Missouri Revocable Trust for Real Estate

Description

How to fill out Revocable Trust For Real Estate?

If you wish to finalize, obtain, or print legal document templates, make use of US Legal Forms, the largest assortment of legal documents available online.

Leverage the website's user-friendly and efficient search to locate the documents you need.

Different templates for commercial and personal purposes are organized by categories and states, or keywords.

Step 4. Once you have found the document you need, click the Purchase now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Complete the transaction. You may use your Visa or Mastercard or PayPal account to finalize the purchase.

- Employ US Legal Forms to discover the Missouri Revocable Trust for Real Estate within a few clicks.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to get the Missouri Revocable Trust for Real Estate.

- You can also access documents you previously saved in the My documents section of your account.

- If you are a new user of US Legal Forms, follow the steps below.

- Step 1. Ensure you have selected the form corresponding to the correct city/state.

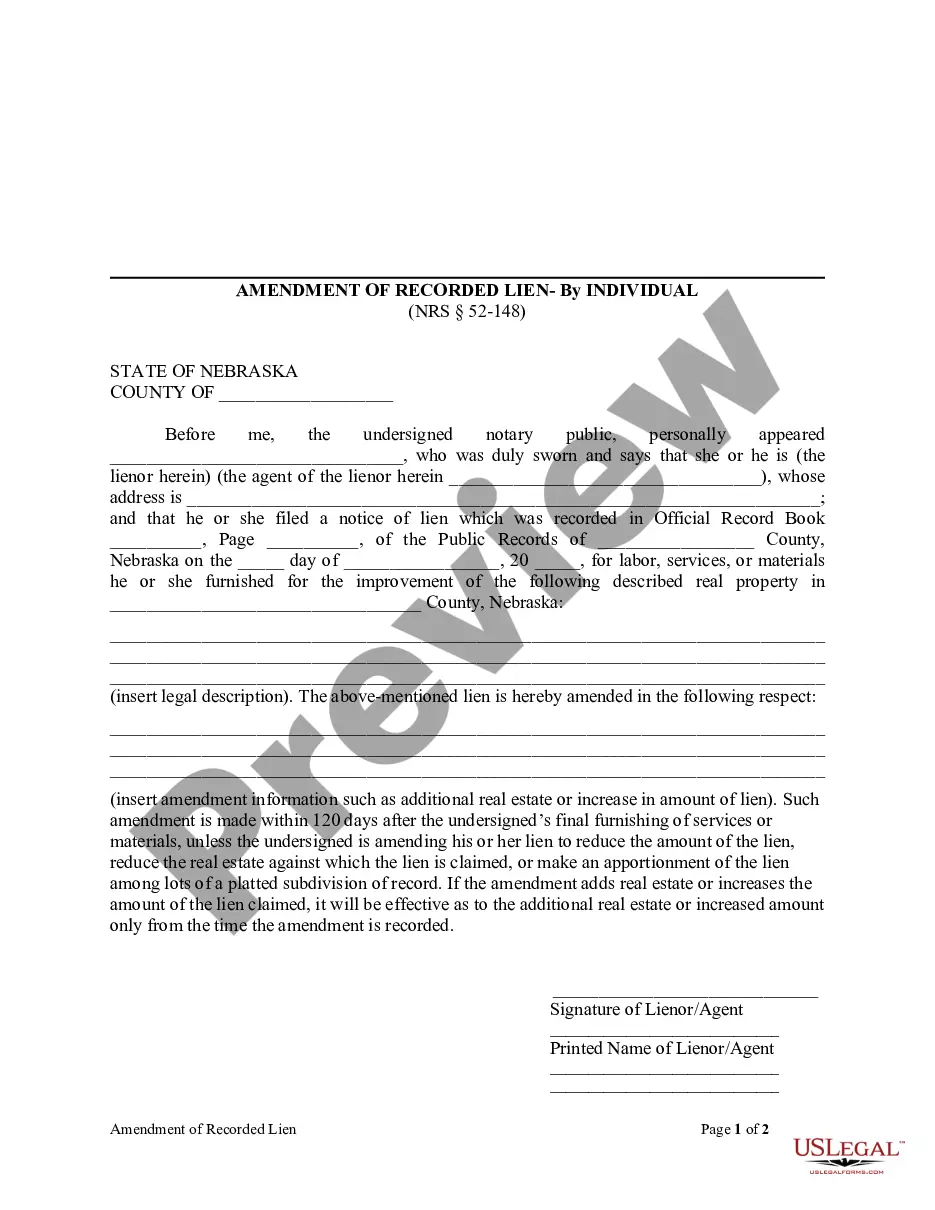

- Step 2. Use the Review option to examine the form’s content. Be sure to read the information carefully.

- Step 3. If you are unhappy with the document, use the Search field at the top of the screen to find alternative versions of the legal document template.

Form popularity

FAQ

A revocable trust, particularly a Missouri Revocable Trust for Real Estate, is often considered the best option to avoid probate. This type of trust allows you to retain control over your assets while planning for their distribution. It simplifies the process for your heirs and can prevent delays and additional expenses typically associated with probate.

Yes, putting your house in a revocable trust can be a smart decision. By establishing a Missouri Revocable Trust for Real Estate, you can protect your property from probate and gain more control over how it is managed during your lifetime. It offers flexibility and can be a useful tool for estate planning and asset management.

In Missouri, several assets are exempt from probate. These include assets held in a Missouri Revocable Trust for Real Estate, life insurance proceeds with designated beneficiaries, and certain payable-on-death accounts. Understanding these exemptions can help you protect your estate and simplify the distribution process.

A properly established trust does not have to go through probate in Missouri. This is one of the significant benefits of using a Missouri Revocable Trust for Real Estate. By transferring assets into the trust, you ensure a streamlined transition to your beneficiaries without court intervention.

To avoid probate in Missouri, consider options like creating a Missouri Revocable Trust for Real Estate. You can also designate beneficiaries for accounts like insurance policies or retirement plans. Additionally, gifting assets while you are still alive can help you circumvent the probate process altogether.

Yes, a trust typically avoids probate in Missouri. When you establish a Missouri Revocable Trust for Real Estate, your assets held within the trust do not go through probate upon your passing. This process saves time and keeps your estate details private, making it an attractive option for many homeowners.

To place a house in a trust in Missouri, you need to create a Missouri Revocable Trust for Real Estate. Start by drafting the trust document, clearly stating the name of the trust and the properties involved. Next, execute a new deed transferring ownership of your house from yourself to the trust. It’s advisable to consult a legal expert to ensure all documents are correctly prepared.

It's crucial to understand which assets should not be placed in a Missouri Revocable Trust for Real Estate. Real estate held in joint tenancy or community property often bypasses the trust and goes directly to the surviving owner upon death. Moreover, assets with transfer-on-death designations, like bank accounts, should remain outside the trust for smooth transfer. By knowing these details, you can better plan your estate.

Certain assets do not belong in a Missouri Revocable Trust for Real Estate. For instance, retirement accounts, such as 401(k)s and IRAs, should not be transferred into a trust since they have specific beneficiary designations. Additionally, life insurance policies that name beneficiaries also typically remain outside the trust. Keeping these assets separate ensures tax efficiency and smoother management.

When establishing a Missouri Revocable Trust for Real Estate, it's wise to leave out certain types of assets. For example, personal items like jewelry and art can create complications during trust administration. Instead, consider managing those assets through a will. By leaving them out of the trust, you maintain clarity and simplicity for your estate.