Minnesota Independent Sales Representative Agreement - Software and Computer Systems

Description

How to fill out Independent Sales Representative Agreement - Software And Computer Systems?

If you wish to obtain, download, or create legal document templates, utilize US Legal Forms, the largest selection of legal forms available online.

Make use of the site’s simple and convenient search to locate the documents you require.

Various templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Minnesota Independent Sales Representative Agreement - Software and Computer Systems in just a few clicks.

Every legal document template you purchase is yours forever. You will have access to each form you downloaded in your account. Click the My documents section and select a form to print or download again.

Stay competitive and download, and print the Minnesota Independent Sales Representative Agreement - Software and Computer Systems with US Legal Forms. There are numerous professional and state-specific forms you can use for your business or personal needs.

- If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to get the Minnesota Independent Sales Representative Agreement - Software and Computer Systems.

- You can also access forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct region/state.

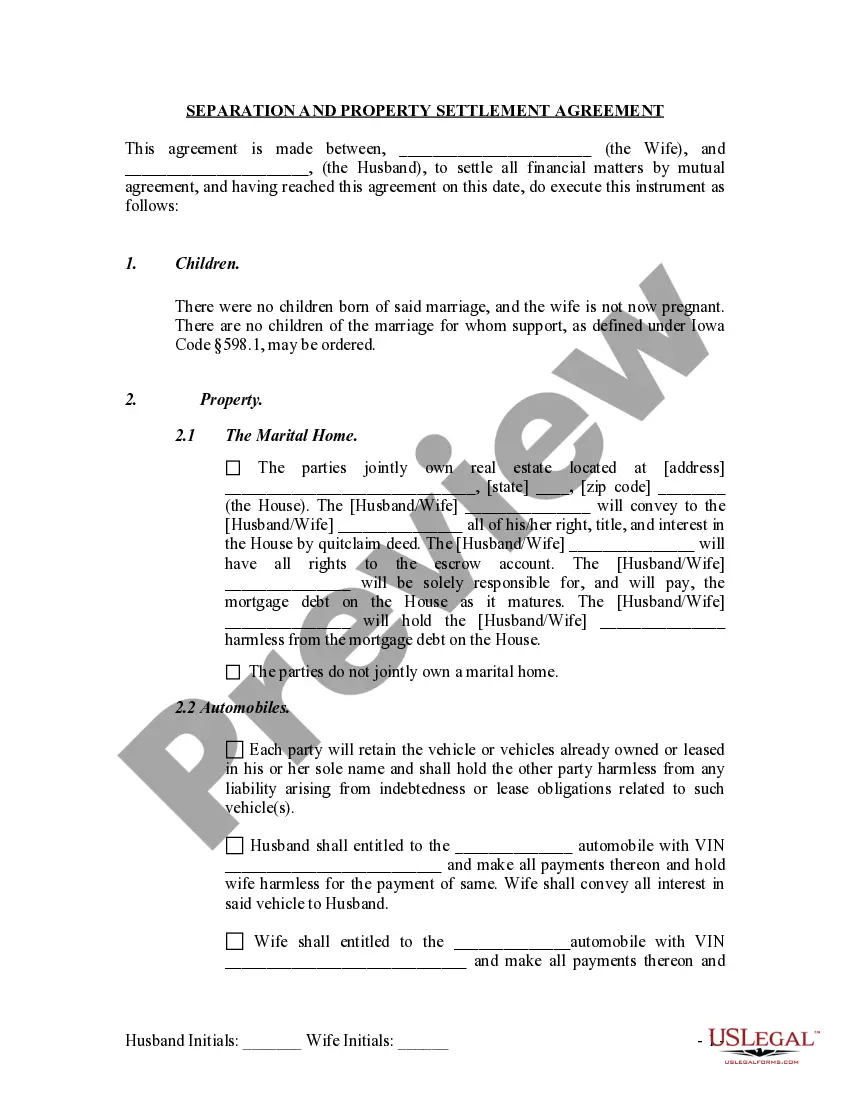

- Step 2. Use the Preview option to review the form’s content. Don’t forget to read the description.

- Step 3. If you are dissatisfied with the form, use the Search area at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to register for the account.

- Step 5. Process the payment. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, modify, and print or sign the Minnesota Independent Sales Representative Agreement - Software and Computer Systems.

Form popularity

FAQ

In Minnesota, items exempt from sales tax include most food and beverages for home consumption, clothing, and certain medical equipment. Some services, like certain types of repair or maintenance, may also be exempt. Understanding these exemptions can help you effectively draft a Minnesota Independent Sales Representative Agreement - Software and Computer Systems and clearly define what is taxable and non-taxable under your agreement.

While Minnesota does not legally require an operating agreement for an LLC, having one is highly recommended. An operating agreement outlines the management structure and operational guidelines for your business, which can be beneficial in disputes or clarifying roles. This becomes especially important when establishing a Minnesota Independent Sales Representative Agreement - Software and Computer Systems to ensure all parties are aligned.

Yes, in Minnesota, software is generally subject to sales tax, but there are exceptions. For example, custom software may have different tax implications compared to off-the-shelf software. When drafting a Minnesota Independent Sales Representative Agreement - Software and Computer Systems, it is crucial to specify the type of software to avoid any misunderstandings regarding tax obligations.

In Minnesota, several items are not subject to sales tax, including certain food products, clothing, and prescription drugs. Additionally, some services may also be exempt from sales tax. When you enter into a Minnesota Independent Sales Representative Agreement - Software and Computer Systems, it's essential to understand these exemptions to ensure compliance with tax regulations.

The agreement between a company and a sales agent defines the terms under which the agent will operate on behalf of the company. This contract typically includes commission structures, sales targets, and the scope of products or services sold. In a Minnesota Independent Sales Representative Agreement - Software and Computer Systems, such agreements are essential for aligning the sales agent's efforts with the company's goals. Utilizing platforms like uslegalforms can streamline the creation and management of these agreements, ensuring compliance and clarity.

The owner's representative contract outlines the responsibilities and expectations between a business owner and their representative. This contract is crucial for ensuring clarity in roles and responsibilities, especially when dealing with sales representatives. In the context of a Minnesota Independent Sales Representative Agreement - Software and Computer Systems, it specifies how representatives can promote and sell software solutions effectively. By establishing these terms, businesses can enhance their sales strategies and foster better partnerships.

For a contract to be legally binding in Minnesota, it must contain essential elements such as offer, acceptance, and consideration. Additionally, both parties must have the capacity to contract, and the agreement must be for a lawful purpose. When drafting a Minnesota Independent Sales Representative Agreement - Software and Computer Systems, ensuring these elements are present can help uphold the legality and enforceability of your contract.

The Minnesota Sales Representative Act governs the relationships between sales representatives and their principals. This act provides guidelines on commissions, termination, and other important aspects of sales representation. Understanding the Minnesota Independent Sales Representative Agreement - Software and Computer Systems in the context of this act can enhance your compliance and foster better business relationships.

In Minnesota, an operating agreement is not legally required for an LLC, but it is highly recommended. This document outlines the management structure and operating procedures of the LLC, helping to prevent disputes among members. Utilizing the Minnesota Independent Sales Representative Agreement - Software and Computer Systems can complement your LLC's structure, providing clarity on sales representation within your business.

A sales representative agreement is a contract between a company and a sales representative that outlines the terms of their relationship. This agreement typically includes details about commissions, territories, and responsibilities. When you consider the Minnesota Independent Sales Representative Agreement - Software and Computer Systems, it provides a clear framework for both parties, ensuring mutual understanding and legal protection.