Missouri Exchange Addendum to Contract - Tax Free Exchange Section 1031

Description

How to fill out Exchange Addendum To Contract - Tax Free Exchange Section 1031?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a vast selection of legal document templates that you can download or print.

Through the website, you can access thousands of forms for business and personal purposes, categorized by types, states, or keywords. You can find the latest versions of forms such as the Missouri Exchange Addendum to Contract - Tax-Free Exchange Section 1031 in moments.

If you already have an account, Log In to download the Missouri Exchange Addendum to Contract - Tax-Free Exchange Section 1031 from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously purchased forms in the My documents section of your profile.

Complete the transaction. Use your credit card or PayPal account to finalize the transaction.

Select the format and download the form to your device. Edit. Fill out, modify, and print and sign the downloaded Missouri Exchange Addendum to Contract - Tax-Free Exchange Section 1031. Every document you add to your account does not expire and belongs to you indefinitely. Therefore, to download or print another copy, simply go to the My documents section and click on the document you need. Access the Missouri Exchange Addendum to Contract - Tax-Free Exchange Section 1031 with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that fulfill your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

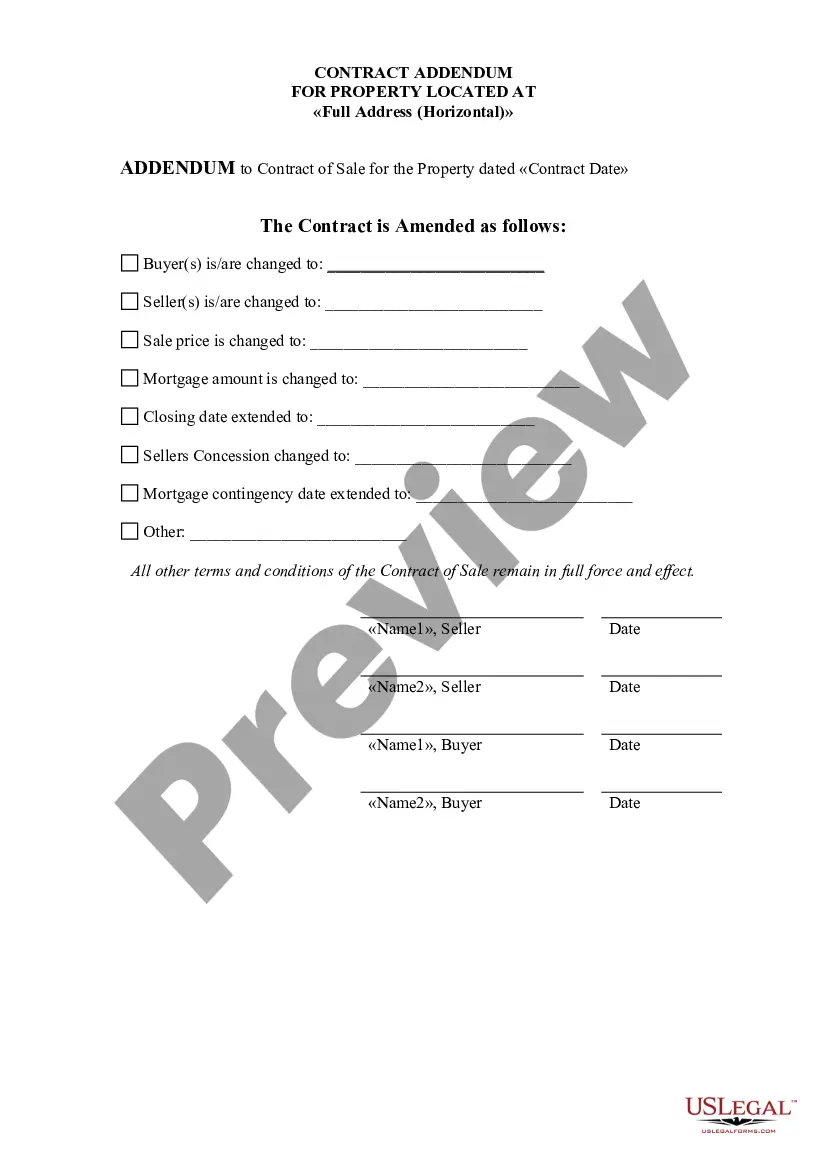

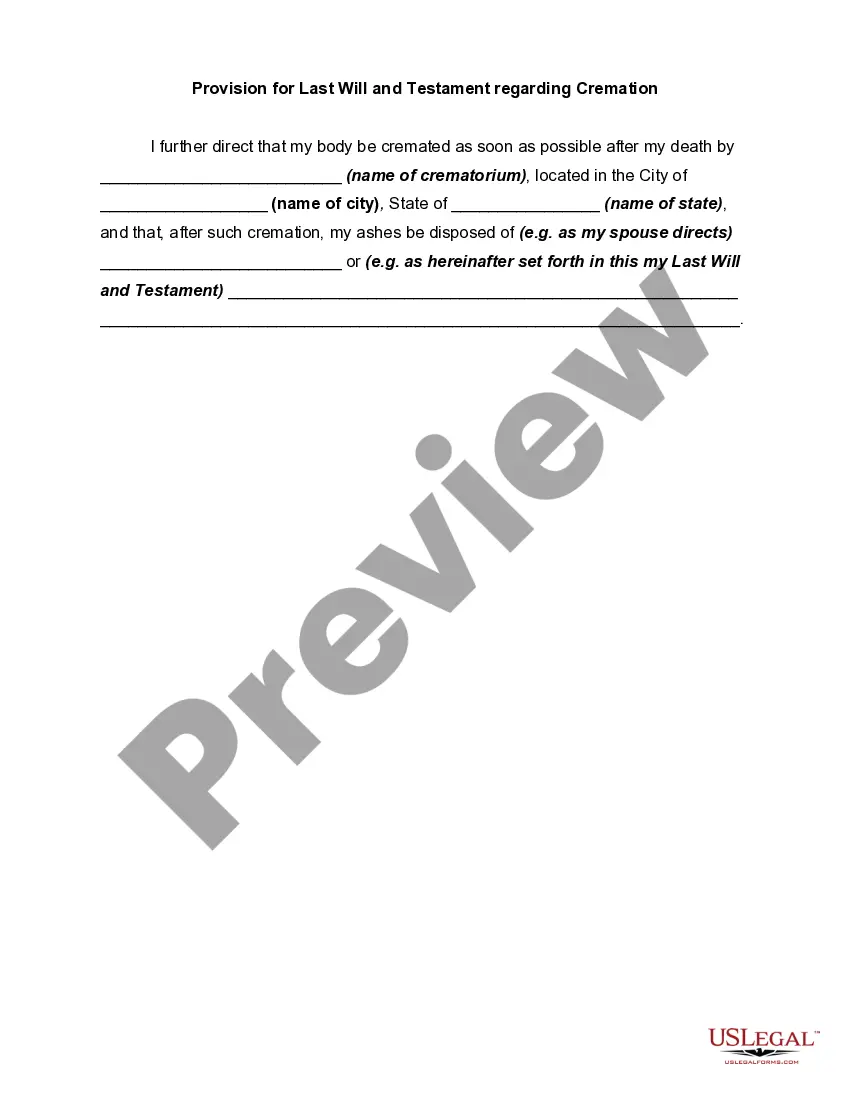

- Choose the Preview option to review the form's content.

- Examine the form summary to confirm that you have chosen the correct document.

- If the form doesn't meet your needs, use the Search bar at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your selection by clicking the Purchase now button.

- Then, select your preferred pricing plan and provide your information to register for an account.

Form popularity

FAQ

It allows an investor to sell their property or business and buy another one without incurring any capital gain. In other words, a 1031 exchange, when used correctly, can allow an investor to take money that would otherwise be taxed and invest it back into more valuable investments.

Under IRC §1031, the following properties do not qualify for tax-deferred exchange treatment: Stock in trade or other property held primarily for sale (i.e. property held by a developer, flipper or other dealer) Securities or other evidences of indebtedness or interest. Stocks, bonds, or notes.

