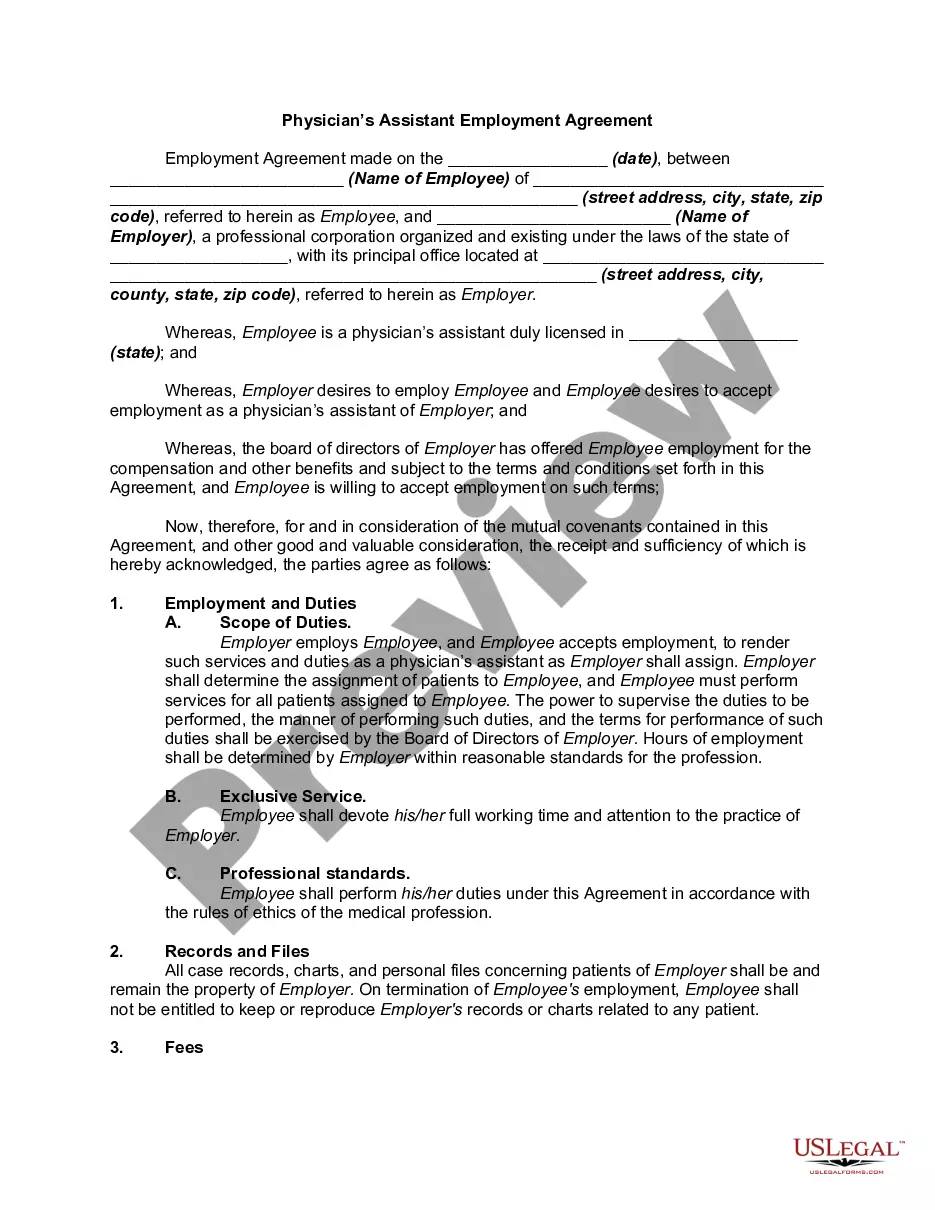

Minnesota Physician's Assistant Agreement - Self-Employed Independent Contractor

Description

How to fill out Physician's Assistant Agreement - Self-Employed Independent Contractor?

If you desire to finish, download, or print legitimate document templates, use US Legal Forms, the foremost collection of legal forms that can be accessed online.

Employ the site's straightforward and convenient search feature to acquire the documents you need.

Numerous templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Step 4. After you have found the form you need, click on the Buy now button. Choose the payment plan you prefer and provide your information to register for the account.

Step 5. Complete the transaction. You can utilize your credit card or PayPal account to finish the transaction.

- Use US Legal Forms to obtain the Minnesota Physician's Assistant Agreement - Self-Employed Independent Contractor with just a few clicks.

- If you are already a US Legal Forms client, Log In to your account and then click the Acquire button to locate the Minnesota Physician's Assistant Agreement - Self-Employed Independent Contractor.

- You may also access forms you previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the directions below.

- Step 1. Ensure you have selected the form for the appropriate city/state.

