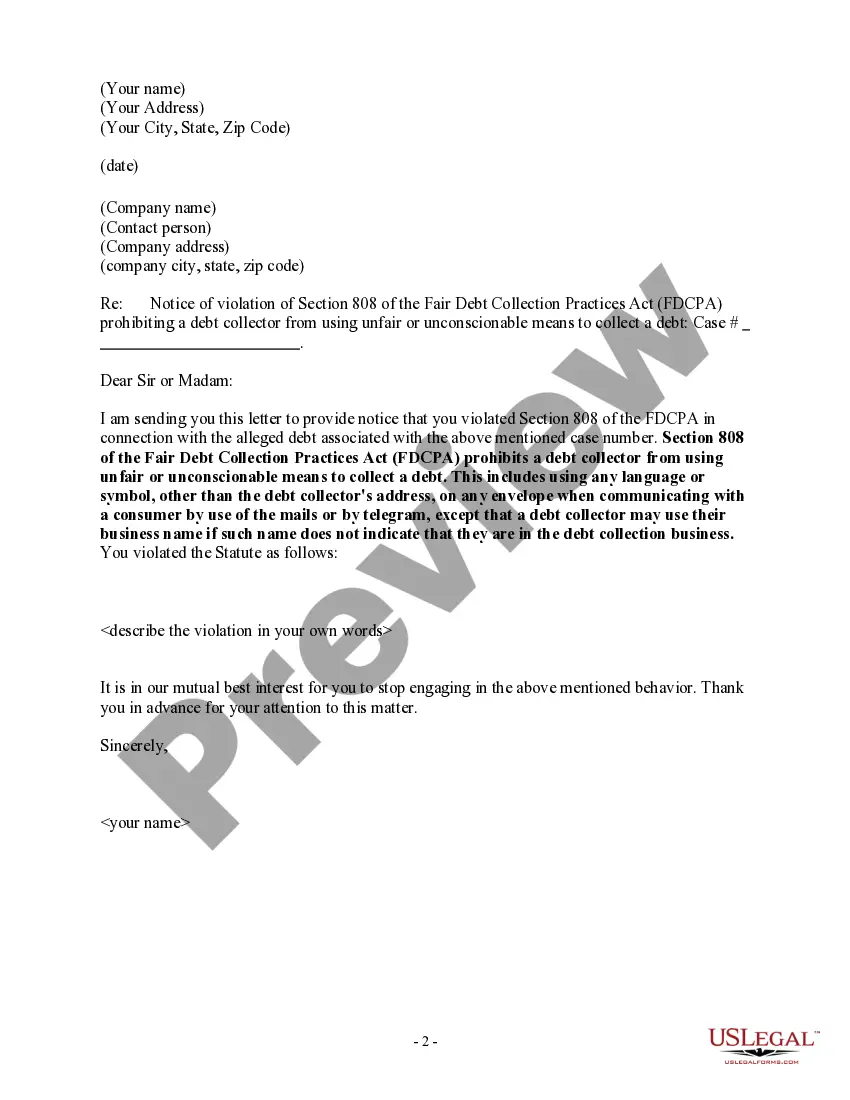

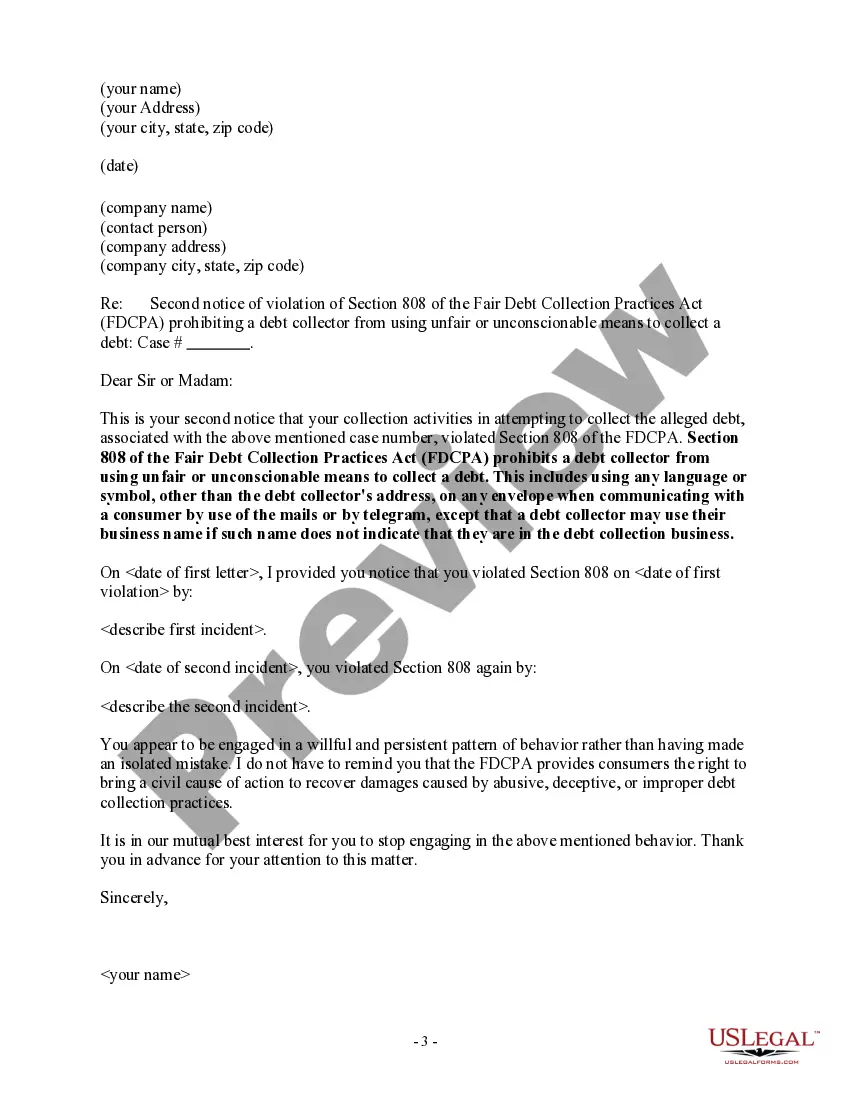

Minnesota Notice of Violation of Fair Debt Act - Improper Document Appearance

Description

How to fill out Notice Of Violation Of Fair Debt Act - Improper Document Appearance?

US Legal Forms - one of many largest libraries of lawful varieties in the States - delivers a variety of lawful record web templates you are able to obtain or produce. Using the internet site, you can get a huge number of varieties for business and personal uses, categorized by classes, claims, or search phrases.You can get the newest models of varieties such as the Minnesota Notice of Violation of Fair Debt Act - Improper Document Appearance in seconds.

If you already have a monthly subscription, log in and obtain Minnesota Notice of Violation of Fair Debt Act - Improper Document Appearance in the US Legal Forms library. The Down load switch will appear on each form you look at. You have accessibility to all earlier acquired varieties within the My Forms tab of your respective profile.

In order to use US Legal Forms the first time, listed below are easy recommendations to obtain began:

- Ensure you have picked the right form for your personal town/area. Click the Preview switch to analyze the form`s content. Read the form description to ensure that you have chosen the appropriate form.

- In case the form doesn`t suit your needs, use the Lookup industry near the top of the monitor to discover the one which does.

- When you are happy with the form, validate your decision by clicking the Acquire now switch. Then, pick the prices strategy you want and give your references to sign up on an profile.

- Method the purchase. Utilize your Visa or Mastercard or PayPal profile to complete the purchase.

- Pick the format and obtain the form on your own product.

- Make modifications. Complete, edit and produce and sign the acquired Minnesota Notice of Violation of Fair Debt Act - Improper Document Appearance.

Each template you included with your bank account lacks an expiration day and is yours permanently. So, if you wish to obtain or produce one more version, just proceed to the My Forms segment and click on around the form you will need.

