Missouri Secured Promissory Note

Description

How to fill out Secured Promissory Note?

Locating the appropriate legal document template can be quite a challenge.

Of course, there are numerous templates available online, but how can you find the legal form you need.

Utilize the US Legal Forms website. This service offers a vast array of templates, including the Missouri Secured Promissory Note, suitable for both business and personal purposes.

You can preview the form by clicking the Review button and read the form description to ensure it is the right one for you.

- All forms are reviewed by experts and comply with both state and federal requirements.

- If you are already registered, Log In to your account and click the Obtain button to access the Missouri Secured Promissory Note.

- Use your account to browse the legal forms you have previously purchased.

- Proceed to the My documents section of your account and obtain an additional copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your area/region.

Form popularity

FAQ

To obtain your Missouri Secured Promissory Note, you can start by visiting the US Legal Forms platform. This website offers a user-friendly interface where you can easily navigate through various document templates. Simply select the Missouri Secured Promissory Note template that fits your needs, customize it to your specifications, and download it securely. Having the right documentation ensures that your investment is protected and helps in legally formalizing the agreement.

A practical example of a Missouri Secured Promissory Note might involve a borrower agreeing to repay a lender $5,000 with a 5% interest rate over two years. The note would detail monthly payments and specify that a car serves as collateral. This example highlights the basic elements that create a binding agreement between the parties.

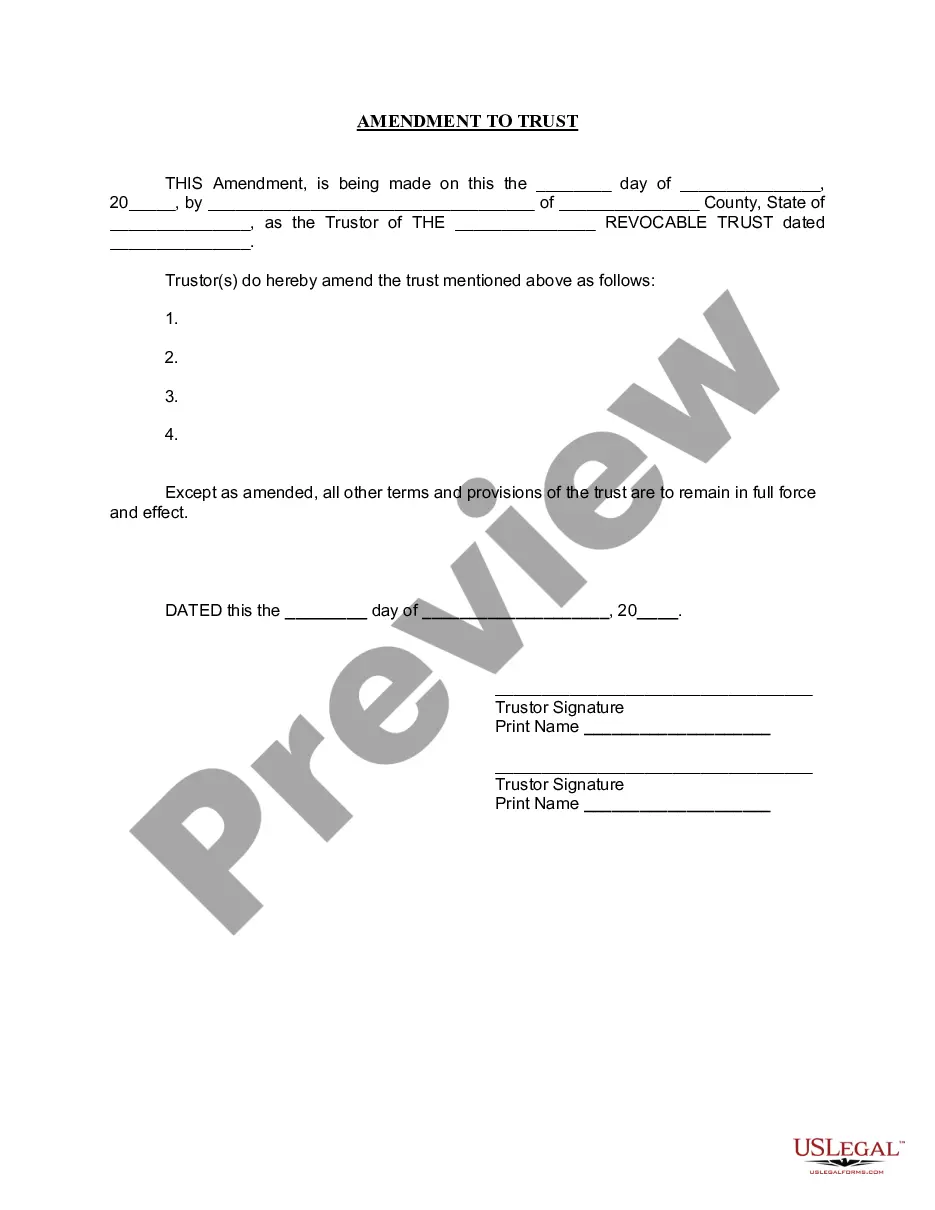

The format of a Missouri Secured Promissory Note is generally straightforward. It starts with the title, followed by the terms and parties involved, and concludes with signature lines for both parties. Ensuring the right format helps validate the note and enhances its enforceability in case of disputes.

A Missouri Secured Promissory Note typically includes essential elements such as the principal amount, interest rate, payment schedule, and maturity date. Additionally, it identifies the borrower and lender, as well as any collateral securing the note. The clarity in structure helps each party understand their obligations, facilitating a smoother transaction.

Absolutely, you can take someone to court with a promissory note if they fail to meet the terms of the agreement, including Missouri Secured Promissory Notes. In such cases, having documentation that shows the agreement, terms of repayment, and any defaults will support your case. It’s wise to consult with legal professionals to ensure you have a strong argument.

A properly drafted promissory note, including Missouri Secured Promissory Notes, usually holds up in court. Courts tend to enforce clear, concise, and legally compliant notes. To prevent disputes, it is recommended that you adhere to established laws and regulations when creating and executing these agreements.

Yes, promissory notes are generally enforceable in court, including Missouri Secured Promissory Notes. To ensure their enforceability, it’s vital that the notes are written clearly and contain all necessary details, such as repayment terms and signatures. An attorney can help review these documents to strengthen their legal standing.

Yes, a promissory note can be secured, especially through Missouri Secured Promissory Notes. When you secure a promissory note, you attach collateral to it, which provides an extra layer of protection for the lender. This means that if the borrower defaults, the lender can claim the collateral to recover the owed amount.

The primary difference lies in collateral; a secured promissory note includes collateral, while an unsecured promissory note does not. With a secured note, you reduce the risk for the lender, which can lead to better borrowing terms. In contrast, unsecured notes may come with higher interest rates due to the increased risk. Understanding these differences is crucial for making the best choice in your Missouri financial transactions.

To turn a promissory note into a security, you will typically need to follow specific legal steps. In Missouri, this may include properly registering the note and disclosing relevant information to potential investors. This process ensures compliance with state securities laws and protects your interests. Consider using the USLegalForms platform to help navigate this process efficiently.