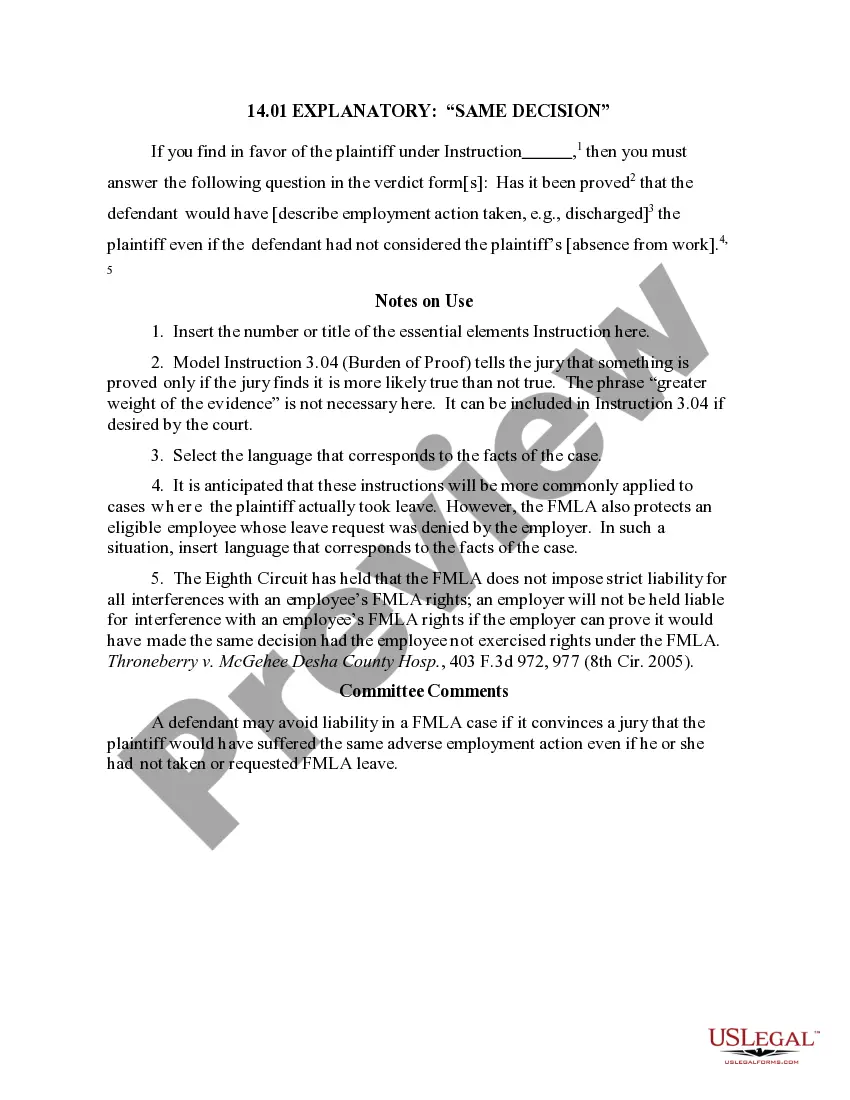

For a Section 1031 exchange, it is imperative that the purchase and sale contracts for both parties be assignable.

A 1031 addendum will normally clearly show intent to do a 1031 exchange, permit assignment, and advise the other party there will be no expense or liability as a result of the exchange. Sometimes there is cooperation language asserting that both parties to the contract will cooperate with a 1031 exchange.

How to do a 1031 exchangeStep 1: Identify the property you want to sell.Step 2: Identify the property you want to buy.Step 3: Choose a qualified intermediary.Step 4: Decide how much of the sale proceeds will go toward the new property.Step 5: Keep an eye on the calendar.Step 6: Be careful about where the money is.More items...

For instance, when an installment sale includes seller financing for which the seller wishes to complete a 1031 exchange but will be receiving some or all of the buyer's installment payments beyond the 180 day window for concluding the exchange.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred, but it is not tax-free. The exchange can include like-kind property exclusively or it can include like-kind property along with cash, liabilities and property that are not like-kind.

Notes and the 1031 ExchangeThough a contract sale can be incorporated in an exchange, it may not be possible to accomplish this goal all the time. In order for a note to be used in an exchange, you, the Exchangor, must not have actual or constructive receipt of the note.

The main requirements for a 1031 exchange are: (1) must purchase another like-kind investment property; (2) replacement property must be of equal or greater value; (3) must invest all of the proceeds from the sale (cannot receive any boot); (4) must be the same title holder and taxpayer; (5) must identify new

The Three Property Rule is defined under IRC Section 1031, which states that an exchanger or taxpayer executing a delayed exchange has 45 calendar days from the closing date of the sale of their relinquished property to formally identify a replacement property or properties.