Missouri Contract for Sale of Goods on Consignment

Description

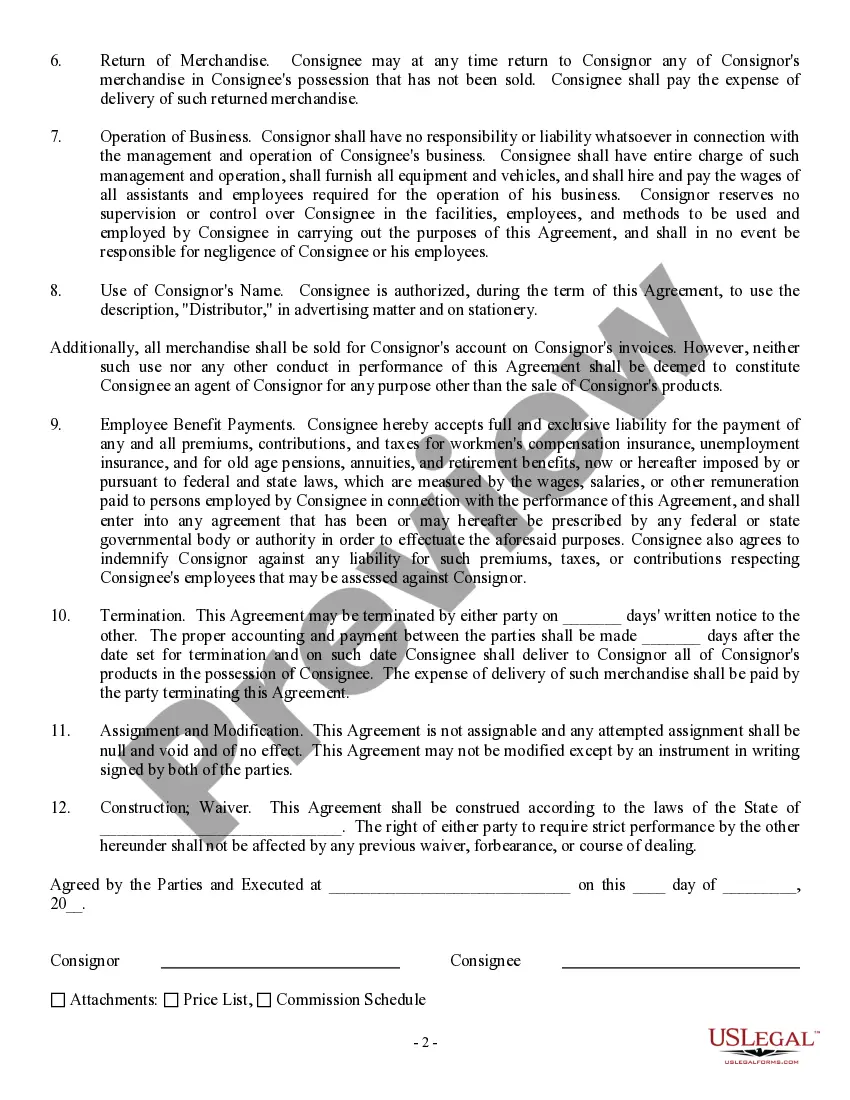

How to fill out Contract For Sale Of Goods On Consignment?

US Legal Forms - one of the premier collections of lawful templates in the United States - provides a range of legal document templates you can download or print.

By using the website, you will access thousands of templates for business and personal purposes, organized by categories, states, or keywords. You can obtain the latest versions of templates such as the Missouri Contract for Sale of Goods on Consignment in just seconds.

If you possess a monthly subscription, Log In and retrieve the Missouri Contract for Sale of Goods on Consignment from the US Legal Forms library. The Download button will become available on every document you view. You have access to all previously downloaded documents within the My documents section of your account.

Edit. Fill out, modify, and print, then sign the downloaded Missouri Contract for Sale of Goods on Consignment.

Each template you added to your account does not expire and belongs to you indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the document you require.

- To use US Legal Forms for the first time, follow these straightforward steps to get started.

- Ensure you have selected the correct template for your city/state. Click the Review button to examine the document's content. Review the document description to confirm you have chosen the appropriate form.

- If the form does not meet your requirements, utilize the Search box at the top of the screen to find the one that does.

- If you are satisfied with the document, affirm your selection by clicking the Purchase now button. Then, select the payment option you prefer and provide your credentials to register for an account.

- Process the payment. Use your credit card or PayPal account to complete the transaction.

- Select the format and download the document to your device.

Form popularity

FAQ

Yes, consignment sales do count as income, particularly when the goods are sold. If you’re operating with a Missouri Contract for Sale of Goods on Consignment, you will recognize this income once the sale occurs rather than when the consigned goods are received. Proper accounting will help you track this income accurately, ensuring you report it appropriately for tax purposes.

It is necessary to issue a 1099 for consignment sales if the total payments to the seller reach $600 or more throughout the year. Under a Missouri Contract for Sale of Goods on Consignment, proper issuance of a 1099 helps maintain transparency and accuracy in your financial dealings. Make sure to gather all pertinent payment information to avoid issues during tax season.

Certain vendors are exempt from 1099 reporting, including those who operate as corporations or certain types of non-profit organizations. If you’re working under a Missouri Contract for Sale of Goods on Consignment, it’s crucial to verify each vendor’s status to determine if they fall under these exemptions. Always keep meticulous records to ensure accurate reporting and compliance with IRS regulations.

A Missouri Contract for Sale of Goods on Consignment provides a clear framework for transactions involving specific goods. Such contracts ensure that both parties understand their responsibilities regarding the goods involved. Typically, the seller retains ownership until the buyer purchases the items. This kind of agreement safeguards both the seller's rights and the buyer's interests.

Accounting for consignment sales involves tracking the goods you have placed on consignment and monitoring sales transactions closely. With a Missouri Contract for Sale of Goods on Consignment, you must recognize revenue only when the goods are sold, not when you accept them. This approach helps maintain accurate financial records and ensures that you report earnings properly. Consider using dedicated accounting software for easier management.

The two primary types of consignments are open consignment and closed consignment. In an open consignment, goods remain the property of the seller until sold, while in a closed consignment, the goods are effectively owned by the retailer once they are on display. Understanding these types can help you structure your Missouri Contract for Sale of Goods on Consignment appropriately.

Yes, a consignment is a type of contract that establishes a relationship between the goods owner and the seller. Through this agreement, consignees sell the goods on behalf of the owner while retaining a percentage of the proceeds. Your Missouri Contract for Sale of Goods on Consignment serves as a legal document that protects the interests of both parties involved in the transaction.

Terminating a consignment agreement typically involves following the procedures outlined in the contract itself. Usually, either party can provide written notice to the other party. It’s essential to review your Missouri Contract for Sale of Goods on Consignment to ensure compliance with any contractual obligations before termination.

To set up a consignment agreement, start by identifying the goods you want to consign and find a retailer willing to sell them. Draft a clear contract outlining the terms, including commission rates, duration of the agreement, and responsibilities of both parties. Consider using the resources available on US Legal Forms to ensure your Missouri Contract for Sale of Goods on Consignment meets legal requirements.

A fair split for consignment sales typically ranges between 60-40 to 50-50, depending on the agreement between the supplier and retailer. Factors such as the type of goods, market demand, and sales effort also influence this split. When establishing this percentage, it is beneficial to reference a Missouri Contract for Sale of Goods on Consignment to ensure both parties feel valued and incentivized. Keep communication open to negotiate terms that suit both sides.