Minnesota Instructions for Completing IRS Form 4506-EZ

Description

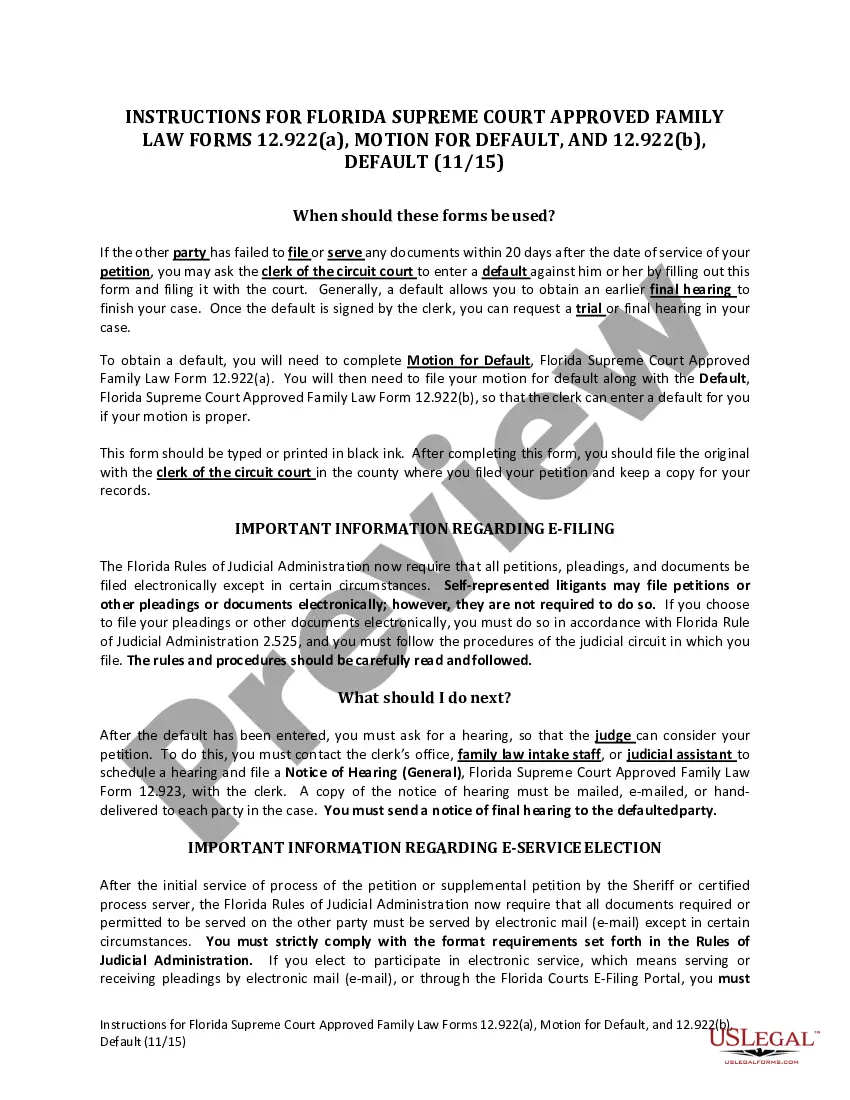

How to fill out Instructions For Completing IRS Form 4506-EZ?

US Legal Forms - one of the biggest libraries of authorized forms in the States - offers a wide array of authorized file templates it is possible to obtain or printing. While using website, you will get 1000s of forms for company and personal functions, categorized by classes, suggests, or keywords and phrases.You can get the most recent types of forms just like the Minnesota Instructions for Completing IRS Form 4506-EZ in seconds.

If you already possess a membership, log in and obtain Minnesota Instructions for Completing IRS Form 4506-EZ from your US Legal Forms catalogue. The Down load switch will show up on every single form you view. You have accessibility to all earlier saved forms inside the My Forms tab of your profile.

If you want to use US Legal Forms the first time, here are easy guidelines to help you get began:

- Be sure to have chosen the best form for your metropolis/region. Go through the Review switch to examine the form`s content material. Read the form explanation to ensure that you have selected the correct form.

- When the form doesn`t satisfy your needs, take advantage of the Lookup area on top of the display screen to get the the one that does.

- In case you are satisfied with the form, verify your selection by simply clicking the Acquire now switch. Then, select the rates prepare you want and offer your qualifications to register to have an profile.

- Method the transaction. Utilize your charge card or PayPal profile to complete the transaction.

- Select the formatting and obtain the form in your product.

- Make adjustments. Complete, change and printing and signal the saved Minnesota Instructions for Completing IRS Form 4506-EZ.

Every single template you put into your money does not have an expiry time and is also the one you have forever. So, if you want to obtain or printing an additional copy, just check out the My Forms area and click on the form you want.

Obtain access to the Minnesota Instructions for Completing IRS Form 4506-EZ with US Legal Forms, the most substantial catalogue of authorized file templates. Use 1000s of expert and condition-certain templates that meet up with your small business or personal requires and needs.

Form popularity

FAQ

Form 4506-T must be signed and dated by the taxpayer listed on line 1a or 2a (If you filed a joint tax return, only one filer is required to sign). You must check the box in the signature area to acknowledge you have the authority to sign and request the information.

1. Complete the form. Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address. How Do I Complete the 4506-T Form? - Lending Club lendingclub.com ? help ? personal-loan-faq lendingclub.com ? help ? personal-loan-faq

Complete these lines on the form: Line 1a: Enter your name as it's shown on your tax returns. Line 1b: Enter your Social Security number. Line 2a: Enter your spouse's name if you filed a joint return. Line 2b: Enter your spouse's Social Security number, if you filed a joint return. Line 3: Enter your current address.

Individuals can use Form 4506T-EZ to request a tax return transcript for the current and the prior three years that includes most lines of the original tax return. The tax return transcript will not show payments, penalty assessments, or adjustments made to the originally filed return.

Paper Request Form ? IRS Form 4506-T Complete lines 1 ? 4, following the instructions on page 2 of the form. Line 3: enter the non-filer's street address and zip or postal code. ... Line 5 provides non-filers with the option to have their IRS Verification of Non-filing Letter mailed directly to a third party by the IRS.