Minnesota Self-Employed Window Washer Services Contract

Description

How to fill out Self-Employed Window Washer Services Contract?

Locating the appropriate sanctioned document template can be a challenge.

Of course, there are numerous designs accessible online, but how will you discover the official form you require.

Utilize the US Legal Forms website. The platform provides thousands of templates, including the Minnesota Self-Employed Window Washer Services Contract, suitable for both business and personal purposes. All the forms are reviewed by experts and comply with state and federal regulations.

If the form does not meet your needs, utilize the Search field to find the correct form. Once you are confident that the form is accurate, proceed by clicking the Purchase now button to obtain the form. Select the pricing plan you desire and enter the necessary information. Create your account and pay for the order using your PayPal account or credit card. Choose the format and download the legal document template for your records. Complete, modify, and print out the Minnesota Self-Employed Window Washer Services Contract. US Legal Forms is the largest repository of legal forms where you can access numerous document templates. Use the service to obtain well-crafted papers that adhere to state requirements.

- If you are already registered, Log In to your account and click the Acquire button to find the Minnesota Self-Employed Window Washer Services Contract.

- Use your account to access the legal forms you have previously obtained.

- Go to the My documents section of your account and download another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

- First, ensure you have selected the correct form for your city/state.

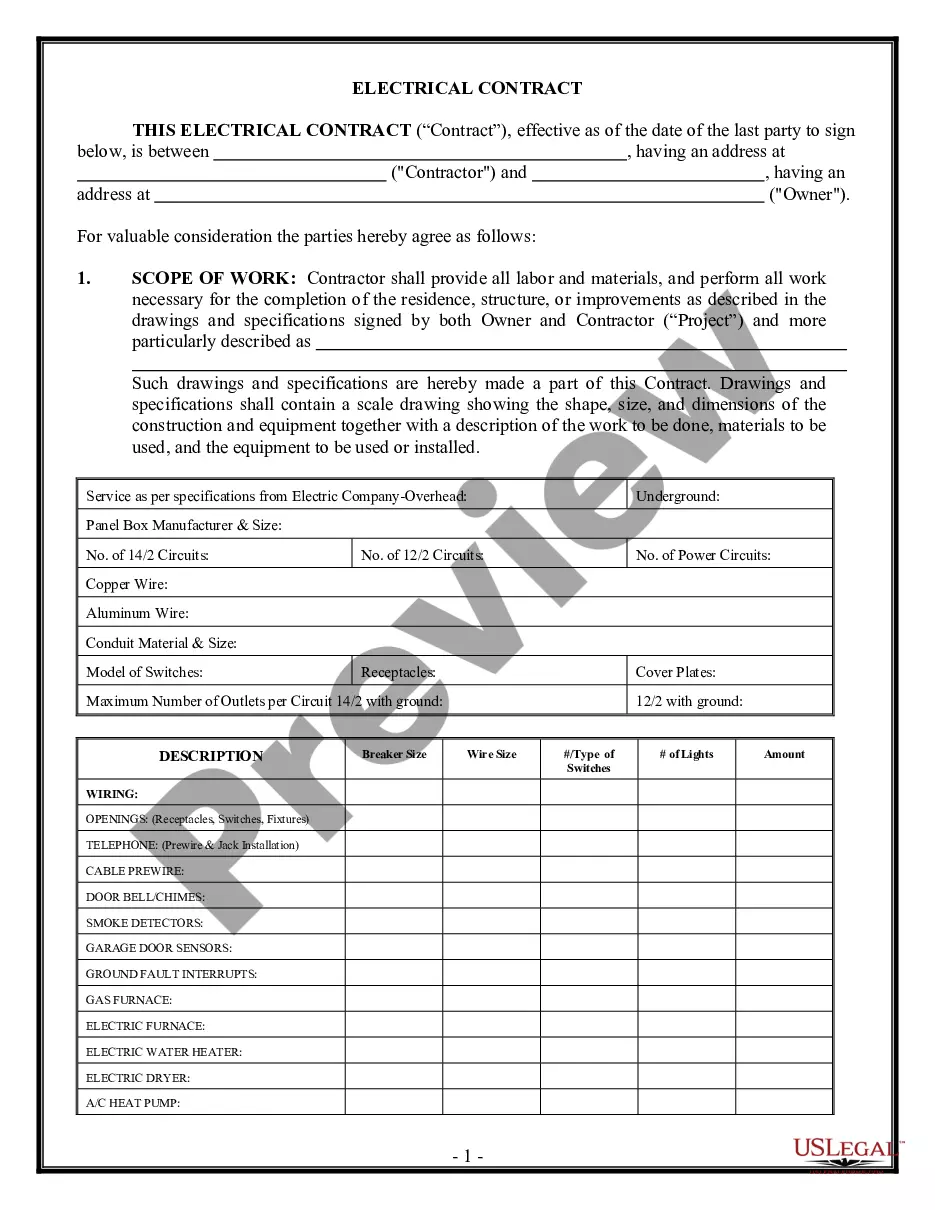

- You can browse the form using the Preview option and review the form description to confirm it is the right one for you.

Form popularity

FAQ

To write a contract agreement for cleaning services, outline the tasks to be performed, along with the payment structure and timelines. Clearly define the rights and obligations of both the cleaner and the client within the document. Using a Minnesota Self-Employed Window Washer Services Contract template from USLegalForms encourages clarity and professionalism in your agreement. This way, you can focus on delivering excellent service while ensuring you're legally protected.

A simple contract agreement should include essential elements, such as the parties involved, the services provided, and the payment details. Make sure to use clear language and straightforward terms to ensure all parties understand the agreement. Incorporating the specifics of your services, like in a Minnesota Self-Employed Window Washer Services Contract, can streamline the process. Templates from USLegalForms can further simplify your contract creation.

