The articles of amendment shall be executed by the corporation by an officer of the corporation.

Missouri Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation

Description

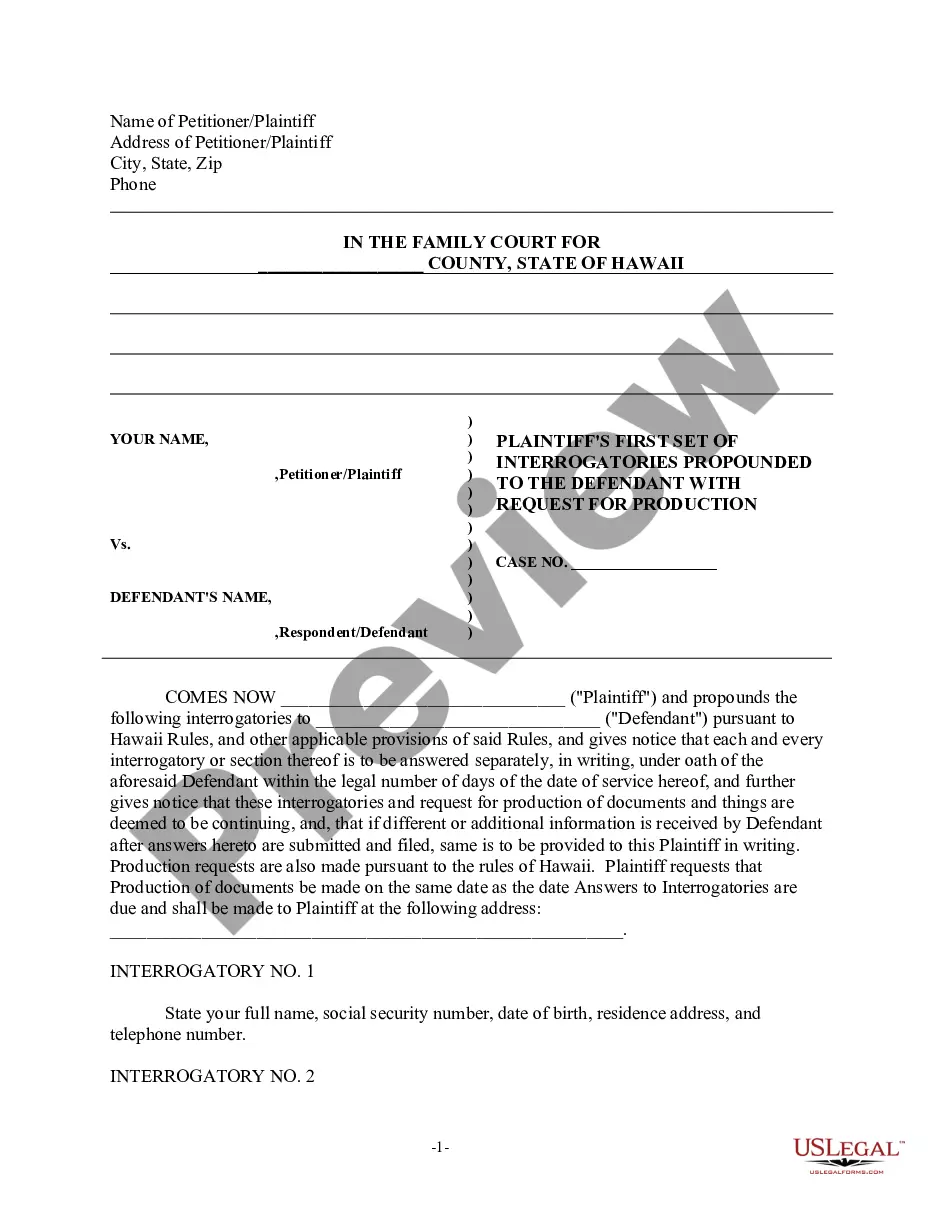

How to fill out Articles Of Amendment To The Articles Of Incorporation Of Church Non-Profit Corporation?

If you need to complete, acquire, or print legal document templates, utilize US Legal Forms, the largest collection of legal documents, accessible online.

Make use of the site's user-friendly and convenient search tool to locate the forms you require. Various templates for commercial and personal needs are organized by categories and regions, or keywords.

Leverage US Legal Forms to quickly find the Missouri Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation with just a few clicks.

Every legal document template you acquire is yours permanently. You have access to each form you purchased in your account. Go to the My documents section and select a template to print or download again.

Fill out and download, and print the Missouri Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation with US Legal Forms. There are thousands of professional and state-specific documents you can use for your commercial or personal requirements.

- If you are already a US Legal Forms subscriber, Log In to your account and then click on the Download button to retrieve the Missouri Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation.

- You can also access forms you have previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure that you have selected the template for the correct city/state.

- Step 2. Use the Preview option to review the details of the template. Don't forget to read the description.

- Step 3. If you are dissatisfied with the template, utilize the Search field at the top of the screen to find alternative versions of the legal document template.

- Step 4. Once you have found the template you need, click on the Get now button. Choose your preferred payment option and enter your credentials to register for an account.

- Step 5. Complete the transaction. You may use your credit card or PayPal account to finalize the purchase.

- Step 6. Select the format of your legal document and download it to your device.

- Step 7. Complete, modify, and print or sign the Missouri Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation.

Form popularity

FAQ

Filling out the certificate of amendment to the Articles of Organization requires careful attention to detail. First, gather necessary information about your church non-profit corporation and the changes you wish to make. Then, complete the form by clearly stating the amendments to the Articles of Incorporation. For assistance with this process, consider using US Legal Forms, which provides easy-to-follow templates and guidance for the Missouri Articles of Amendment to the Articles of Incorporation of Church Non-Profit Corporation.

Nonprofit organizations can't legally operate without a designated board of directors that takes responsibility for ensuring legal compliance and accountability. A nonprofit board of directors is responsible for hiring capable staff, making big decisions and overseeing all operations.

The IRS generally requires a minimum of three board members for every nonprofit, but does not dictate board term length.

At least three directors are required. All Nonprofit corporations must file an annual report each year listing their officers and directors.

At least three directors are required. All Nonprofit corporations must file an annual report each year listing their officers and directors.

Churches and ministries are formed as non-profit corporations. Unlike for-profit corporations, non-profit corporations have no owners / shareholders and do not issues shares. They are not C Corporations or Subchapter S Corporations, although the C Corporation designation is sometimes used to describe them.

How to Start a Nonprofit in MissouriName Your Organization.Recruit Incorporators and Initial Directors.Appoint a Registered Agent.Prepare and File Articles of Incorporation.File Initial Report.Obtain an Employer Identification Number (EIN)Store Nonprofit Records.Establish Initial Governing Documents and Policies.More items...

To amend (change, add or delete) provisions contained in the Articles of Incorporation, it is necessary to prepare and file with the California Secretary of State a Certificate of Amendment of Articles of Incorporation in compliance with California Corporations Code sections 900-910.

Missouri charges a $25 filing fee for non-profit Articles of Incorporation. The fee for an initial registration statement is $15, but 501(c)(3) nonprofits are exempt from this requirement. Missouri's fee for filing an annual report is $15.

State laws determine the minimum number of board directors, which is usually two or three. Depending on the state, there could be a board of one, but it might be difficult to attain 501(c)(3) status with just one board member. Nonprofit organizational budgets are sometimes a factor in the number of board members.