Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause

Description

How to fill out Contract With Consultant As Self-Employed Independent Contractor With Limitation Of Liability Clause?

It is feasible to spend hours online attempting to locate the authentic document template that meets the state and federal requirements you require.

US Legal Forms offers a vast array of legitimate forms that are assessed by professionals.

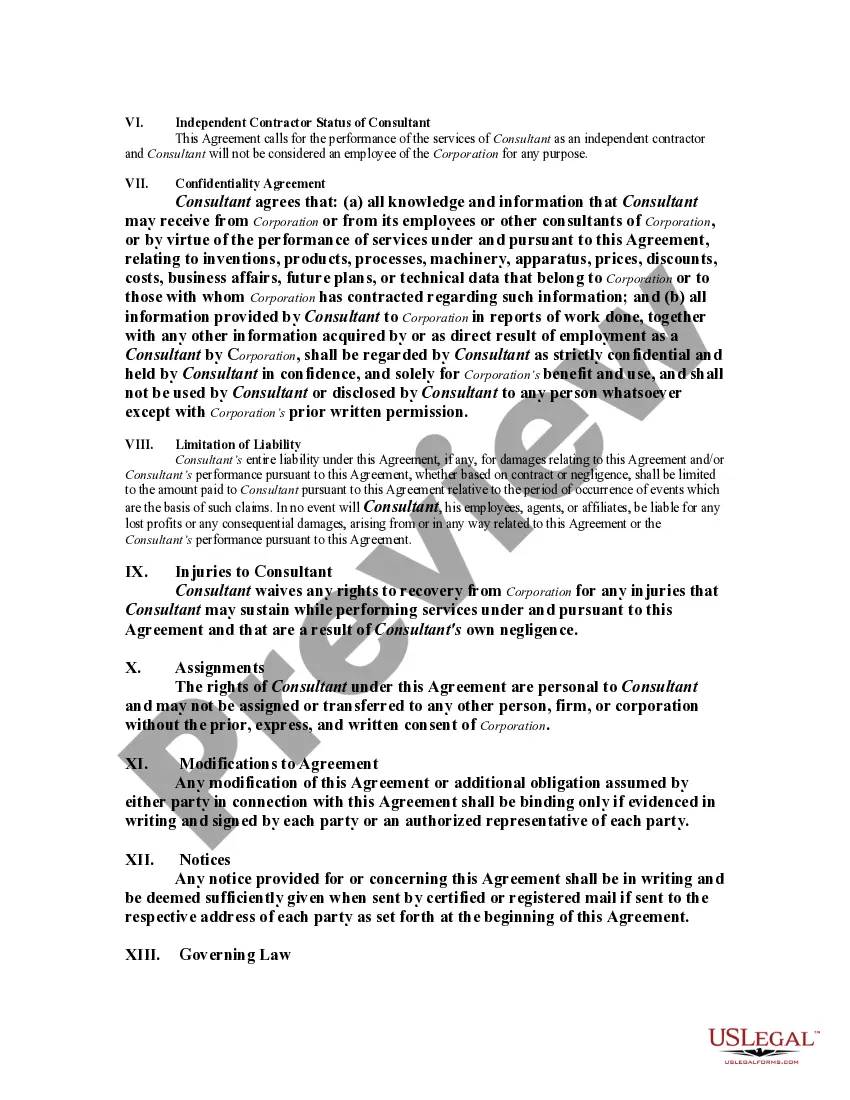

You can obtain or print the Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause from the service.

