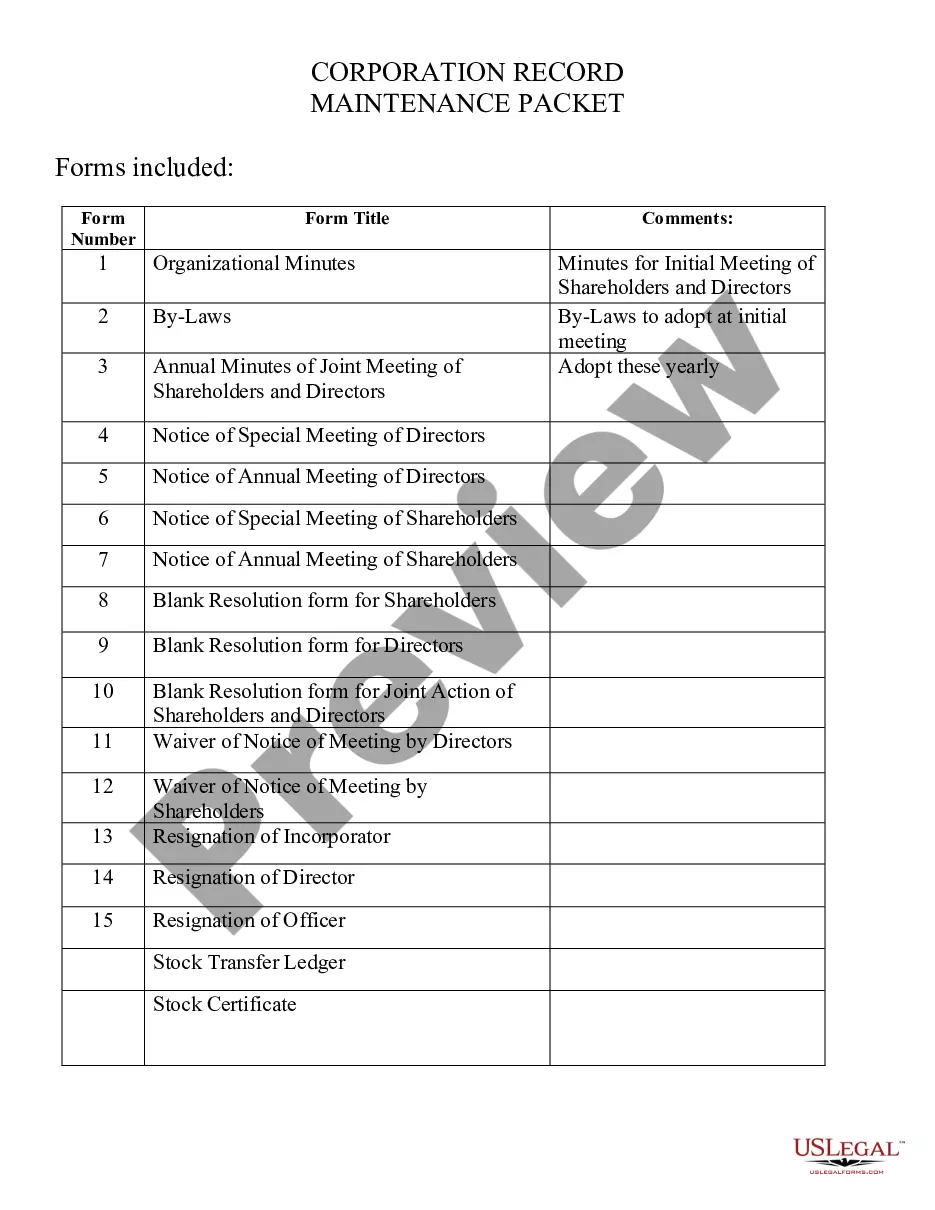

This form is a due diligence questionnaire that requests information to be used to complete the Registration Statement prior to the Effective Date. The questionnaire should be distributed to each person who is selling securities pursuant to the Registration Statement in business transactions.

Minnesota Comprehensive Selling Stockholder Questionnaire

Description

How to fill out Comprehensive Selling Stockholder Questionnaire?

