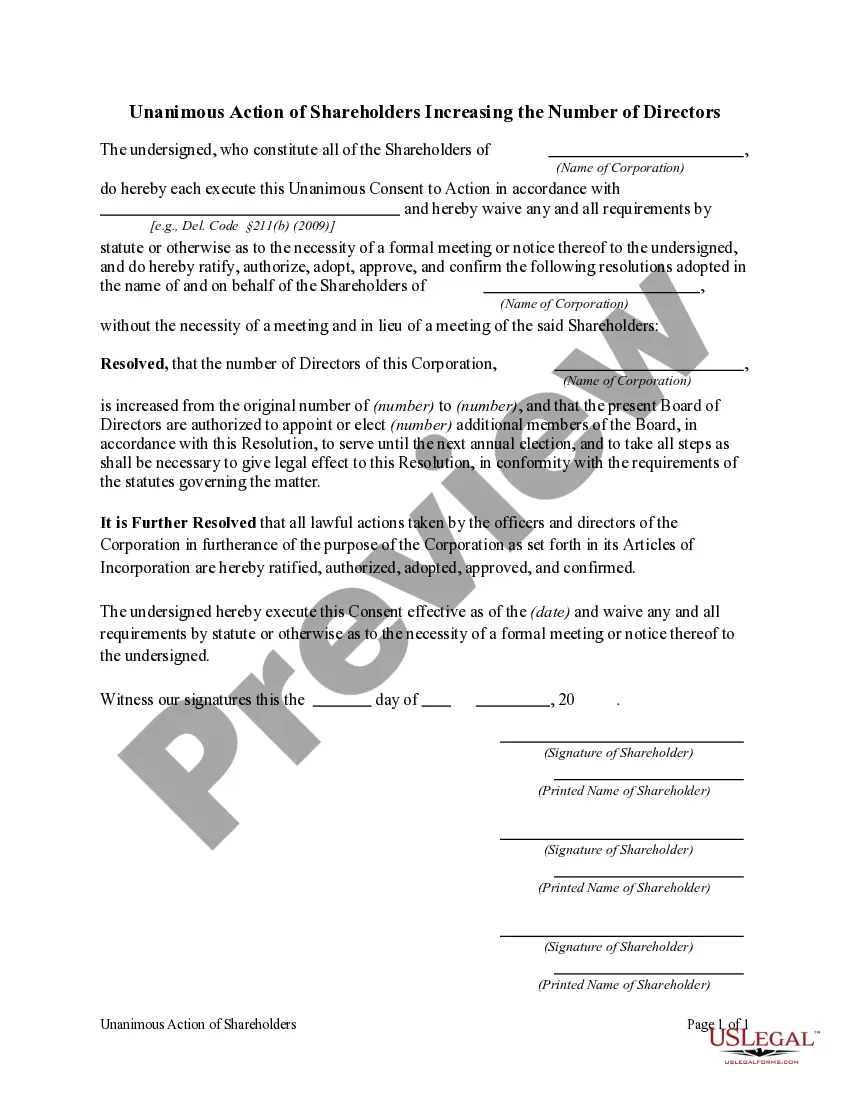

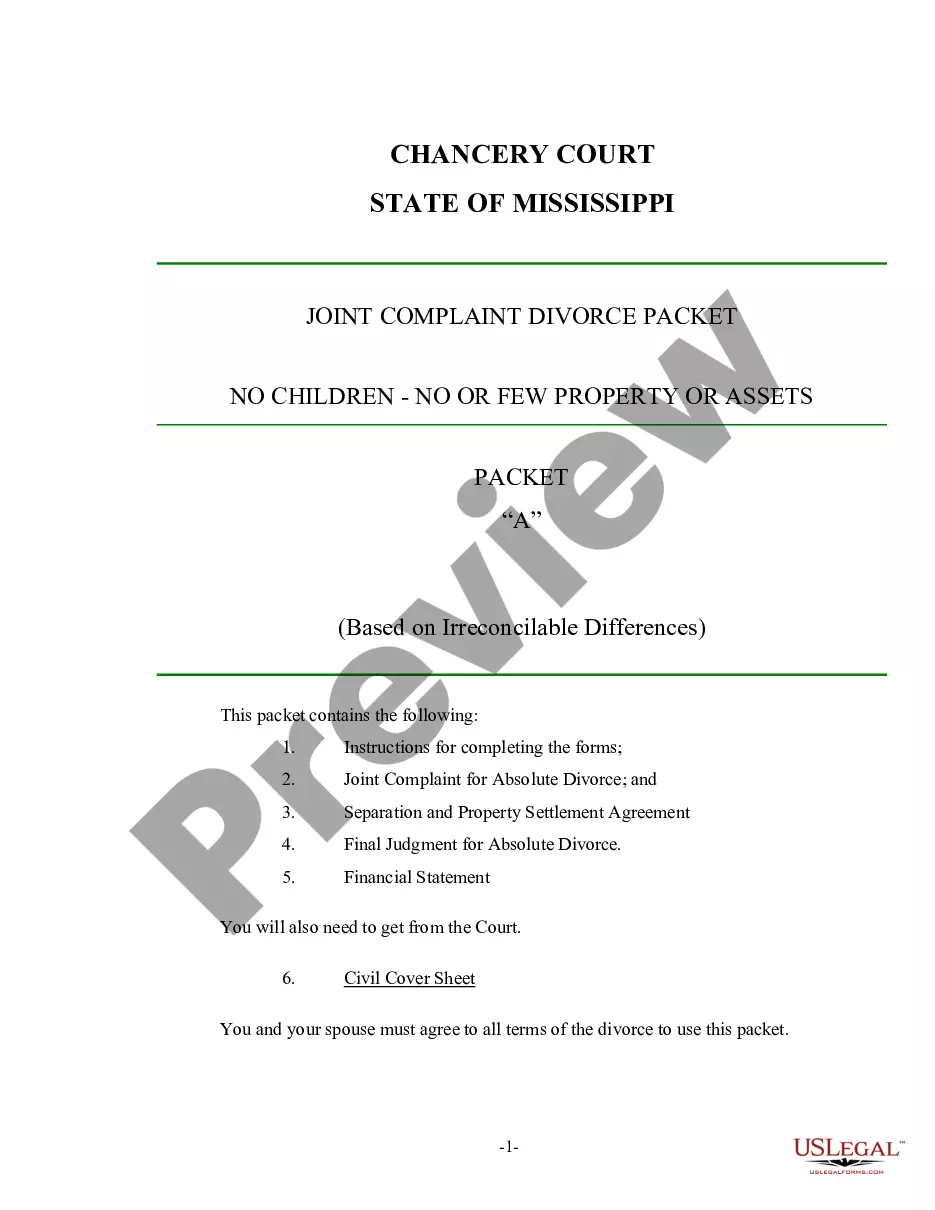

Missouri Sample Letter for Deed of Trust and Promissory Note

Description

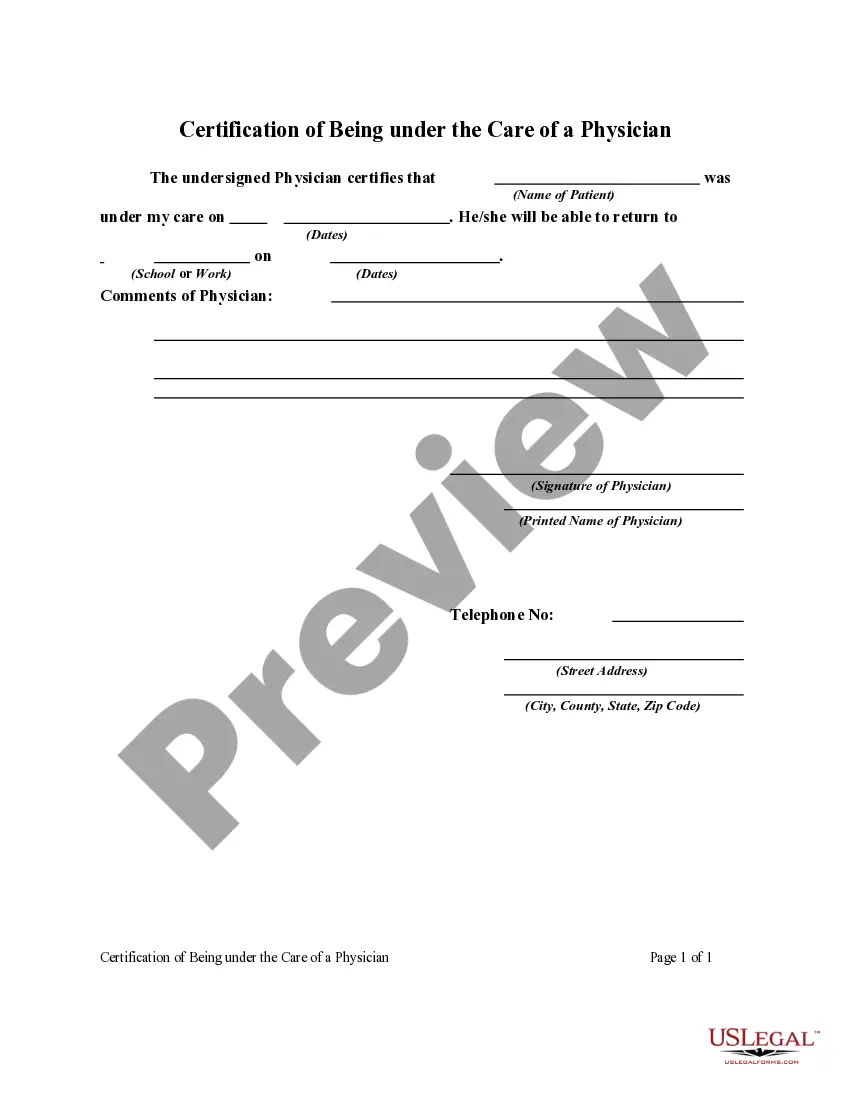

How to fill out Sample Letter For Deed Of Trust And Promissory Note?

US Legal Forms - one of many largest libraries of legitimate types in America - gives a wide range of legitimate file templates you may down load or print out. While using web site, you can get 1000s of types for organization and person uses, sorted by classes, claims, or search phrases.You will discover the latest versions of types such as the Missouri Sample Letter for Deed of Trust and Promissory Note within minutes.

If you have a monthly subscription, log in and down load Missouri Sample Letter for Deed of Trust and Promissory Note through the US Legal Forms local library. The Download button can look on every single type you perspective. You gain access to all in the past downloaded types in the My Forms tab of your own bank account.

