Missouri Consignment Agreement in the Form of a Receipt

Description

How to fill out Consignment Agreement In The Form Of A Receipt?

Are you presently in a location where you require documents for both business or personal reasons almost daily.

There is an assortment of official document templates accessible online, but finding forms you can depend on isn't simple.

US Legal Forms offers thousands of form templates, including the Missouri Consignment Agreement in the Form of a Receipt, that are designed to comply with federal and state requirements.

Once you find the correct form, click Buy now.

Select the pricing plan you want, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Missouri Consignment Agreement in the Form of a Receipt template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct state/region.

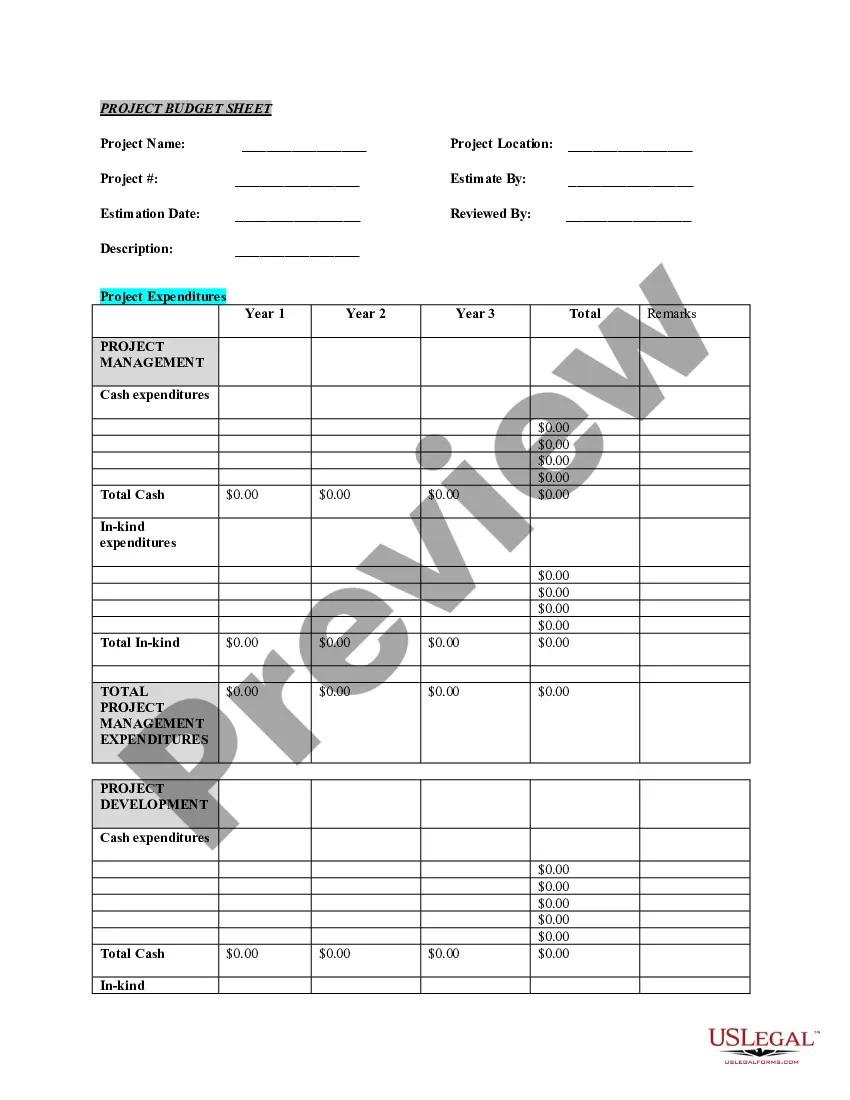

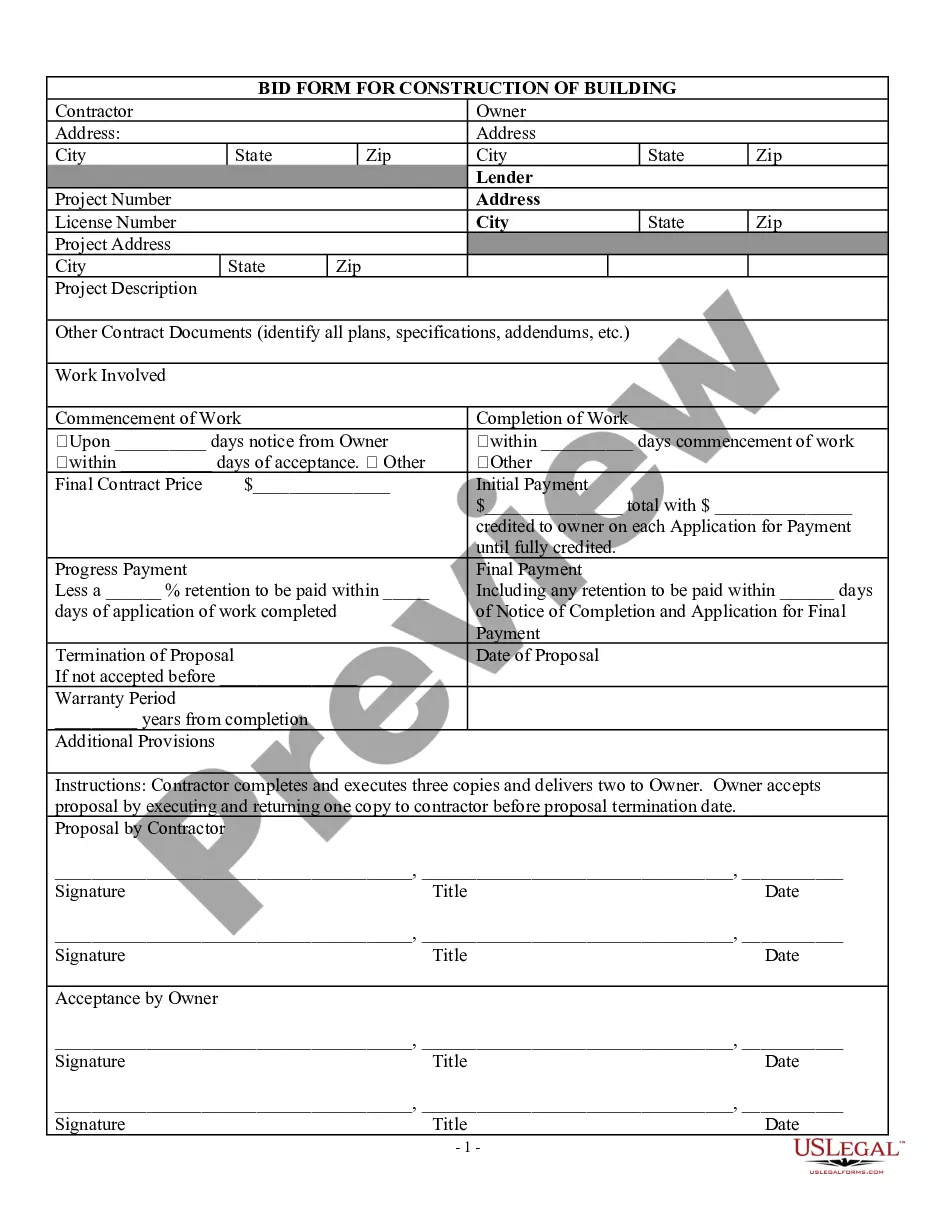

- Use the Preview button to review the form.

- Check the description to confirm you have chosen the right form.

- If the form isn’t what you are looking for, utilize the Search box to find the form that fits your needs and requirements.

Form popularity

FAQ

The three main types of consignments include auction consignments, wholesale consignments, and retail consignments. Auction consignments involve selling items through an auction house, while wholesale consignments focus on selling goods in bulk to stores or distributors. Retail consignments allow individuals to sell items through a storefront or online platform. When drafting a Missouri Consignment Agreement in the Form of a Receipt, it's important to define the type of consignment to ensure all parties understand their responsibilities and expectations.

Writing a Missouri Consignment Agreement in the Form of a Receipt involves a few key steps. First, clearly outline the roles of both the consignor and the consignee, specifying who owns the goods and who will sell them. Next, include details such as the description of the items, the terms of sale, and any fees or commissions involved. Finally, ensure that both parties sign the document to acknowledge their agreement, as this will formalize the consignment arrangement and protect both parties.

Moid, Missouri, is a lesser-known locality that may not be widely recognized. There may be references to it in various contexts, including real estate or local governance. If you are looking to establish a business presence or engage in consignment activities in this area, using a Missouri Consignment Agreement in the Form of a Receipt can assist in formalizing your transactions and understanding local requirements.

