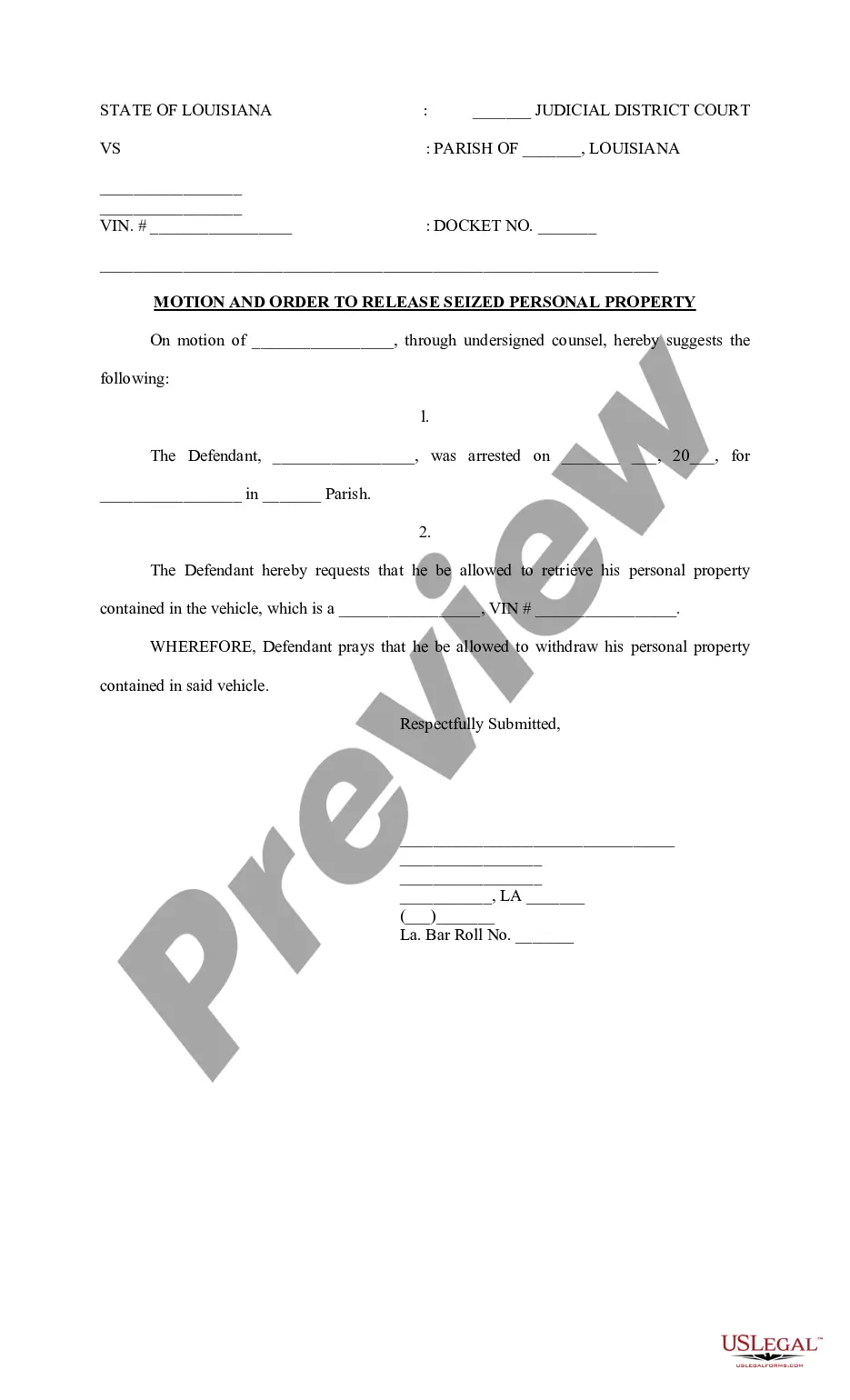

Minnesota Self-Employed Nail Technician Services Contract

Description

How to fill out Self-Employed Nail Technician Services Contract?

It is feasible to utilize the internet attempting to locate the legal document format that fulfills the federal and state requirements you require.

US Legal Forms offers thousands of legal forms that can be evaluated by professionals.

You can effortlessly download or print the Minnesota Self-Employed Nail Technician Services Agreement from the service.

To find another version of your form, utilize the Search field to locate the format that meets your needs and requirements.

- If you already have a US Legal Forms account, you can sign in and click on the Download button.

- Then, you can complete, modify, print, or sign the Minnesota Self-Employed Nail Technician Services Agreement.

- Every legal document format you purchase is yours permanently.

- To obtain another copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are visiting the US Legal Forms site for the first time, follow the simple instructions provided below.

- First, ensure you have selected the correct document format for the county/town of your choice.

- Review the form description to confirm you have chosen the accurate form.

Form popularity

FAQ

The term 'nail freelance' refers to the practice of offering nail services independently, as opposed to working for a specific salon. Freelance nail technicians often have the freedom to set their own prices and schedules. To streamline this process, many professionals utilize a Minnesota Self-Employed Nail Technician Services Contract to safeguard their interests.

While you do not need any formal qualifications to be a nail tech in the UK, you will need to take courses or organise an apprenticeship in order to learn the trade. Once you have learned the ins and outs of nail care, you need to choose whether you want to be self-employed or find a job in an existing nail studio.

Self-Employed Nail Technician Salary On average, self-employed nail technicians can make anywhere from £100 to A£400 a day, which would earn you between A£26,000 and A£104,000 a year before tax. This includes self-employed positions that are based within a salon environment, such as renting a chair.

How to Start an In-Home Nail BusinessWhat's the Industry Like? Start by researching the local market.Get Educated.Obtain Licenses and Permits.Make a Business Plan.Invest in Quality Products.Buy the Right Insurance.Promote Your Business.

Do You Need A License To Do Nails Uk? A nail tech in the UK does not require formal qualifications in order to do so, but they do have to complete either courses or apprenticeship schemes.

Working for yourself as a nail technician can be rewarding, but being self-employed can also increase your tax burden. When you are self-employed, the Internal Revenue Service considers you to be both the employer and the employee, and that essentially doubles the amount of taxes you pay.

If you want to work as a nail technician in the state of Minnesota, then you will need to complete 350 hours of training at a licensed school. Once you obtain your initial license, you will need to be mindful of the renewal process.

On average, self-employed nail technicians can make anywhere from £100 to A£400 a day, which would earn you between A£26,000 and A£104,000 a year before tax. This includes self-employed positions that are based within a salon environment, such as renting a chair.

Whether you're a nail technician who operates as a sole trader or you're a mobile operator, you will need insurance to cover such unexpected losses. Nail technician insurance covers many of the risks that standard business insurance covers.

In the UK, there is no specific qualification you need to take to be able to start a nail business. However, you will need to get insurance and many providers do require proof of qualifications in order to cover you. So, while you could in theory be a self-taught nail technician, it is not recommended.