Minnesota Appliance Refinish Services Contract - Self-Employed

Description

How to fill out Appliance Refinish Services Contract - Self-Employed?

If you wish to completely acquire, download, or reproduce legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Take advantage of the site’s user-friendly and efficient search feature to locate the documents you require. Various templates for business and personal purposes are organized by categories and jurisdictions, or keywords.

Employ US Legal Forms to obtain the Minnesota Appliance Refinish Services Contract - Self-Employed with just a few clicks.

Every legal document template you purchase is yours forever. You will have access to every form you downloaded in your account. Click on the My documents section and select a form to print or download again.

Stay competitive and download, and print the Minnesota Appliance Refinish Services Contract - Self-Employed with US Legal Forms. There are thousands of professional and state-specific templates you can use for your business or personal needs.

- If you are an existing US Legal Forms client, Log In to your account and then click the Download button to retrieve the Minnesota Appliance Refinish Services Contract - Self-Employed.

- You can also access forms you previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the steps below.

- Step 1. Ensure you have selected the form for your specific city/state.

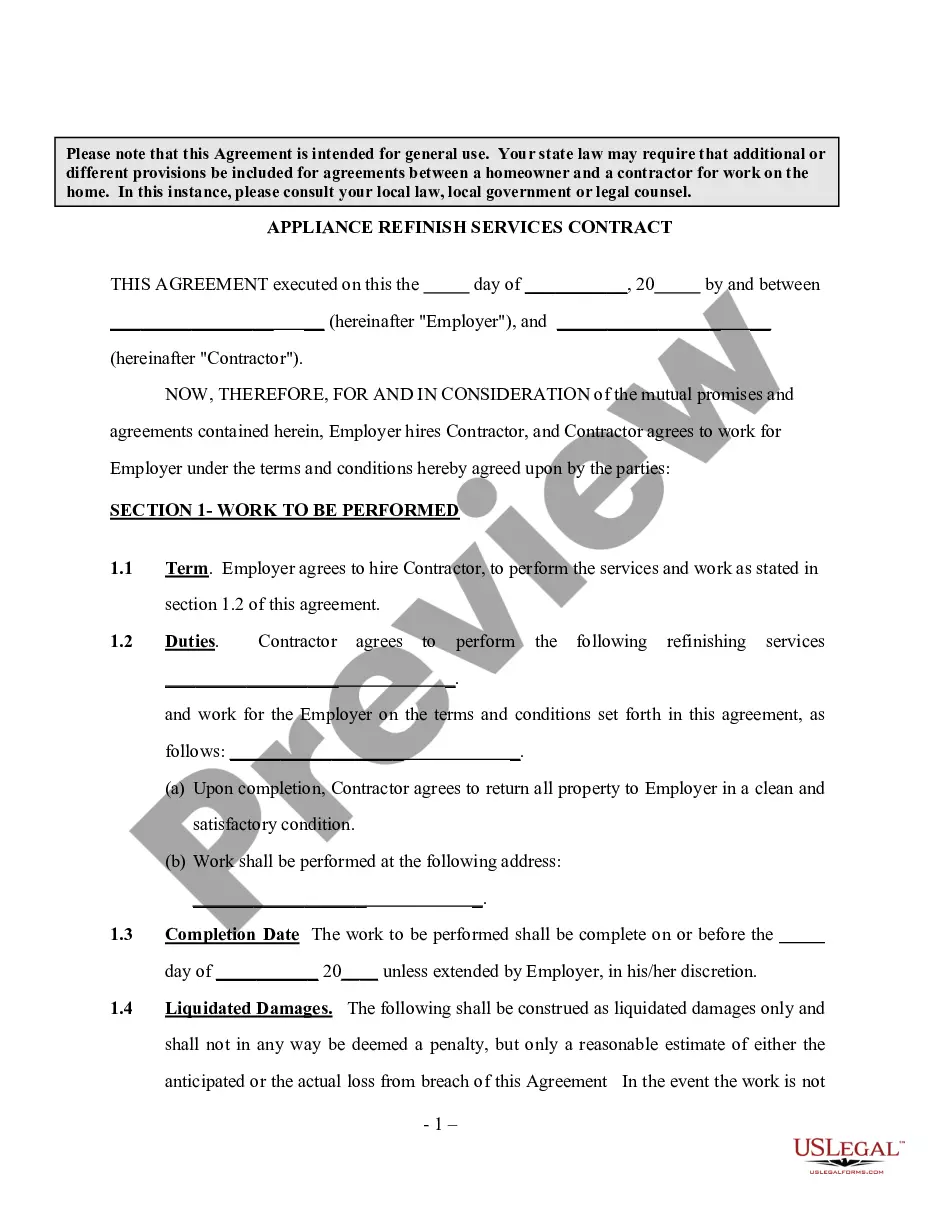

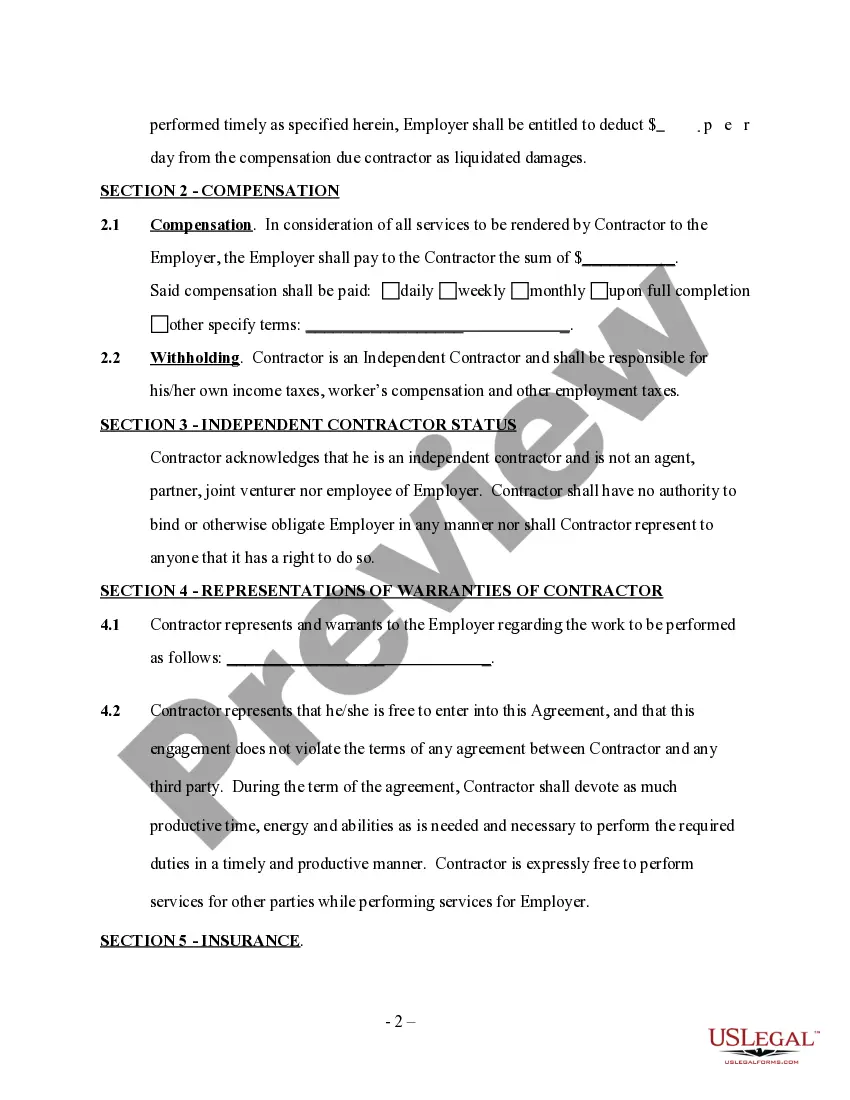

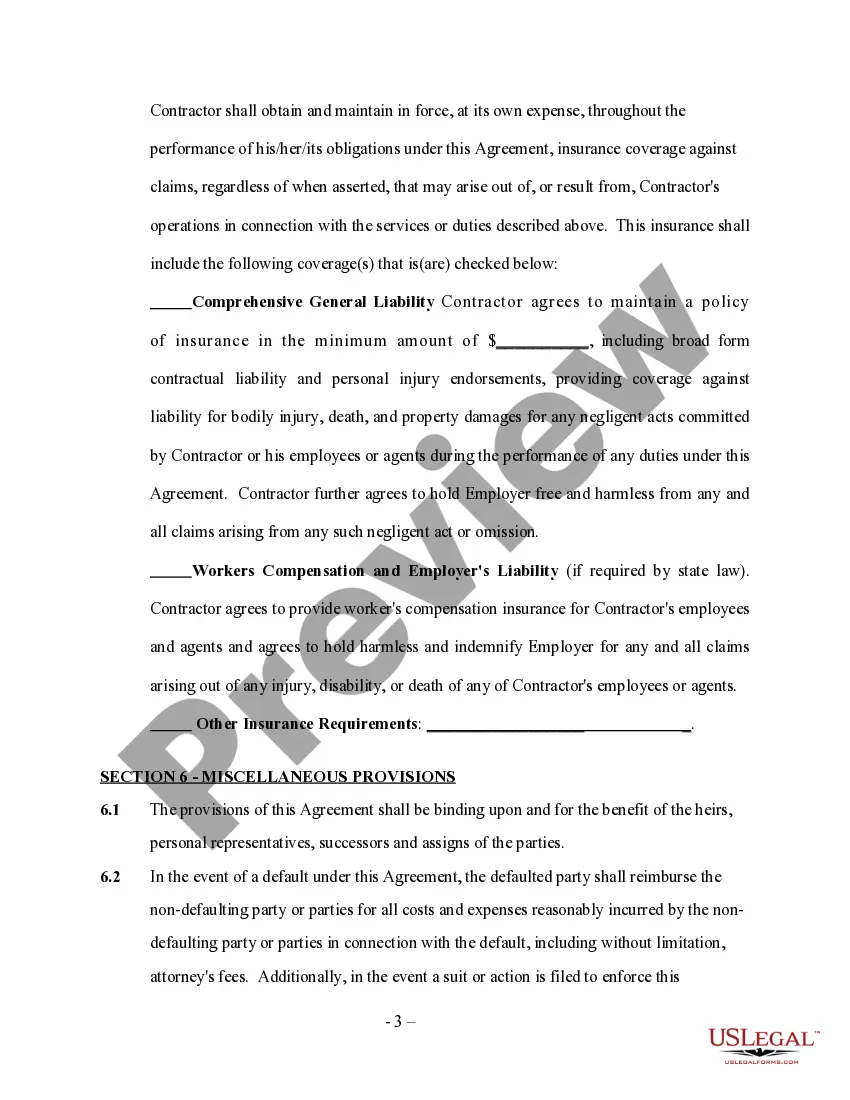

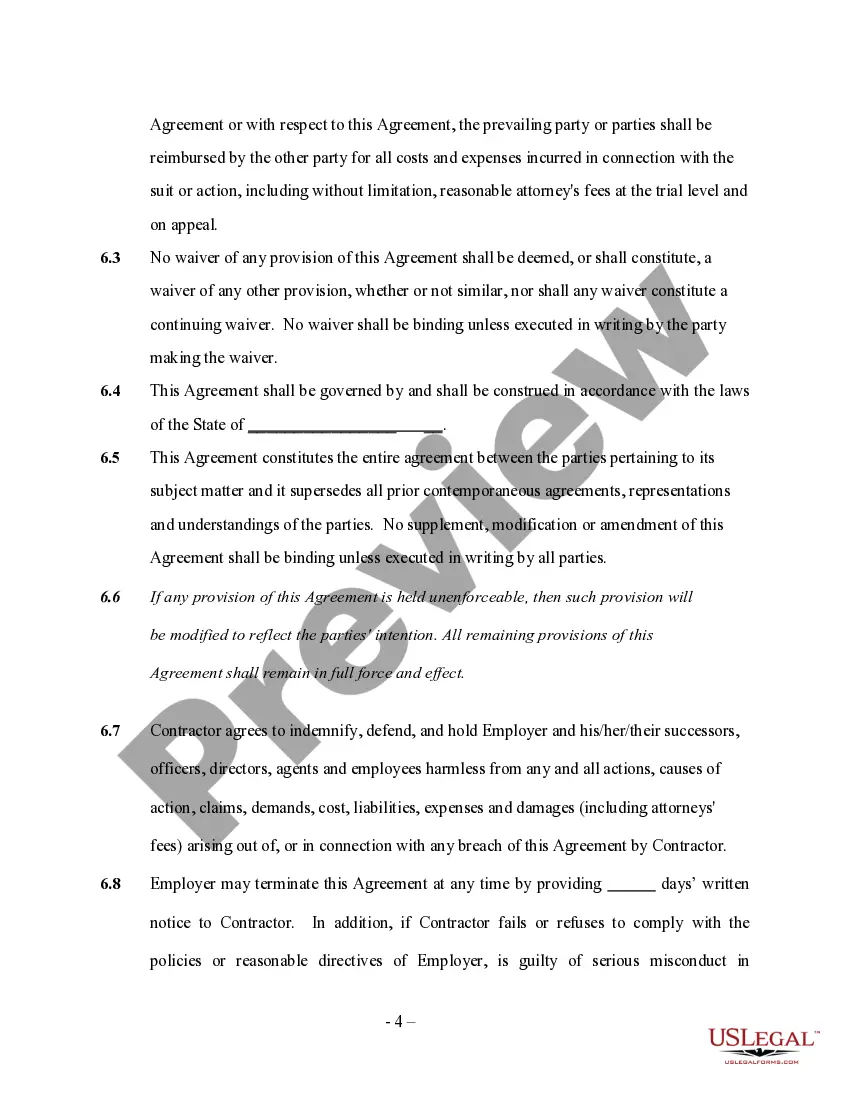

