Minnesota Sports Surfaces Installation And Services Contract - Self-Employed

Description

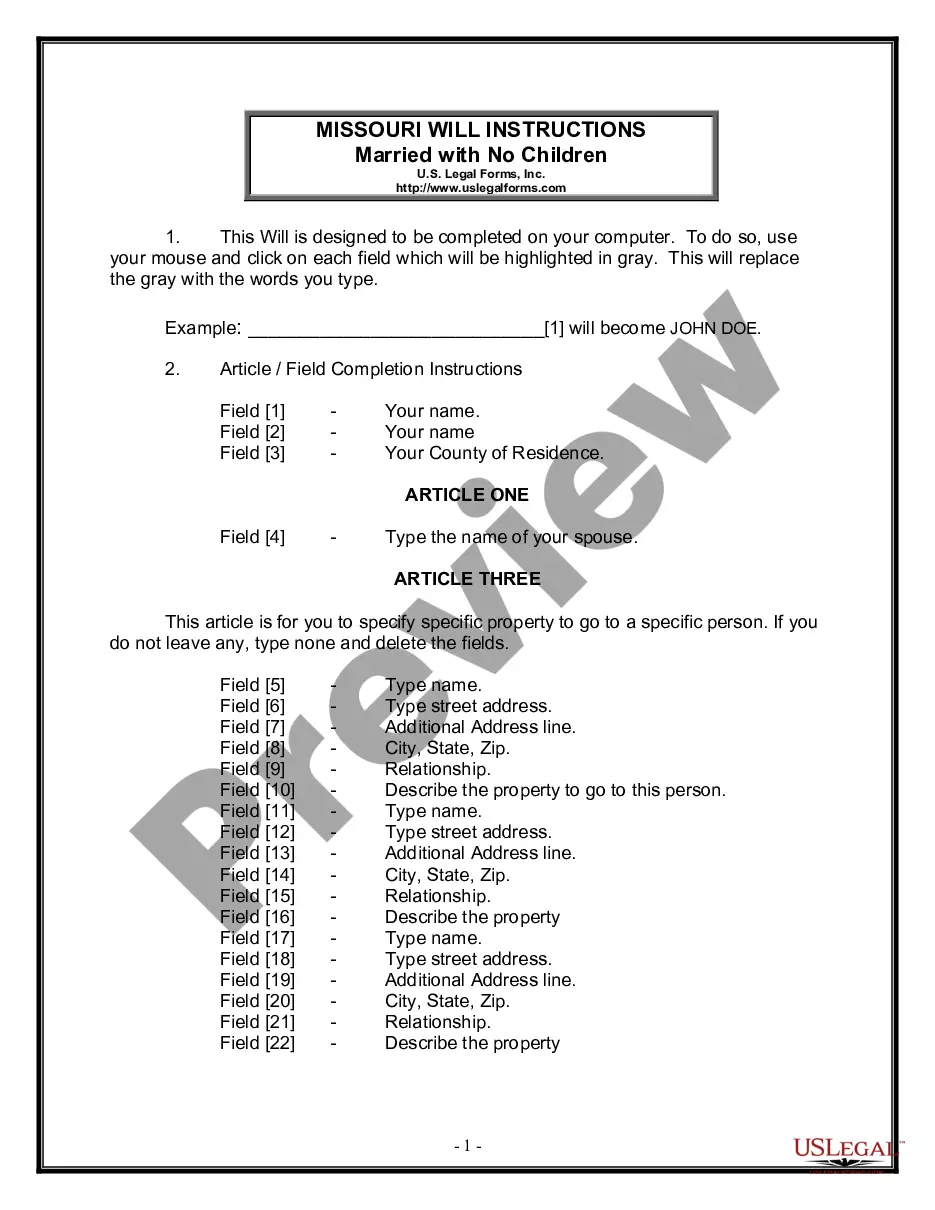

How to fill out Sports Surfaces Installation And Services Contract - Self-Employed?

If you require to aggregate, download, or print legal document templates, utilize US Legal Forms, the largest repository of legal forms available online. Take advantage of the site's straightforward and user-friendly search feature to locate the documents you need. A range of templates for business and personal purposes are organized by categories and states, or keywords. Use US Legal Forms to find the Minnesota Sports Surfaces Installation And Services Contract - Self-Employed with just a few clicks.