If you want to use US Legal Forms the first time, listed here are basic recommendations to help you get started:

- Ensure you have chosen the correct type to your metropolis/region. Click on the Preview button to analyze the form`s content. Look at the type explanation to ensure that you have selected the appropriate type.

- When the type does not satisfy your demands, use the Lookup discipline at the top of the screen to obtain the the one that does.

- Should you be satisfied with the shape, validate your option by simply clicking the Get now button. Then, choose the costs plan you like and offer your accreditations to register for an bank account.

- Method the transaction. Make use of your credit card or PayPal bank account to perform the transaction.

- Find the file format and down load the shape in your system.

- Make changes. Complete, revise and print out and indication the downloaded Missouri Sample Letter for Deed of Trust and Promissory Note.

Every template you put into your bank account does not have an expiry day and it is yours permanently. So, if you would like down load or print out another copy, just go to the My Forms area and then click in the type you require.

Gain access to the Missouri Sample Letter for Deed of Trust and Promissory Note with US Legal Forms, the most comprehensive local library of legitimate file templates. Use 1000s of skilled and status-certain templates that satisfy your organization or person demands and demands.

Form popularity

FAQ

The Note is signed by the people who agree to pay the debt (the people that will be making the mortgage payments). The Deed and the Deed of Trust are signed by those who will own the property that is being mortgaged.