- Step 2. Use the Preview option to review the form’s details. Remember to read the description.

- Step 3. If you are unsatisfied with the form, utilize the Search box at the top of the screen to find other versions of the legal form template.

- Step 4. Once you have found the form you need, click the Buy now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the payment. You can use your Visa or MasterCard or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Fill out, edit, and print or sign the Minnesota Appliance Refinish Services Contract - Self-Employed.

Form popularity

FAQ

Yes, repairs performed in Minnesota are generally considered taxable unless they qualify for an exemption. This includes repairs made during appliance refinishing services provided under a Minnesota Appliance Refinish Services Contract - Self-Employed. It's important to categorize your services correctly and understand the implications for tax reporting. Using tools from uslegalforms can help simplify this process.

Whether you add tax to your invoice typically depends on the taxable status of the services you provide. If your services are taxable and you are operating under a Minnesota Appliance Refinish Services Contract - Self-Employed, you must include sales tax on your invoices. It's vital to clearly itemize these charges to maintain transparency with your clients. Consulting resources like uslegalforms can clarify invoicing practices.

Independent contractors in Minnesota must adhere to specific legal requirements such as obtaining necessary licenses and permits. You also need to report your income accurately and comply with tax obligations. When you operate as a self-employed individual under a Minnesota Appliance Refinish Services Contract, understanding these legal frameworks ensures you maintain compliance and avoid potential issues. Utilizing platforms like uslegalforms can aid in navigating these requirements.

In Minnesota, several services are considered taxable, including those related to repair, maintenance, and information technology services. If you provide appliance refinishing services, your work may be subject to taxation if it involves physical goods. As a self-employed individual under a Minnesota Appliance Refinish Services Contract, it is important to be aware of which services you offer that might be taxable.

Yes, Minnesota imposes self-employment tax on individuals who earn income from self-employment ventures. This tax applies to your net earnings derived from your Minnesota Appliance Refinish Services Contract - Self-Employed work. It's essential to keep thorough records and understand how these taxes can affect your overall financial picture. Utilizing resources such as uslegalforms can help clarify these obligations.

In Minnesota, handyman work can be taxable depending on the nature of the services provided. Generally, if your work involves repairs, alterations, or maintenance, it falls under taxable services. However, if you are engaging in non-taxable services, it is essential to clarify your obligations. For those operating under a Minnesota Appliance Refinish Services Contract - Self-Employed, understanding taxability is crucial for compliance.

