This form is a Quitclaim Deed where the Grantor is a limited liability company and the Grantee is a limited liability company. Grantor conveys and quitclaims the described property to Grantee. This deed complies with all state statutory laws.

Missouri Quitclaim Deed from Limited Liability Company to Limited Liability Company

Description

How to fill out Missouri Quitclaim Deed From Limited Liability Company To Limited Liability Company?

Obtain any template from 85,000 legal documents including Missouri Quitclaim Deed from Limited Liability Company to Limited Liability Company online with US Legal Forms. Each template is created and updated by state-licensed attorneys.

If you already have a subscription, Log In. Once you’re on the form’s page, hit the Download button and navigate to My documents to access it.

If you have not subscribed yet, follow the steps outlined below: Check the state-specific criteria for the Missouri Quitclaim Deed from Limited Liability Company to Limited Liability Company you wish to utilize.

With US Legal Forms, you will always have instant access to the appropriate downloadable template. The service will provide you with documents and categorize them to make your search easier. Use US Legal Forms to acquire your Missouri Quitclaim Deed from Limited Liability Company to Limited Liability Company quickly and effortlessly.

- Browse the description and preview the template.

- Once you’re confident that the sample meets your needs, simply click Buy Now.

- Select a subscription plan that fits your financial situation.

- Create a personal account.

- Pay in one of two convenient methods: by credit card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the file to the My documents section.

- After your reusable form is prepared, print it out or save it to your device.

Form popularity

FAQ

Yes, you can remove a property from an LLC, usually by executing another quitclaim deed. This deed will transfer ownership back to an individual or another entity. It is important to follow the legal requirements for documenting this change, including proper recording of the deed. For assistance in creating the necessary documents, consider using the US Legal Forms platform.

