Missouri Contractor Access Form

Description

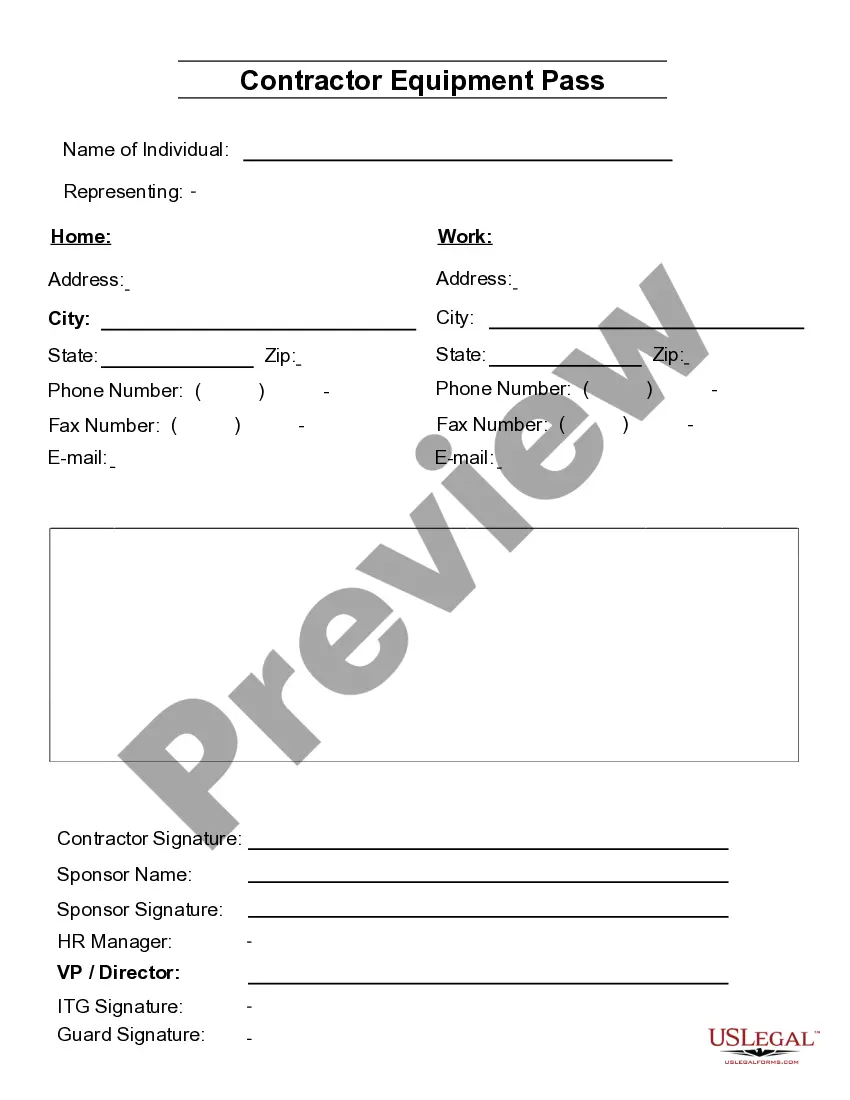

How to fill out Contractor Access Form?

US Legal Forms - one of the several largest repositories of legal documents in the USA - offers an assortment of legal form templates that you can download or print.

By using the website, you can access a vast collection of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms like the Missouri Contractor Access Form in just a few minutes.

If you already have a monthly subscription, Log In and retrieve the Missouri Contractor Access Form from your US Legal Forms library. The Obtain button will appear on every form you view. You can find all previously downloaded forms in the My documents section of your account.

Select the format and download the form to your device.

Edit. Fill out, modify, print, and sign the downloaded Missouri Contractor Access Form. Each template you save in your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Missouri Contractor Access Form with US Legal Forms, the most extensive collection of legal document templates. Utilize a vast array of professional and state-specific templates that cater to your business or personal needs.

- If you're using US Legal Forms for the first time, here are simple steps to help you begin.

- Make sure you have selected the correct form for your city/state. Click the Preview button to review the form’s content.

- Read the form description to confirm that you have chosen the right form.

- If the form doesn’t meet your needs, utilize the Search field at the top of the screen to find the one that does.

- If you are satisfied with the form, confirm your selection by clicking the Get now button. Then, choose your preferred payment plan and provide your credentials to register for an account.

- Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Form popularity

FAQ

If you earn more than $1,200 you must file Form MO-1040. If your home of record is Missouri and you are stationed in Missouri due to military orders, all of your income, including your military pay, is taxable to Missouri.

If I live in Illinois and work fulltime in Missouri, which state tax do I file my annual return with? You will need to file both a Missouri (non-resident) and Illinois (resident) income tax return. The tax that that was withheld for Missouri will be considered as a credit for your Illinois return.

This is your Missouri resident credit. Enter the amount on Form MO-1040, Line 29Y and 29S. (If you have multiple credits, add the amounts on Line 11 from each MO-CR). Your total credit cannot exceed the tax paid or the percent of tax due to Missouri on that part of your income. Information to complete Form MO-CR.

Form MO-1040A Missouri Individual Income Tax Short Form.

Just like the federal level, Missouri imposes income taxes on your earnings if you have a sufficient connection to the state if you work or earn an income within state borders. You may not have to file a Missouri return if: You are a resident and have less than $1,200 of Missouri adjusted gross income.

Form MO-NRI: Form MO-NRI is used when a nonresident elects to pay taxes on the percentage of income (Missouri income percentage) earned in Missouri, or when a part-year resident chooses to pay taxes on the percentage of income earned while a Missouri resident.

The MO-1040P has been eliminated for 2021. Please use MO-1040, MO-A, and MO-PTS if applicable. The Department has eliminated the MO-1040P Property Tax Credit and Pension Exemption Short Form for tax year 2021, see MO-1040 Instructions for more details.

If you earn more than $1,200 you must file Form MO-1040. If your home of record is Missouri and you are stationed in Missouri due to military orders, all of your income, including your military pay, is taxable to Missouri.

Form MO-A - 2020 Individual Income Tax Adjustments.

If you or your spouse earned Missouri source income of $600 or more (other than military pay), you must file a Missouri income tax return by completing Form MO-1040 and Form MO-NRI. Be sure to include a copy of your federal return.