Minnesota Nursing Agreement - Self-Employed Independent Contractor

Description

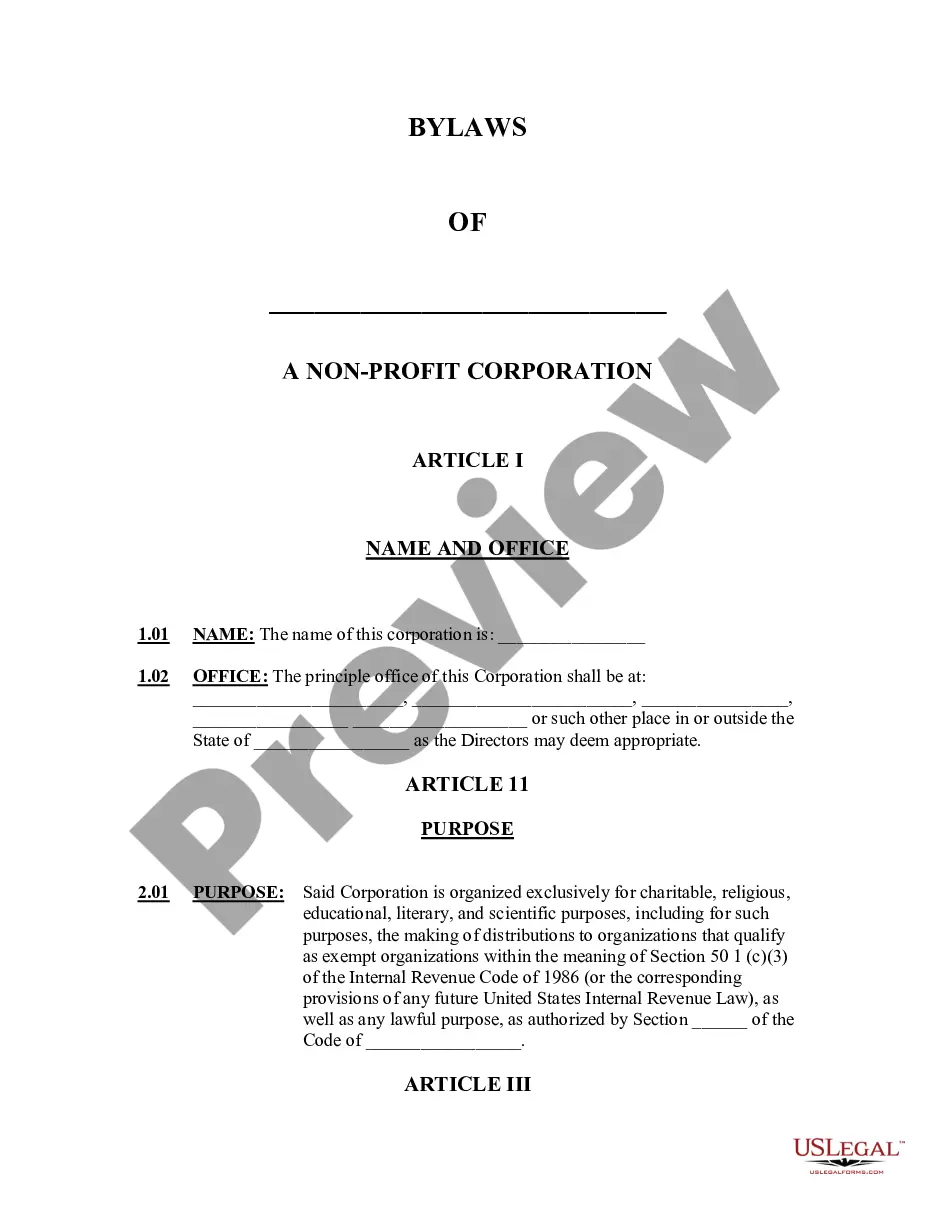

How to fill out Nursing Agreement - Self-Employed Independent Contractor?

Locating the appropriate authentic document template can be a challenge. Clearly, there are numerous designs accessible online, but how do you identify the genuine version you require? Make use of the US Legal Forms platform. The service provides a vast array of templates, such as the Minnesota Nursing Agreement - Self-Employed Independent Contractor, which you can utilize for professional and personal purposes. All documents are verified by experts and comply with federal and state regulations.

