Minnesota Dancer Agreement - Self-Employed Independent Contractor

Description

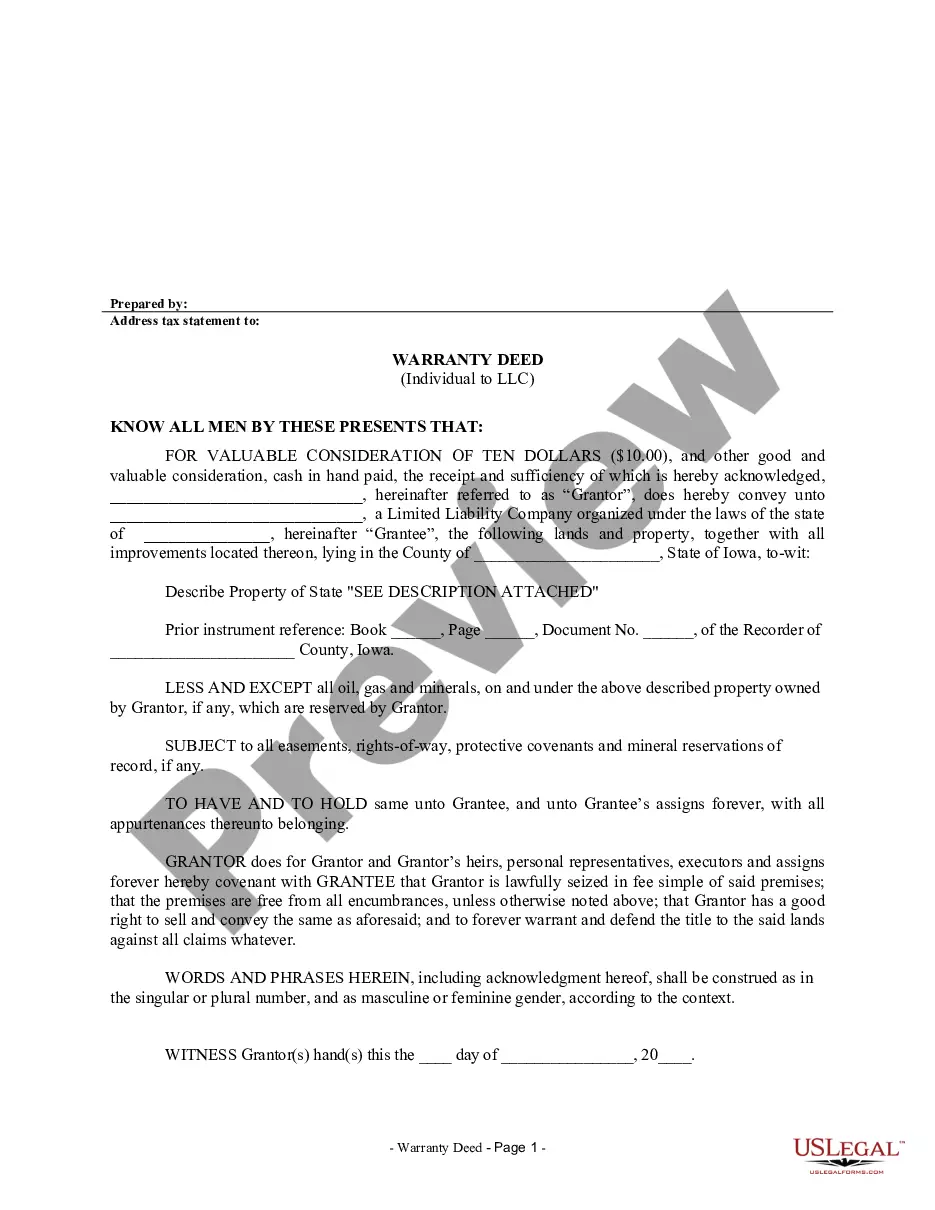

How to fill out Dancer Agreement - Self-Employed Independent Contractor?

If you need to complete, download, or print legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search feature to acquire the documentation you require. Numerous templates for business and specific purposes are organized by categories and claims, or keywords.

Use US Legal Forms to obtain the Minnesota Dancer Agreement - Self-Employed Independent Contractor in just a few clicks.

