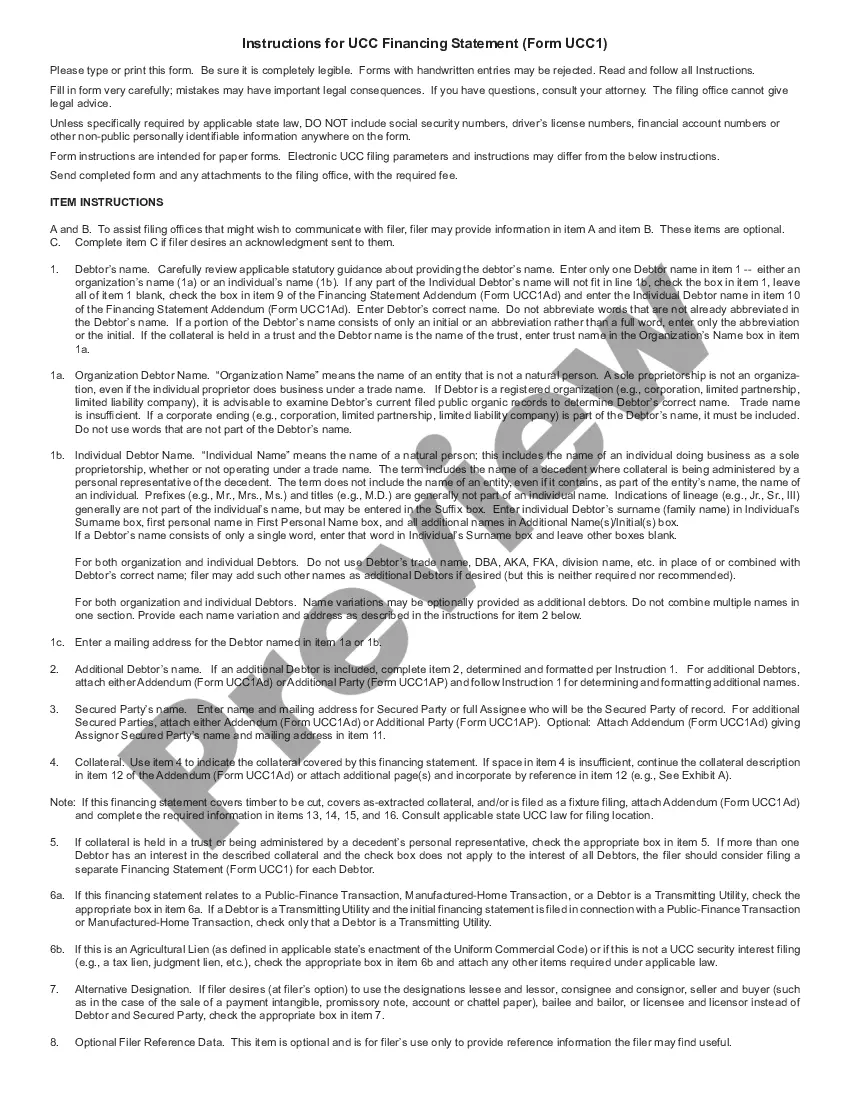

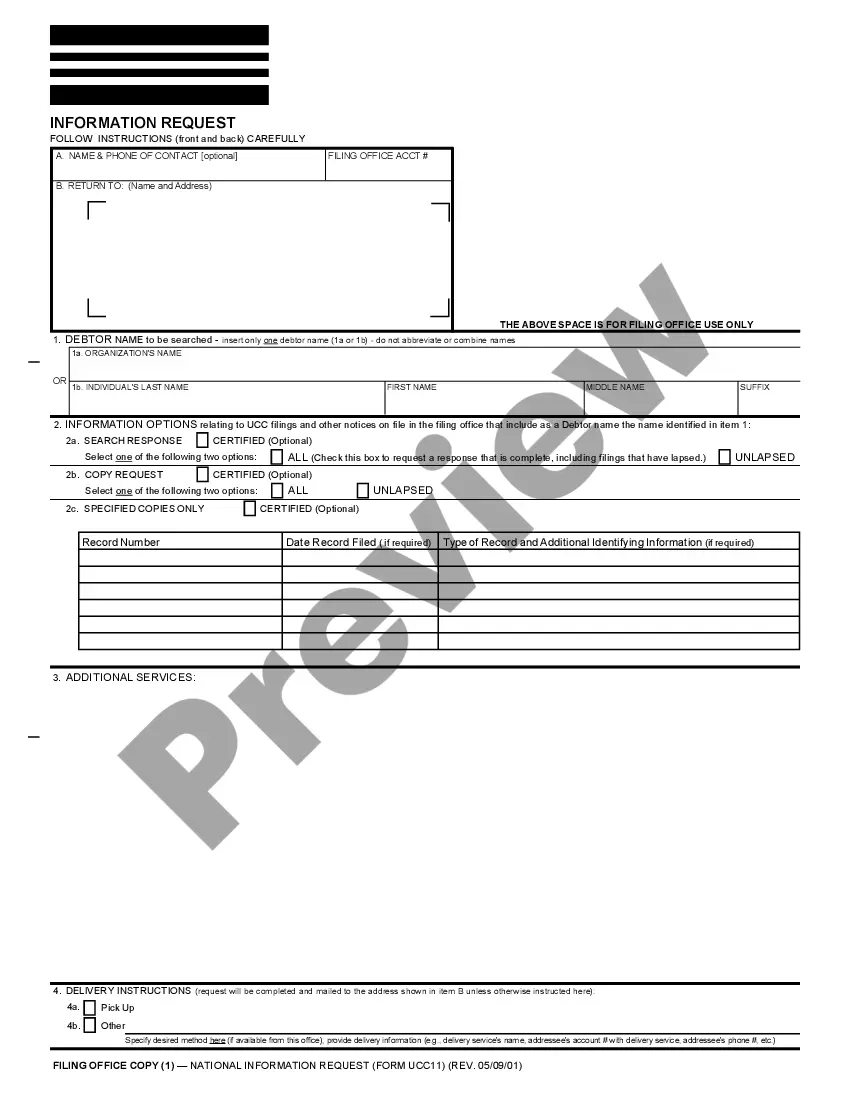

Request for Tax Lien Information or Copies form used to procure tax lien information on file with the Minnesota filing office.

Minnesota UCC Request for Tax Lien Information or Copies

Description

How to fill out Minnesota UCC Request For Tax Lien Information Or Copies?

Get any form from 85,000 legal documents such as Minnesota UCC Request for Tax Lien Information or Copies online with US Legal Forms. Every template is prepared and updated by state-licensed lawyers.

If you already have a subscription, log in. Once you’re on the form’s page, click on the Download button and go to My Forms to access it.

In case you haven’t subscribed yet, follow the steps listed below:

- Check the state-specific requirements for the Minnesota UCC Request for Tax Lien Information or Copies you need to use.

- Read through description and preview the template.

- When you’re sure the sample is what you need, click on Buy Now.

- Select a subscription plan that works for your budget.

- Create a personal account.

- Pay in just one of two suitable ways: by credit card or via PayPal.

- Choose a format to download the document in; two options are available (PDF or Word).

- Download the document to the My Forms tab.

- When your reusable form is downloaded, print it out or save it to your gadget.

With US Legal Forms, you’ll always have instant access to the proper downloadable template. The service provides you with access to forms and divides them into categories to streamline your search. Use US Legal Forms to obtain your Minnesota UCC Request for Tax Lien Information or Copies easy and fast.

Form popularity

FAQ

After receiving your request, the lender has 20 days to terminate the UCC filing.

A UCC filing is a legal notice a lender files with the secretary of state when they have a security interest against one of your assets. It gives notice that the lender has an interest, or lien, against the asset being used by you to secure the financing. The term UCC filing comes from the uniform commercial code.

The financing statement is generally filed with the office of the state secretary of state, in the state where the debtor is located - for an individual, the state where the debtor resides, for most kinds of business organizations the state of incorporation or organization.

