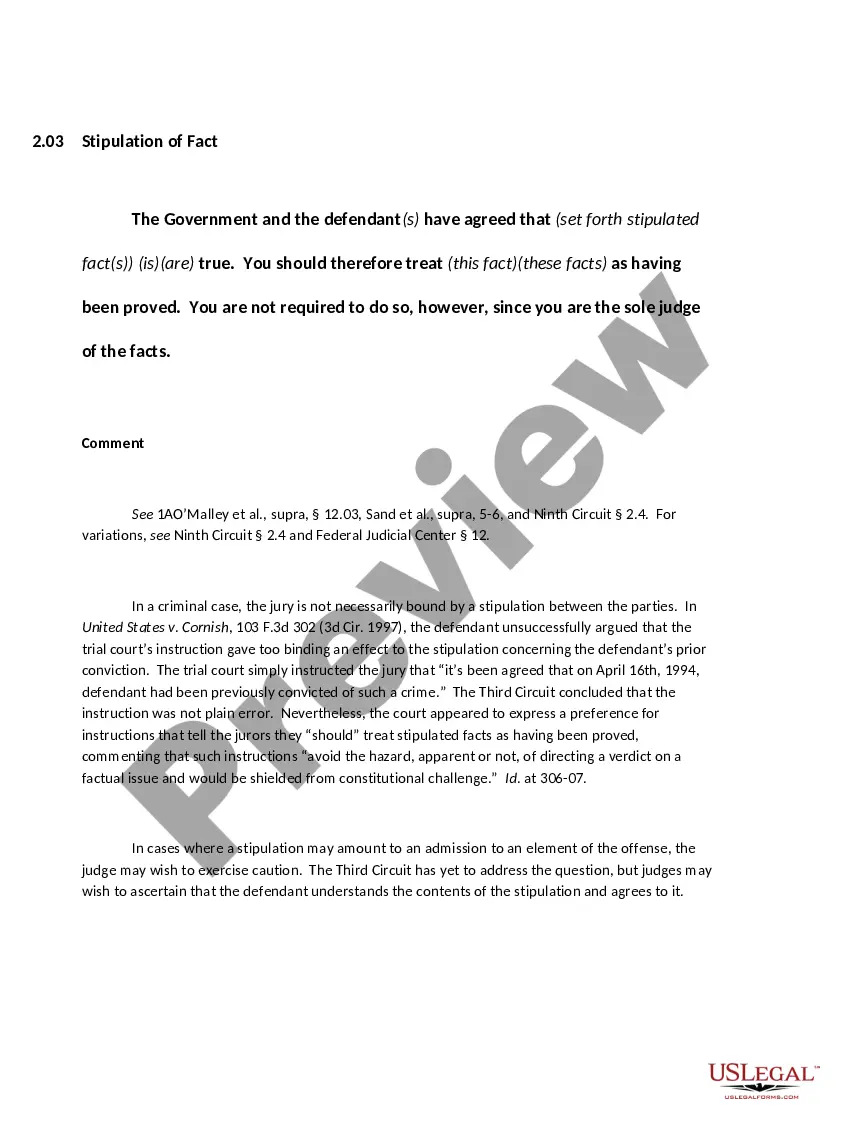

No particular language is necessary for the acceptance or rejection of a claim or for subsequent notices and reports so long as the instruments used clearly convey the necessary information.

Missouri Rejection of Claim and Report of Experience with Debtor

Description

How to fill out Rejection Of Claim And Report Of Experience With Debtor?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a variety of legal document templates that you can download or print.

While using the website, you can find countless forms for business and personal needs, sorted by categories, states, or keywords. You will discover the latest forms such as the Missouri Rejection of Claim and Report of Experience with Debtor in just seconds.

If you have an existing monthly subscription, Log In and download the Missouri Rejection of Claim and Report of Experience with Debtor from the US Legal Forms library. The Download option will appear on each form you view. You have access to all previously downloaded forms in the My documents section of your profile.

Make edits. Fill out, modify, and print the downloaded Missouri Rejection of Claim and Report of Experience with Debtor.

Every template you added to your account has no expiration date and belongs to you permanently. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need. Access the Missouri Rejection of Claim and Report of Experience with Debtor using US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal requirements and preferences.

- If you are using US Legal Forms for the first time, here are simple guidelines to help you get started.