Every legal document format you purchase is yours forever. You have access to every form you acquired in your account. Click on the My documents section and choose a form to print or download again.

Stay competitive and download, and print the Minnesota Dancer Agreement - Self-Employed Independent Contractor with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Minnesota Dancer Agreement - Self-Employed Independent Contractor.

- You can also find forms you previously purchased in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Utilize the Review option to examine the form’s content. Remember to check the details.

- Step 3. If you are dissatisfied with the form, use the Search box at the top of the screen to find other versions of the legal form format.

- Step 4. Once you have found the form you need, click the Purchase now button. Choose the pricing plan you prefer and enter your details to create an account.

- Step 5. Complete the transaction. You can use your credit card or PayPal account to finalize the purchase.

- Step 6. Download the format of the legal form to your device.

- Step 7. Fill out, edit, and print or sign the Minnesota Dancer Agreement - Self-Employed Independent Contractor.

Form popularity

FAQ

Non-compete agreements can indeed apply to independent contractors, including those operating under a Minnesota Dancer Agreement - Self-Employed Independent Contractor. These agreements typically restrict an individual's ability to work with competitors within a certain timeframe and location. However, the enforceability of such agreements can depend on state laws and specific contract terms. It is essential for independent contractors like dancers to understand their rights and obligations when entering into these agreements, as they can impact future opportunities.

The 183 day rule in Minnesota refers to the amount of time a person can stay in the state without becoming a resident for tax purposes. If you spend more than 183 days in Minnesota, the state may consider you a resident, which affects your tax obligations. Keeping detailed records through a Minnesota Dancer Agreement - Self-Employed Independent Contractor can help clarify your status. Always check with a tax advisor for guidance related to your specific situation.

As an independent contractor in Minnesota, you report your income on your personal tax return using Schedule C. It's important to keep detailed records of your earnings and expenses, as these documents support your claims. The Minnesota Dancer Agreement - Self-Employed Independent Contractor can help you outline your earnings clearly, making tax time less stressful. Consulting a tax professional ensures you follow all reporting requirements.

In Minnesota, an independent contractor is someone who provides services to clients under a contractual agreement, rather than as an employee. This means you control how and when you work, giving you the flexibility to manage your own schedule. With a Minnesota Dancer Agreement - Self-Employed Independent Contractor, you establish clear terms that protect both parties involved. Understanding this classification helps ensure compliance with state regulations.

An independent contractor agreement in Minnesota outlines the relationship between the contractor and the hiring party. This document, specifically the Minnesota Dancer Agreement - Self-Employed Independent Contractor, details critical aspects such as payment terms, project deadlines, and the specific duties expected of the contractor. Utilizing a well-structured agreement can shield you from misunderstandings and legal complications down the line.

Yes, non-compete agreements can be enforceable for independent contractors, but the enforceability varies by state. In Minnesota, the terms must be reasonable in scope and duration, especially in a Minnesota Dancer Agreement - Self-Employed Independent Contractor context. It’s crucial to carefully review these agreements to ensure they comply with state laws and protect your ability to work in your field.

Yes, dancers often work as independent contractors. This means they have the freedom to choose their schedule, projects, and clients. However, it is essential to have a clear Minnesota Dancer Agreement - Self-Employed Independent Contractor in place to outline the terms of your work and protect your rights. This agreement helps clarify the relationship, ensuring that both the dancer and the hiring party understand their responsibilities.

To fill out an independent contractor form, you need to provide personal details, job description, and tax information. It is vital to ensure all information aligns with the terms outlined in your independent contractor agreement. Using a structured template, like the Minnesota Dancer Agreement - Self-Employed Independent Contractor from uslegalforms, can help you complete the form accurately and efficiently.

Filling out an independent contractor agreement requires attentiveness to detail and clarity on both sides' roles. Specify the project scope, payment frequency, and any necessary legal obligations. Consider using the Minnesota Dancer Agreement - Self-Employed Independent Contractor template available on the uslegalforms platform to simplify this task and reduce the likelihood of misunderstandings.

Filling out a declaration of independent contractor status form involves gathering information about your business and the nature of your work. Make sure to provide accurate details regarding your service offerings and the level of control you maintain over your work. A template for the Minnesota Dancer Agreement - Self-Employed Independent Contractor can guide you through recording this essential information correctly.