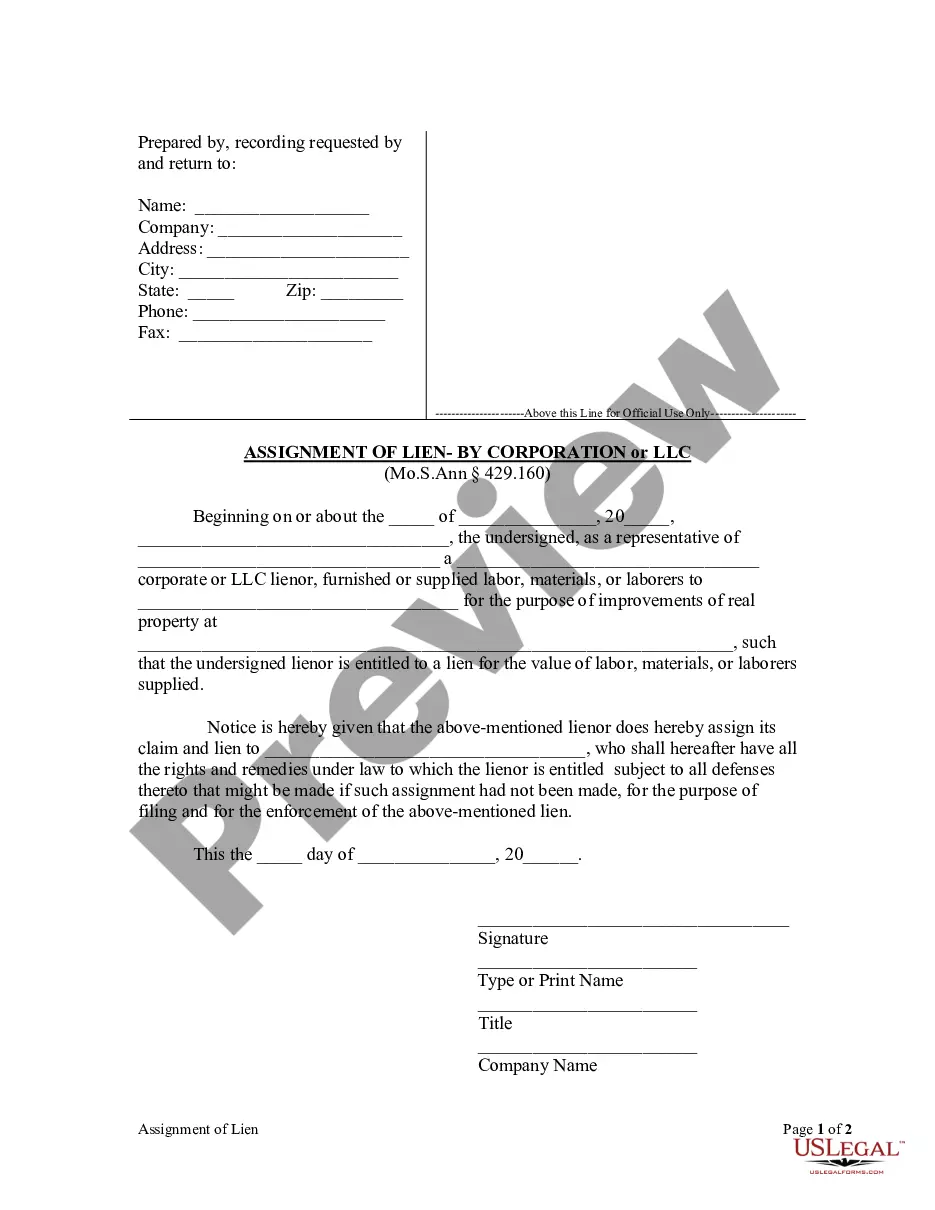

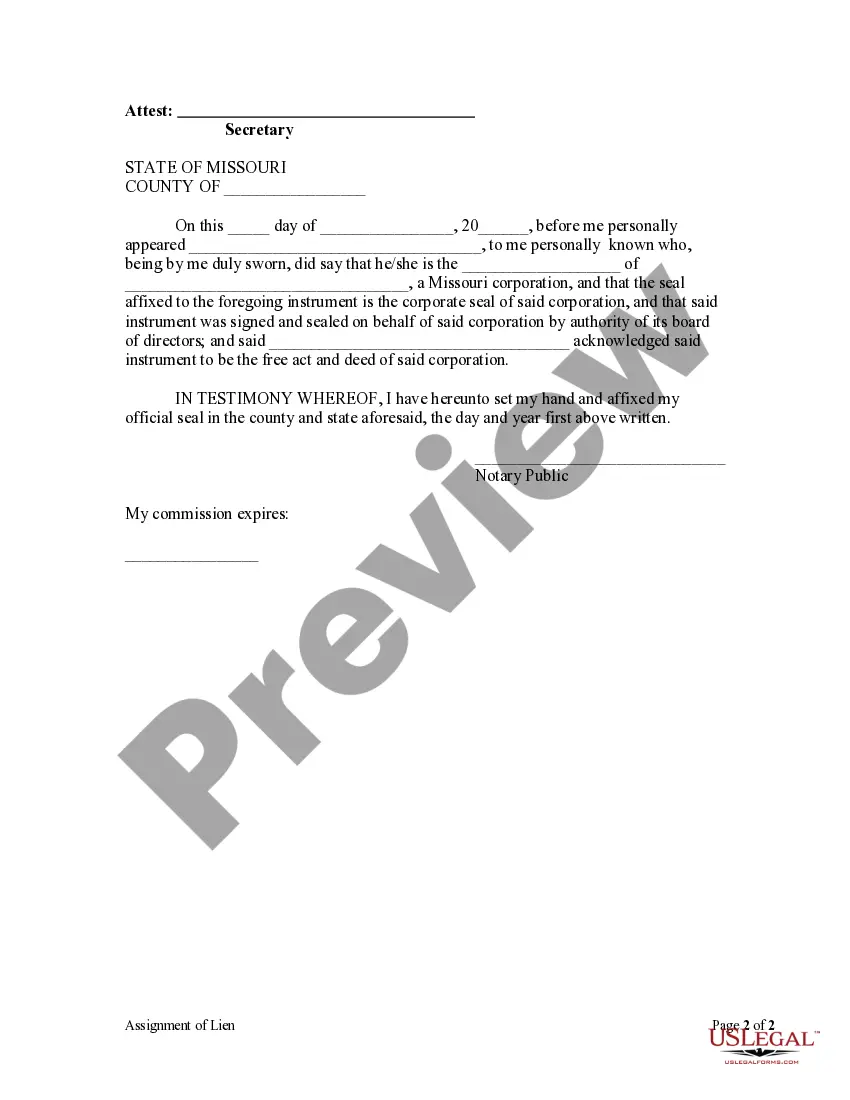

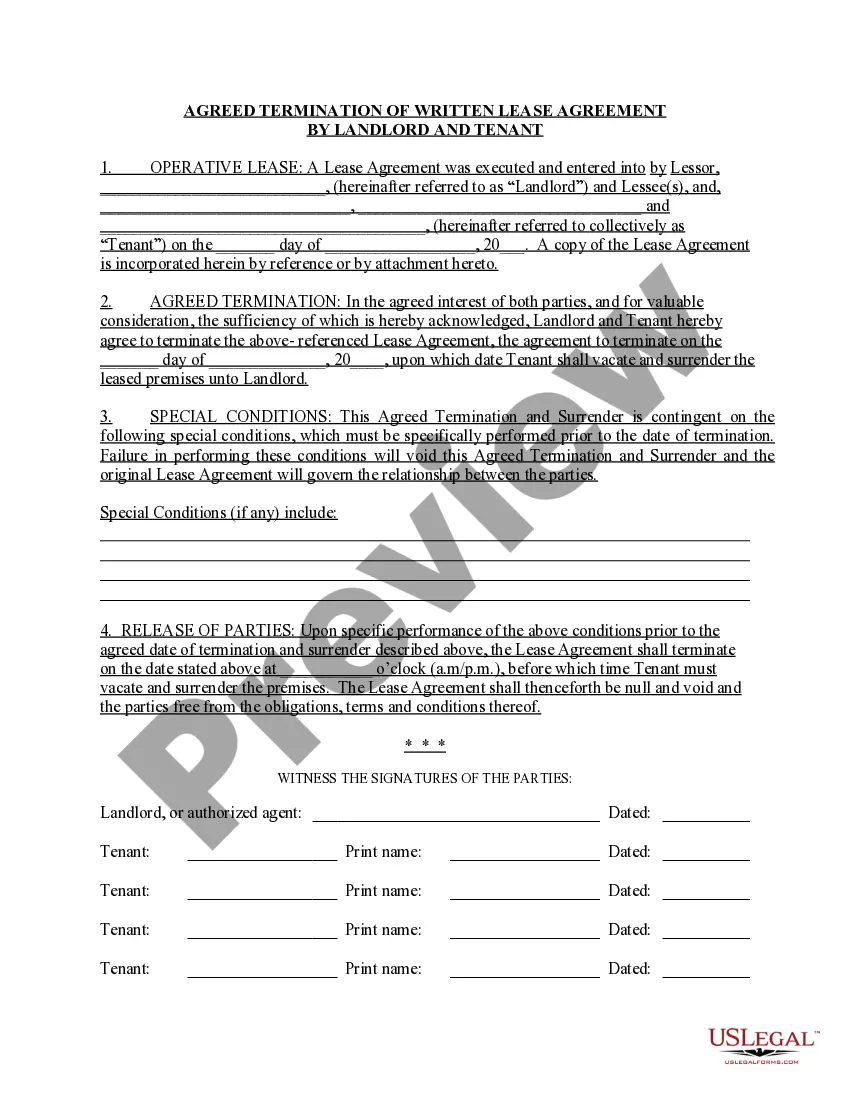

This Assignment of Lien form is for use by a corporate lienor who furnished or supplied labor, materials, or laborers for the purpose of improvements of real property, such that the lienor is entitled to a lien for the value of labor, materials, or laborers supplied, to provide notice that the lienor assigns its claim and lien with all the rights and remedies under law to which the lienor is entitled subject to all defenses thereto that might be made if such assignment had not been made, for the purpose of filing and for the enforcement of the lien.

Missouri Assignment of Lien - Corporation

Description

How to fill out Missouri Assignment Of Lien - Corporation?

Acquire any template from 85,000 legal documents such as Missouri Assignment of Lien - Corporation or LLC online with US Legal Forms. Each template is created and refreshed by state-certified legal experts.

If you already possess a subscription, Log In. When you are on the form’s page, click the Download button and navigate to My documents to access it.

If you haven't subscribed yet, follow the steps listed below.

With US Legal Forms, you will always have swift access to the appropriate downloadable template. The service offers you access to documents and categorizes them to simplify your search. Utilize US Legal Forms to obtain your Missouri Assignment of Lien - Corporation or LLC quickly and effortlessly.

- Verify the state-specific requirements for the Missouri Assignment of Lien - Corporation or LLC you wish to utilize.

- Review the description and preview the template.