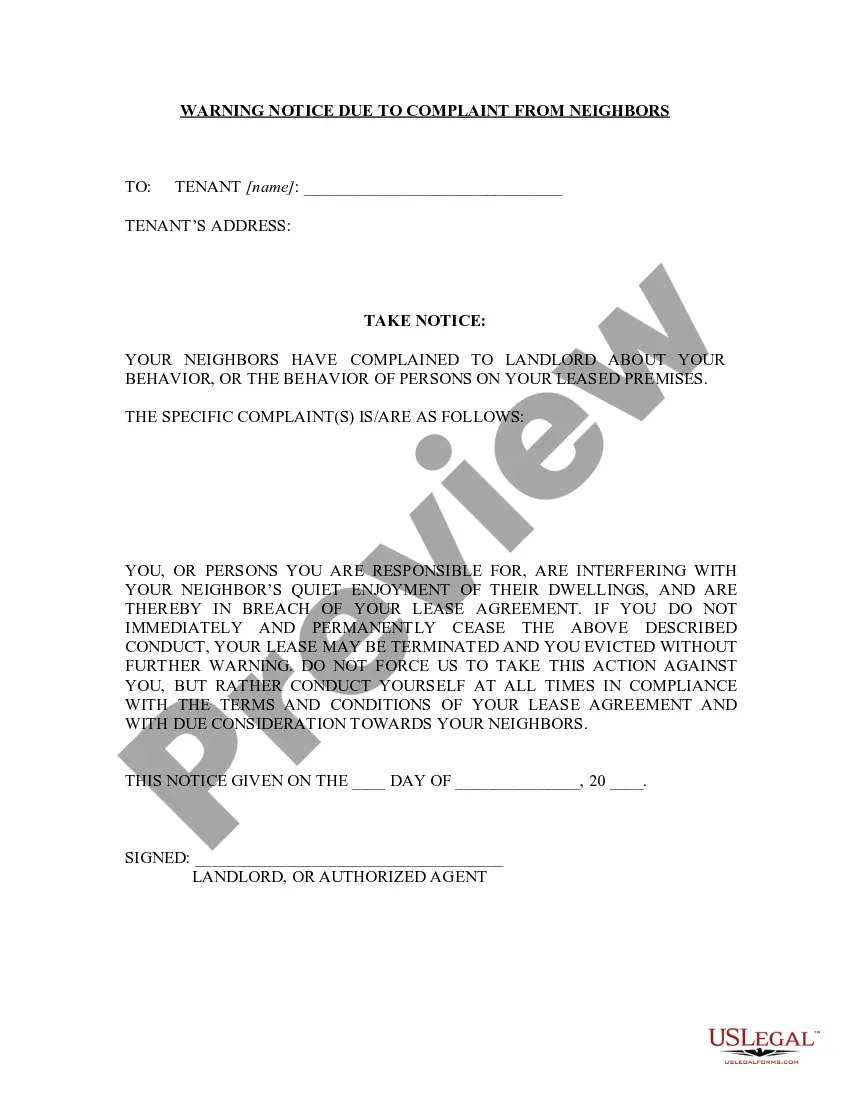

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

In Minnesota, all mechanics liens must be filed within 120 days from the claimant's last day providing materials or labor. In Minnesota, mechanics liens expire 1 year from the date of the lien claimant's last furnishing of labor or materials to the project.

Having a UCC filed on your business credit report can have negative effects in general on your overall credit risk, scoring and other associated risk analysis, (across all three business credit bureaus) and can even kill your chances at getting financing for your business.

If a lien is filed against your property (in the form of a lien statement), it must be filed with the county recorder and a copy delivered to you, the property owner, either personally or by certified mail, within 120 days after the last material or labor is furnished for the job.

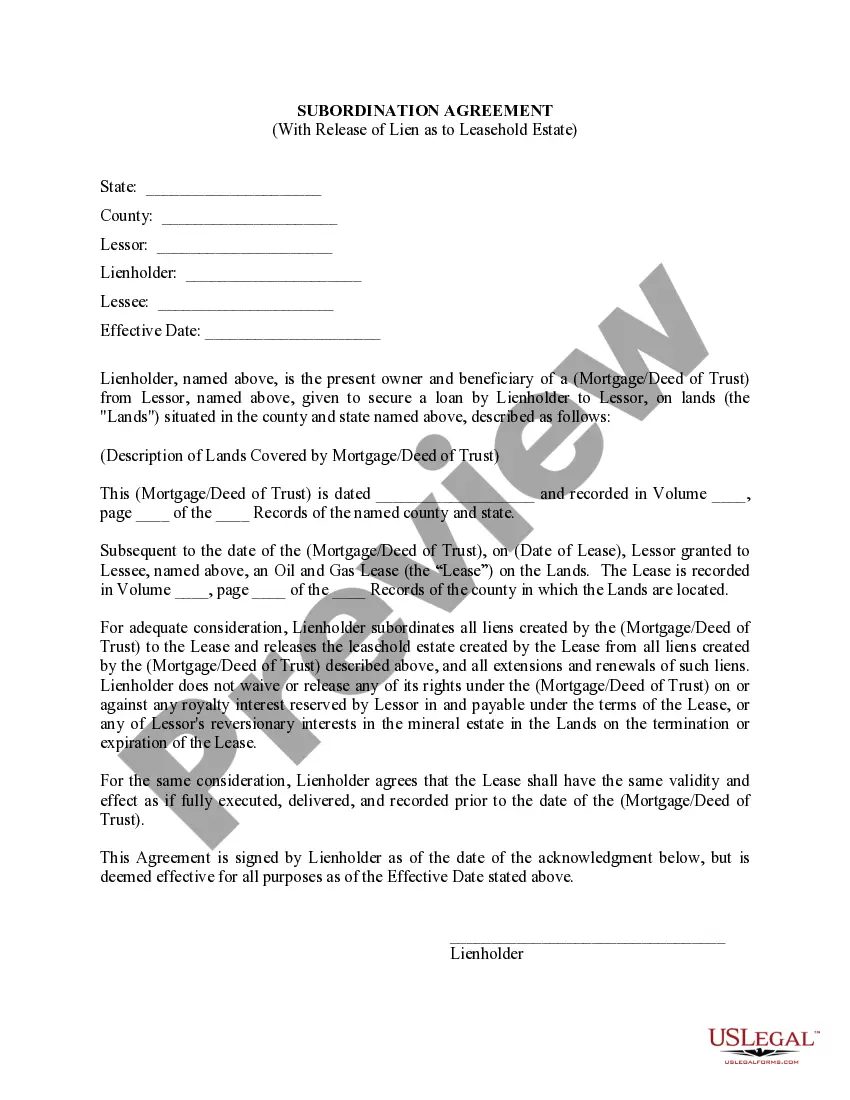

A mortgage creates a lien on your property that gives the lender the right to foreclose and sell the home to satisfy the debt. A deed of trust (sometimes called a trust deed) is also a document that gives the lender the right to sell the property to satisfy the debt should you fail to pay back the loan.

While it's unlikely that just anyone can put a lien on your home or land, it's not unheard of for a court decision or a settlement to result in a lien being placed against a property.