Minnesota Partial Release of Deed of Trust

Description

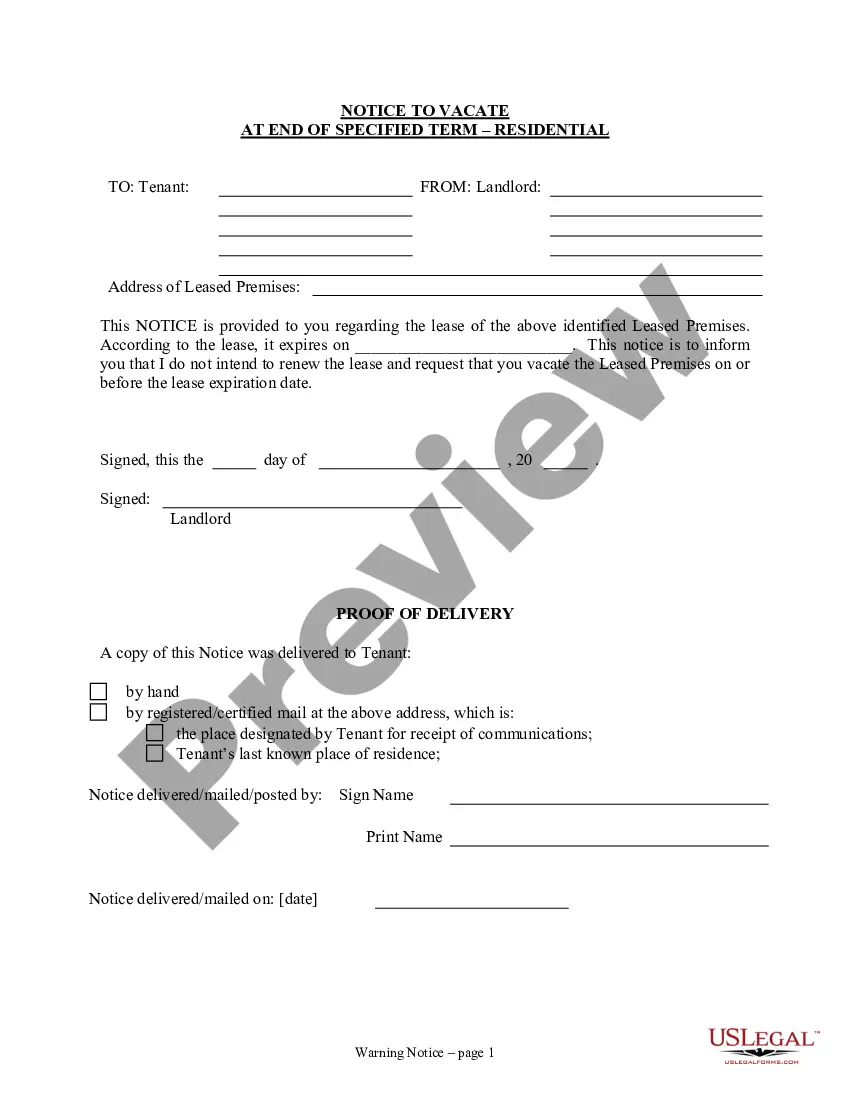

How to fill out Partial Release Of Deed Of Trust?

US Legal Forms - one of many greatest libraries of lawful varieties in the USA - delivers an array of lawful record layouts it is possible to obtain or printing. While using web site, you can get 1000s of varieties for enterprise and specific functions, categorized by groups, suggests, or keywords.You will discover the newest variations of varieties such as the Minnesota Partial Release of Deed of Trust in seconds.

If you already possess a registration, log in and obtain Minnesota Partial Release of Deed of Trust from the US Legal Forms collection. The Acquire key will appear on each develop you look at. You have accessibility to all earlier downloaded varieties within the My Forms tab of your respective bank account.

In order to use US Legal Forms initially, allow me to share straightforward directions to obtain started:

- Be sure you have picked out the proper develop for your personal city/area. Select the Review key to check the form`s articles. Look at the develop outline to actually have selected the proper develop.

- In case the develop does not satisfy your needs, use the Search field at the top of the display screen to find the one who does.

- Should you be content with the shape, confirm your decision by visiting the Get now key. Then, opt for the pricing prepare you prefer and give your references to sign up to have an bank account.

- Process the deal. Make use of Visa or Mastercard or PayPal bank account to accomplish the deal.

- Select the file format and obtain the shape on your gadget.

- Make changes. Fill out, change and printing and sign the downloaded Minnesota Partial Release of Deed of Trust.

Each web template you included in your money does not have an expiration particular date and is also your own eternally. So, if you want to obtain or printing an additional backup, just visit the My Forms area and click about the develop you want.

Get access to the Minnesota Partial Release of Deed of Trust with US Legal Forms, probably the most extensive collection of lawful record layouts. Use 1000s of professional and express-particular layouts that fulfill your organization or specific demands and needs.

Form popularity

FAQ

A Minnesota deed of trust is used to secure real estate financing by placing the borrower's property in trust until the lender has been paid back.

Recorder ? Registrar of Titles Property owners may request a free electronic copy of their deed and certificate of title without the need for a paid subscription by emailing us at recordsrequest@hennepin.us.

A deed of trust involves three parties: a lender, a borrower, and a trustee. The lender gives the borrower money. In exchange, the borrower gives the lender one or more promissory notes. As security for the promissory notes, the borrower transfers a real property interest to a third-party trustee.

A Minnesota deed of trust is used to secure real estate financing by placing the borrower's property in trust until the lender has been paid back.

A Deed of Trust is an agreement between a borrower, a lender and a third-party person who's appointed as a Trustee. It's used to secure real estate transactions where money needs to be borrowed in order for property to be purchased.

A deed of trust is an agreement between a home buyer and a lender at the closing of a property. The agreement states that the home buyer will repay the home loan and the mortgage lender will hold the property's legal title until the loan is paid in full.