No definite rule exists for determining whether one is an independent contractor or an employee. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor. Finally, independent contractors are generally free to perform the same type of work for others.

Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause

Description

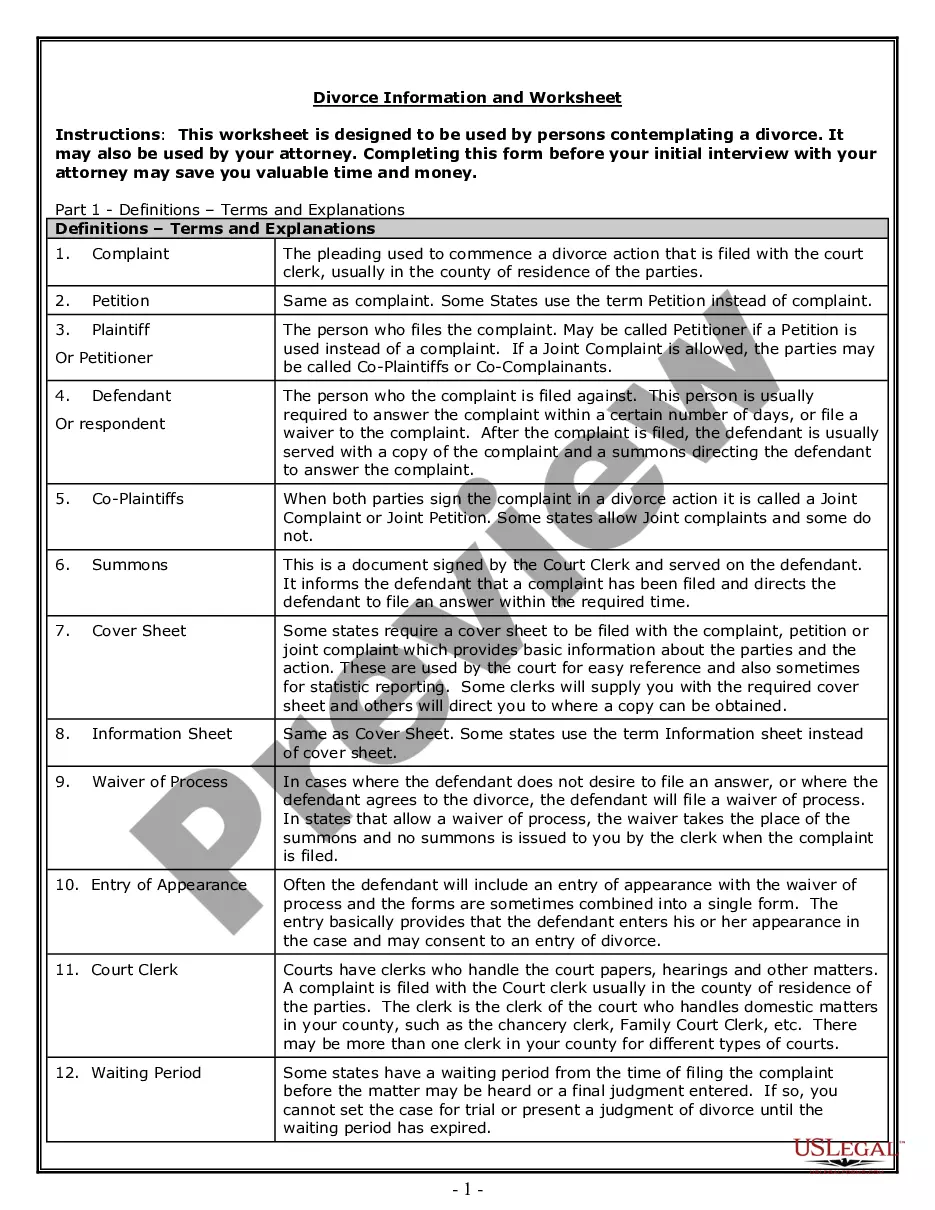

How to fill out Contract With Self-Employed Independent Contractor To Sell Video Surveillance Cameras With Provisions For Termination With Or Without Cause?

Finding the appropriate legal document template can be challenging.

Of course, there are numerous templates accessible online, but how can you locate the legal form you require.

Utilize the US Legal Forms website.

First, ensure you have chosen the correct form for your area/district. You can preview the form using the Preview option and read the description to confirm it is suitable for you.

- The service offers a vast array of templates, including the Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause, which can be used for business and personal needs.

- All forms are vetted by professionals and adhere to state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to retrieve the Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause.

- Use your account to browse through the legal forms you have purchased previously.

- Visit the My documents tab of your account to get an additional copy of the documents you require.

- If you are a new user of US Legal Forms, here are simple steps to follow.

Form popularity

FAQ

Receiving a 1099 form typically indicates that you are classified as self-employed. This form reports income earned outside traditional employment, supporting the status of independent contractors. Thus, if you are receiving a 1099, it often correlates with agreements like the Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause.

Yes, independent contractors are indeed considered self-employed. This classification reflects their autonomy in managing work and finances, often without the same benefits or protections afforded to traditional employees. It’s crucial to understand this distinction, especially when entering into a Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause.

Independent contractors file taxes by completing Form 1040 and attaching Schedule C to report their business income and expenses. They also include Schedule SE to calculate self-employment tax. Electing to work under a Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause can simplify this process and clarify income generation.

The two-year contractor rule generally refers to the time frame in which a contractor is seen as eligible for certain benefits or obligations under a contract. This period often affects eligibility for unemployment benefits and can influence how you structure your Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause. Understanding this rule can help you navigate the benefits applicable to your contract.

To avoid self-employment tax, independent contractors can consider forming an S corporation or LLC. This structure may allow you to classify some income as distributions, which are not subject to self-employment tax. Additionally, carefully managing your deductions can also reduce your taxable income linked to the Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause.

The three key controls for independent contractors typically include behavioral control, financial control, and the type of relationship. Behavioral control refers to the degree of oversight a company exerts during work. Financial control involves how a contractor is compensated and any expenses that are reimbursed, which directly impacts the Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause.

In Missouri, an independent contractor agreement outlines the relationship between a business and a self-employed individual. This agreement specifically articulates the roles, responsibilities, compensation, and other critical elements, including provisions for termination with or without cause. Utilizing a Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause ensures that both parties have a clear understanding of their arrangement and legal protections.

While both self-employed individuals and independent contractors may operate independently, there are distinctions. A self-employed person directly runs their own business, whereas an independent contractor typically works under a contractual arrangement for a client. In the context of a Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause, the contractor is usually engaged for a specific project and is not considered an employee of the business.

The independent contractor agreement serves as a formal contract between a business and a self-employed individual. In the context of a Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause, this agreement outlines responsibilities, payment terms, and project expectations. By documenting these elements, it helps prevent misunderstandings and provides a structured framework for both parties to follow.

The primary difference between an independent contractor and an employee in Missouri lies in the level of control and degree of independence in the working relationship. Employees typically receive regular paychecks and are subject to employer control in various aspects of their work. Conversely, independent contractors operate independently, control how they provide services, and often have more freedom in their careers. Understanding this distinction can help both parties draft a clear Missouri Contract with Self-Employed Independent Contractor to Sell Video Surveillance Cameras with Provisions for Termination with or without Cause.