Missouri Contract - Sale of Goods

Description

How to fill out Contract - Sale Of Goods?

Are you currently in a circumstance where you require documents for potential organization or particular tasks almost daily.

There are numerous authentic document templates accessible online, but locating formats you can rely on is challenging.

US Legal Forms offers thousands of form templates, such as the Missouri Contract - Sale of Goods, which are designed to comply with federal and state regulations.

Once you find the correct form, click Get now.

Choose the pricing plan you want, fill in the necessary information to create your account, and complete the purchase using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Missouri Contract - Sale of Goods template.

- If you do not have an account and wish to start utilizing US Legal Forms, follow these steps.

- Locate the form you need and ensure it is for the correct city/county.

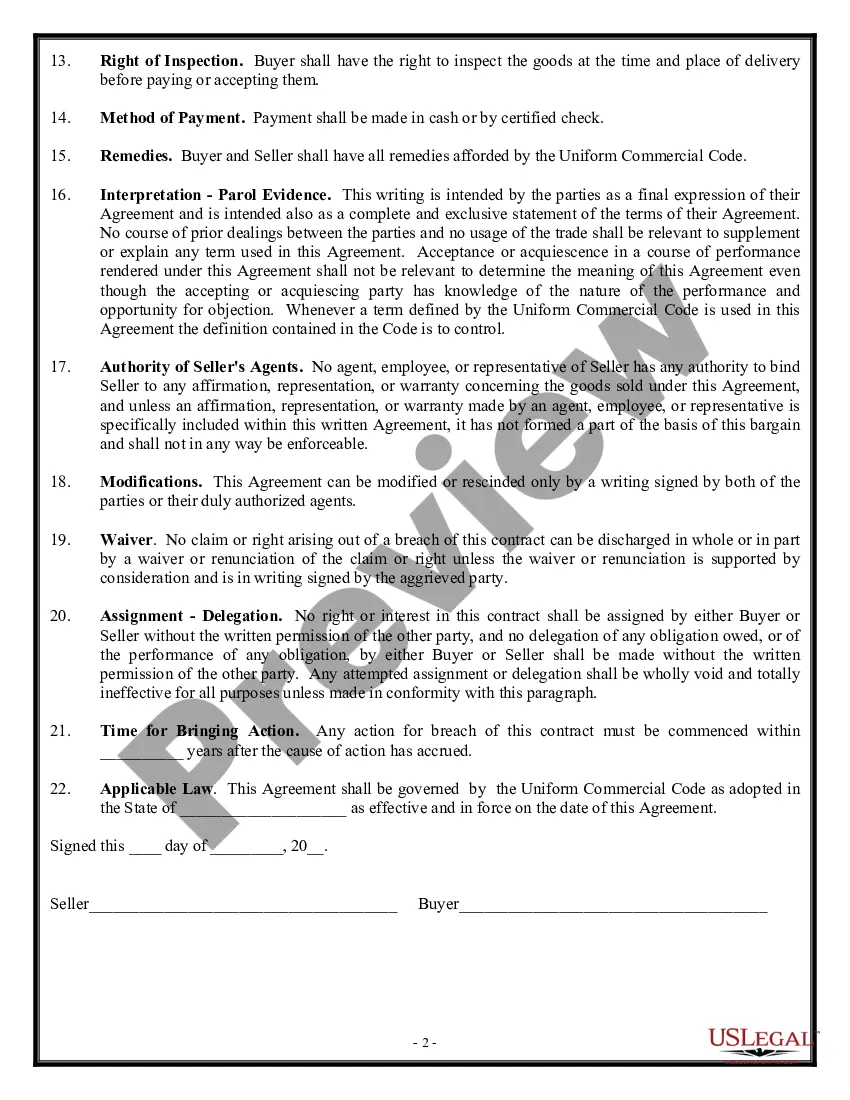

- Use the Preview option to examine the form.

- Review the details to confirm you have selected the right document.

- If the form is not what you are looking for, utilize the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

To fill out a contract agreement, begin by clearly stating the names of all parties involved. Next, specify the terms of the agreement, including the subject matter, payment details, and any deadlines. It's essential to include a section for signatures to validate the document. If you need a comprehensive template, consider using USLegalForms, which provides templates tailored for a Missouri Contract - Sale of Goods.

In a shipment contract, the seller's obligations include shipping the goods to the buyer's designated location and providing a receipt for the shipment. Under a Missouri Contract - Sale of Goods, this means the seller must also ensure the goods are properly packaged and labeled for transport. Furthermore, the seller must notify the buyer of the shipment, ensuring clarity and communication throughout the transaction.

Under a Missouri Contract - Sale of Goods, the seller is obligated to transfer ownership of the goods to the buyer and ensure that the goods meet the agreed-upon quality and specifications. Additionally, the seller must provide all necessary documentation and perform delivery within the stipulated time frame. Failing to meet these obligations could result in a breach of contract, leading to potential legal ramifications.

Yes, in Missouri, a contract for the sale of goods priced at $500 or more must be in writing to be enforceable. This requirement, part of the Statute of Frauds, aims to protect parties involved in significant transactions. Thus, using a Missouri Contract - Sale of Goods template from US Legal Forms can help ensure compliance with these legal requirements.

The basic performance obligations of the seller under a Missouri Contract - Sale of Goods include delivering the goods as per the terms agreed upon. This also involves ensuring that the goods are suitable for the agreed-upon purpose, and they must conform to the specifications outlined in the contract. Timely delivery and provision of appropriate documentation are also critical responsibilities.

In Missouri, a contract for the sale of specific goods arises when both the buyer and seller identify the items involved. This means there should be a clear agreement on the specific goods being sold, ensuring there is no ambiguity. A Missouri Contract - Sale of Goods can outline these specifics clearly, preventing misunderstandings between parties.

The sales tax on a $23,000 car in Missouri can vary based on local rates, but the state sales tax rate is generally about 4.225%. If you apply this rate, the tax would be approximately $971.75. It’s crucial to include sales tax calculations when drafting agreements related to the Missouri Contract - Sale of Goods.

Yes, Missouri requires remote sellers to collect sales tax if their sales exceed $100,000 in the state during the preceding twelve months. This law affects out-of-state sellers and highlights the importance of understanding local regulations when finalizing a Missouri Contract - Sale of Goods. Staying updated on these requirements ensures that your business remains compliant.

Several items are exempt from sales tax in Missouri, including certain food products, prescription medications, and some services. Additionally, sales made under a Missouri Contract - Sale of Goods related to manufacturing or agriculture might qualify for exemptions. It's essential to know these exemptions to make informed purchasing decisions and ensure compliance.

To register for vendor use tax in Missouri, you must first visit the Missouri Department of Revenue's website. There, you can complete the necessary forms online or download them for mail submission. Remember, registering helps you stay compliant when selling goods under a Missouri Contract - Sale of Goods. It's a straightforward process that ensures you meet all your tax obligations.