Missouri Multistate Promissory Note - Secured

Description

How to fill out Multistate Promissory Note - Secured?

Selecting the ideal authentic document template can be challenging.

Of course, there are numerous templates available online, but how can you find the authentic form you require.

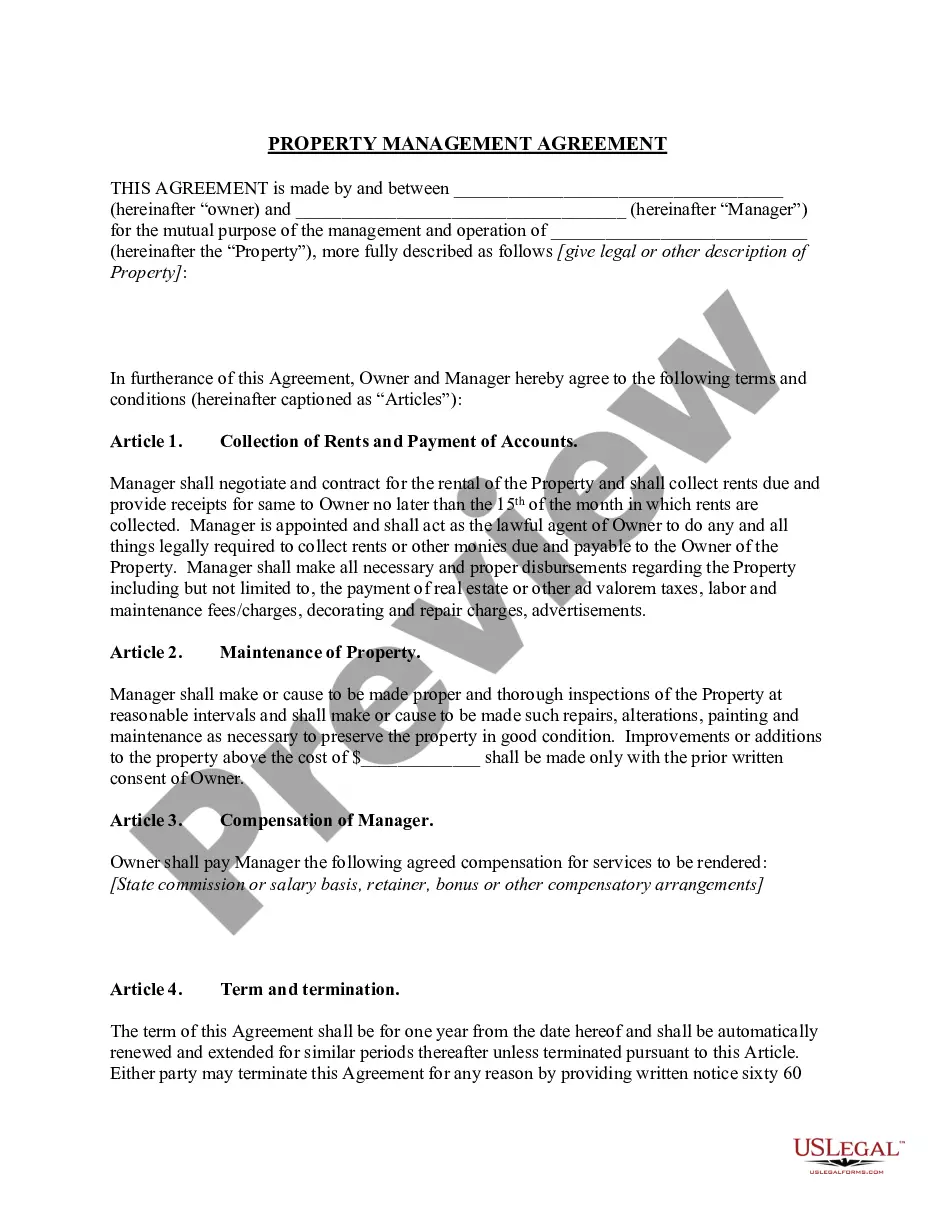

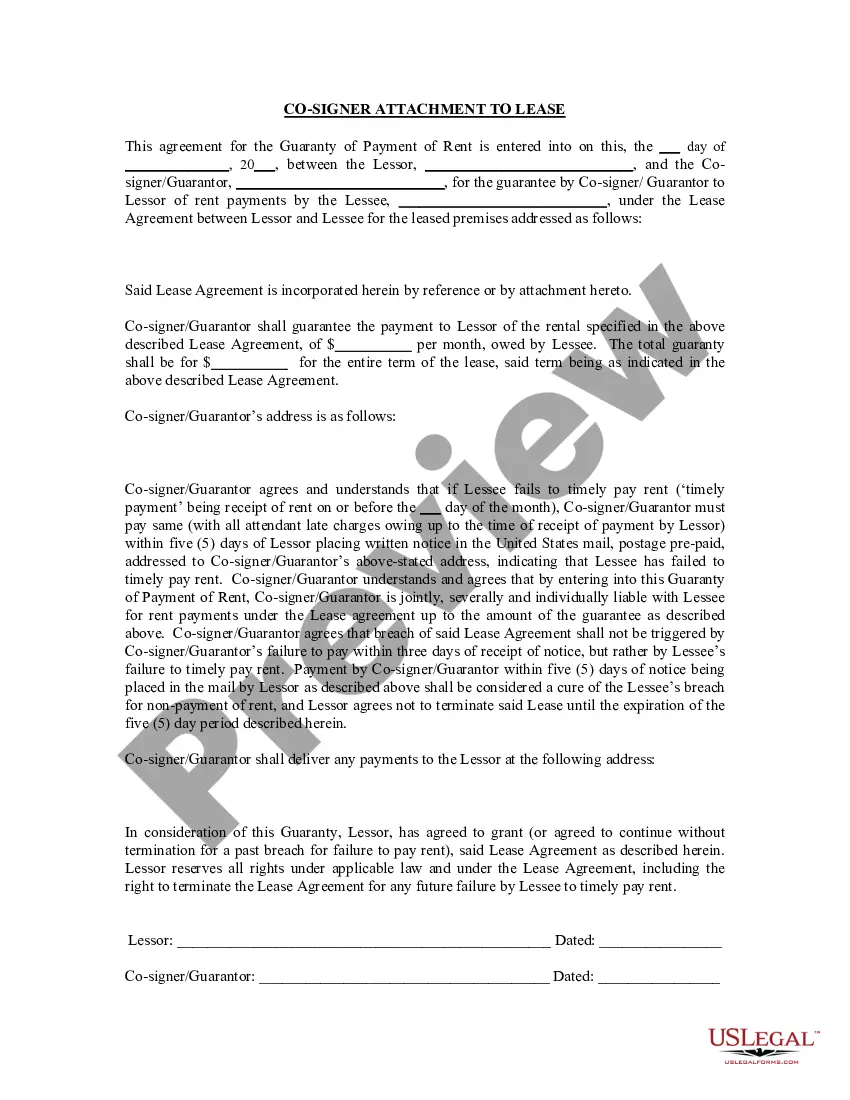

Utilize the US Legal Forms website. This service offers thousands of templates, including the Missouri Multistate Promissory Note - Secured, suitable for both business and personal purposes.

You can preview the form using the Review option and read the form description to confirm it is suitable for you.

- All forms are verified by professionals and comply with state and federal regulations.

- If you are currently registered, Log In to your account and click the Download button to access the Missouri Multistate Promissory Note - Secured.

- Using your account, you can search through the legal forms you have previously obtained.

- Go to the My documents section in your account to obtain another copy of the document you need.

- If you are a first-time user of US Legal Forms, follow these simple steps.

- First, ensure you have selected the correct form for your state/region.

Form popularity

FAQ

While promissory notes can be useful, they do have some disadvantages. For instance, if you have a Missouri Multistate Promissory Note - Secured, the collateral ties up your assets in case of default. Additionally, enforcing payments may involve legal proceedings, which can be costly and time-consuming.

It can be either, depending on its terms. A Missouri Multistate Promissory Note - Secured is clearly defined as secured, meaning it has collateral backing it. Unsecured notes, in contrast, do not offer this additional layer of security.

The key difference lies in collateral; a secured promissory note is backed by an asset, while an unsecured note is not. The Missouri Multistate Promissory Note - Secured offers the financial safety of collateral. Consequently, lenders may offer better terms for secured notes.

Promissory notes can be secured, depending on the terms referenced. A Missouri Multistate Promissory Note - Secured incorporates specific collateral, making it more secure than an unsecured note. Security enhances confidence for both parties in financial agreements.