- Once you are sure the sample meets your needs, click on Buy Now.

- Select a subscription plan that aligns well with your budget.

- Establish a personal account.

- Make a payment using one of two convenient methods: by credit card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable form is ready, print it out or save it to your device.

Form popularity

FAQ

In Missouri, a lien release does not always have to be notarized, but it is highly recommended. Having a notarized lien release can provide additional legal protection and clarity. It confirms that the lien has been officially satisfied and prevents any future disputes. For those looking for guidance on preparing lien releases, USLegalForms offers comprehensive templates to ensure your documents meet Missouri requirements.

Yes, you can file a lien without a lawyer in Missouri. The Missouri Assignment of Lien - Corporation process is straightforward enough for individuals to manage on their own. However, it is crucial to understand the specific requirements to avoid any mistakes. Our USLegalForms platform offers user-friendly resources and templates to help you navigate this process confidently.

To put a lien on a corporation in Missouri, you must first complete the Missouri Assignment of Lien - Corporation form. This form requires specific information about the debt owed and the corporation involved. After filling out the form, you should file it with the appropriate county clerk's office. Utilizing our platform at USLegalForms can simplify this process by providing you with the necessary forms and guidance.

Yes, Missouri is recognized as a lien holder state. This means that creditors can file liens against a business's assets to secure debts, giving them legal rights to claim those assets if necessary. When dealing with liens, understanding your rights as a lienholder is crucial for effective debt management.

In Missouri, liens function as legal claims against property or business assets to secure payment of debts. When a lien is placed, it must be recorded to be enforceable. A Missouri Assignment of Lien - Corporation serves to formalize this claim, and it can affect the ability of the business to obtain financing or sell its assets until the lien is resolved.

Non-title holding states include states like California and New York, where the lienholder may have a legal claim but does not possess the title to the property. Understanding the classification of states is crucial when dealing with liens, as it affects how creditors and debtors interact. You can find detailed information on lien laws specific to each state to guide your decisions.

Missouri is not classified as a non-title holding state. In Missouri, the lienholder does not automatically hold the title to the property or business. Instead, the lien serves as a legal claim against the assets, ensuring that creditors have recourse if the debt remains unpaid.

To put a lien on a business in Missouri, you must file a Missouri Assignment of Lien - Corporation with the appropriate county authority. This involves completing the necessary paperwork, providing relevant details about the debt, and paying any applicable fees. Once filed, the lien becomes a public record, notifying other creditors of your claim on the business's assets.