Missouri Sample Letter for Compromise on a Debt

Description

How to fill out Sample Letter For Compromise On A Debt?

Selecting the optimal legal document format can be a challenge. Certainly, there are numerous templates available online, but how do you find the legal form you need? Utilize the US Legal Forms website. This service provides a vast array of templates, including the Missouri Sample Letter for Compromise on a Debt, which can be utilized for business and personal purposes. All forms are vetted by professionals and comply with federal and state regulations.

If you are currently registered, Log In to your account and click on the Download button to obtain the Missouri Sample Letter for Compromise on a Debt. Use your account to browse the legal forms you have previously purchased. Navigate to the My documents section of your account and obtain another copy of the document you need.

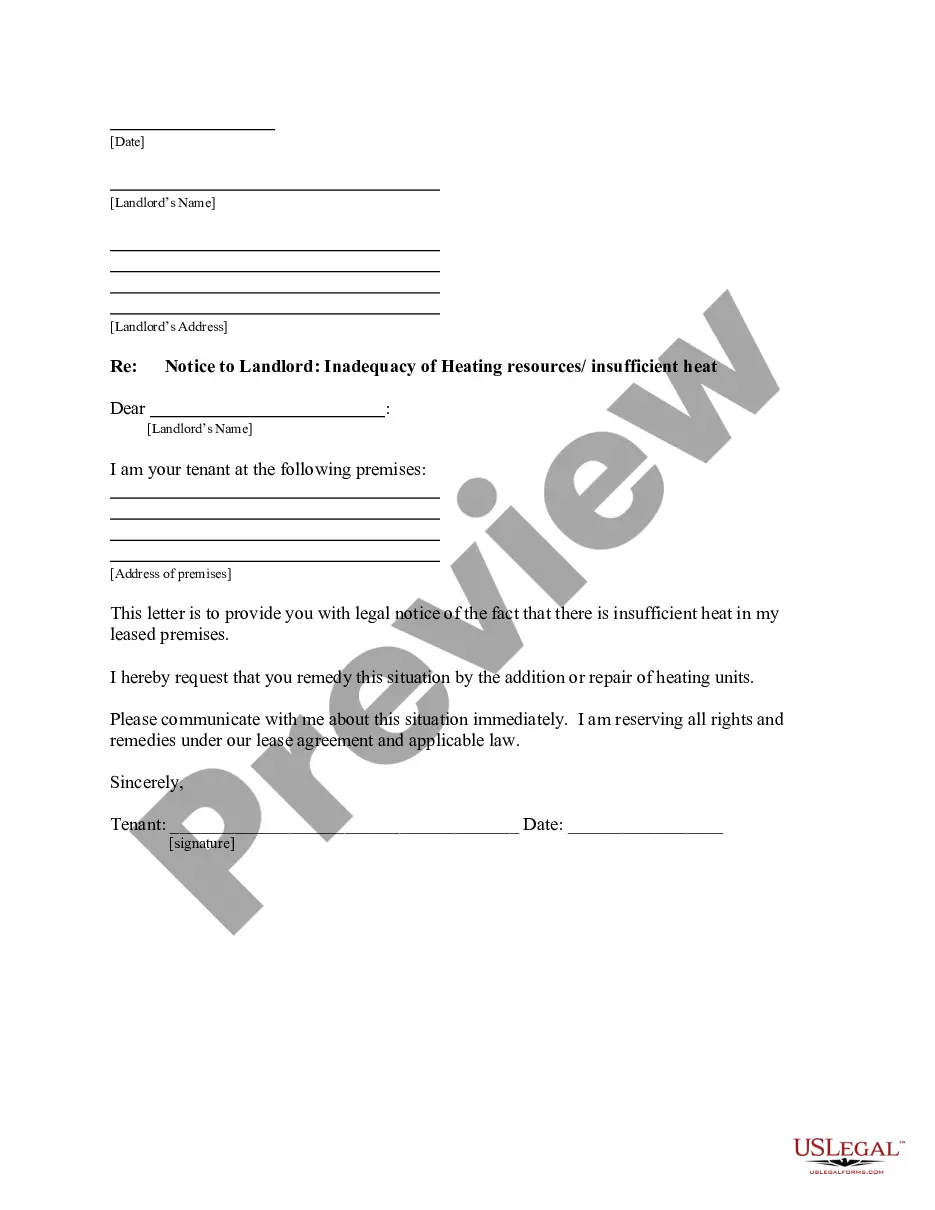

If you are a new user of US Legal Forms, here are simple instructions you can follow: First, ensure you have selected the correct form for your city/region. You can review the form using the Preview button and read the form description to confirm it is the appropriate one for you.

US Legal Forms is the largest collection of legal templates where you can find various document formats. Use the service to obtain professionally crafted documents that adhere to state requirements.

- If the form does not meet your needs, utilize the Search field to find the correct form.

- Once you are confident the form is suitable, click the Get Now button to acquire the form.

- Select the pricing plan you require and provide the necessary information.

- Create your account and pay for your order using your PayPal account or credit card.

- Choose the document format and download the legal document to your device.

- Complete, modify, print, and sign the acquired Missouri Sample Letter for Compromise on a Debt.

Form popularity

FAQ

In Missouri, a debt collector typically has five years to collect a consumer debt. This timeline starts from the date of default. If you are facing collection actions, consider drafting a Missouri Sample Letter for Compromise on a Debt to negotiate terms with your creditor and potentially alleviate the debt burden.

The statute of limitations for a tax lien in Missouri is generally ten years, consistent with the length of time the state can collect unpaid taxes. This period allows the state to maintain its claim against property involved. Utilizing a Missouri Sample Letter for Compromise on a Debt can be an effective way to address your tax situation within this time frame.