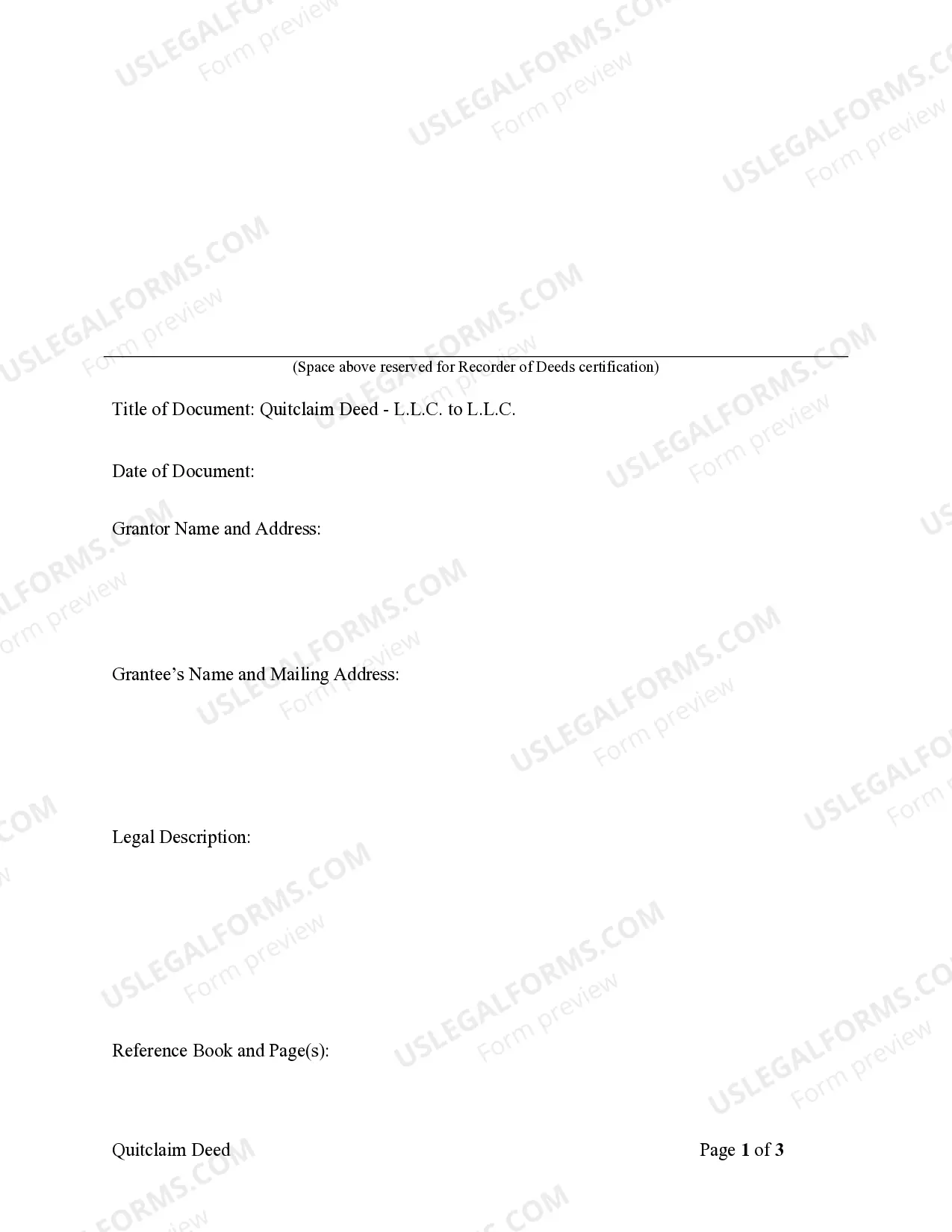

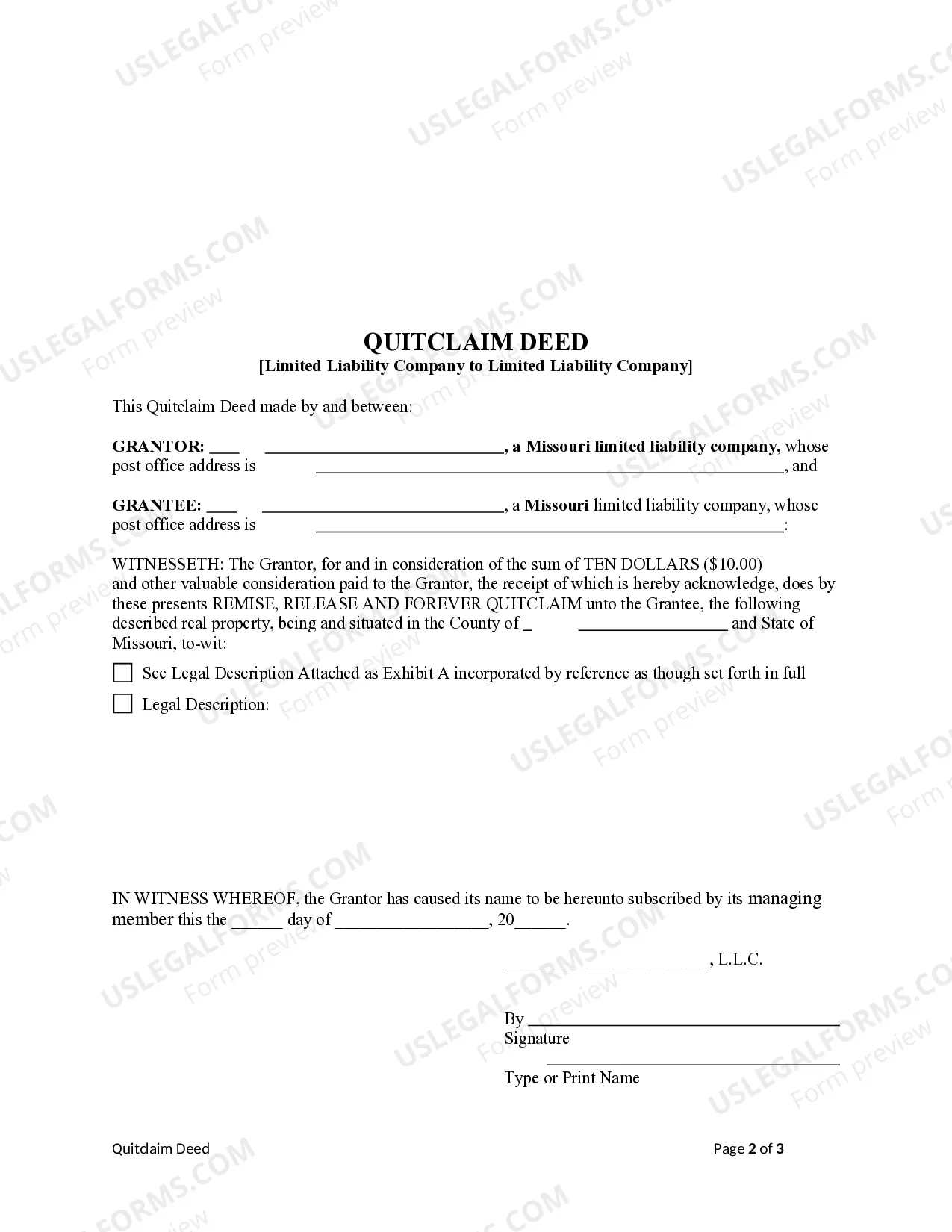

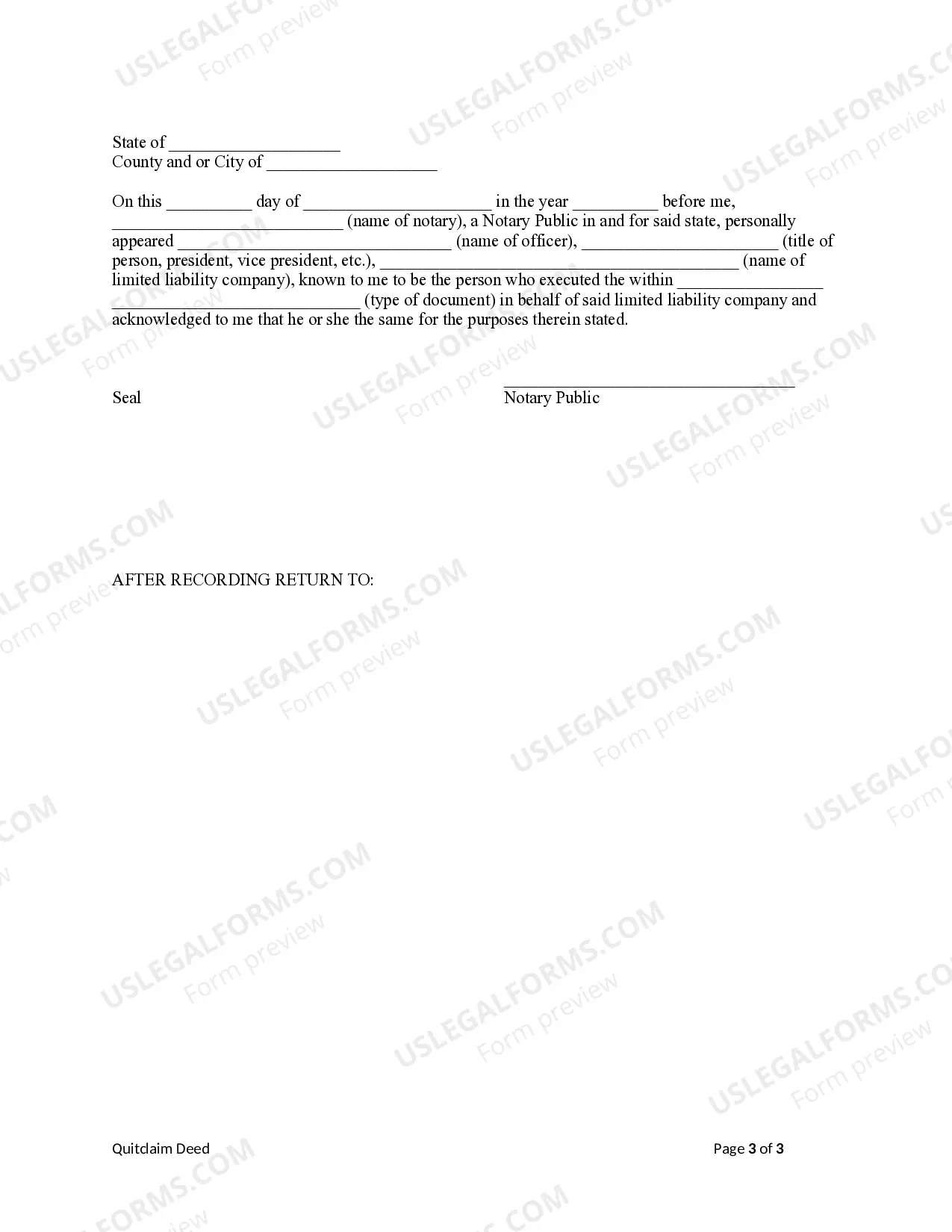

To quit claim a property to an LLC, start by preparing a Missouri Quitclaim Deed from Limited Liability Company to Limited Liability Company. Clearly list the grantor and the LLC as the grantee, and include a legal description of the property. After signing the deed, you must record it with the appropriate county recorder's office to finalize the transfer. The US Legal Forms platform provides templates and resources to guide you through each step.

Using an LLC for property ownership can lead to some disadvantages. Often, there are additional costs associated with forming and maintaining an LLC, such as filing fees and ongoing compliance requirements. Furthermore, transferring property into an LLC may trigger tax implications or affect your ability to secure financing. Understanding these factors is crucial when considering a Missouri Quitclaim Deed from Limited Liability Company to Limited Liability Company.