To write a cleaning contract agreement, start by clearly stating the terms and conditions of the service. Include details such as the scope of work, payment terms, and duration of the contract. Be sure to define the responsibilities of both parties, which helps avoid misunderstandings. Consider using a template, like those available on USLegalForms, to create a structured Minnesota Self-Employed Window Washer Services Contract.

Typically, a contractor's license is not necessary for window cleaning in Minnesota. However, it's essential to verify local regulations, as requirements can vary by city. When you use a Minnesota Self-Employed Window Washer Services Contract, you create a clear agreement that protects both you and your clients, paving the way for a successful business.

In Minnesota, you generally do not need a specialized license to operate as a window washer. However, you may need to register your business and obtain a general business license. Having a Minnesota Self-Employed Window Washer Services Contract can help set clear expectations and ensure compliance with any local regulations.

The earnings for a self-employed window cleaner can vary significantly based on location, client base, and service offerings. On average, a self-employed window washer in Minnesota can earn between $25 to $75 per hour. The potential for higher earnings often depends on securing a solid contract, such as a Minnesota Self-Employed Window Washer Services Contract, which can provide consistent income.

To secure a commercial window cleaning contract, start networking with businesses that require such services. Building a strong portfolio can help showcase your skills, along with having a Minnesota Self-Employed Window Washer Services Contract ready to present. You might also consider joining local business groups to make connections and gain insights into potential contracts.

In Minnesota, various services are subject to sales tax, including maintenance, repair, and cleaning services. If you offer Minnesota Self-Employed Window Washer Services Contract, you will need to collect sales tax on these services unless a specific exemption applies. Keep yourself informed about changing tax laws to avoid any potential issues.

Yes, cleaning services, including window washing services, are generally taxable in Minnesota. This means that when you provide Minnesota Self-Employed Window Washer Services Contract, you should factor in sales tax when setting your prices. However, some specific cleaning services may have exemptions, so be sure to review applicable regulations to ensure compliance.