Minnesota Underwriter Agreement - Self-Employed Independent Contractor

Description

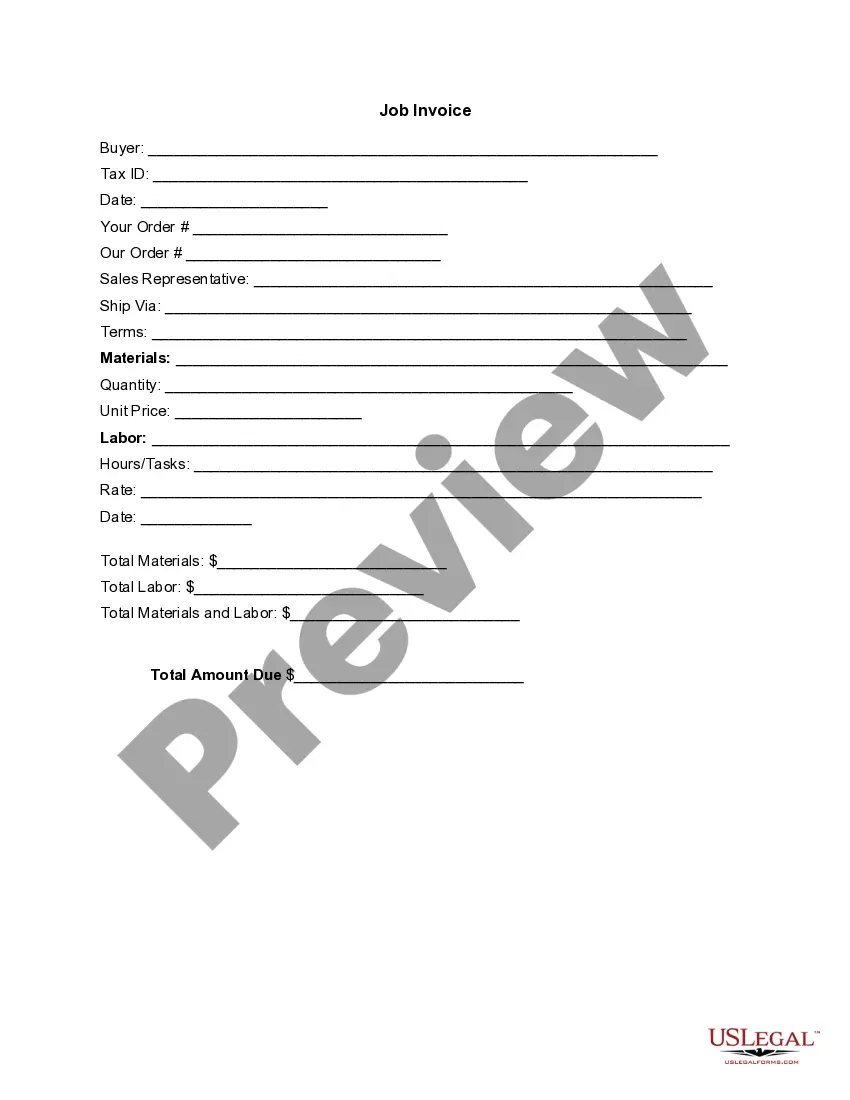

How to fill out Underwriter Agreement - Self-Employed Independent Contractor?

Finding the appropriate legal document template can be challenging.

Of course, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The service provides thousands of templates, including the Minnesota Underwriter Agreement - Self-Employed Independent Contractor, which you can use for business and personal purposes. All the forms are verified by experts and comply with state and federal regulations.

If the form does not meet your needs, use the Search field to find the appropriate form. Once you are confident that the form is suitable, click the Purchase now button to acquire the form. Select the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Choose the file format and download the legal document template to your device. Finally, complete, review, print, and sign the acquired Minnesota Underwriter Agreement - Self-Employed Independent Contractor. US Legal Forms is the largest repository of legal forms that offers various document templates. Utilize the service to download professionally created documents that adhere to state requirements.

- If you are already registered, Log In to your account and click on the Download button to find the Minnesota Underwriter Agreement - Self-Employed Independent Contractor.

- Use your account to access the legal forms you have obtained previously.

- Visit the My documents section of your account and obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple instructions for you to follow.

- First, ensure you have selected the correct form for your city/county.

- You can view the form using the Review option and read the form details to confirm it is suitable for you.

Form popularity

FAQ

To prove you are an independent contractor, you should gather documentation that clearly demonstrates your work status. This includes contracts, invoices, and records of payment that reflect your self-employed status. Additionally, you can utilize the Minnesota Underwriter Agreement - Self-Employed Independent Contractor to establish your professional identity. By organizing these materials, you create a solid case that supports your claim as an independent contractor.

The independent contractor agreement in Minnesota defines the working relationship between a contractor and a client. This document establishes the expectations, responsibilities, and payment terms for the contractor's services. Utilizing the Minnesota Underwriter Agreement - Self-Employed Independent Contractor helps protect both parties by clarifying their rights and obligations. For ease of use, you can access comprehensive templates through uslegalforms to ensure you meet all legal requirements in Minnesota.

To create an independent contractor agreement, start by outlining the terms of the working relationship. Include details like the scope of work, payment terms, and duration of the agreement. It is essential to incorporate the Minnesota Underwriter Agreement - Self-Employed Independent Contractor details to ensure compliance with state laws. Consider using a reliable platform like uslegalforms, which offers templates specifically designed for Minnesota independent contractor agreements.

To fill out a declaration of independent contractor status form, begin by accurately identifying the contractor and the business employing them. Include details about the nature of the work and confirm that the contractor meets the necessary criteria under state laws. This is crucial in establishing the validity of your contract, particularly when referencing the Minnesota Underwriter Agreement - Self-Employed Independent Contractor. For convenience, consider using US Legal Forms to access ready-to-use declarations.

Filling out an independent contractor form involves providing detailed information about both the contractor and the hiring entity. Clearly state the scope of work, payment terms, and any deadlines. Make sure to adhere to legal requirements by incorporating elements like the Minnesota Underwriter Agreement - Self-Employed Independent Contractor. Platforms like US Legal Forms offer intuitive forms that make completion straightforward.

To fill out an independent contractor agreement, first ensure all parties' names and contact information are correct. Then, specify the nature of the work and the agreed payment structure. It is important to review and include any relevant state laws that may impact your agreement, such as those relevant to the Minnesota Underwriter Agreement - Self-Employed Independent Contractor. Utilizing templates from US Legal Forms can help ensure that all necessary details are included.

To write an independent contractor agreement, start by clearly defining the parties involved and their roles. Next, outline the specific services the contractor will provide, along with payment terms and deadlines. Additionally, include clauses regarding confidentiality and termination. You can simplify this process by using the Minnesota Underwriter Agreement - Self-Employed Independent Contractor template available on the US Legal Forms platform.

While Minnesota does not legally require an operating agreement for an LLC, having one is highly recommended. An operating agreement outlines the management structure and operating procedures of the LLC. This can be crucial for protecting your interests as a self-employed independent contractor under the Minnesota Underwriter Agreement. Using uslegalforms can help you create a tailored operating agreement that meets your needs.

Yes, an independent contractor is considered self-employed. This means they operate their business without the traditional employer-employee relationship. The Minnesota Underwriter Agreement - Self-Employed Independent Contractor helps clarify the terms and responsibilities of being self-employed in Minnesota. It's essential for contractors to understand these concepts for effective management of their business.