Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate

Description

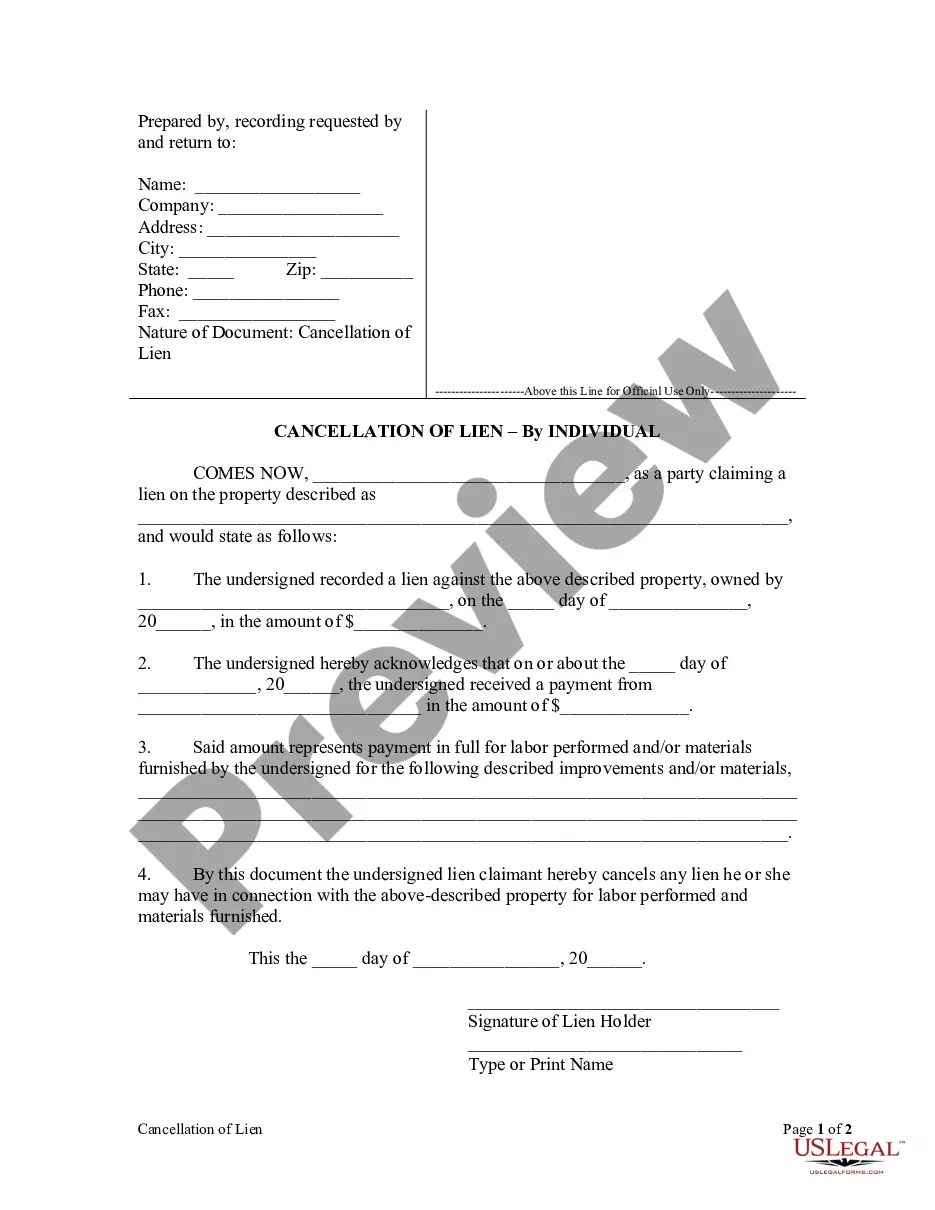

How to fill out Lease Of Retail Store With Additional Rent Based On Percentage Of Gross Receipts - Real Estate?

If you desire to be thorough, obtain, or print authorized document templates, use US Legal Forms, the largest collection of legal forms, which are accessible online.

Leverage the site's straightforward and user-friendly search to locate the documents you need.

A variety of templates for business and personal use are sorted by categories and states, or keywords.

Step 4. Once you have found the form you want, click the Buy now button. Choose the payment plan you prefer and provide your information to create an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to locate the Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate with just a few clicks.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to get the Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate.

- You can also access forms you previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form’s details. Be sure to read through the information thoroughly.

- Step 3. If you are not satisfied with the form, use the Search box at the top of the screen to find other templates in the legal form category.

Form popularity

FAQ

A natural breakpoint is a specific sales figure determined by dividing the base rent by the percentage rent rate in a Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. This figure represents the threshold sales level at which additional rent becomes due. When sales reach this point, the landlord receives extra rent based on a percentage of gross receipts. Understanding the natural breakpoint is crucial for effective financial planning and can assist you in maximizing your retail store's profitability.

To calculate the leased percentage in a Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, start by determining the total gross receipts for your business during the specified period. Next, find the base rent amount stated in your lease agreement. Divide the total gross receipts by the base rent amount, then multiply by 100 to express the result as a percentage. This calculation helps you determine your rental obligations based on your business performance.

To calculate a breakpoint, identify the base rent amount and the agreed percentage for additional rent. Divide the base rent by the percentage to determine the breakpoint sales figure. This calculation is vital in a Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate as it helps both parties understand when additional payments commence.

The break-even point in percentage leases refers to the point where the tenant’s gross sales cover both base rent and any additional percentage rent. In the context of the Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, reaching this point ensures that the tenant is not operating at a loss. It is crucial for tenants to understand this metric for sustainable financial health.

To calculate percentage change in rent, you first determine the difference between the current rent and the previous rent. Then, divide that difference by the previous rent, and multiply by 100 to get the percentage change. In a Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, being aware of these changes can impact overall financial planning for both landlords and tenants.

A breakpoint in a contract refers to a specific threshold that triggers additional rent payments in a Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate. When gross sales surpass this threshold, the tenant starts paying a percentage of those sales as additional rent. Understanding breakpoints is essential to both landlords and tenants to manage expectations about financial commitments.

The lease factor percentage refers to the percentage used to calculate additional rent based on gross sales. This percentage can vary based on the lease agreement and is often a negotiation point between landlord and tenant. Under the Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, understanding the lease factor percentage is vital for clear financial planning and obligations.

The formula for the percentage of agreement involves determining the total amount agreed upon and dividing it by the total potential amount. For example, if your retail store’s gross receipts are projected, identifying how much percentage is applicable is crucial. In the context of a Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this helps clarify expectations for both landlords and tenants.

Yes, leases can be taxable in Missouri. The tax typically applies to the total rental payment, which may include both base rent and additional charges such as percentage rent. When dealing with a Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, it is important to check the latest local tax regulations to remain compliant.

To calculate a percentage lease, start by determining the gross sales of your business. Then, apply the agreed percentage rate to that sales figure to find the additional rent owed. In the context of a Missouri Lease of Retail Store with Additional Rent Based on Percentage of Gross Receipts - Real Estate, this method allows landlords to share in the success of their tenants by tying rent to sales performance.