Minnesota Masonry Services Contract - Self-Employed

Description

How to fill out Masonry Services Contract - Self-Employed?

It is feasible to spend hours online searching for the legal document template that meets the state and federal requirements you need.

US Legal Forms offers an extensive collection of legal forms that can be examined by professionals.

It is easy to obtain or print the Minnesota Masonry Services Contract - Self-Employed from the platform.

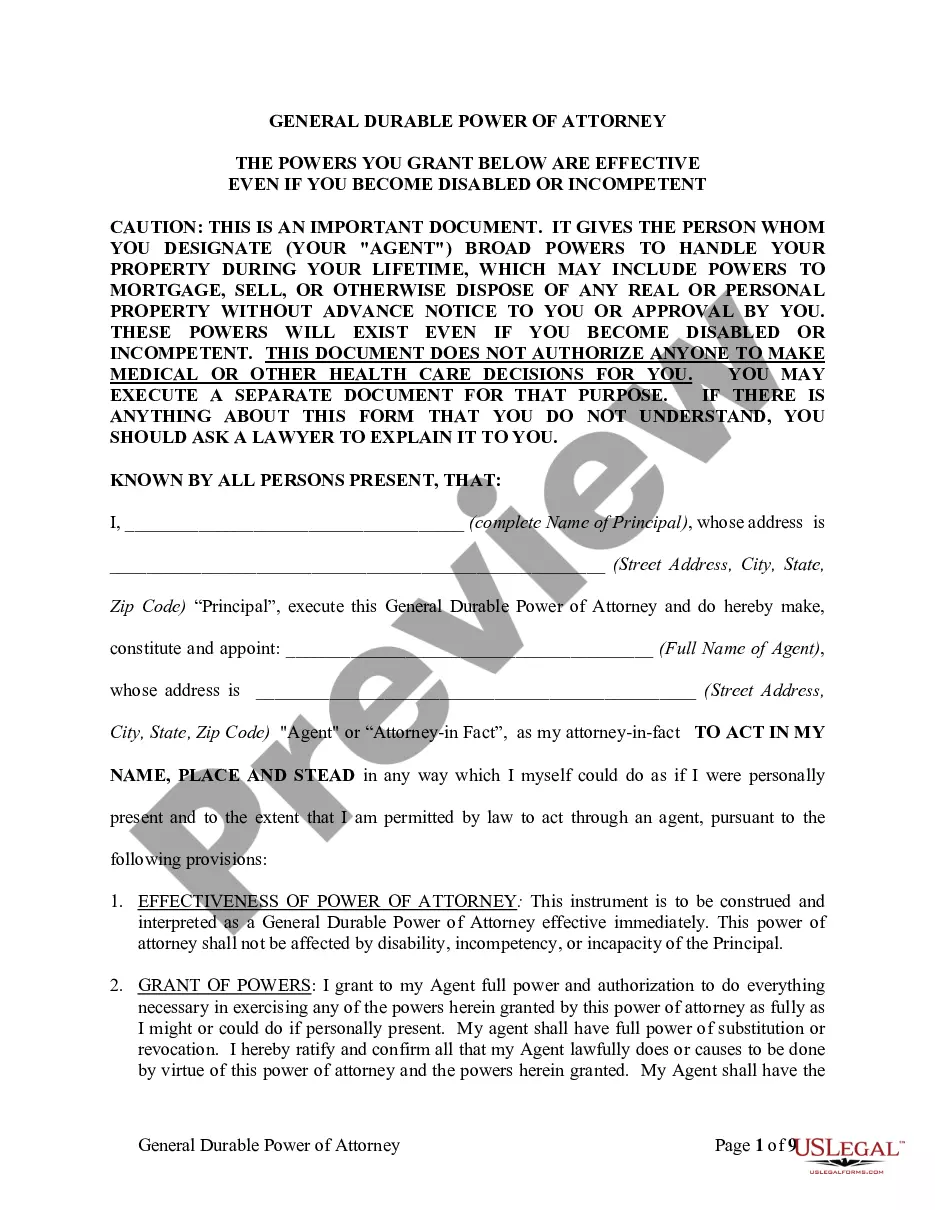

If available, use the Preview button to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and click the Acquire button.

- Afterward, you can complete, modify, print, or sign the Minnesota Masonry Services Contract - Self-Employed.

- Every legal document template you purchase is yours permanently.

- To get another copy of any acquired document, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for your county/region of choice.

- Review the document description to confirm you have chosen the right form.

Form popularity

FAQ

Yes, you can be your own general contractor in Minnesota, provided you hold the necessary licenses and registrations. This option is particularly beneficial for self-employed individuals who prefer to manage their own projects. By acting as your own general contractor, you retain full control over timelines, budgets, and subcontracting. If you're navigating a Minnesota Masonry Services Contract - Self-Employed, you have the opportunity to streamline your operations while ensuring quality work.

In Minnesota, any person or business that contracts to perform construction work or services, including masonry services, generally needs a contractor's license. This requirement applies to those who are self-employed and manage contracts for construction projects. Having the appropriate licenses ensures compliance with state regulations and protects both the contractor and the client. If you work under a Minnesota Masonry Services Contract - Self-Employed, obtaining your license is essential for legal operations.

To write an independent contractor agreement, start with a title that clearly identifies the document. Include key sections, such as the description of services, compensation details, and terms of termination, ensuring relevance to a Minnesota Masonry Services Contract - Self-Employed. Additionally, define the working relationship and the obligations of both parties. Lastly, review the agreement to make sure it is clear and meets legal standards.

Filling out an independent contractor agreement begins with entering your name and the contractor's name. After that, specify the scope of work and include details relevant to a Minnesota Masonry Services Contract - Self-Employed. You should also outline payment terms, deadlines, and any other important conditions. Double-check the agreement for clarity and completeness before finalizing it.

To fill out an independent contractor form, start by entering your personal details, including your name and contact information. Next, provide your business information and describe the services you will provide, such as those in a Minnesota Masonry Services Contract - Self-Employed. Make sure to include payment terms and any relevant timelines. Finally, review the completed form for accuracy before submitting it.

Filing as an independent contractor involves completing specific tax forms for your earnings. You will typically need to report your income using a Schedule C when filing your taxes. Using a Minnesota Masonry Services Contract - Self-Employed can help you track your earnings and expenses, ensuring you meet your tax obligations effectively.

To set yourself up as a contractor, start by developing your skills and understanding your industry. Register your business legally and gather the necessary documentation, including your Minnesota Masonry Services Contract - Self-Employed. This contract will guide your client relationships and ensure a professional presentation of your services.

While both terms describe a similar work arrangement, 'self-employed' generally encompasses a broader category of individuals working for themselves. The term 'independent contractor' is more specific and often relates to contractual work. Either term can be used, but clarity in your Minnesota Masonry Services Contract - Self-Employed will communicate your role effectively.

To set up as a self-employed contractor, you should first define your business structure, such as a sole proprietorship or LLC. Obtain any necessary licenses and insurance to protect yourself and your clients. Finally, craft a solid Minnesota Masonry Services Contract - Self-Employed to clarify your services and ensure all parties understand the terms.

Setting yourself up as an independent contractor involves registering your business and acquiring any required licenses. Next, create essential documents such as your Minnesota Masonry Services Contract - Self-Employed, which will help protect your interests. Proper organization will streamline your operations and enable you to attract clients smoothly.