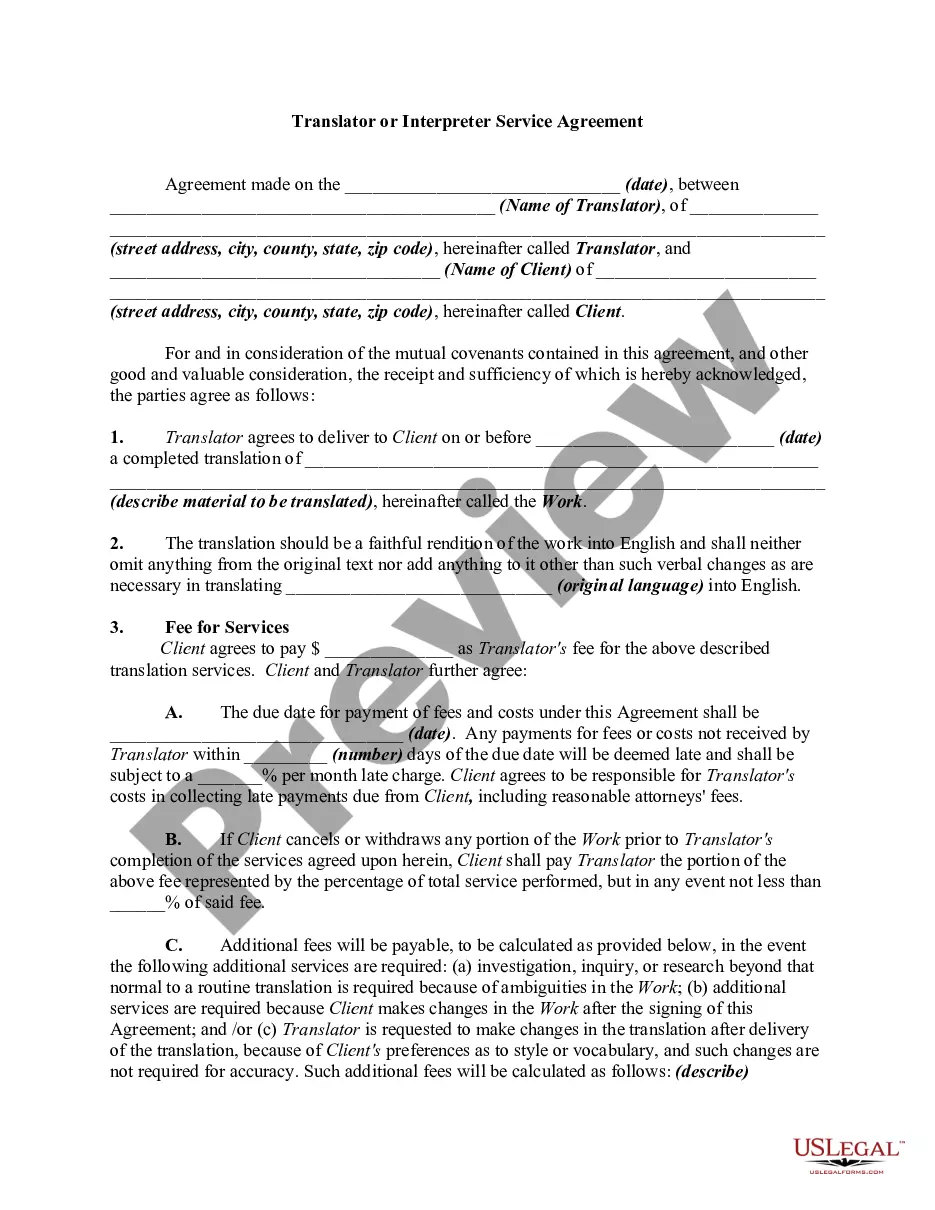

Missouri Receipt of Payment for Obligation

Description

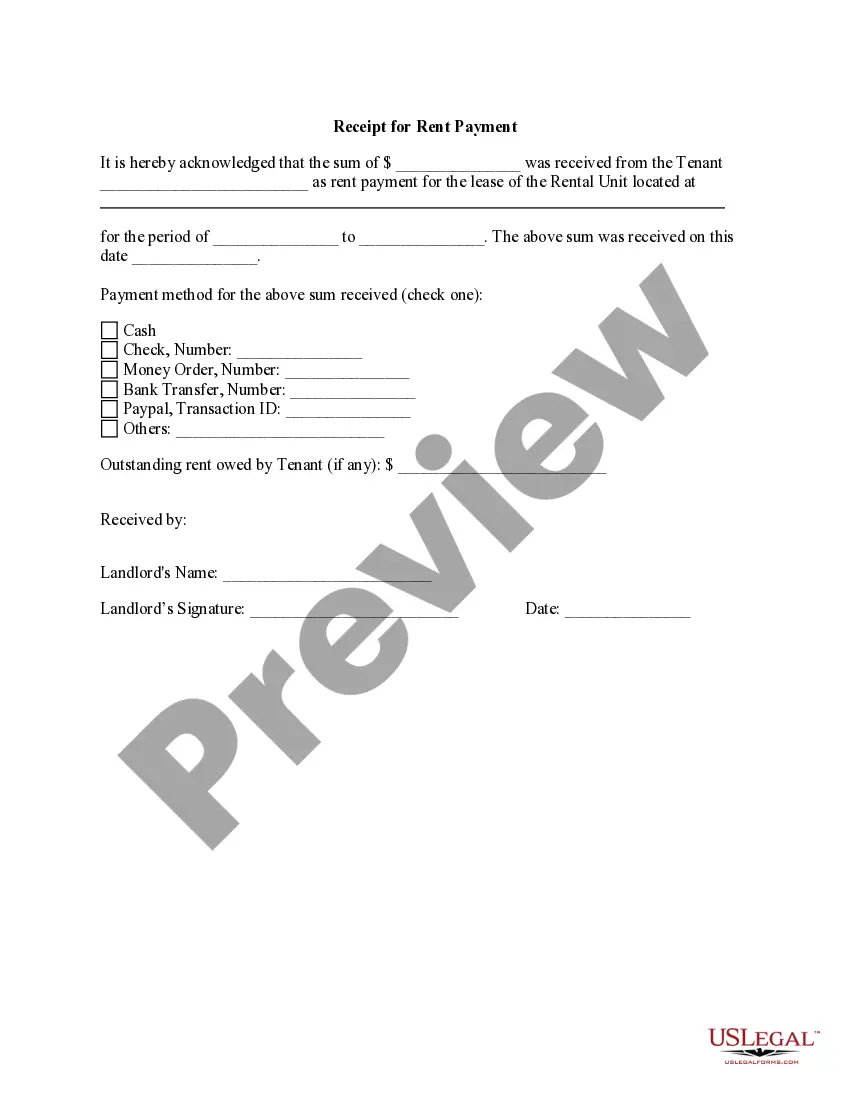

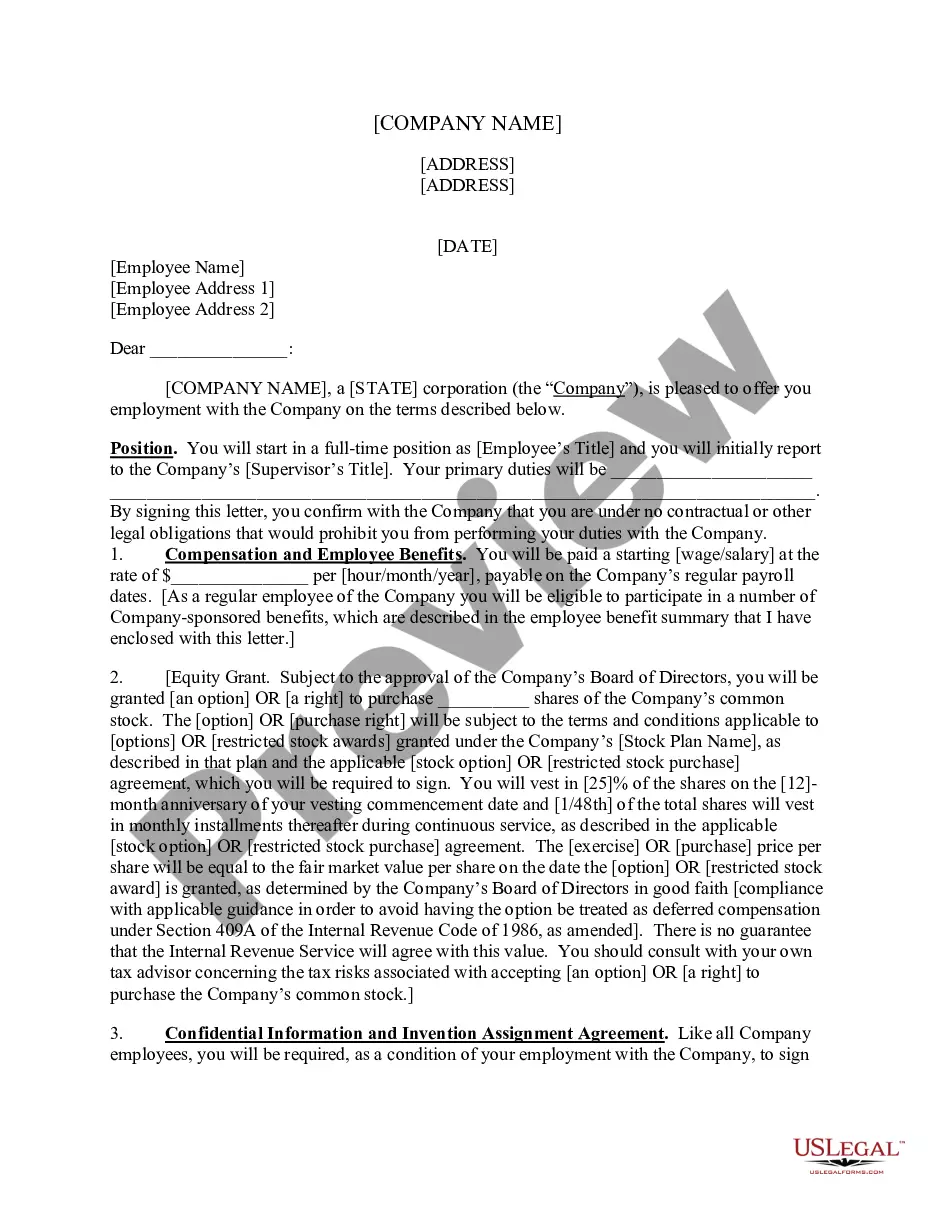

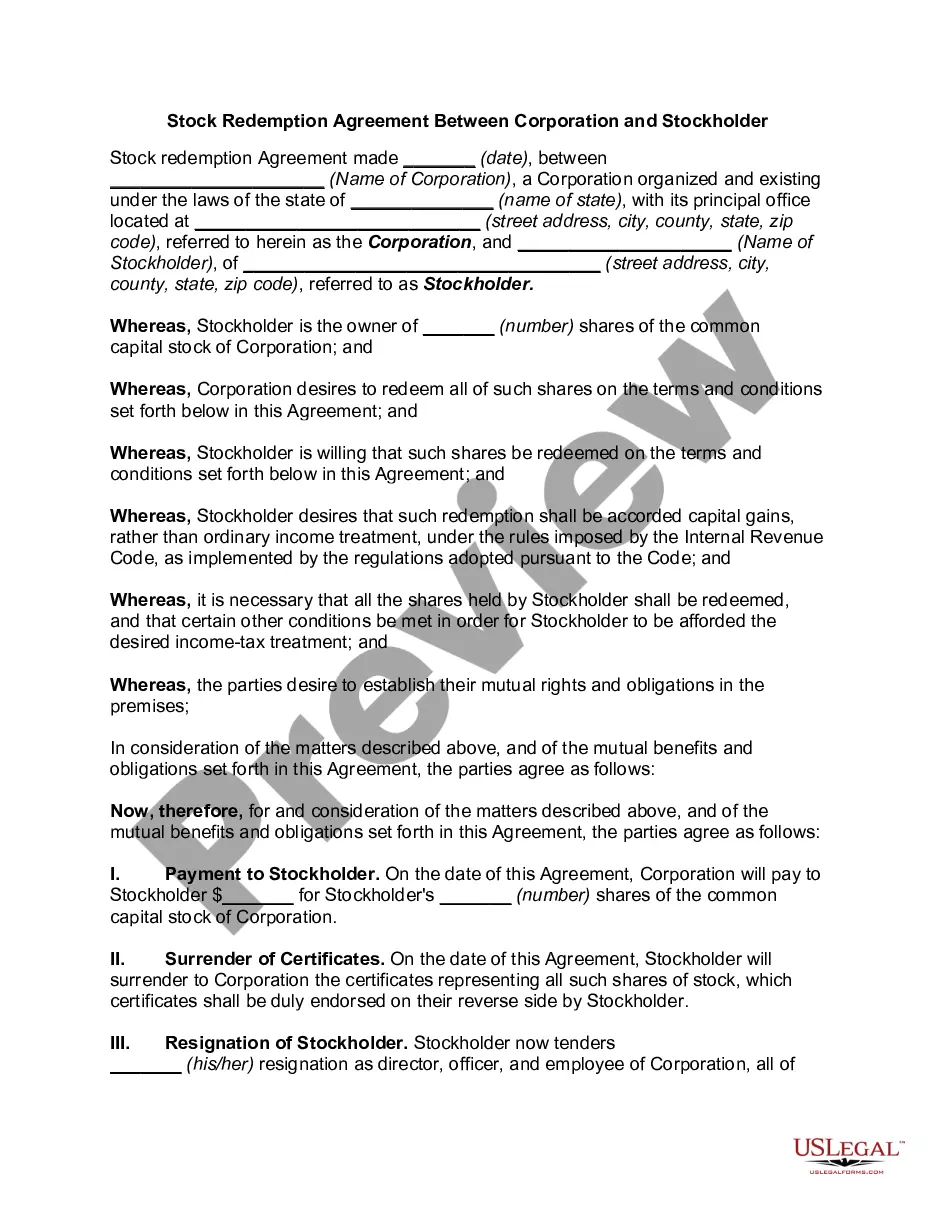

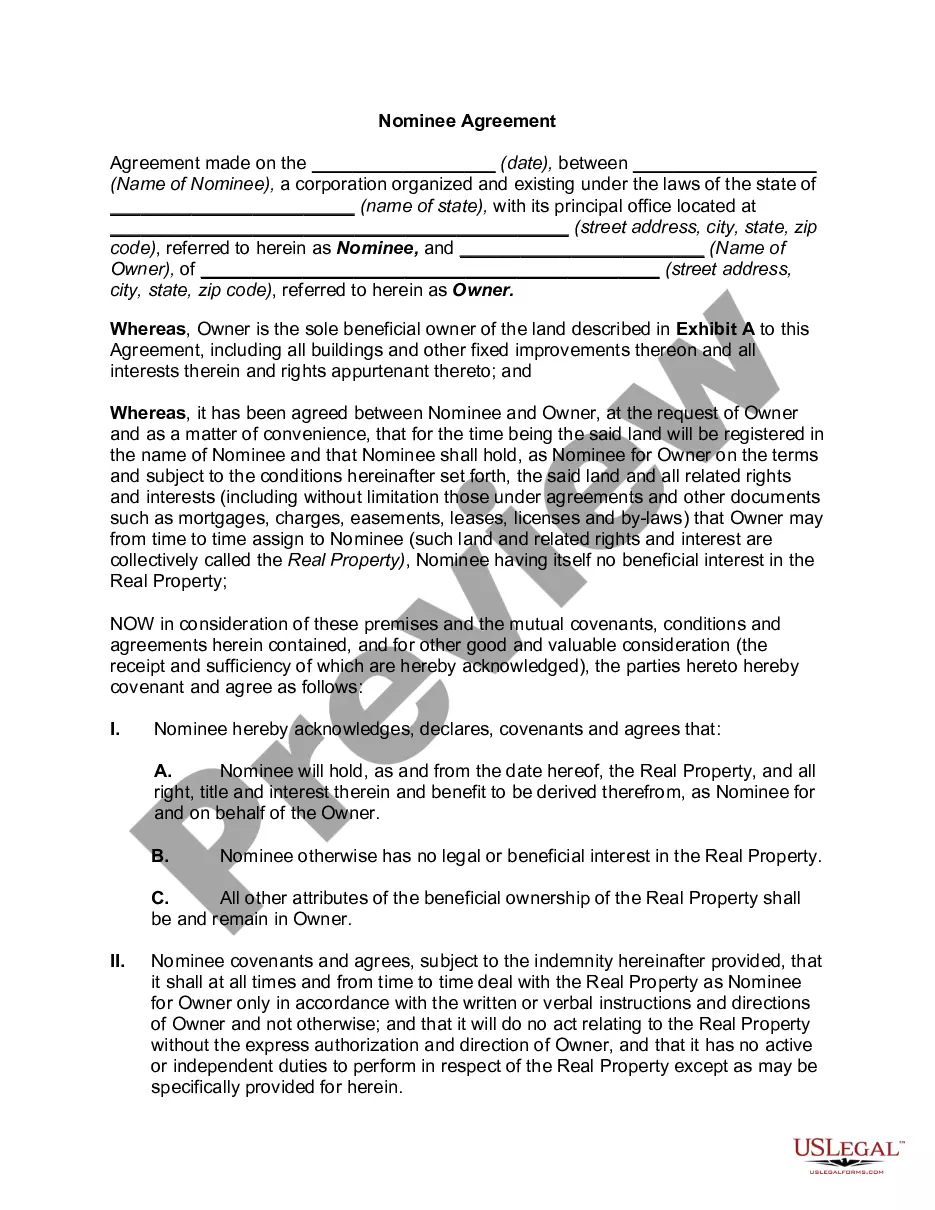

How to fill out Receipt Of Payment For Obligation?

US Legal Forms - among the greatest libraries of lawful types in the United States - offers a wide range of lawful record templates you are able to down load or print. Making use of the web site, you will get a large number of types for company and specific functions, categorized by types, suggests, or keywords and phrases.You can find the newest variations of types such as the Missouri Receipt of Payment for Obligation within minutes.