If you are already registered, Log In to your account and click the Download button to access the Minnesota Nursing Agreement - Self-Employed Independent Contractor. Use your account to review the authentic forms you have acquired in the past. Navigate to the My documents section of your account and obtain another copy of the document you need.

If you are a first-time user of US Legal Forms, here are straightforward instructions for you to follow: First, ensure you have chosen the correct document for the area/county. You can preview the form using the Review button and read the form description to confirm it is suitable for you. If the document does not meet your requirements, use the Search field to find the appropriate form. Once you are certain that the document is correct, click the Download now button to retrieve the form. Select the payment plan you wish and provide the necessary details. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the authentic document template to your device. Complete, modify, print, and sign the acquired Minnesota Nursing Agreement - Self-Employed Independent Contractor.

- US Legal Forms is the largest repository of legal documents where you can view a variety of paper templates.

- Utilize the service to obtain professionally crafted paperwork that adhere to state regulations.

- Ensure all necessary fields are filled out accurately to avoid issues later.

- Keep your account information secure and confidential.

- Always review your documents for accuracy before finalizing.

- Contact customer support if you encounter any problems during the process.

Form popularity

FAQ

While the term '1099 employee' is a bit of a misnomer, nurses can work as independent contractors and receive a 1099 form for tax purposes. This means they operate as self-employed individuals rather than traditional employees. To navigate this arrangement successfully, it is important to develop a Minnesota Nursing Agreement - Self-Employed Independent Contractor that clearly defines the working relationship and responsibilities.

Yes, a registered nurse (RN) can be self-employed and work as an independent contractor. This arrangement allows RNs to maintain control over their schedules and client choices. To ensure legal compliance and clarity, it is advisable to create a Minnesota Nursing Agreement - Self-Employed Independent Contractor that details your services and responsibilities, making your independent practice more structured.

Yes, nurses can be classified as 1099 contractors if they operate as independent contractors. This classification allows nurses to work flexibly and choose their clients, which can lead to increased job satisfaction. However, it is essential to have a well-drafted Minnesota Nursing Agreement - Self-Employed Independent Contractor to outline the terms of your engagement and protect your rights as a contractor.

Nurses can receive either a W-2 or a 1099, depending on their employment arrangement. If you work as an employee for a healthcare facility, you will likely receive a W-2. However, if you operate as a self-employed independent contractor, you will receive a 1099. Understanding this distinction is crucial when considering a Minnesota Nursing Agreement - Self-Employed Independent Contractor.

An independent contractor agreement in Minnesota is a legal document that defines the relationship between a contractor and a client. This agreement typically includes terms related to payment, duties, and duration of the contract. For nurses, having a Minnesota Nursing Agreement - Self-Employed Independent Contractor is essential to ensure compliance with state regulations and to clarify expectations. It serves as a foundation for a professional working relationship.

To work as an independent contractor as a nurse, you need to establish a business identity. Start by obtaining the necessary licenses and certifications required in Minnesota. Next, create a Minnesota Nursing Agreement - Self-Employed Independent Contractor that outlines your terms and responsibilities. This agreement protects both you and your clients, ensuring a clear understanding of the working relationship.

The contract should state who pays which expenses. The contractor is usually responsible for all expenses including mileage, vehicle maintenance, and other business travel costs; work supplies and tools; licenses, fees, and permits; phone and internet expenses; and payments to employees or subcontractors.

Simply put, being an independent contractor is one way to be self-employed. Being self-employed means that you earn money but don't work as an employee for someone else.

Self-employed workers and contractors are typically not eligible for unemployment benefits. However, in this unprecedented crisis the State of Minnesota is offering unemployment compensation for the self employed and 1099 workers. This includes those with only part-time employment.

The owners/officers may be eligible to collect unemployment benefits according to the limits prescribed in Minnesota Law §268.085, Subd. 9. You should inform the Minnesota Unemployment Insurance Program as soon as possible of your decision to elect coverage.