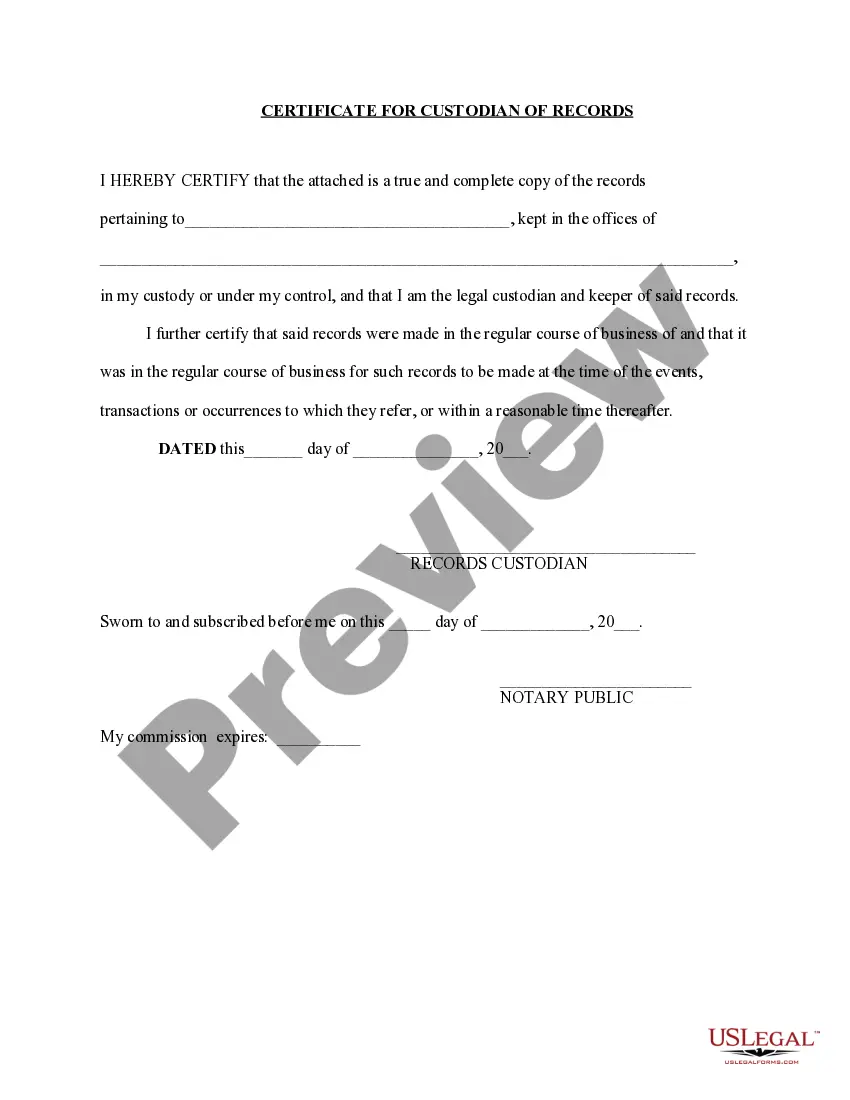

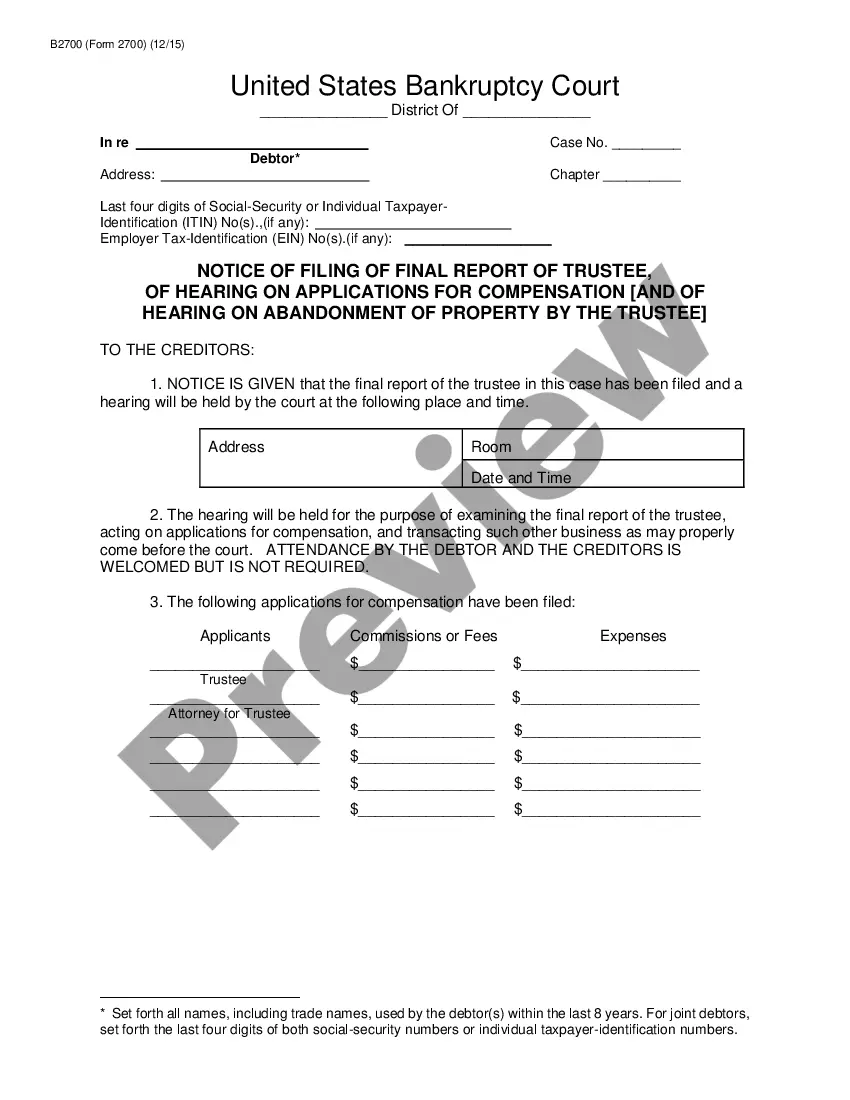

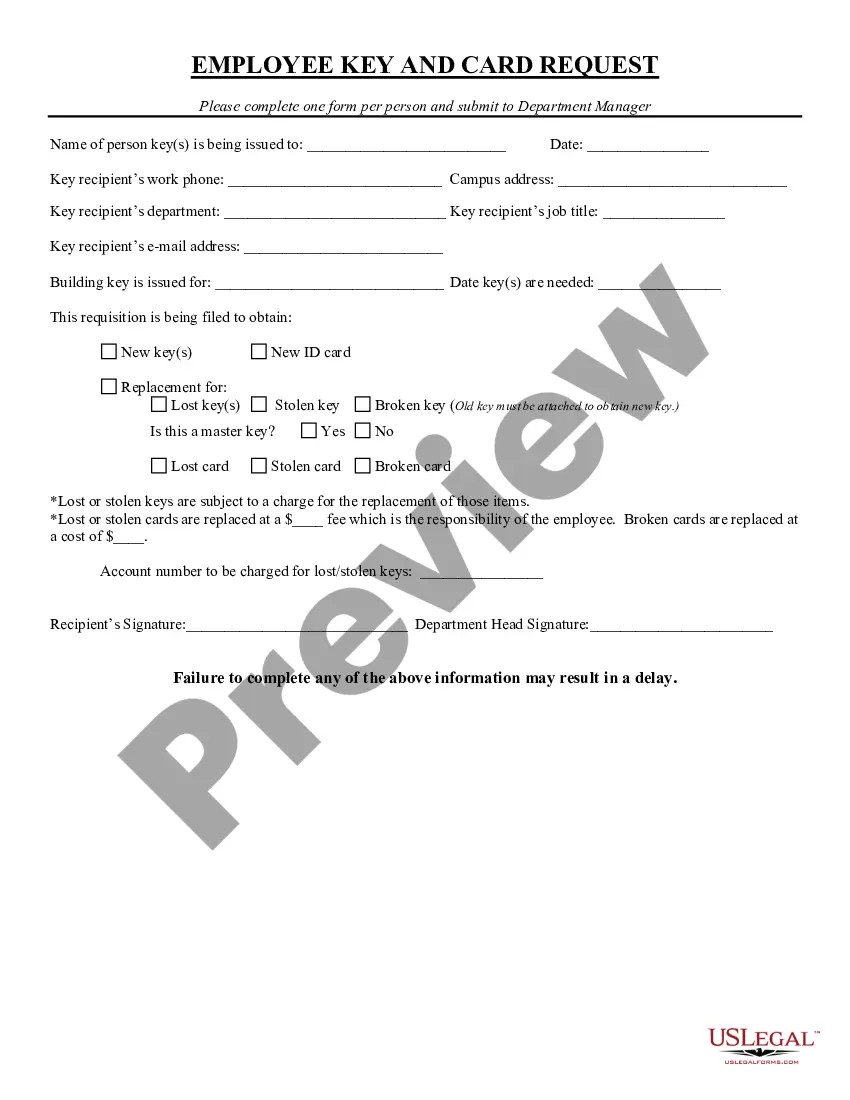

- Make sure to select the correct form for your city/state. Click the Review button to examine the form's content. Read the form summary to ensure you have selected the correct form.

- If the form does not meet your requirements, use the Search box at the top of the screen to find the one that does.

- Once you are satisfied with the form, confirm your choice by clicking the Buy now button. Then, choose the payment plan you wish and provide your information to set up your account.

- Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

- Choose the format and download the form to your device.

Form popularity

FAQ

A judgment in Missouri has a statute of limitations of ten years. Once a judgment is rendered, the creditor has ten years to collect the debt. If the creditor fails to do so, they may lose the ability to enforce the judgment. Knowing about the Missouri Rejection of Claim and Report of Experience with Debtor can help you navigate this vital aspect of debt collection.

The statute of limitations for a breach of fiduciary duty in Missouri is typically five years. This period begins when the affected party discovers the breach or reasonably should have discovered it. It is crucial to take action during this window to preserve your claims. Understanding how the Missouri Rejection of Claim and Report of Experience with Debtor applies to your situation can aid in addressing these critical issues.