If you currently have a membership, log in and down load Missouri Receipt of Payment for Obligation from your US Legal Forms collection. The Acquire key will show up on each and every type you look at. You get access to all in the past downloaded types within the My Forms tab of your respective accounts.

If you wish to use US Legal Forms the first time, here are basic instructions to get you began:

- Ensure you have chosen the proper type to your metropolis/region. Select the Preview key to review the form`s content material. Read the type description to actually have chosen the correct type.

- In case the type doesn`t satisfy your requirements, make use of the Research discipline on top of the screen to discover the one that does.

- When you are content with the shape, confirm your selection by visiting the Purchase now key. Then, select the prices program you prefer and offer your references to sign up on an accounts.

- Process the deal. Utilize your charge card or PayPal accounts to complete the deal.

- Choose the file format and down load the shape on the device.

- Make alterations. Fill out, edit and print and sign the downloaded Missouri Receipt of Payment for Obligation.

Each and every web template you included in your bank account does not have an expiry date which is your own eternally. So, if you want to down load or print an additional duplicate, just visit the My Forms area and click on around the type you want.

Obtain access to the Missouri Receipt of Payment for Obligation with US Legal Forms, probably the most comprehensive collection of lawful record templates. Use a large number of expert and status-distinct templates that meet your business or specific demands and requirements.

Form popularity

FAQ