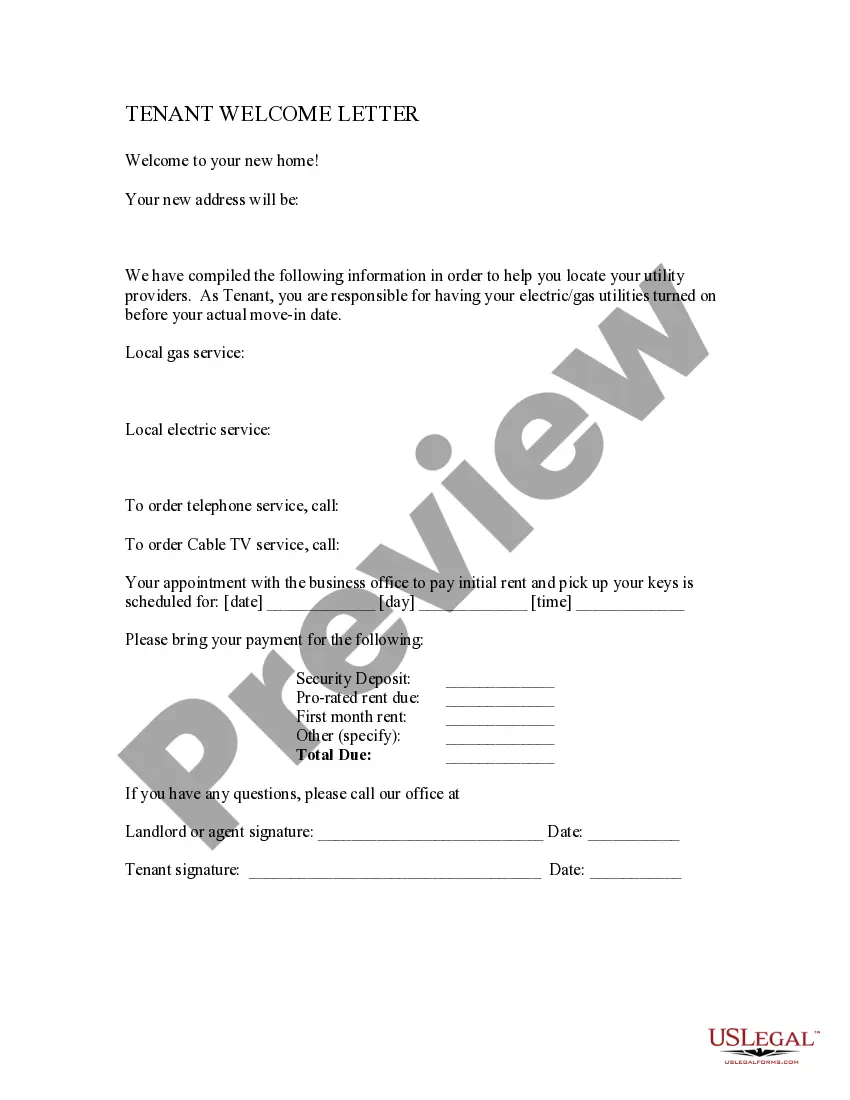

If available, make use of the Preview button to view the document template as well.

- If you have a US Legal Forms account, you can Log In and click the Download button.

- After that, you can fill out, modify, print, or sign the Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause.

- Every legal document template you purchase belongs to you permanently.

- To get another copy of the purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/area you choose.

- Review the form description to confirm you have selected the correct form.

Form popularity

FAQ

The limitation of liability clause in a consulting agreement specifies the maximum amount the consultant is liable for under certain circumstances. This is fundamental for controlling financial exposure and ensuring that parties understand their responsibilities. Including this clause in a Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause promotes a successful business relationship.

A limitation of liability disclaimer warns users about the extent to which a contractor can be held liable for damages or losses. This can be crucial when managing expectations in consulting agreements. By integrating this disclaimer into a Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, you can clarify the boundaries of accountability.

The indemnification clause for independent contractors requires one party to compensate the other for harm or loss. This is especially important in professional setups, as it shields the contractor from bearing all the risks alone. Including this clause in a Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause solidifies trust between the parties.

A limitation of liability for professional services sets a boundary on the compensation one can recover from a service provider. This is particularly relevant in consulting, where complex issues can arise. Crafting this clause within a Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause helps ensure transparency and fairness.

The contractor limitation of liability clause outlines the extent of liability that a contractor assumes in their agreement. This can limit exposure to claims arising from negligence or unforeseen circumstances. Including such a clause in a Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause is crucial for protecting both parties.

Limitations of liability sample clauses typically restrict the amount of damages that can be claimed. This type of clause ensures that the financial implications for the consultant are reasonable and manageable. Understanding these limitations when creating a Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can offer peace of mind.

Yes, an independent contractor can operate as a consultant. Many consultants function as independent contractors, providing expertise and services on a freelance basis. When drafting a Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it is essential to clearly define the roles and responsibilities.

A limitation of liability clause for independent contractors protects both parties by capping the financial responsibility in case of claims. This means if something goes wrong, the independent contractor's liability does not exceed a specified amount. Incorporating this clause into a Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause can help clarify risk management.

The difference between a 1099 and a W-2 employee in Missouri primarily involves tax treatment. A 1099 worker is considered self-employed and must handle their own taxes, while a W-2 employee has taxes withheld from their paycheck. When using a Missouri Contract with Consultant as Self-Employed Independent Contractor with Limitation of Liability Clause, it is crucial to clarify the tax responsibilities.

To write an independent contractor agreement in Missouri, start by defining the services to be provided and the terms of engagement. Include payment details, deadlines, and specify that the contractor retains independence in executing the work. By including a Limitation of Liability Clause, you can protect both parties in a Missouri Contract with Consultant as Self-Employed Independent Contractor.