This form is an Application for Certificate of Discharge of IRS Lien. Use to obtain certificate of release when lien has been removed or satisfied. Check for compliance with your specific circumstances.

Minnesota Application for Certificate of Discharge of IRS Lien

Description

How to fill out Application For Certificate Of Discharge Of IRS Lien?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a broad selection of legal template files that you can download or print. By using the site, you will find thousands of forms for business and personal use, categorized by type, state, or keywords. You can access the latest versions of forms such as the Minnesota Application for Certificate of Discharge of IRS Lien in a matter of minutes.

If you have a monthly subscription, Log In and download the Minnesota Application for Certificate of Discharge of IRS Lien from your US Legal Forms library. The Download button will be visible on each form you view. You can access all previously acquired forms within the My documents section of your account.

To utilize US Legal Forms for the first time, here are straightforward instructions to get started: Ensure you have selected the correct form for your city/region. Click the Review button to examine the form's details. Check the form description to confirm you have chosen the right one. If the form does not meet your requirements, use the Search area at the top of the screen to find one that does. When you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred payment plan and provide your details to register for an account. Complete the transaction. Use your credit card or PayPal account to finalize the payment. Choose the format and download the form to your device. Make modifications. Fill out, edit, print, and sign the downloaded Minnesota Application for Certificate of Discharge of IRS Lien. Each template you added to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

- Gain access to the Minnesota Application for Certificate of Discharge of IRS Lien with US Legal Forms, the most extensive collection of legal document templates.

- Utilize thousands of professional and state-specific templates that cater to your business or personal requirements and preferences.

Form popularity

FAQ

To obtain a federal tax lien payoff, you should contact the IRS to request a payoff amount. This amount will include the principal tax, penalties, and interest that have accrued. Once you have the payoff figure, you can proceed with payment to eliminate the lien. For a smoother experience, check the US Legal Forms platform for guidance on the Minnesota Application for Certificate of Discharge of IRS Lien.

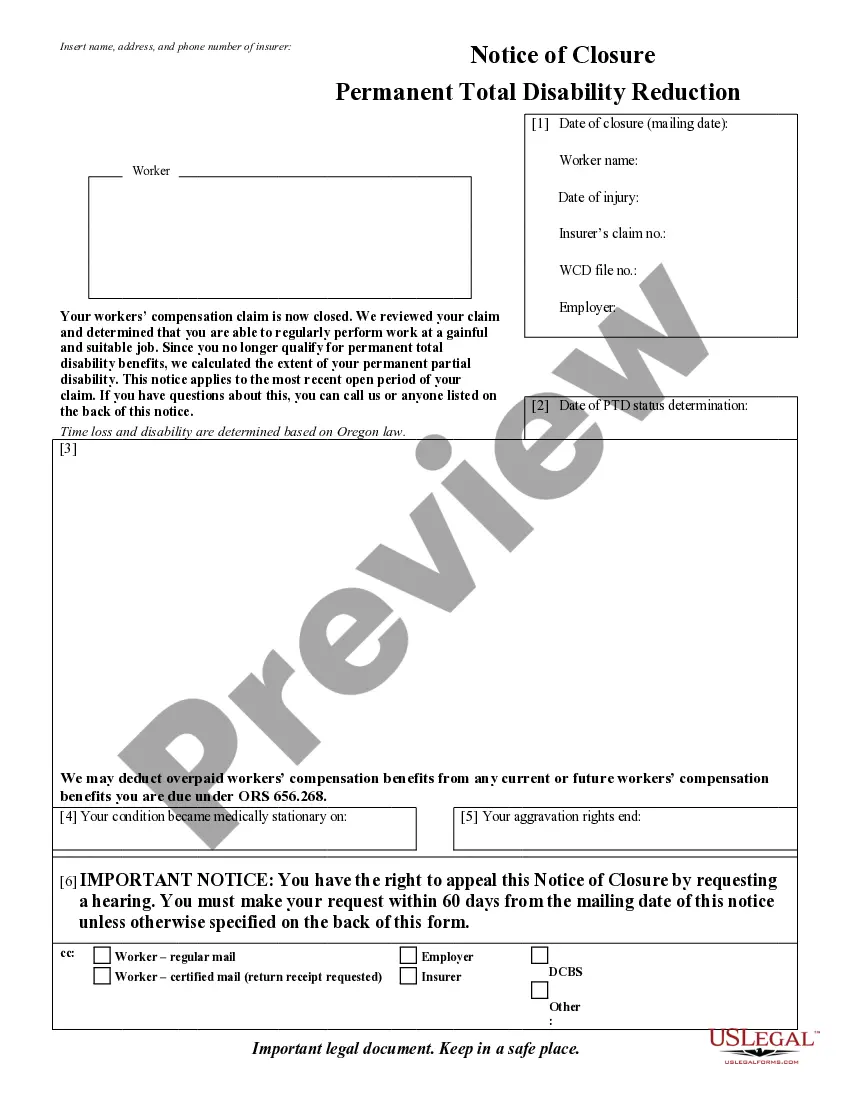

To apply for a certificate of discharge from a federal tax lien, you need to fill out Form 14135, Application for Certificate of Discharge of Property from Federal Tax Lien. After completing the form, submit it to the IRS along with any required supporting documents. This certificate can release specific properties from the lien while leaving the lien in place on other properties. Utilize the US Legal Forms platform to access templates and detailed guidance for the Minnesota Application for Certificate of Discharge of IRS Lien.

The IRS form for lien withdrawal is Form 12277, Application for Withdrawal of Filed Form 668(Y), Notice of Federal Tax Lien. You must complete this form and submit it to the IRS along with any required documentation. It’s important to ensure that all information is accurate to avoid delays. For assistance with the process, consider using the resources available on the US Legal Forms platform regarding the Minnesota Application for Certificate of Discharge of IRS Lien.

Yes, you can remove a federal tax lien under certain conditions. This often involves paying off the tax debt or showing that the lien was filed in error. Once the conditions are met, you can apply for a Certificate of Discharge. The US Legal Forms platform can guide you through the Minnesota Application for Certificate of Discharge of IRS Lien, making the process easier.

To obtain a copy of a federal tax lien, you can start by contacting the IRS directly. The IRS will provide you with the necessary documents upon request. Additionally, you can check public records in your local county office, as federal tax liens are often recorded there. For a streamlined process, consider using the US Legal Forms platform, which offers resources to help you navigate the Minnesota Application for Certificate of Discharge of IRS Lien.

Overview. Minnesota Tax Lien Judgment Certificates are no longer sold. The Minnesota Legislature abolished the certificate sale process in 1974 as found in Minnesota Statutes, Chapter 280.001.

Except for property exempt under subdivision 3, the tax assessed on personal property or manufactured homes and collectible under this chapter is a lien on all the real and personal property within this state of the person liable for the payment of the tax.

Minnesota is a tax deed state. In a tax deed state the actual property is sold after tax foreclosure, opposed to a tax lien state where a lien is sold against the property giving the owner the right to collect the back due taxes and earn interest.

State & Federal Tax Liens The Minnesota Department of Revenue and United States Internal Revenue Service issues and delivers State and Federal Tax Liens to the County Recorder's Office for recording.

The removal of a lien on a motor vehicle or real property after the claim has been satisfied is referred to as a ?discharge of lien?.