Minnesota Partial Release of Mortgage / Deed of Trust on Undivided Leasehold Interest

Description

How to fill out Partial Release Of Mortgage / Deed Of Trust On Undivided Leasehold Interest?

Are you currently in the situation the place you will need files for both business or person reasons just about every time? There are a lot of lawful document templates available online, but locating types you can trust is not simple. US Legal Forms offers 1000s of form templates, just like the Minnesota Partial Release of Mortgage / Deed of Trust on Undivided Leasehold Interest, which are written to satisfy state and federal demands.

Should you be currently knowledgeable about US Legal Forms web site and have a free account, just log in. After that, it is possible to obtain the Minnesota Partial Release of Mortgage / Deed of Trust on Undivided Leasehold Interest web template.

Should you not have an account and need to start using US Legal Forms, adopt these measures:

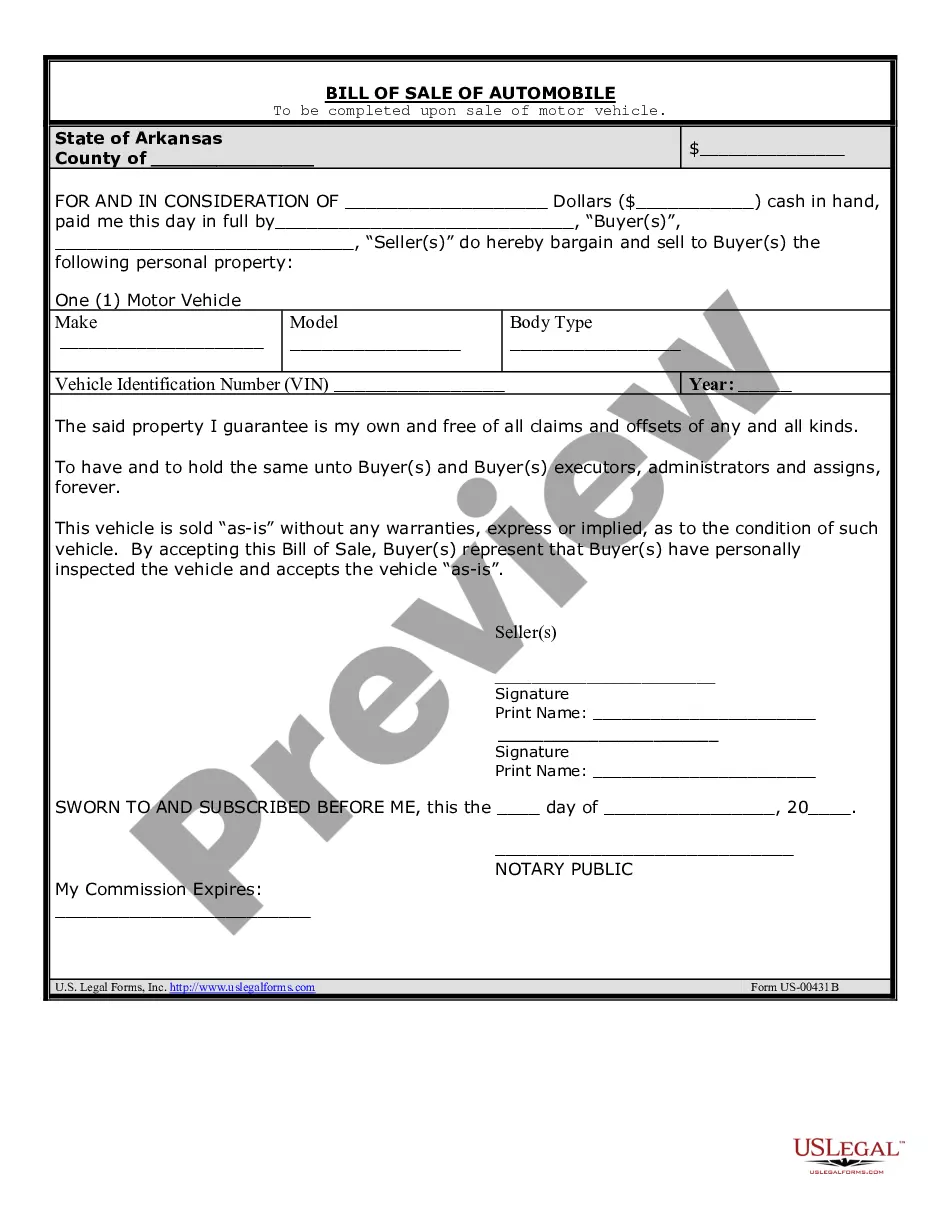

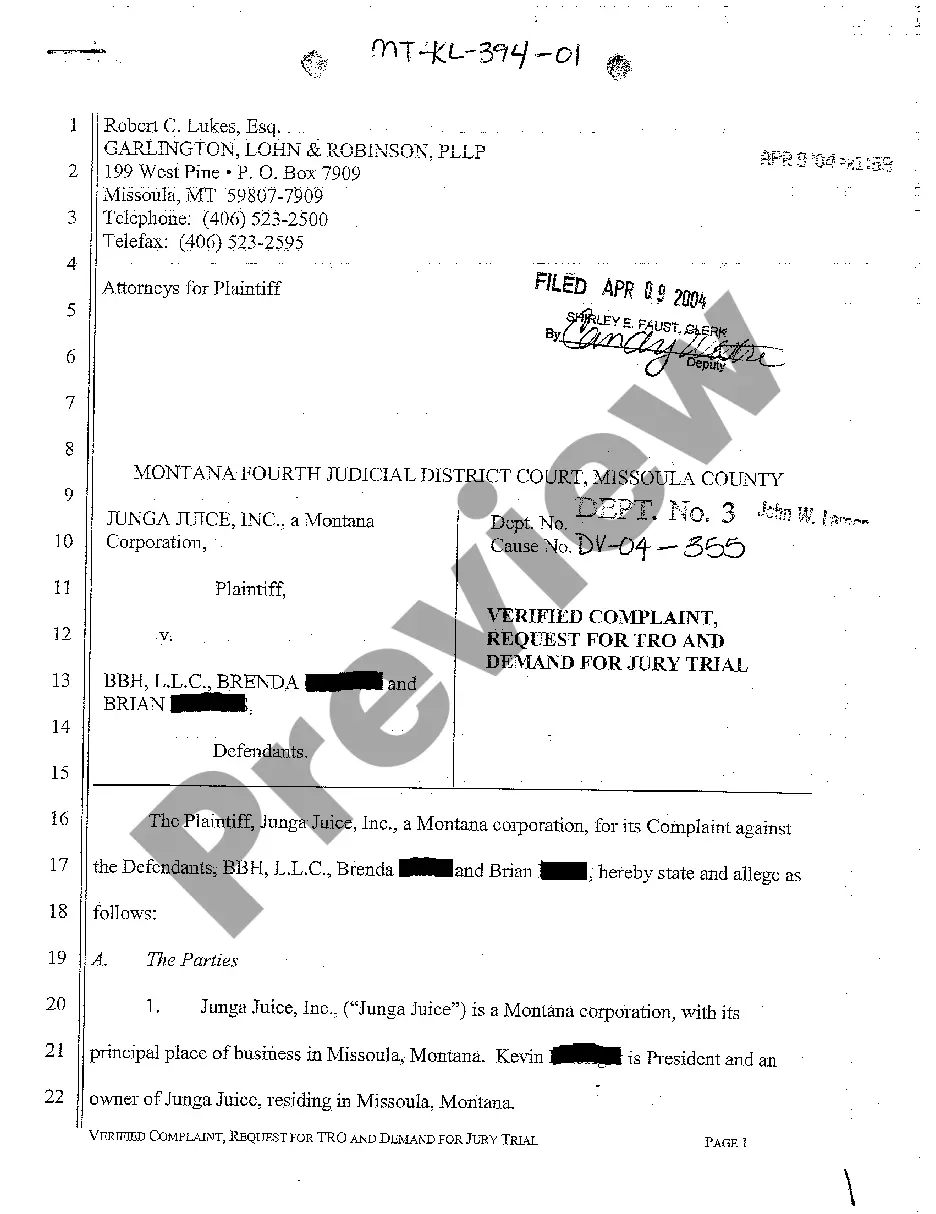

- Find the form you need and ensure it is to the appropriate metropolis/area.

- Make use of the Review switch to examine the form.

- Read the outline to actually have selected the correct form.

- If the form is not what you are searching for, take advantage of the Look for area to find the form that meets your requirements and demands.

- Whenever you get the appropriate form, simply click Purchase now.

- Choose the costs prepare you want, submit the necessary info to create your account, and buy your order with your PayPal or bank card.

- Select a hassle-free paper file format and obtain your backup.

Locate every one of the document templates you might have purchased in the My Forms menus. You can get a extra backup of Minnesota Partial Release of Mortgage / Deed of Trust on Undivided Leasehold Interest any time, if needed. Just click on the essential form to obtain or print the document web template.

