Missouri Sale of Goods, Short Form

Description

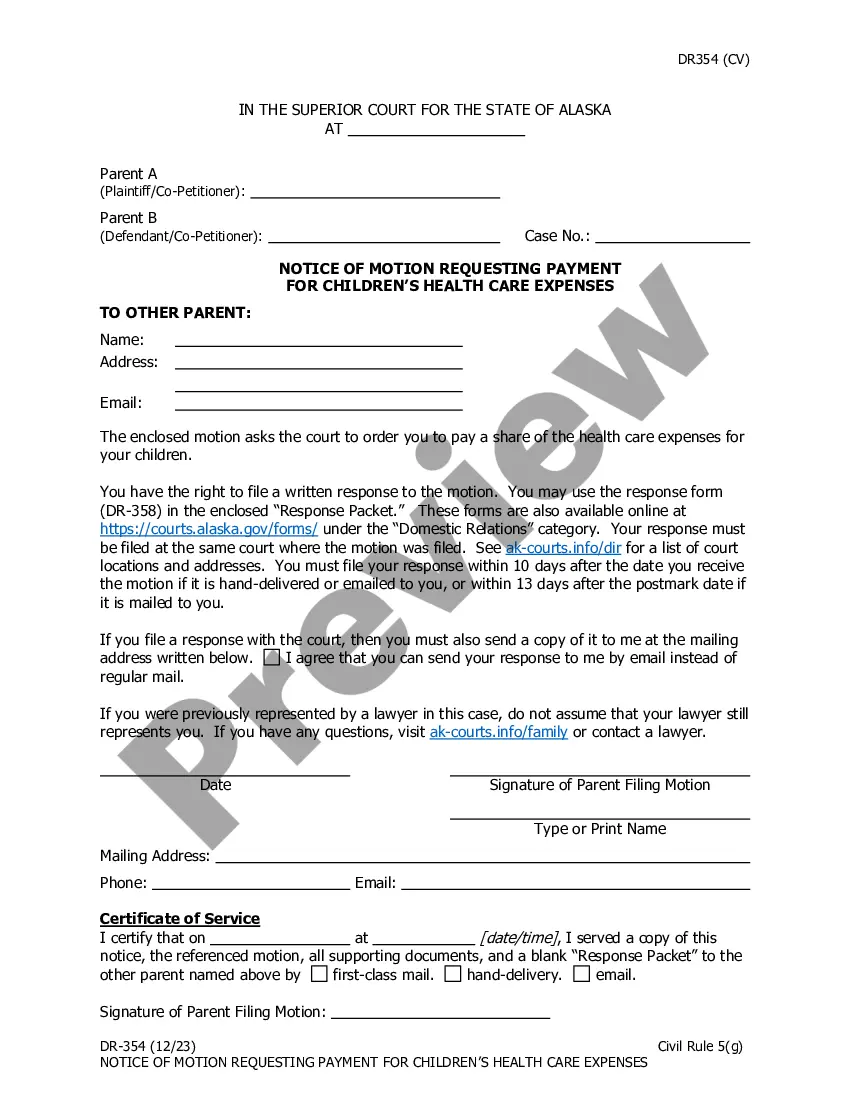

How to fill out Sale Of Goods, Short Form?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a range of legal form templates that you can download or print.

By utilizing the website, you can access thousands of forms for business and personal use, organized by categories, states, or keywords. You can obtain the latest versions of forms like the Missouri Sale of Goods, Short Form in just moments.

If you already possess a membership, Log In and download the Missouri Sale of Goods, Short Form from the US Legal Forms archive. The Download button will appear on each form you view. You have access to all previously acquired forms in the My documents section of your account.

Complete the payment. Use a credit card or PayPal account to finalize the transaction.

Select the format and download the form onto your device. Make modifications. Fill out, modify, and print and sign the downloaded Missouri Sale of Goods, Short Form. Each document you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print an additional copy, simply go to the My documents section and click on the form you need. Access the Missouri Sale of Goods, Short Form with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements.

- Make sure you have selected the correct form for your area/state.

- Click the Preview button to review the form’s content.

- Examine the form details to ensure you have chosen the proper form.

- If the form doesn’t fit your needs, use the Search box at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, choose the pricing plan you prefer and enter your information to register for an account.

Form popularity

FAQ

MO sales refer to sales made within the state of Missouri. This includes both retail and wholesale transactions, involving a wide range of goods and services. Proper understanding of sales tax obligations in relation to the Missouri Sale of Goods, Short Form is essential for compliance. For support in navigating these regulations, consider using UsLegalForms.

The sales tax number for Missouri is crucial for businesses engaged in selling goods. In Missouri, the state sales tax rate is currently set at 4.225%. Local jurisdictions may also impose additional taxes, so it’s important to check the total rate applicable to your sales. For thorough information and assistance with sales tax documentation, check UsLegalForms.

Yes, Missouri provides a 1040 short form, which makes filing easier for many taxpayers. This form includes necessary sections for reporting income and deductions concisely. If your tax situation is straightforward, using the MO-1040 short form can save you time and reduce hassle. Explore the resources on UsLegalForms to ensure your documents are prepared correctly.

In Missouri, taxpayers typically use the 1040 form or the 1040A form based on their individual tax circumstances. The choice between these forms often depends on the complexity of your tax situation. If you are dealing with income from the Missouri Sale of Goods, Short Form, you may find using the 1040 option more suitable. Always refer to UsLegalForms for clarity on which forms best suit your needs.

Yes, the IRS continues to provide a 1040 short form option in various formats. This includes simpler versions intended for those who meet specific criteria. Residents of Missouri often find this form beneficial for straightforward tax situations, especially when dealing with the Missouri Sale of Goods, Short Form. Check with resources like UsLegalForms for updated forms and helpful advice.

Yes, there is a MO-1040 short form. This form simplifies tax reporting for residents of Missouri. It allows you to report income efficiently and claim several common deductions. If you're seeking to file your taxes accurately with the Missouri Sale of Goods, Short Form, consider using are reliable platform like UsLegalForms for guidance.

To apply for a Missouri sales tax number, you must complete the appropriate application form provided by the state. This form requires basic business information and outlines the types of goods or services you sell. After submitting your application, you will receive your sales tax number, which is essential for conducting business legally. Utilizing resources like US Legal Forms can assist you in navigating this process smoothly and efficiently, especially when managing the Missouri Sale of Goods, Short Form.

Calculating sales tax in Missouri requires knowing the state and local tax rates applicable to your transaction. Begin by determining the total sale amount, and then multiply it by the combined sales tax rate, which typically varies by location. For guidance on specific calculations, the Missouri Sale of Goods, Short Form can help you outline your sales, ensuring that you apply the correct tax rates. Using tools from US Legal Forms can further streamline this process.

To fill out Missouri Form 149, start by gathering the necessary information, such as the names of the parties involved and the description of the goods. In the appropriate fields, you will provide details about the sale, including terms, conditions, and any relevant dates. You can access a user-friendly version of the Missouri Sale of Goods, Short Form on the US Legal Forms platform, which simplifies the process and ensures that you complete it correctly, minimizing errors.

A vendor's license and a seller's permit are often confused but serve slightly different purposes. A vendor's license typically allows you to operate as a business, while a seller's permit specifically permits you to collect sales tax. For the Missouri Sale of Goods, Short Form, ensuring you have the correct credentials is crucial.