Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor

Description

How to fill out Cable Disconnect Service Contract - Self-Employed Independent Contractor?

If you require extensive, acquire, or producing sanctioned document templates, utilize US Legal Forms, the leading assortment of legal documents that are accessible online.

Leverage the site's straightforward and efficient search functionality to find the documentation you need. Numerous templates for corporate and personal applications are organized by categories and states, or keywords.

Employ US Legal Forms to secure the Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor within just a few clicks.

- If you are already a US Legal Forms member, sign in to your account and click the Download button to obtain the Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor.

- You may also access documents you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you've selected the form for the correct city/state.

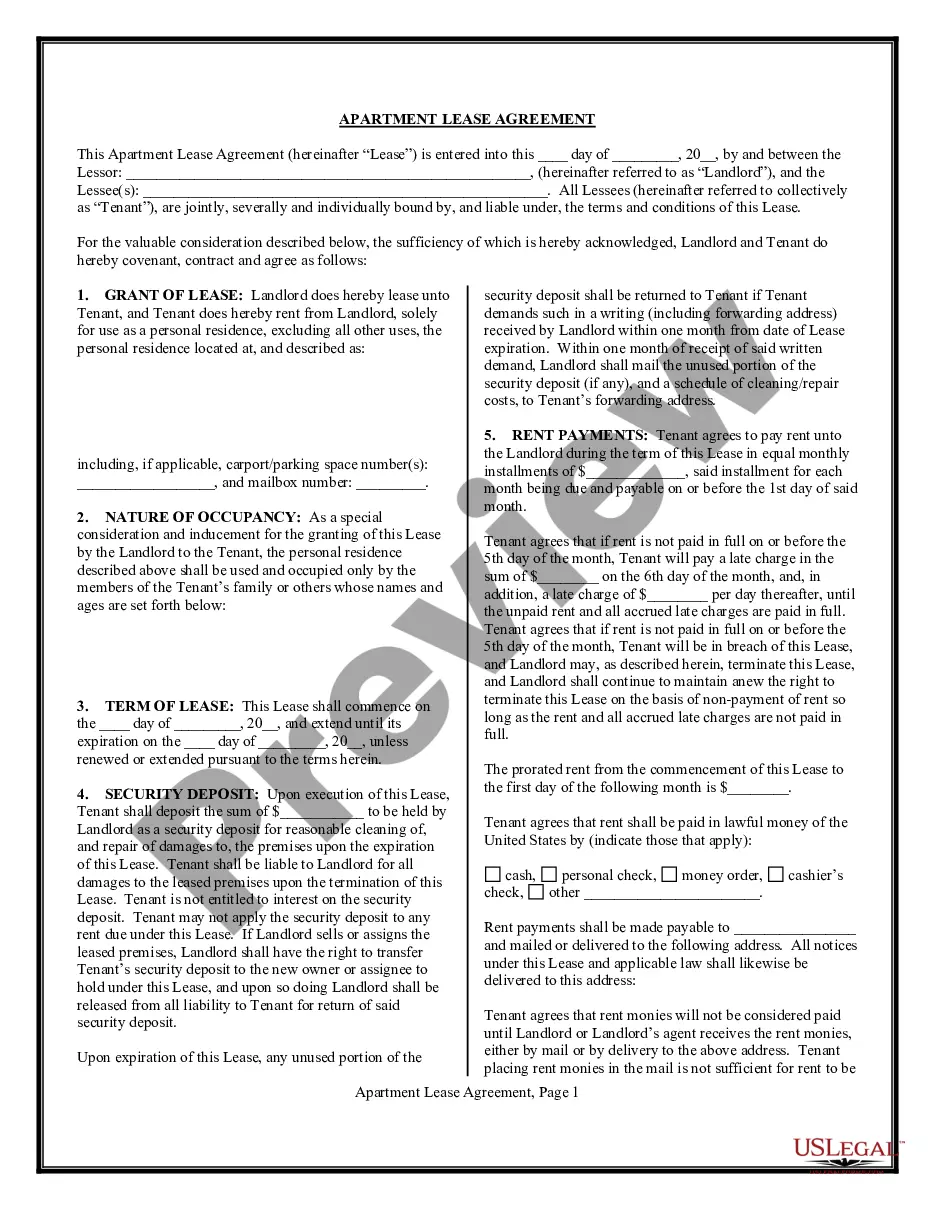

- Step 2. Use the Preview mode to review the form’s content. Be sure to read the description.

- Step 3. If you’re not satisfied with the form, utilize the Search field at the top of the screen to find alternative versions in the legal document template.