In Missouri, the general statute of limitations for filing a civil lawsuit is five years. This timeframe starts when the incident occurs, or when the injured party becomes aware of the injury. If you face a legal matter, you need to act quickly to ensure your rights are protected. Relevant information about Missouri Rejection of Claim and Report of Experience with Debtor can help guide you in these situations.

In Missouri, the statute of limitations on a trust generally lasts five years. This period begins when the beneficiary is aware of the trust or should have been aware of it. It is essential to resolve any issues with a trust promptly. This relates to the Missouri Rejection of Claim and Report of Experience with Debtor, as understanding these limitations can greatly affect your rights.

Penal code 38.02 in Missouri typically relates to specific procedures surrounding financial crimes. It outlines the responsibilities and penalties for individuals engaged in fraudulent activities. Awareness of this code is essential for anyone involved in financial dealings or legal disputes. Resources like the Missouri Rejection of Claim and Report of Experience with Debtor can shed light on this complex area.

In Missouri, the statute of limitations for filing a breach of fiduciary duty claim is generally five years from the date the wrongdoing was discovered. This timeframe ensures that claims are pursued in a timely manner, providing fairness to all parties involved. Knowing this can help protect rights in fiduciary relationships. The Missouri Rejection of Claim and Report of Experience with Debtor includes relevant information for addressing such breaches.

