"Construction Loan Agreements and Variations" is a American Lawyer Media form. This form is to be used as a construction loan agreement.

Minnesota Construction Loan Agreements and Variations

Description

How to fill out Construction Loan Agreements And Variations?

If you wish to total, download, or produce legal record themes, use US Legal Forms, the greatest variety of legal types, that can be found on the Internet. Utilize the site`s simple and handy research to discover the papers you need. A variety of themes for enterprise and person reasons are categorized by classes and claims, or search phrases. Use US Legal Forms to discover the Minnesota Construction Loan Agreements and Variations with a handful of mouse clicks.

In case you are currently a US Legal Forms client, log in in your bank account and click on the Down load key to have the Minnesota Construction Loan Agreements and Variations. You can also gain access to types you in the past saved from the My Forms tab of the bank account.

Should you use US Legal Forms the very first time, refer to the instructions under:

- Step 1. Be sure you have selected the form for your appropriate town/country.

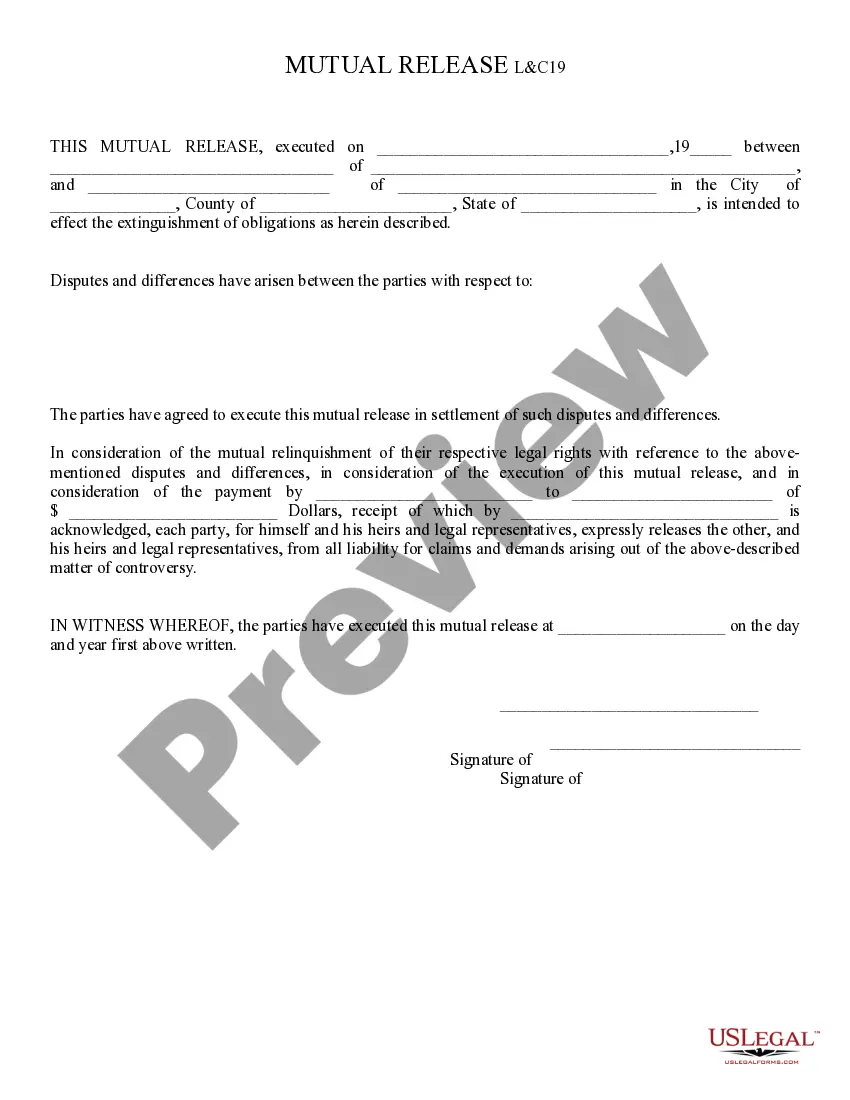

- Step 2. Make use of the Preview option to examine the form`s content material. Do not forget about to see the explanation.

- Step 3. In case you are unsatisfied with all the form, use the Look for discipline on top of the monitor to find other types of your legal form web template.

- Step 4. Upon having discovered the form you need, select the Get now key. Select the rates prepare you choose and add your accreditations to sign up on an bank account.

- Step 5. Approach the deal. You can utilize your bank card or PayPal bank account to perform the deal.

- Step 6. Find the structure of your legal form and download it on your own product.

- Step 7. Total, edit and produce or sign the Minnesota Construction Loan Agreements and Variations.

Every single legal record web template you buy is yours eternally. You might have acces to each form you saved within your acccount. Select the My Forms portion and pick a form to produce or download again.

Compete and download, and produce the Minnesota Construction Loan Agreements and Variations with US Legal Forms. There are thousands of skilled and status-certain types you can use to your enterprise or person demands.

Form popularity

FAQ

Categorizing loan agreements by type of facility usually results in two primary categories: term loans, which are repaid in set installments over the term, or. revolving loans (or overdrafts) where up to a maximum amount can be withdrawn at any time, and interest is paid from month to month on the drawn amount.

Section 104 of the Act defines a construction contract as an agreement with a person for any of the following: The carrying out of construction operations. Arranging for the carrying out of construction operations by others, and.

A loan agreement is a formal contract between a borrower and a lender. These counterparties rely on the loan agreement to ensure legal recourse if commitments or obligations are not met. Sections in the contract include loan details, collateral, required reporting, covenants, and default clauses.

Understanding the Important Clauses in a Loan Agreement #1: Fluctuation Of Interest Rates Clause: ... #2: 'Default' Definition Clause: ... #3: Security Cover Clause: ... #4: Disbursement Clause: ... #5: Force Majeure Clause: ... #6: Reset Clause: ... #7: Prepayment Clause: ... #8: Other Balances Set Off Clause:

Lump sum contracts Lump sum contracts, also called fixed price contracts, establish a fixed price for all of the materials and labor required to complete a job. This is the most basic and common type of construction contract.

Student loans: 10-year terms are most common, although they can range up to 30 years in some cases, like consolidation loans. Mortgages: 30-year mortgages are most common, but 15-year mortgages are also available.

Loan agreements typically include covenants, value of collateral involved, guarantees, interest rate terms and the duration over which it must be repaid.

It can be classified into three main categories, namely, unsecured and secured, conventional, and open-end and closed-end loans.