Missouri Receipt as Payment in Full

Description

How to fill out Receipt As Payment In Full?

You can spend hours online trying to locate the legal document template that fulfills the state and federal requirements you need.

US Legal Forms provides a vast array of legal documents that are reviewed by experts.

You can effortlessly download or print the Missouri Receipt as Payment in Full from my service.

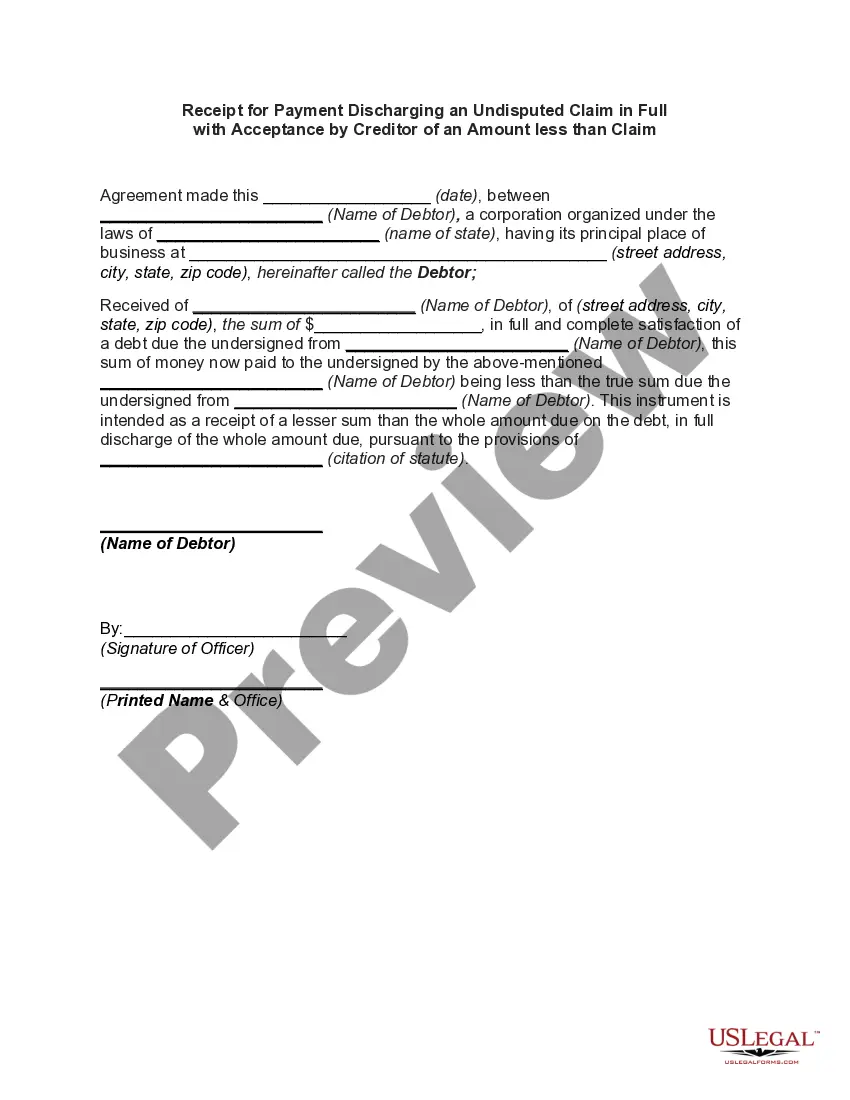

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you may Log In and click on the Download option.

- Then, you can complete, modify, print, or sign the Missouri Receipt as Payment in Full.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of a purchased form, go to the My documents tab and click on the corresponding option.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have selected the correct document template for the area/region of your choice.

- Read the form description to ensure you have chosen the proper document.

Form popularity

FAQ

Your Missouri refund may be intercepted for several reasons, including unpaid tax debts or other financial obligations like student loans. The state has the authority to use your refund to settle outstanding liabilities. If you suspect an interception, it's important to review your account details and contact the Missouri Department of Revenue for clarification. Keeping track of your payments with a Missouri Receipt as Payment in Full can help you manage these situations better.

The gross receipts tax in Missouri is a tax imposed on the total revenue received by a business before any deductions. This tax applies to various types of businesses and can significantly impact your financial management. Understanding the gross receipts tax can help you prepare more effectively for your tax obligations. Utilizing a Missouri Receipt as Payment in Full can also streamline your documentation process.

A Missouri estimated tax payment is a proactive method for individuals and businesses to manage their state tax obligations. It allows taxpayers to make periodic payments throughout the year to cover expected tax liability. By doing so, you can avoid penalties for underpayment when you file your tax return. These payments can also be reflected in a Missouri Receipt as Payment in Full.

Even if you owe no taxes, you may still be required to file a Missouri state tax return. Filing can help maintain your tax compliance and eligibility for future credit. If you file, consider obtaining a Missouri Receipt as Payment in Full to document your zero balance and ensure all necessary filings are complete.

You should mail your Missouri estimated tax payments to the designated address outlined on the MO-1040ES form. Sending your payments correctly ensures timely processing and can help you avoid penalties. When using a Missouri Receipt as Payment in Full, always keep a copy for your records to verify your payment if needed.

Your Missouri tax return should be mailed to the address specified by the state for your filing method and type of return. Generally, this includes both electronic and paper filings. If you’re unsure, consider using a Missouri Receipt as Payment in Full to confirm your submission, as it can provide a reliable record of your filing.

Yes, you need to mail the MO-1040V form if you are making a payment with your Missouri Individual Income Tax return. It helps ensure the state processes your payment correctly. Using a Missouri Receipt as Payment in Full can also streamline your tax return process and keep records organized.

To confirm whether Missouri received your tax payment, you can check your account status on the Missouri Department of Revenue's website. They provide a tracking service for payments, which is very helpful. Furthermore, utilizing the Missouri Receipt as Payment in Full ensures you have proof of your transactions, making it easier to resolve any potential issues. Keeping records of your payments is essential for your peace of mind.

Typically, the Missouri tax refund process takes about 4 to 6 weeks once your return is filed. If you used electronic filing, it may be processed faster. Remember, if there are any discrepancies with your returns or receipts, such as those related to the Missouri Receipt as Payment in Full, it could delay your refund. You can check your refund status on the Missouri Department of Revenue website for updates.

To obtain a Missouri no tax due letter, you simply need to request it from the Missouri Department of Revenue. You can do this online or by contacting their offices directly. Having a Missouri Receipt as Payment in Full can help expedite your request by showing proof of your tax payments. This letter will confirm that you have no outstanding tax liabilities.