Use US Legal Forms, the most comprehensive collection of lawful varieties, to conserve efforts and steer clear of mistakes. The support offers professionally made lawful document templates which you can use for an array of reasons. Create a free account on US Legal Forms and begin producing your life easier.

Form popularity

FAQ

A mortgage involves only two parties: the borrower and the lender. A deed of trust has a borrower, lender and a ?trustee.? The trustee is a neutral third party that holds the title to a property until the loan is completely paid off by the borrower.

The majority of the time a deed of trust is used in a real estate transaction in North Carolina, it will be a purchase money mortgage, or a mortgage issued to the borrower by the seller of the home as part of the purchase transaction, unlike a traditional mortgage which is obtained through a bank.

Focusing on this geographical region, the Deed of Trust is the preferred or required security instrument for real property in the following states: Maryland, North Carolina, Tennessee, Virginia and West Virginia. Mortgages are used in Kentucky, Ohio and Pennsylvania.

Mortgages are used, but they are rare. A security deed (deed to secure debt) is the customary security instrument in Georgia. Georgia does not use a Deed of Trust. Two witnesses are required to witness the signature of the grantor for a security deed to be recorded.

Mortgage States and Deed of Trust States StateMortgage StateDeed of Trust StateMarylandYYMassachusettsYMichiganYYMinnesotaY47 more rows

Deeds of trust are the most common instrument used in the financing of real estate purchases in Alaska, Arizona, California, Colorado, the District of Columbia, Idaho, Maryland, Mississippi, Missouri, Montana, Nebraska, Nevada, North Carolina, Oregon, Tennessee, Texas, Utah, Virginia, Washington, and West Virginia, ...

A mortgage or deed of trust is an agreement in which a borrower puts up title to real estate as security (collateral) for a loan. People often refer to a home loan as a "mortgage." But a mortgage isn't a loan agreement. The promissory note promises to repay the amount you borrowed to buy a home.