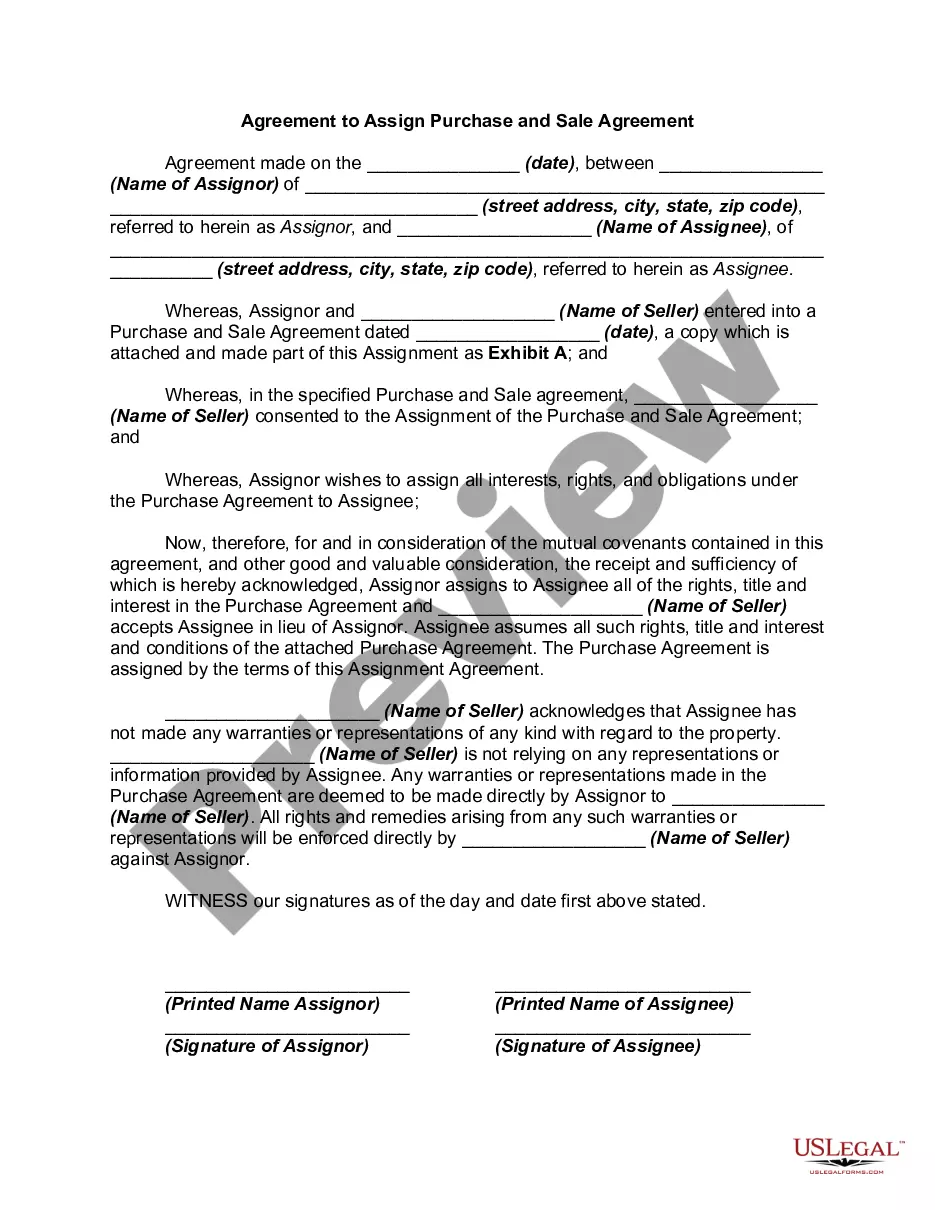

A trust deed is always used together with a promissory note that sets out the amount and terms of the loan. The property owner signs the note, which is a written promise to repay the borrowed money.

A Standard Document used for transferring an interest in an unsecured promissory note to a revocable trust that can be customized for use in any US jurisdiction. This Standard Document contains integrated notes and drafting tips.

Passage of Title. -The fundamental distinction between deeds of trust and mortgages in California is that in the case of a mortgage legal title does not pass from the debtor,5 whereas the converse is true in con- nection with a trust deed.

A deed of trust is a legal agreement that's similar to a mortgage, which is used in real estate transactions. Whereas a mortgage only involves the lender and a borrower, a deed of trust adds a neutral third party that holds rights to the real estate until the loan is paid or the borrower defaults.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes.

Foreclosure process: Mortgages typically go through a judicial foreclosure process, through your county court system. Deeds of trust use a non-judicial foreclosure process. Length of time to foreclose: Mortgage foreclosures usually take significantly longer than non-judicial foreclosures with a deed of trust.

The two main differences between a mortgage and a deed of trust are: a mortgage involves two parties, while a deed of trust has three, and. mortgages are usually foreclosed judicially, while deeds of trust typically go through a nonjudicial foreclosure process (but not always).