While quitclaim deeds can simplify property transfers, they come with potential risks. One primary concern is that a quitclaim deed does not guarantee clear title, meaning there could be existing liens or claims against the property. Additionally, if the deed is not properly recorded, the transfer may not hold up in court. It is vital to use a Missouri Quitclaim Deed from Limited Liability Company to Limited Liability Company correctly to mitigate these issues.

To change property ownership from personal to an LLC, you will need to execute a Missouri Quitclaim Deed from Limited Liability Company to Limited Liability Company. This deed transfers the title of the property from your name to the LLC. It is essential to properly complete and record this deed with the local county recorder's office to ensure legal recognition. Using the US Legal Forms platform can help streamline this process with easy-to-use templates and guidance.

Quitclaim Does Not Release Debts Signing a quitclaim deed and giving up all rights to the property doesn't release you from any financial obligations you may have. It only removes you from the title, not from the mortgage, and you are still responsible for making payments.

Quitclaim deeds are most often used to transfer property between family members. Examples include when an owner gets married and wants to add a spouse's name to the title or deed, or when the owners get divorced and one spouse's name is removed from the title or deed.

But you might be wondering if an owner can transfer a deed to another person without a real estate lawyer. The answer is yes. Parties to a transaction are always free to prepare their own deeds.A quitclaim deed, for example, is far simpler than a warranty deed.

However, there are substantial downsides associated with transferring your primary home into an LLC.If you are using your personal residence for estate planning purposes, a qualified personal residence trust (QPRT) may be more effective than transferring your property to a limited liability company.

Step 1: Obtain a standard quitclaim form from your county office or use an online form to start drafting your quitclaim deed. Step 2: Include the following on each quitclaim document. Step 3: Create a cover page, if desired.