US Legal Forms - one of the greatest libraries of legitimate types in the States - provides a wide array of legitimate file web templates it is possible to down load or print out. While using web site, you will get thousands of types for company and specific uses, sorted by classes, states, or search phrases.You can find the latest versions of types like the Minnesota Guide to Complying with the Red Flags Rule under FCRA and FACTA in seconds.

If you already have a subscription, log in and down load Minnesota Guide to Complying with the Red Flags Rule under FCRA and FACTA in the US Legal Forms collection. The Down load button will appear on every type you see. You have access to all formerly acquired types from the My Forms tab of the profile.

If you would like use US Legal Forms initially, listed below are easy guidelines to help you started off:

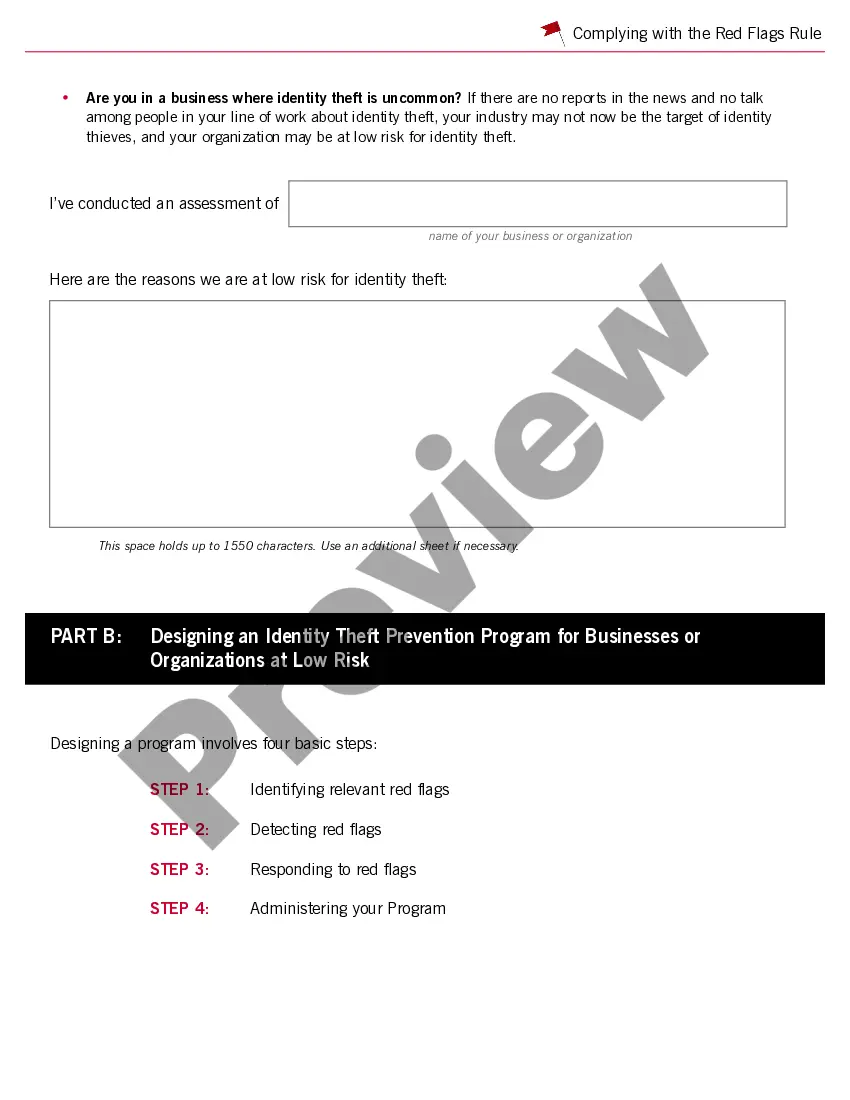

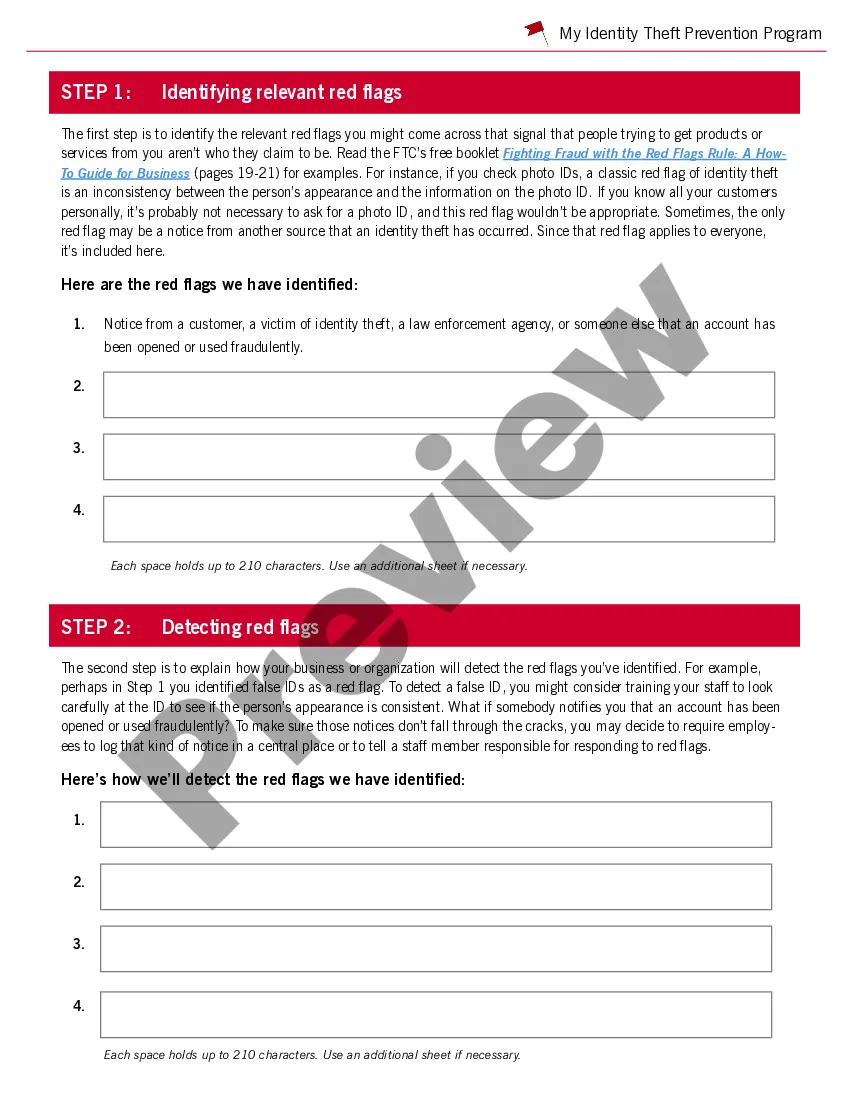

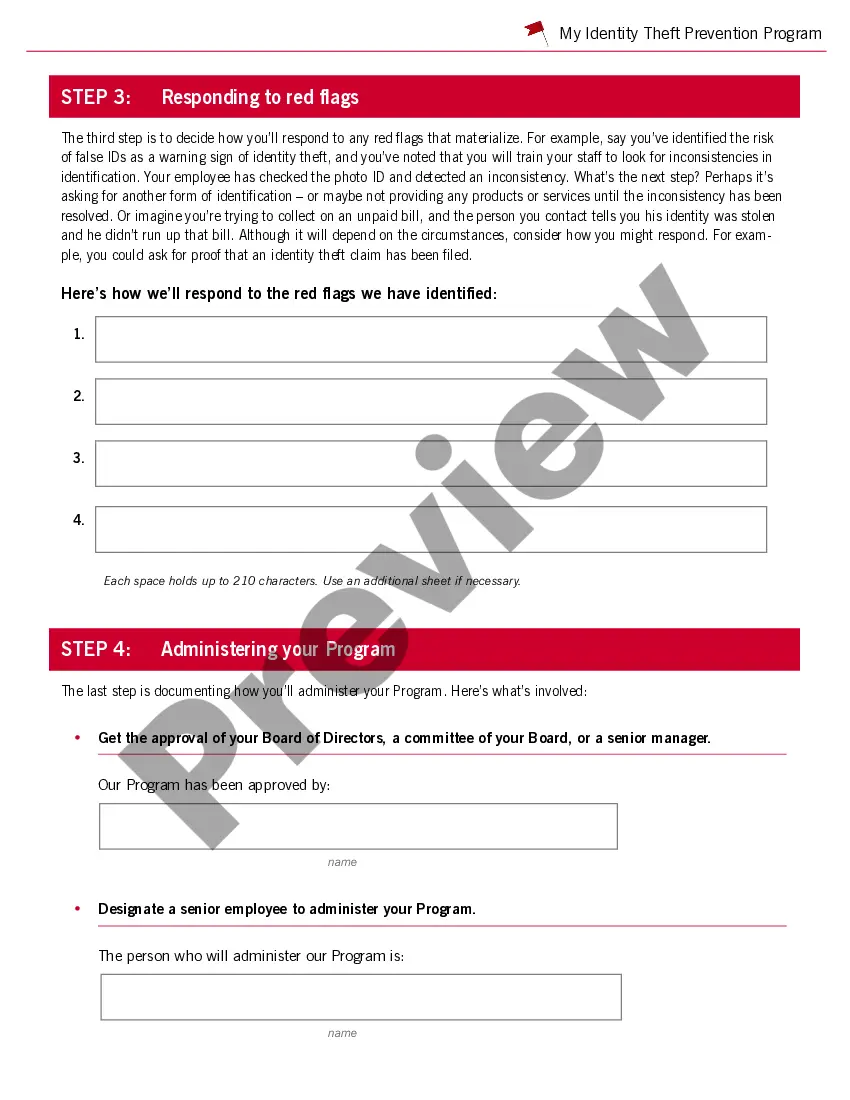

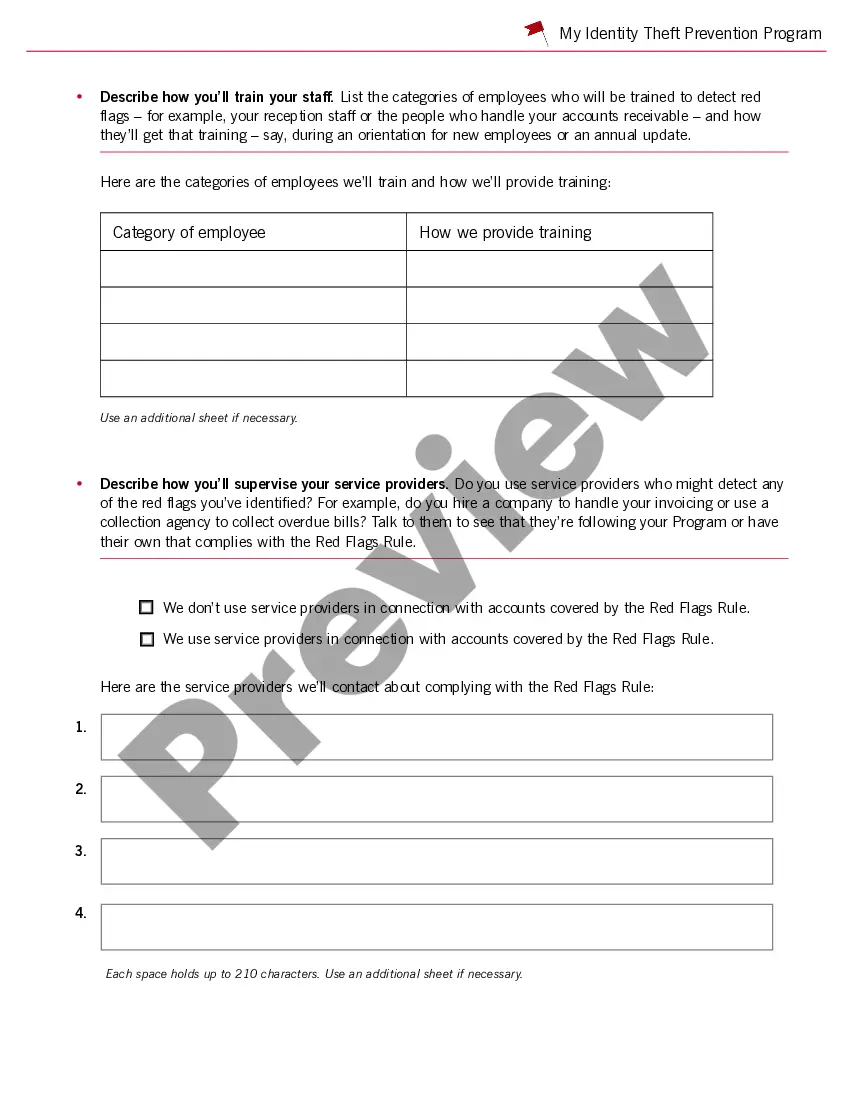

- Be sure you have picked the right type for your metropolis/area. Select the Preview button to check the form`s articles. Browse the type outline to ensure that you have selected the correct type.

- In the event the type doesn`t suit your demands, take advantage of the Look for industry on top of the screen to discover the one that does.

- If you are happy with the shape, confirm your decision by simply clicking the Buy now button. Then, pick the pricing program you want and give your credentials to sign up for the profile.

- Procedure the purchase. Use your Visa or Mastercard or PayPal profile to complete the purchase.

- Find the formatting and down load the shape on your system.

- Make changes. Fill out, edit and print out and sign the acquired Minnesota Guide to Complying with the Red Flags Rule under FCRA and FACTA.

Each web template you included with your account lacks an expiry date and is yours permanently. So, if you would like down load or print out one more backup, just proceed to the My Forms section and click about the type you require.

Gain access to the Minnesota Guide to Complying with the Red Flags Rule under FCRA and FACTA with US Legal Forms, probably the most substantial collection of legitimate file web templates. Use thousands of skilled and express-distinct web templates that meet your business or specific demands and demands.