The main sources of income in Missouri include agriculture, manufacturing, and services. The state's diverse economy offers various opportunities for revenue generation across different sectors. If you are involved in consignment sales or related activities, using a Missouri Consignment Agreement in the Form of a Receipt can help streamline your business operations and make it easier to manage your income sources.

Missouri source income encompasses all income generated from sources within the state, including wages earned for services performed in Missouri and profits from businesses operating within its borders. This definition helps outline the parameters for tax obligations in Missouri. For those involved in commerce through a Missouri Consignment Agreement in the Form of a Receipt, understanding these nuances is vital for financial accuracy.

Source income includes any earnings that originate from a specific source, such as salaries, rental payments, or sales from goods and services. It is fundamental for tax purposes to correctly identify and report these earnings. When engaging in activities covered under a Missouri Consignment Agreement in the Form of a Receipt, recognizing what constitutes source income can help you make informed business decisions.

To fill out a 53/1 form in Missouri, gather your financial details, such as income and expenses related to your business. Be sure to provide accurate information regarding your operations and verify that all entries match your records. This process is particularly important when dealing with agreements like a Missouri Consignment Agreement in the Form of a Receipt, as it ensures compliance and accurate representation of your business activities.

Missouri source income is defined as income derived from activities and transactions that take place within the state. This income can stem from various sources, including wages, business profits, and rental income associated with properties located in Missouri. Being aware of what qualifies as source income is crucial for compliance with state tax laws. For example, a Missouri Consignment Agreement in the Form of a Receipt would be relevant if you are selling goods within Missouri.

Missouri source business income refers to the revenue generated from business operations within the state of Missouri. This includes profits from products sold and services rendered within the state. Understanding this concept is important for proper tax reporting. If you’re considering a Missouri Consignment Agreement in the Form of a Receipt, it's essential to keep track of your source income for accurate financial management.

A consignment agreement should include item descriptions, commission rates, payment terms, duration of the agreement, and responsibilities of both parties. Incorporating these elements creates a clear understanding between the consignor and consignee. Always refer to your Missouri Consignment Agreement in the Form of a Receipt for comprehensive management.