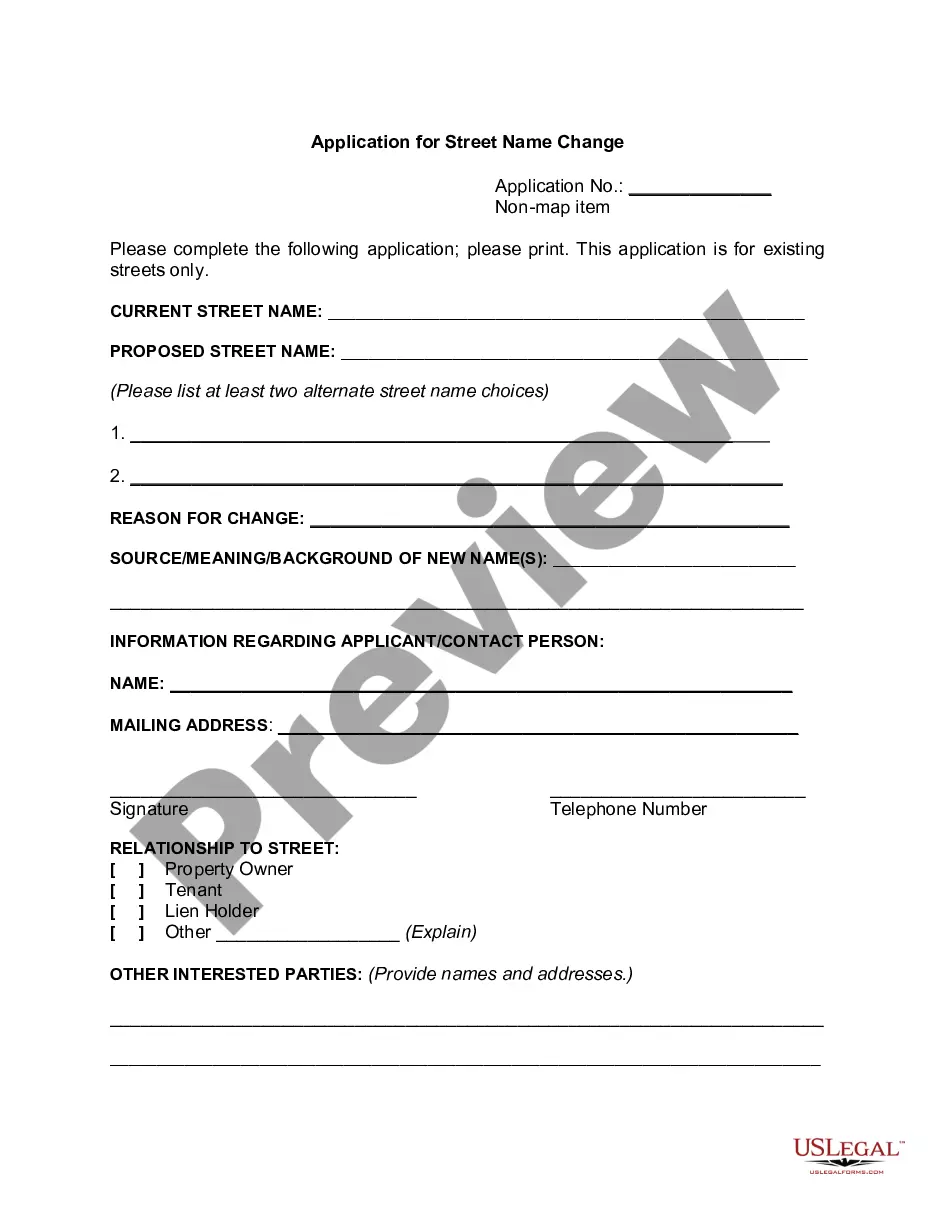

- Step 2. Use the Preview option to review the form's content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, use the Search field near the top of the screen to find additional forms within the legal type template.

Form popularity

FAQ

Because dentists and doctors are exempt from the ABC Test, they must meet the common law requirements to be classified as independent contractors in California. These requirements are similar in many other states across the country as well.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

The PA Supreme Court interpreted the Pennsylvania Unemployment Statute, which states that a worker is an independent contractor if the individual is free from control and direction over the performance of the services both under his contract of service and in fact and, in regard to such services, if the individual is

While AB 5 has exemptions for physicians, dentists, podiatrists and psychologists, it currently does not provide any exemption for nurse practitioners, nurse anesthetists, pharmacists, occupational/physical/speech/respiratory therapists, medical technicians or physician's assistants many of whom serve as independent

People such as doctors, dentists, veterinarians, lawyers, accountants, contractors, and subcontractors who are in an independent trade, business, or profession in which they offer their services to the general public are generally independent contractors.

The general rule is that an individual is an independent contractor if the payer has the right to control or direct only the result of the work and not what will be done and how it will be done. If you are an independent contractor, then you are self-employed.

For some business-minded physician assistants (PAs), independent contracting offers a versatile and entrepreneurial way to practice medicine allowing for significant flexibility in hours, increased freedom of choice and income.

What Is an Independent Contractor? An independent contractor is a self-employed person or entity contracted to perform work foror provide services toanother entity as a nonemployee. As a result, independent contractors must pay their own Social Security and Medicare taxes.

Cons of Independent Contracting Employers like contractors because they can avoid paying for taxes and benefits, and that means those costs fall entirely on independent contractors. Contractors must withhold their own federal, state, and local taxes. They may also have to submit quarterly estimated taxes to the IRS.