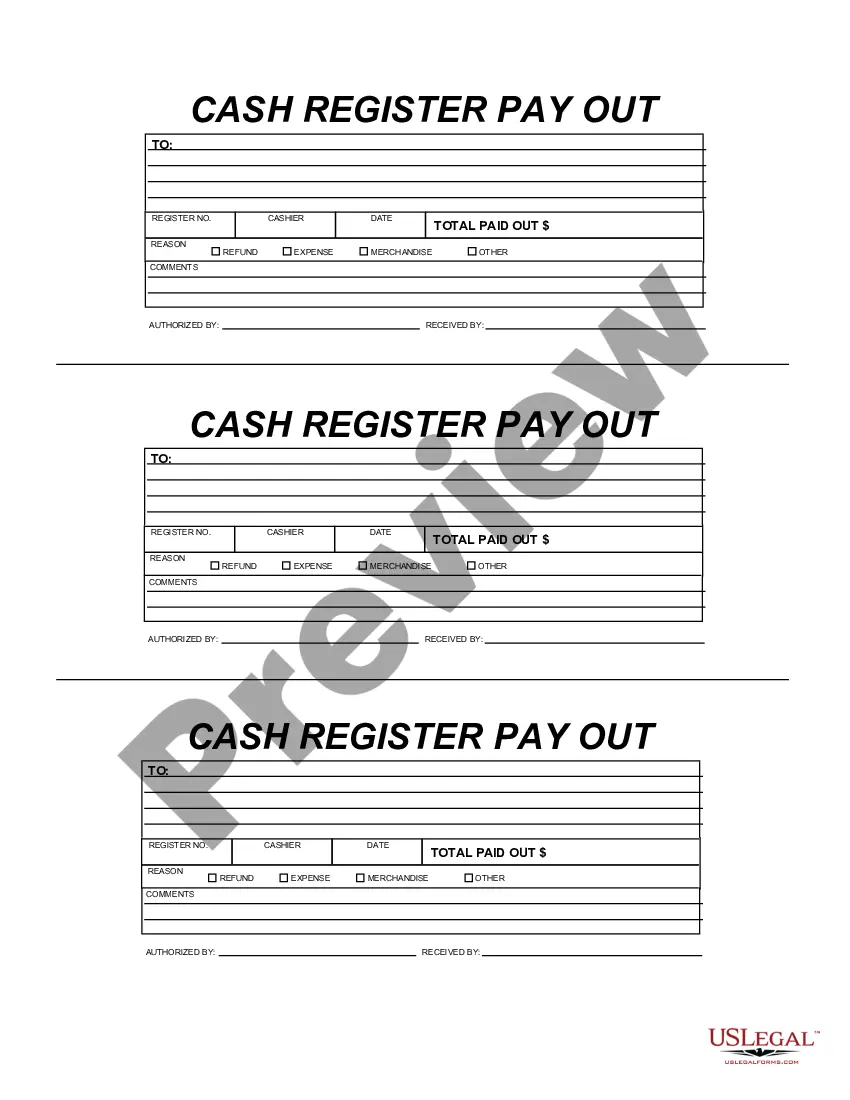

Missouri Cash Register Payout

Description

How to fill out Cash Register Payout?

You can spend hours on the web searching for the legal document template that meets the state and federal requirements you will need.

US Legal Forms provides a vast array of legal forms that can be reviewed by experts.

It is easy to download or print the Missouri Cash Register Payout from my services.

To find another version of the form, use the Lookup field to locate the template that fits your needs and specifications.

- If you already have a US Legal Forms account, you can Log In and then click on the Obtain button.

- After that, you can complete, edit, print, or sign the Missouri Cash Register Payout.

- Every legal document template you purchase is yours indefinitely.

- To get an additional copy of the purchased form, go to the My documents tab and click the relevant option.

- If you are visiting the US Legal Forms website for the first time, follow the simple steps outlined below.

- First, ensure that you have chosen the correct document template for your desired state/city.

- Review the form summary to confirm you have selected the appropriate type.

Form popularity

FAQ

An employer can reduce an employee2032s wages without violating any law. However, an employer subject to the Missouri Minimum Wage Law or the Federal Fair Labor Standards Act (FLSA), may not reduce an employee2032s wages below the federal minimum or state minimum wage (whichever is higher).

There are no circumstances under which an employer can totally withhold a final paycheck under Missouri law; employers are typically required to issue a final paycheck containing compensation for all earned, unpaid wages.

Employees who are unable to work from home and meet the following criteria will qualify for Emergency Paid Leave: Employees who are required or advised to quarantine or placed on home restrictions by order of a government agency, the university, or a health care provider, as a result of COVID-19.

Employers are not required to provide vacation pay, holiday pay, or severance pay these are benefits given at an employer's discretion. The exception would be instances where an employer has entered into a contract where certain benefits are established by agreement.

Deductions Authorized by Law or Court Order This exemption is self-explanatory: it is permissible for the employer to deduct employee pay in accordance with the terms of the applicable court order or legislation.

Missouri labor laws do not require employers to provide employees with severance pay. If an employer chooses to provide severance, it must comply with the terms of its established policy or employment contract.

Missouri law requires that final wages be paid to an employee upon the end or termination of employment. An employer who fails to pay final wages is in violation of Missouri Statute 290.110 RSMo. Section 290.110 requires that that all final wages be paid without any deductions.

By law, an employer may be allowed to deduct from wages where: The deduction is required or authorised by statute; or. There is specific provision in the worker's contract; or. The worker has given prior written consent to the deduction.

An employer can reduce an employee2032s wages without violating any law. However, an employer subject to the Missouri Minimum Wage Law or the Federal Fair Labor Standards Act (FLSA), may not reduce an employee2032s wages below the federal minimum or state minimum wage (whichever is higher).

Here's what the Dept. of Labor's website has to say about this issue: Where deductions for walk-outs, breakage, or cash register shortages reduce the employee's wages below the minimum wage, such deductions are illegal.