A contract becomes legally binding in Minnesota when it includes essential elements like offer, acceptance, and consideration. Additionally, both parties must have the capacity to contract and consent to the terms without duress. When creating a Minnesota Appliance Refinish Services Contract - Self-Employed, ensuring these components are present strengthens the enforceability of your agreement, providing peace of mind for you and your clients.

In Minnesota, you can perform various tasks as a self-employed individual without a contractor's license, such as appliance refinishing and minor repairs. However, it is essential to understand the specific limits of your work, as certain complex jobs may require licensing. Using a Minnesota Appliance Refinish Services Contract - Self-Employed can help clarify the scope of your work to clients, protecting both you and the customer.

To establish yourself as an independent contractor in Minnesota, you should first choose a business name and register it if necessary. Next, consider obtaining any required licenses or permits specific to the appliance refinishing industry. Finally, create a Minnesota Appliance Refinish Services Contract - Self-Employed to outline your work terms, payment, and responsibilities, ensuring clarity in your agreements.

To write a contract for a 1099 employee, specify their roles, payment structure, and project timelines. Clearly describe the nature of the work and outline expectations for deliverables. It is essential to clarify that they are working as an independent contractor, not an employee. For creating a Minnesota Appliance Refinish Services Contract - Self-Employed, US Legal Forms offers customizable templates that can simplify this process.