Obtain access to the Minnesota Notice of Violation of Fair Debt Act - Improper Document Appearance with US Legal Forms, the most considerable library of lawful record web templates. Use a huge number of professional and express-particular web templates that satisfy your organization or personal requires and needs.

Form popularity

FAQ

Don't provide personal or sensitive financial information Never give out or confirm personal or sensitive financial information ? such as your bank account, credit card, or full Social Security number ? unless you know the company or person you are talking with is a real debt collector.

Harassment of the debtor by the creditor ? More than 40 percent of all reported FDCPA violations involved incessant phone calls in an attempt to harass the debtor.

Threaten, slander or harass Obscene language, threats to sue (unless they are actually pursuing legal action), law enforcement threats, name-calling, aggressive language. threatening harmful behavior, and otherwise harassing behavior is prohibited by the FDCPA.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take.

Statutory damages of up to $1,000. The terms of the FDCPA allow consumers to recover damages up to $1,000 from a debt collector. This amount is above and beyond other forms of damages that a consumer may be entitled to. To obtain this amount, a consumer merely has to prove that the collector violated the FDCPA.

Ten Things Bill Collectors Don't Want You to Know The More You Pay, the More They Earn. Payment Deadlines Are Phony. The Don't Need a 'Financial Statement' The Threats Are Inflated. You Can Stop Their Calls. They Can Find Out How Much You Have in the Bank. If You're Out of State, They're Out of Luck. They Can't Take It All.

If the FDCPA is violated, the debtor can sue the debt collection company as well as the individual debt collector for damages and attorney fees.

If you are struggling with debt and debt collectors, Farmer & Morris Law, PLLC can help. As soon as you use the 11-word phrase ?please cease and desist all calls and contact with me immediately? to stop the harassment, call us for a free consultation about what you can do to resolve your debt problems for good.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.