Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor

Description

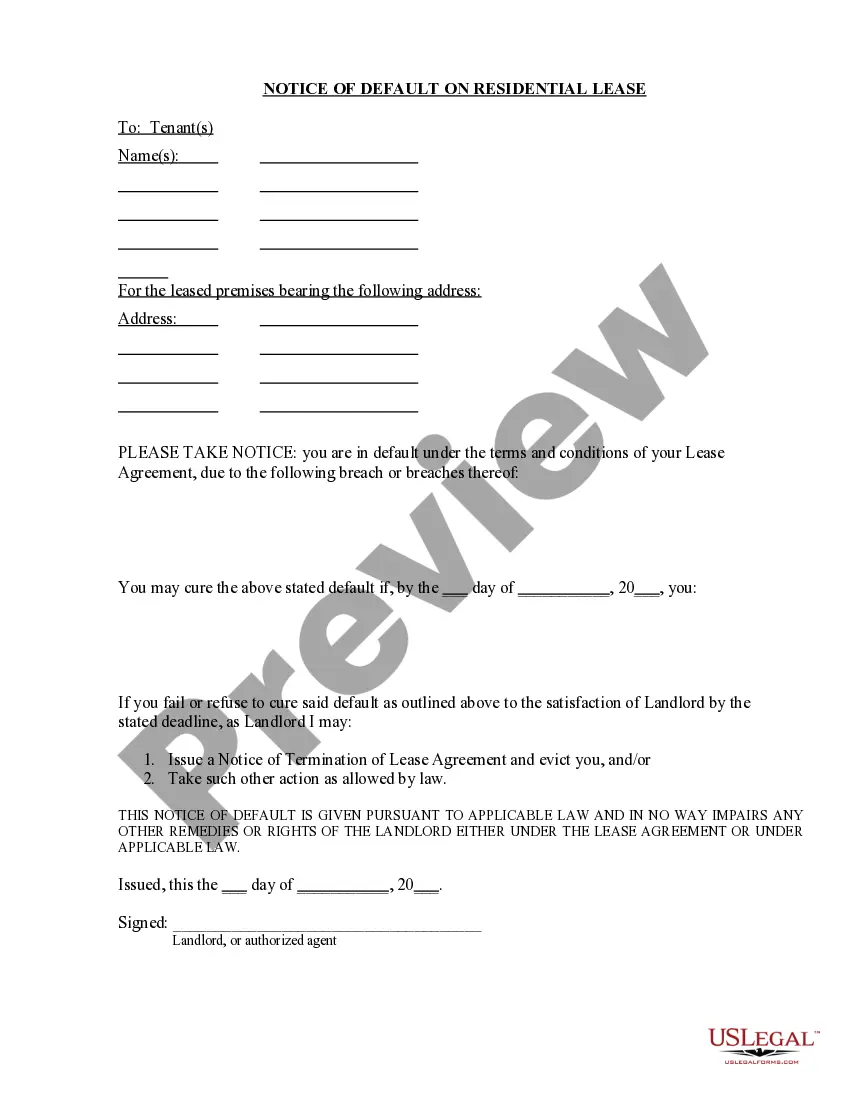

How to fill out Journalist - Reporter Agreement - Self-Employed Independent Contractor?

US Legal Forms - one of the largest collections of legal templates in the United States - provides a broad selection of legal document formats that you can download or print. By using the website, you can access thousands of templates for business and personal purposes, sorted by categories, claims, or keywords. You can find the latest editions of templates such as the Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor in just a few minutes.

If you already have an account, Log In and retrieve the Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor from your US Legal Forms local collection. The Download button will appear on each template you view. You can access all previously downloaded templates from the My documents section of your account.