If you are already a US Legal Forms customer, Log In to your account and click the Acquire button to obtain the Minnesota Sports Surfaces Installation And Services Contract - Self-Employed. You can also access forms you previously downloaded in the My documents tab of your account.

If you are using US Legal Forms for the first time, follow the instructions below: Step 1. Ensure you have selected the form for the correct city/state. Step 2. Utilize the Review option to examine the form's content. Do not forget to read the details. Step 3. If you are not satisfied with the form, use the Search area at the top of the screen to find alternative versions in the legal form template. Step 4. Once you have identified the form you need, click the Purchase now button. Select the pricing plan you prefer and enter your credentials to register for an account. Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction. Step 6. Choose the format of the legal form and download it to your device. Step 7. Complete, modify, and print or sign the Minnesota Sports Surfaces Installation And Services Contract - Self-Employed.

Avoid altering or removing any HTML tags. Only synonymize plain text outside of the HTML tags.

- Every legal document template you purchase is yours permanently.

- You have access to every form you downloaded within your account.

- Click the My documents section and select a form to print or download again.

- Be proactive and download, and print the Minnesota Sports Surfaces Installation And Services Contract - Self-Employed with US Legal Forms.

- There are millions of professional and state-specific forms you can utilize for your business or personal needs.

Form popularity

FAQ

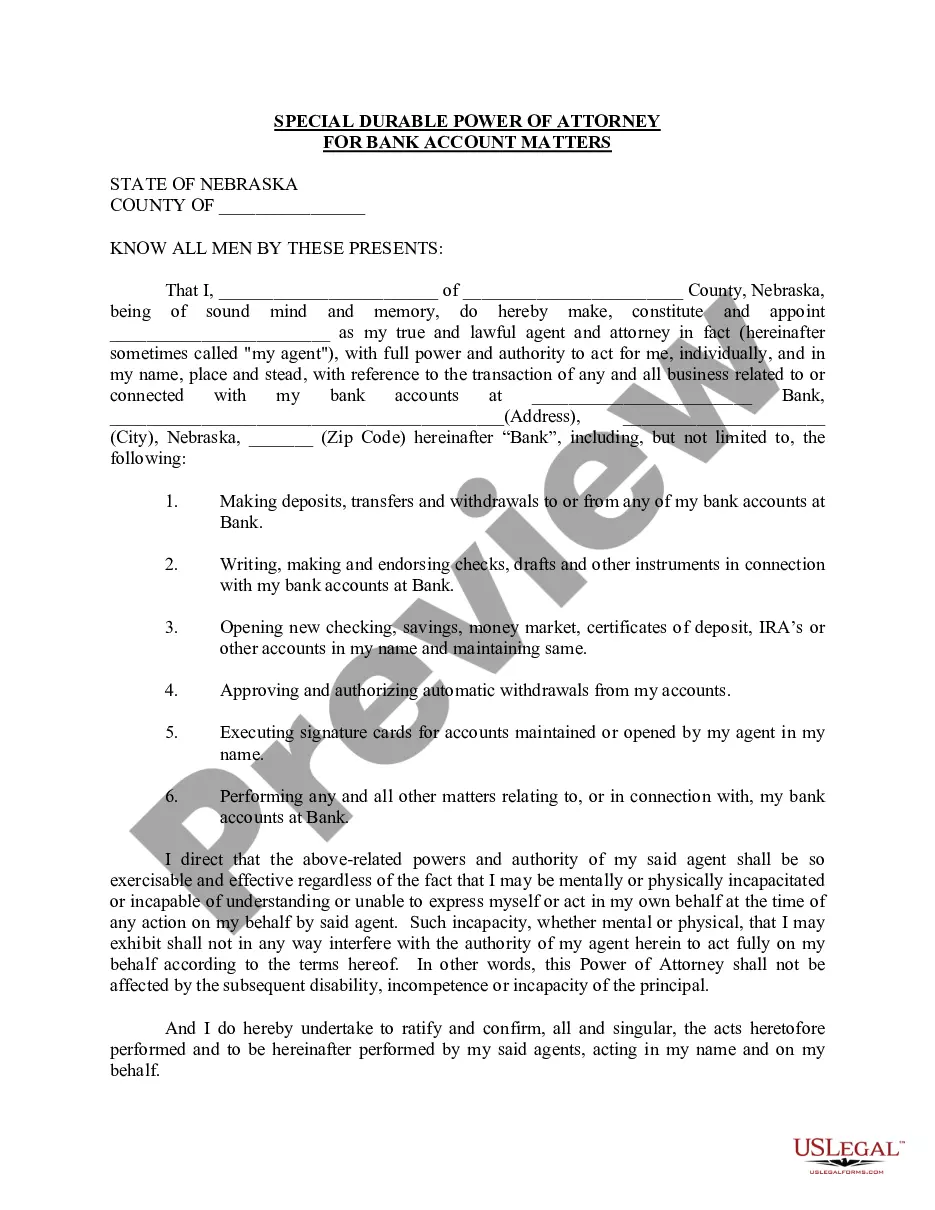

An independent contractor agreement in Minnesota is a legal document that outlines the terms of the working relationship between a contractor and a client. This agreement specifies the scope of work, payment terms, and responsibilities of both parties. For those involved in the Minnesota Sports Surfaces Installation And Services Contract - Self-Employed, having a well-drafted independent contractor agreement is essential to ensure clear expectations and protect your interests.

In Minnesota, having an operating agreement is not a legal requirement for limited liability companies (LLCs), but it is highly recommended. An operating agreement outlines the management structure and operational procedures of your business. This document can clarify the roles of members and manage disputes effectively. If you are self-employed in the Minnesota Sports Surfaces Installation And Services Contract sector, creating an operating agreement can provide you with additional legal protection and clarity.

