction using your PayPal or credit card.

- Select the file format and download the official document template to your device.

- Complete, modify, and print out, and sign the downloaded Missouri Re-Hire Employee Information Form.

Form popularity

FAQ

Employers are required to report newly hired employees within 20 calendar days of the hire date. If an employee is required to fill out a W-4 form, that employee must be reported.

If an employee is required to fill out a W-4 form, that employee must be reported. New hire reporting is mandated by federal law under Title 42 of U.S. Code, Section 653a of the Personal Responsibility and Work Opportunity Reconciliation Act and by the Revised Statutes of Missouri, Sections 285.300 to 285.308.

Owners of an LLC are called members, which can be corporations, individuals, and even other LLCs. LLCs can have employees, who work for the company, and independent contractors, who perform contracted work but are not company employees.

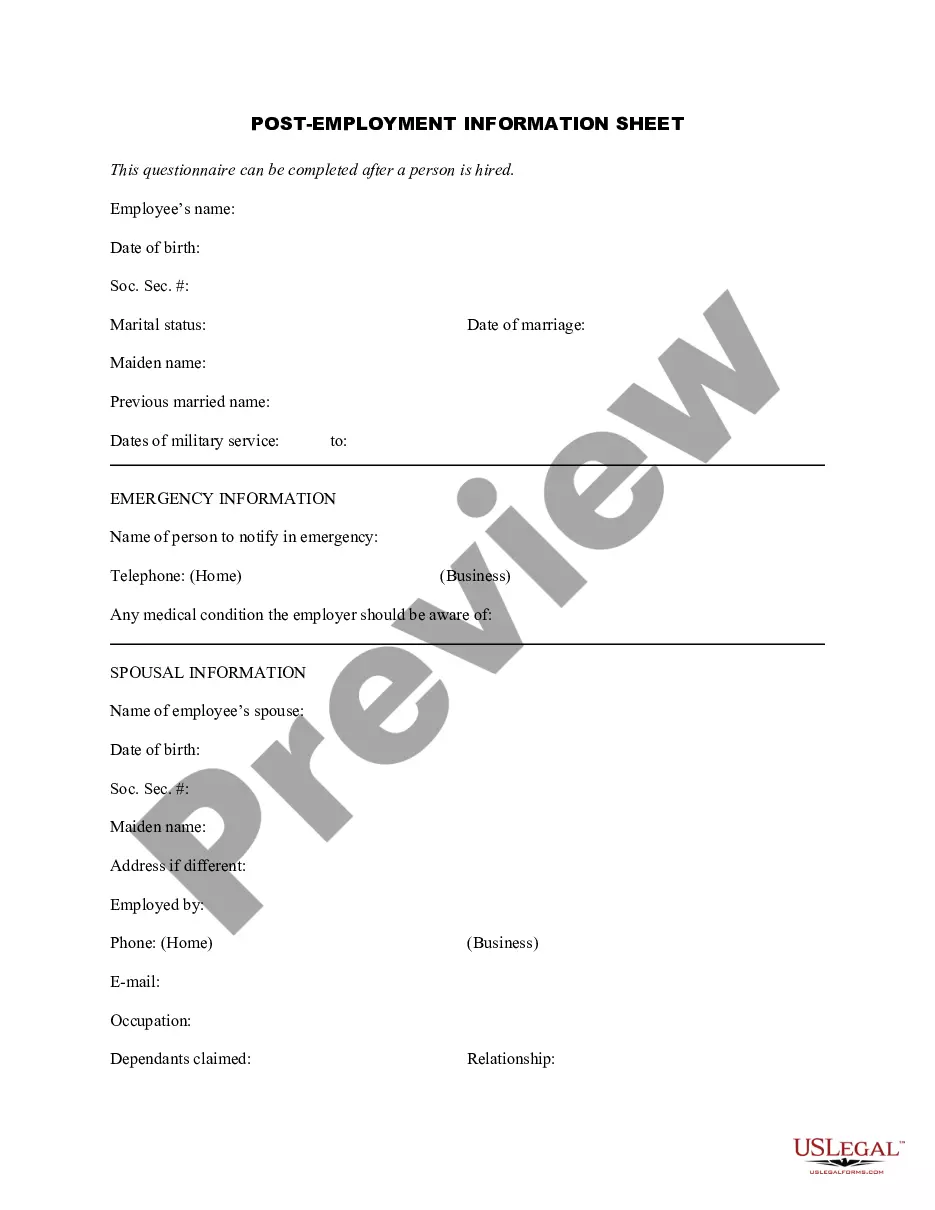

Here are some forms you can expect to fill out when you begin a new job:Job-specific forms. Employers usually create forms unique to specific positions in a company.Employee information.CRA and tax forms.Compensation forms.Benefits forms.Company policy forms.Job application form.Signed offer letter.More items...?

Hiring processFind your candidates. Ask your best employees if they know anyone who might be a good fit for the role.Conduct interviews. You should try to have at least a couple of employees interview the candidates, if possible.Run a background check.Make sure they're eligible to work in the U.S.10-Apr-2021

You may also call 1-888-663-6751....You may use one of the following reporting methods:Mail the W-4 or equivalent form to the Missouri Department of Revenue, PO Box 3340, Jefferson City, MO 65105-3340;Fax copies of the W-4 or equivalent form to (573) 526-8079;Electronically report employees via Secure File Transfer.

Steps to Hiring your First Employee in MissouriStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Employees do not need to be members of the LLC, however members may choose to be employees. The legal definition of an employee is any individual hired for a wage, salary fee, or payment to perform work from an employer. Keep in mind that employees are different than independent contractors.

Make sure you and new hires complete employment forms required by law.W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

You may also call 1-888-663-6751....You may use one of the following reporting methods:Mail the W-4 or equivalent form to the Missouri Department of Revenue, PO Box 3340, Jefferson City, MO 65105-3340;Fax copies of the W-4 or equivalent form to (573) 526-8079;Electronically report employees via Secure File Transfer.