To turn a promissory note into a security, you must register it and comply with securities regulations. If you hold a Missouri Multistate Promissory Note - Secured, you can use it for collateral in various financial transactions. Consulting a legal expert can clarify the process and requirements.

In Missouri, the statute of limitations for a promissory note is typically five years. This means that a lender has five years to enforce the terms of the Missouri Multistate Promissory Note - Secured in court. It's crucial to act swiftly if you need to collect on an unpaid note.

Yes, a Missouri Multistate Promissory Note - Secured can be backed by collateral. This means if the borrower fails to repay, the lender can claim the specified collateral. It's a common practice for lenders to require security to minimize risk and protect their investment.

Promissory notes typically qualify as debt securities, as they represent a right to receive payment. This characteristic is vital for both parties in a financial agreement, especially in the context of a Missouri Multistate Promissory Note - Secured. This type of note ensures that the lender has a reliable obligation to repay, fostering trust in the transaction. Understanding this classification can help you manage your financial affairs more effectively.

Promissory notes can sometimes be considered exempt from securities regulation, depending on their characteristics and how they are issued. Factors such as the note's duration and use of proceeds play a key role in this classification. Opting for a Missouri Multistate Promissory Note - Secured may provide a more structured approach and potentially avoid securities complications. Consult with a legal professional for advice tailored to your situation.

An unsecured promissory note is typically not considered a security because it lacks any backing or collateral. This distinction is important in legal contexts because it affects how these notes are treated under the law. By choosing a Missouri Multistate Promissory Note - Secured, you can enhance the security of your transactions. Always explore all your options to find the best structure for your financing needs.