Consequences of not filing Just like other crimes, the punishment can include time in jail. However, the majority of taxpayers who don't file their state returns are only subject to penalties, interest and other fees in addition to the amount of tax due.

Just like the federal level, Missouri imposes income taxes on your earnings if you have a sufficient connection to the state if you work or earn an income within state borders. You may not have to file a Missouri return if: You are a resident and have less than $1,200 of Missouri adjusted gross income.

A Notice of Balance Due has been issued because of an outstanding tax delinquency. Failure to resolve the tax issue, within the stated time limits on the notice, will result in the suspension of your professional license or the loss of employment with the State of Missouri.

Missouri has a graduated individual income tax, with rates ranging from 2.00 percent to 4.95 percent. There are also jurisdictions that collect local income taxes. Missouri has a 4.0 percent corporate income tax rate.

The MO DOR assesses a 5% penalty per month up to 25% of the unpaid balance if you don't file your tax return on time. The state also charges a one-time 5% penalty if you pay your taxes late.

Contact your County Assessor's Office. For contact information, see the Missouri State Tax Commission website.

The applicable statute of limitations for such collections to initiate a civil suit for the collection of delinquent taxes is five (5) years from the date of finality of the assessment.

The Department can intercept a refund of state income tax and apply it towards any income tax debt from previous years. If the individual owns a business that has delinquent sales tax, use tax, employer's withholding tax or corporate income tax their income tax refund may be applied towards these debts.