Minnesota Sample Letter for Notice Under Fair Debt Collection Act

Description

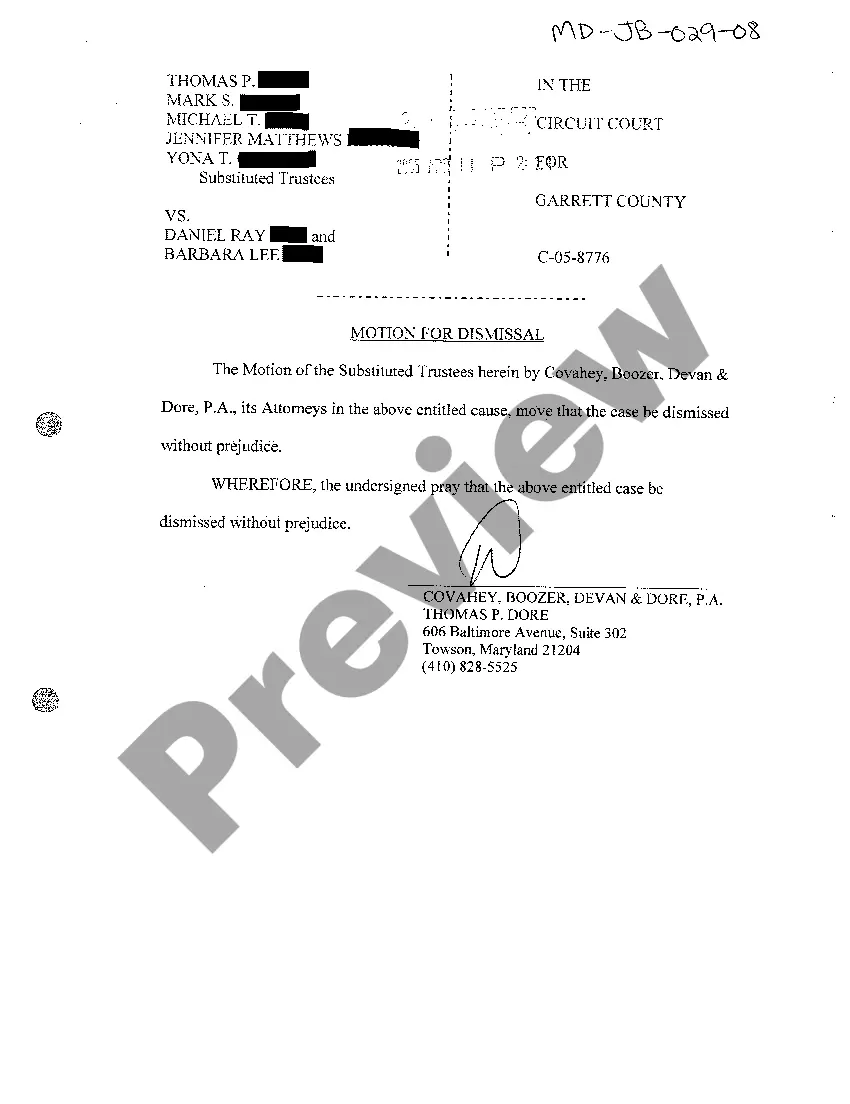

How to fill out Sample Letter For Notice Under Fair Debt Collection Act?

If you wish to complete, download, or print out legitimate papers themes, use US Legal Forms, the most important variety of legitimate kinds, that can be found online. Make use of the site`s simple and practical search to get the documents you need. Numerous themes for business and specific uses are categorized by classes and claims, or keywords. Use US Legal Forms to get the Minnesota Sample Letter for Notice Under Fair Debt Collection Act within a couple of click throughs.

Should you be currently a US Legal Forms client, log in for your account and click on the Down load option to get the Minnesota Sample Letter for Notice Under Fair Debt Collection Act. Also you can access kinds you formerly downloaded from the My Forms tab of the account.

If you use US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Be sure you have chosen the shape to the proper town/nation.

- Step 2. Take advantage of the Review solution to look over the form`s content material. Do not forget to see the outline.

- Step 3. Should you be not happy with all the develop, utilize the Research discipline on top of the screen to locate other models from the legitimate develop template.

- Step 4. Once you have identified the shape you need, click on the Acquire now option. Opt for the prices strategy you prefer and add your credentials to register on an account.

- Step 5. Approach the transaction. You can use your charge card or PayPal account to perform the transaction.

- Step 6. Select the structure from the legitimate develop and download it on your product.

- Step 7. Full, revise and print out or indication the Minnesota Sample Letter for Notice Under Fair Debt Collection Act.

Each legitimate papers template you buy is your own property eternally. You possess acces to every develop you downloaded inside your acccount. Click on the My Forms segment and choose a develop to print out or download again.

Be competitive and download, and print out the Minnesota Sample Letter for Notice Under Fair Debt Collection Act with US Legal Forms. There are thousands of expert and express-particular kinds you may use for your business or specific requirements.

Form popularity

FAQ

What do you include in a debt collection letter? The amount the debtor owes you, including any interest (attach the original invoice as well); The initial date of payment and the new date of payment; Clear instructions on how to pay the outstanding debt (banking details, etc);

Detail the debt amount: State the dollar amount of debt owed, the original date that this amount was due, and any other fees or interest accrued. If there are multiple amounts, include the total amount due. Provide context: Outline events in chronological order. Provide as much detail and context as possible.

I am writing in regards to the above-referenced debt to inform you that I am disputing this debt. Please verify the debt as required by the Fair Debt Collection Practices Act. I am disputing this debt because I do not owe it. Because I am disputing this debt, you should not report it to the credit reporting agencies.

Dear [RECIPIENT'S NAME], Despite our previous reminders, the above amount due remains unpaid. As such, we would appreciate you making this payment as soon as possible. We regret to advise that unless payment is received by [DATE] this collection will be passed over to our debt collection agency/lawyer.

An effective debt collection letter should include all of the following: The total amount the client owes you. The original date the balance was due. Instructions detailing how to make the overdue payment. The new due date, whether a specific date or as soon as possible.

How to Write An Effective Collection Letter Reference the products or services that were purchased. ... Maintain a friendly but firm tone. ... Remind the payee of their contract or agreement with you. ... Offer multiple ways the payee can take action. ... Add a personal touch. ... Give them a new deadline.

Within five days after a debt collector first contacts you, it must send you a written notice, called a "validation notice," that tells you (1) the amount it thinks you owe, (2) the name of the creditor, and (3) how to dispute the debt in writing.