Missouri New Employee Survey

Description

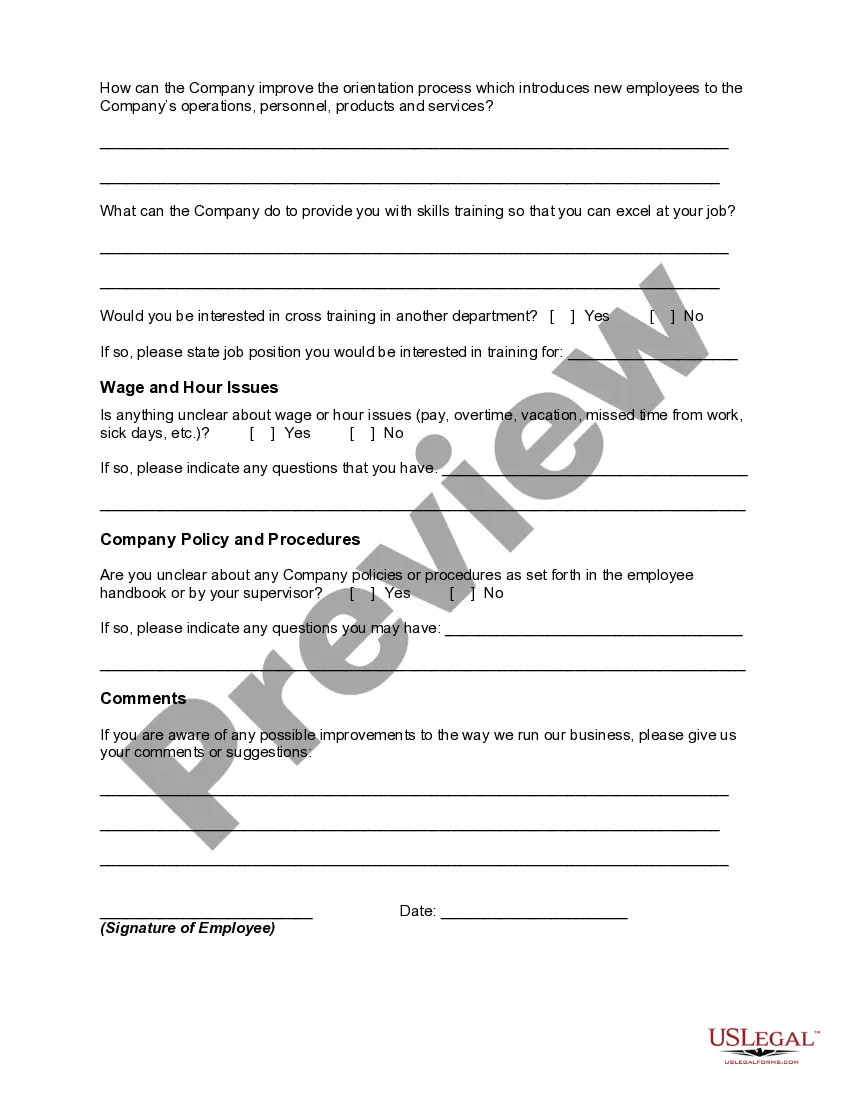

New employee surveys can be done for many purposes. One of them is the new employee orientation survey. This survey is generally done after a few days of orientation to determine any potential issues relating to productivity, turnover, attitudes and other aspects. It would also help the management to understand the productivity of the orientation or training program that the new employee went through in the initial days. The employee's experiences in the early days of employment are also important determinants, since they represent the company's image through the eyes of a new person.

Another kind of new employee survey can be undertaken to know whether the employee has completely understood all the aspects of the new job or not. This can include the job analysis and description, the basics of the job, the most enjoyable and least enjoyable parts of the job, and so on. New employee survey can include information relating to corporate culture, training, supervisor relations, work environment, pay and benefits, communications, feedback, leadership, corporate vision, and overall satisfaction.

How to fill out New Employee Survey?

Selecting the optimal valid document format can be challenging.

Of course, there are numerous templates accessible online, but how do you obtain the specific approved type you desire.

Utilize the US Legal Forms website.

First, make sure you've chosen the correct form for your location. You can view the document using the Preview button and examine the form summary to confirm it is the right fit for your needs. If the document does not satisfy your requirements, use the Search bar to find the appropriate form. Once you are confident that the document is suitable, click the Get now button to download it. Select the payment option you want and enter the necessary details. Create your account and process the payment through your PayPal account or with a Visa or Mastercard. Choose the file format and download the valid document to your device. Complete, modify, print, and sign the received Missouri New Employee Survey. US Legal Forms is the largest repository of legal documents where you can explore numerous file templates. Use the service to obtain properly constructed forms that meet state requirements.

- The service offers a vast array of templates, such as the Missouri New Employee Survey, suitable for business and personal needs.

- All templates are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to retrieve the Missouri New Employee Survey.

- Use your account to review the legal documents you have previously acquired.

- Navigate to the My documents section of your account for another copy of the document you require.

- If you are new to US Legal Forms, here are straightforward steps for you to follow.

Form popularity

FAQ

For new hire reporting in Missouri, you typically need the New Hire Reporting Form. This form captures essential details about the employee, such as their name, address, and social security number. Completing this is crucial, as it aligns with the Missouri New Employee Survey obligations. You can find these forms easily through services like US Legal Forms, which help streamline the paperwork.

If there is a conspiracy between the employer and employee not to report, that penalty may not exceed $500 per newly hired employee. States may also impose non-monetary civil penalties under state law for noncompliance.

The most common types of employment forms to complete are:W-4 form (or W-9 for contractors)I-9 Employment Eligibility Verification form.State Tax Withholding form.Direct Deposit form.E-Verify system: This is not a form, but a way to verify employee eligibility in the U.S.

MODES is an administrative agency of the state of Missouri. MODES's purpose is to promote employment security by providing for the payment of compensation to individuals who become unemployed through no fault of their own.

Initial hiring documentsJob application form.Offer letter and/or employment contract.Drug testing records.Direct deposit form.Benefits forms.Mission statement and strategic plan.Employee handbook.Job description and performance plan.More items...?

You may also call 1-888-663-6751....You may use one of the following reporting methods:Mail the W-4 or equivalent form to the Missouri Department of Revenue, PO Box 3340, Jefferson City, MO 65105-3340;Fax copies of the W-4 or equivalent form to (573) 526-8079;Electronically report employees via Secure File Transfer.

Federal law requires employers to report basic information on new and rehired employees within 20 days of hire to the state where the new employees work. Some states require it sooner.

Regardless of whether the employer is publicly-traded, a private employer is required to comply with California's pay data reporting requirement if it has the threshold number of employees (inside and outside of California), at least one employee in California, and is required to file an EEO-1 Report.

Steps to Hiring your First Employee in MissouriStep 1 Register as an Employer.Step 2 Employee Eligibility Verification.Step 3 Employee Withholding Allowance Certificate.Step 4 New Hire Reporting.Step 5 Payroll Taxes.Step 6 Workers' Compensation Insurance.Step 7 Labor Law Posters and Required Notices.More items...?

Each new employee will need to fill out the I-9, Employment Eligibility Verification Form from U.S. Citizenship and Immigration Services. The I-9 Form is used to confirm citizenship and eligibility to work in the U.S.