Yes, liens can expire in Missouri. Typically, a tax lien expires after ten years if no enforcement action is taken. However, if you find yourself with a lien, using a Missouri Sample Letter for Compromise on a Debt can guide you in communicating with the necessary authorities to resolve the matter before it reaches expiration.

In Missouri, the state has up to ten years to collect back taxes after they are assessed. This time frame starts from the date the debt is accrued. If you're dealing with back taxes, a Missouri Sample Letter for Compromise on a Debt may help in negotiating a reduction or a manageable payment plan with the state.

Tax liens in Missouri are placed on property when taxes remain unpaid. This lien gives the state a claim against your property, which can complicate sales or refinances. You can utilize a Missouri Sample Letter for Compromise on a Debt if you’re seeking to negotiate your tax liability or remove the lien effectively.

In Missouri, a tax lien generally lasts for ten years from the date it is filed. If the state takes action to enforce the lien, this duration can be extended. You may consider using a Missouri Sample Letter for Compromise on a Debt to address tax issues or negotiate repayment arrangements, helping to potentially clear any associated liens.

The form for an Offer in Compromise in Missouri is specifically designed to help taxpayers propose a settlement of their tax debt for less than the full amount owed. You can obtain the necessary forms from the Missouri Department of Revenue’s website. If you want to ensure your offer has the best chance of approval, consider using a Missouri Sample Letter for Compromise on a Debt to support your application.

In Missouri, the state can collect back taxes for up to three years from the date the tax return was due. After this period, the state may no longer pursue collections. However, if you are facing challenges with your tax obligations, employing a Missouri Sample Letter for Compromise on a Debt can help you address these issues proactively.

To establish a payment plan for Missouri state taxes, you must apply online or contact the Missouri Department of Revenue. This plan allows you to make manageable monthly payments towards your tax debt. If you are considering a compromise, a Missouri Sample Letter for Compromise on a Debt may also be a valuable tool to negotiate terms with the state.

Yes, you can settle state tax debt through various methods, including payment plans or offers in compromise. An Offer in Compromise allows taxpayers to negotiate a reduced amount to settle their tax liabilities. A well-crafted Missouri Sample Letter for Compromise on a Debt can facilitate the settlement process, making it easier for you to achieve a resolution with the state.