The independent contractor test in Minnesota helps determine whether a worker qualifies as an independent contractor or an employee. Key factors include the degree of control the employer has over the work, the distinct nature of the business, and whether the worker is engaged in a trade. Understanding this distinction is vital for anyone entering a Minnesota Sports Surfaces Installation And Services Contract - Self-Employed, as it affects tax responsibilities and legal protections. It may be helpful to consult resources on US Legal Forms for clarity on this topic.

The five essential elements of a contract are offer, acceptance, consideration, mutual assent, and enforceability. An offer is the proposal to engage in a contract, and acceptance is the agreement to those terms. Consideration involves something exchanged between parties, mutual assent indicates that both parties understand and agree to the terms, and enforceability ensures the contract can be upheld in court. These elements are crucial for a Minnesota Sports Surfaces Installation And Services Contract - Self-Employed to be valid.

The 5 C's of a contract are clarity, completeness, consideration, compliance, and capacity. Clarity ensures that all terms are understandable, while completeness secures that all elements necessary for enforceability are included. Consideration addresses what each party brings to the contract. Compliance means following all relevant laws and standards. Lastly, capacity confirms that all parties are legally able to enter an agreement, especially relevant for a Minnesota Sports Surfaces Installation And Services Contract - Self-Employed.

The five basic principles of a contract include mutual agreement, consideration, capacity, legality, and intention. In the context of a Minnesota Sports Surfaces Installation And Services Contract - Self-Employed, mutual agreement ensures both parties consent to the terms. Consideration represents what each party will give or receive. Capacity refers to the legal ability to enter into a contract, while legality ensures the contract complies with state laws.

Common examples include: Clothing for general use, see Clothing. Food (grocery items), see Food and Food Ingredients. Prescription and over-the-counter drugs for humans, see Drugs....For more information, see:Personal Services.Professional Services.Taxable Services.

Like many other states, professional services in Minnesota are generally not taxable unless it results in the creation of a product to be sold.

When it comes to sales tax, the general rule of thumb has always been products are taxable, while services are non-taxable. Under that scenario, if your business sells coffee mugs, you should charge sales tax for those products.

Contractors and subcontractors enter into construction contracts to furnish materials and labor to build, alter, or improve real property. This includes any specialty contractors. You must pay sales and use tax on the cost of all materials, supplies, and equipment used to complete a construction contract.