Form popularity

FAQ

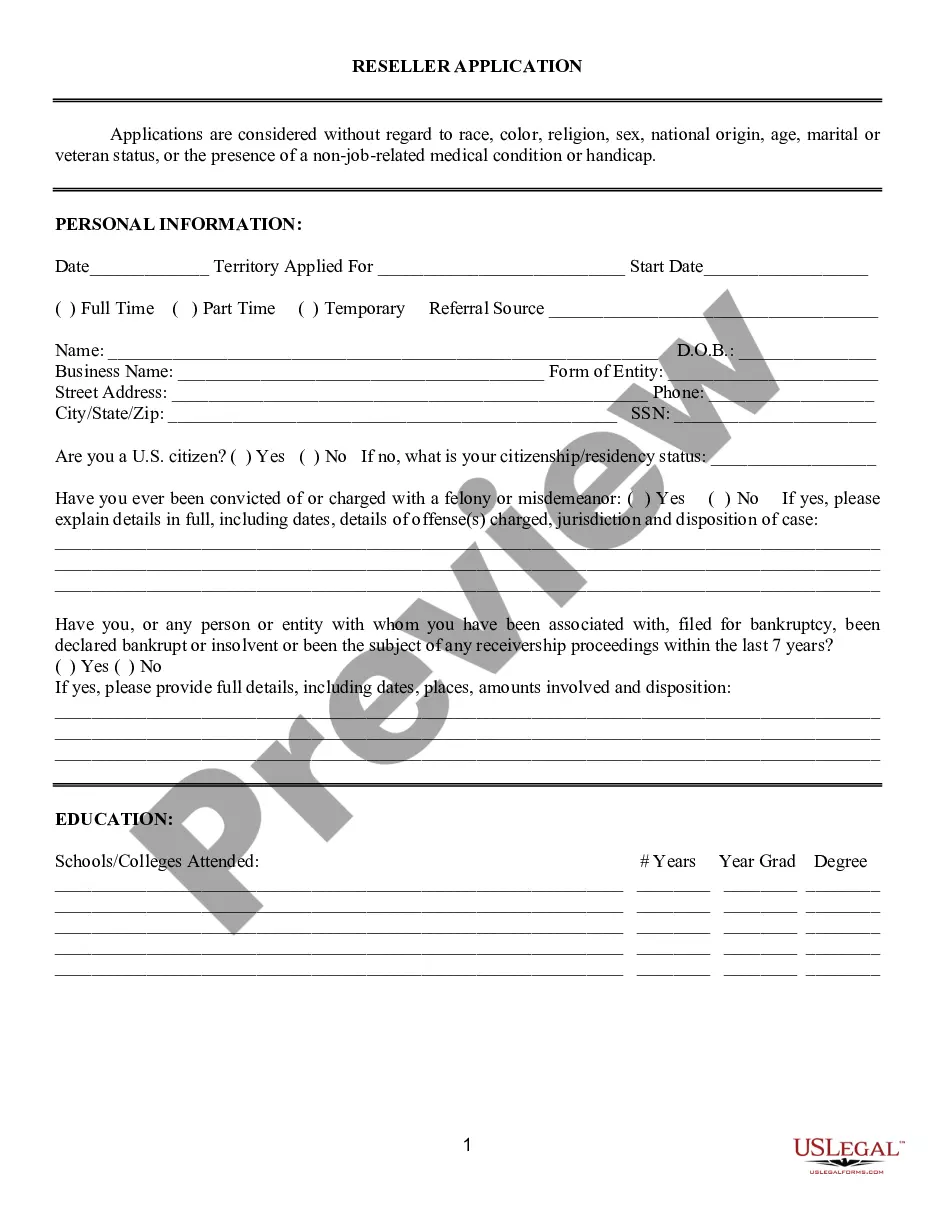

A basic independent contractor agreement outlines the essential terms of the working relationship between the contractor and the client. Key elements include the scope of work, payment terms, deadlines, and termination clauses. Utilizing a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor can provide a solid foundation for this agreement, ensuring clarity and professionalism. This structure benefits both parties by setting expectations and protecting rights.

Independent contractors must meet specific legal requirements, including having a written agreement outlining their relationship with clients. This includes a clear definition of services and payment terms. It is advisable to use a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor to ensure compliance with local laws, which can provide insights into tax obligations and liability. Being aware of these requirements helps you operate within legal boundaries.

To prove you are an independent contractor, you should gather documentation such as contracts, invoices, and tax forms. These documents demonstrate your services and payments from clients. Additionally, a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor can provide a formal record of your status, outlining the terms of your work. This evidence not only clarifies your role in the business relationship but also protects your rights.

To fill out an independent contractor form, begin by writing down the contractor’s information and the specifics of the contract. Include any payment details and project milestones. If your work involves a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor, make sure to indicate any relevant laws or regulations that apply. USLegalForms offers user-friendly forms that can guide you in this process.

Filling out an independent contractor agreement involves providing essential details such as the contractor's name, address, and the nature of the work. You should also outline the payment structure and the duration of the project. For a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor, ensure you include sections that address liability and insurance. A step-by-step guide from platforms like USLegalForms can help you navigate this efficiently.

To write an independent contractor agreement for a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor, start by clearly defining the scope of work. Specify the responsibilities, payment terms, and deadlines. Also, include confidentiality clauses and termination conditions to protect both parties. Using a template from USLegalForms can simplify this process significantly.

Politely terminating a contract involves expressing gratitude for the contractor's work and providing clear reasons for the termination. A written notice can help articulate your points respectfully. For those dealing with a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor, maintaining a positive tone can leave the door open for future collaborations.

To effectively terminate a contract, start with a thorough review of the agreement for termination procedures. Document your reasons clearly and provide written notice, adhering to any specified notification period. This is especially relevant for those in a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor, where clear communication fosters mutual respect.

No, it is not illegal to terminate a 1099 contract as long as it adheres to the terms outlined in the agreement. Think of a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor as a clear framework detailing termination rights. Always ensure that your reasons for termination are fair and documented.

To terminate a contract with an independent contractor, refer to the termination clauses within the agreement. Generally, providing written notice meets most contract requirements. For those under a Minnesota Cable Disconnect Service Contract - Self-Employed Independent Contractor, communication is key to ensure a smooth transition.