In Missouri, a person can refuse to identify themselves as a witness under specific circumstances, particularly in civil matters. This refusal may be based on the potential self-incrimination or other legal protections. Understanding this statute is crucial for anyone considering testimony in a case. The Missouri Rejection of Claim and Report of Experience with Debtor can provide added insights when navigating legal complexities.

The 85 percent law in Missouri pertains to the amount of time prisoners must serve before being eligible for parole. Specifically, those convicted of certain crimes must serve at least 85 percent of their sentence. Understanding this law is important for those involved in parole discussions or for families seeking clarity. Knowing the details can also help inform the Missouri Rejection of Claim and Report of Experience with Debtor.

A consent judgment in Missouri is an agreement between parties in a legal dispute that is approved by the court. This type of judgment allows for a resolution without going to trial and can help both parties save time and legal costs. The terms of the agreement are outlined in a document, which becomes an official court order. Utilizing the Missouri Rejection of Claim and Report of Experience with Debtor can help parties understand this process better.

In Missouri, creditors typically have a period of one year to file a claim against an estate after the probate case opens. This timeline is important because it establishes a deadline for settling debts before distributing assets. If a claim is filed after this period, it may be rejected. Understanding the Missouri Rejection of Claim and Report of Experience with Debtor is crucial for both creditors and debtors navigating these timelines.