To utilize US Legal Forms for the first time, here are simple instructions to help you begin: Make sure you have selected the correct template for the city/state. Click the Review button to examine the content of the form. Read the template description to confirm that you have selected the correct one. If the template doesn’t meet your requirements, use the Search box at the top of the page to find the one that does. If you are happy with the form, confirm your choice by clicking the Purchase now button. Then, choose the pricing plan you prefer and provide your information to register for an account. Process the purchase. Use your Visa or Mastercard or PayPal account to complete the transaction. Select the format and download the form to your device. Edit. Complete, modify, and print and sign the downloaded Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor. Each template you added to your account does not have an expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply head to the My documents section and click on the template you need.

- Access the Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor with US Legal Forms, the most extensive library of legal document templates.

- Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

Form popularity

FAQ

For those entering into a Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor relationship, completing the correct tax forms is essential. Typically, independent contractors must fill out a W-9 form, which provides their taxpayer identification number to the client. Additionally, at the end of the year, independent contractors often receive a 1099 form, reporting their earnings. If you seek guidance on these forms, US Legal Forms offers resources and templates to simplify the process.

When discussing the Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor, both terms are commonly used, but they can have different implications. 'Self-employed' generally refers to individuals who work for themselves, while 'independent contractor' specifically denotes a person or entity hired to perform services without being an employee. In many contexts, especially legal or contractual discussions, using 'independent contractor' may provide more clarity regarding the nature of the work relationship. Ultimately, both terms can be valid, but you might want to choose based on your audience and context.

Yes, it is possible for someone to be misclassified as an independent contractor when they should actually be considered an employee. This often happens when a client exercises too much control over the worker's tasks and schedule, which contradicts the principles of a Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor. To avoid this misclassification, it’s essential to evaluate the nature of your working relationship and ensure that both parties understand their rights and obligations. Consulting a legal expert can provide clarity and help you navigate these complexities.

While many people use the terms freelancer and independent contractor interchangeably, there are subtle differences between the two. A freelancer often works on short-term projects and may have various clients simultaneously, similar to a Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor. In contrast, an independent contractor may have a more formal contract with a client and can work on longer-term projects. Both arrangements provide flexibility, but understanding these distinctions can help you choose the right path for your career.

To be classified as an independent contractor under the Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor, you must meet specific legal requirements. You should have the freedom to control how you perform your work, set your own hours, and manage your business expenses. Additionally, you must typically provide your own tools and equipment, and work for multiple clients rather than a single employer. Understanding these requirements is crucial for compliance and protecting your rights.

To create an independent contractor agreement, start by clearly defining the scope of work, payment terms, and the relationship between the parties. It is essential to include details such as deadlines, deliverables, and confidentiality clauses to protect both parties. For a Minnesota Journalist - Reporter Agreement - Self-Employed Independent Contractor, you can use templates available on the US Legal Forms platform, which provides customizable agreements to suit your needs. This ensures that your agreement is legally sound and tailored to your specific requirements.

Typically, the independent contractor agreement can be written by either party involved, but it is often the responsibility of the client to draft it. As a Minnesota Journalist, you should review the document carefully to ensure it meets your needs and protects your interests. Collaboration on the agreement can lead to better understanding and clarity of expectations. Using a reliable platform like USLegalForms can streamline this process.

Filling out an independent contractor agreement involves clearly specifying your name, the client’s name, and the services provided. Next, include payment details, such as the rate and payment schedule. Don't forget to outline any conditions related to the agreement, like deadlines or deliverables. If you're unsure about the format or content, USLegalForms offers user-friendly templates to guide you through this process.

To write an independent contractor agreement as a Minnesota Journalist, start by outlining the scope of work and the specific services you will provide. Include details such as payment terms, deadlines, and any confidentiality clauses. Make sure to also clarify the independent contractor status, emphasizing that you are not an employee. Consider using USLegalForms templates to simplify the process and ensure you meet all legal requirements.

As a self-employed independent contractor, you need to report your earnings on your tax return using Schedule C. You will also need to keep accurate records of your income and expenses related to your work as a Minnesota Journalist. It's important to stay organized and retain all invoices and receipts. This will help you easily calculate your net income and ensure compliance with tax regulations.