Selecting the appropriate official document design can be relatively difficult.

Naturally, there exists a range of templates accessible online, but how can you locate the authentic format you need.

Visit the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps you can follow: First, ensure you select the correct document for your region/area. You can review the form using the Review button and read the form summary to ensure this is the right one for you. If the form does not meet your needs, use the Search box to find the appropriate document. Once you are sure that the form is correct, click on the Get now button to obtain the form. Choose the pricing plan you want and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Select the file format and download the legal document template to your device. Finally, complete, modify, print, and sign the acquired Minnesota Comprehensive Selling Stockholder Questionnaire. US Legal Forms is the top collection of legal documents where you can find numerous document templates. Use the service to download professionally crafted files that meet state requirements.

- The service provides thousands of templates, including the Minnesota Comprehensive Selling Stockholder Questionnaire, which you can utilize for business and personal needs.

- All the forms are verified by experts and comply with federal and state regulations.

- If you are already registered, Log In to your account and click on the Acquire button to access the Minnesota Comprehensive Selling Stockholder Questionnaire.

- Use your account to search for the legal forms you have purchased previously.

- Go to the My documents tab in your account and retrieve another copy of the document you need.

Form popularity

FAQ

For mailing Wisconsin W2 forms, you should send them to the appropriate address based on your filing status, which is typically listed on the state’s Department of Revenue website. Ensure that you include any necessary documentation, as it helps streamline the process. To simplify your filing journey, explore our US Legal Forms platform for detailed guides and forms related to the Minnesota Comprehensive Selling Stockholder Questionnaire.

You can pick up Minnesota tax forms at your local Minnesota Department of Revenue office or select public libraries throughout the state. Additionally, many tax preparation businesses offer these forms during the tax season. If you are looking for specific documents related to the Minnesota Comprehensive Selling Stockholder Questionnaire, you may also find useful information in our comprehensive tax resources on the US Legal Forms platform.

The M1X form in Minnesota is utilized to amend your previously filed Individual Income Tax return. It's crucial to correct any errors to maintain compliance with state tax laws and navigate your financial landscape effectively, especially when dealing with the Minnesota Comprehensive Selling Stockholder Questionnaire. For assistance with the M1X form, you can find helpful resources on US Legal Forms that guide you through the amendment process.

MN tax form M1 is the Individual Income Tax return for residents of Minnesota. This form is essential for reporting your income and calculating your tax liability. When completing the Minnesota Comprehensive Selling Stockholder Questionnaire, familiarity with the M1 is beneficial for a comprehensive view of your financial status. US Legal Forms can provide further insights into filing this form accurately.

Mailing your Minnesota state tax forms is simple when you know the correct address. Generally, you should send your forms to the Minnesota Department of Revenue, but the destination may vary depending on whether you are sending income tax, property tax, or other forms. The Minnesota Comprehensive Selling Stockholder Questionnaire may also require timely submissions, so make sure to double-check the mailing address. US Legal Forms has up-to-date mailing information for your convenience.

In Minnesota, various deductions are available to taxpayers that can significantly lower your tax burden. Common deductions include mortgage interest, property taxes, and medical expenses. By understanding these deductions, you can complete the Minnesota Comprehensive Selling Stockholder Questionnaire with ease. US Legal Forms offers helpful information and templates to maximize your tax benefits.

Minnesota Form M8 is the state’s sales tax refund application. This form allows businesses to claim refunds for overpaid sales taxes. Understanding how to fill it out correctly is crucial, especially when navigating financial obligations such as those outlined in the Minnesota Comprehensive Selling Stockholder Questionnaire. You can find resources on US Legal Forms to help guide you through the process.

When dealing with Minnesota sales tax, it’s essential to keep accurate records of all sales transactions. You should maintain copies of invoices, receipts, and any documentation related to exempt sales. Proper record-keeping not only assists during audits but also ensures compliance with the Minnesota Comprehensive Selling Stockholder Questionnaire. Consider using US Legal Forms for easy access to templates that facilitate record management.